please help

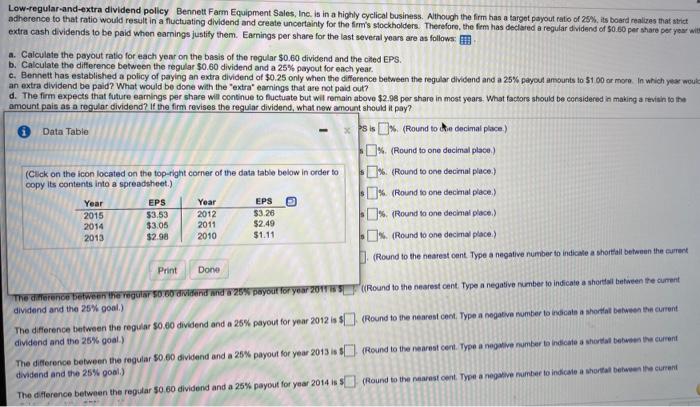

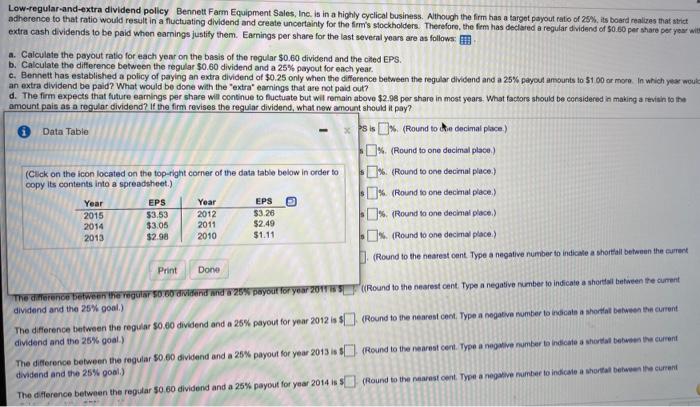

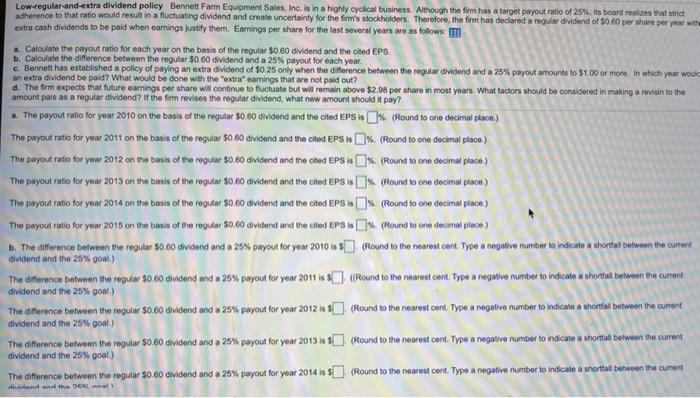

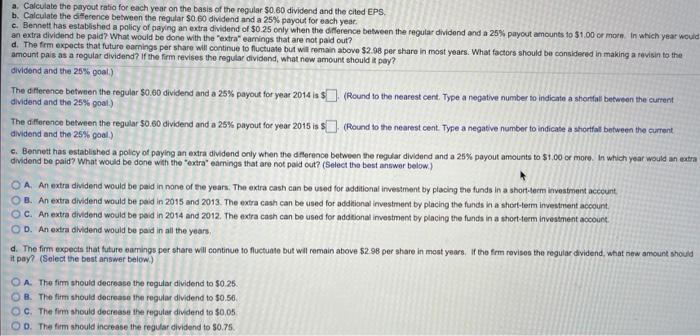

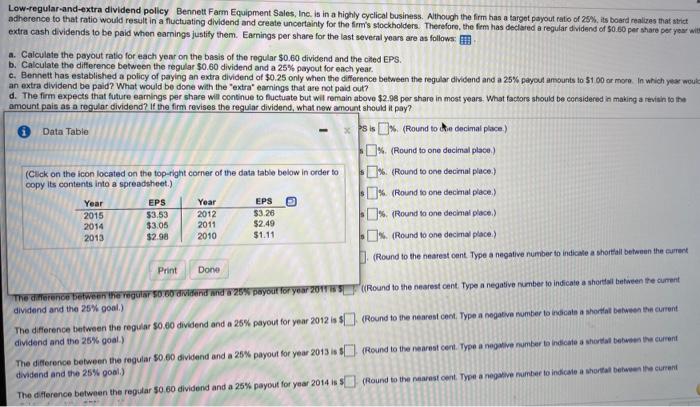

Low-regular-and-extra dividend policy Bennett Farm Equipment Sales, Inc. is in a highly cyclical business. Although the firm has a target payout ratio of 25% its board realize that strict adherence to that ratio would result in a fluctuating dividend and create uncertainty for the firm's stockholders. Therefore, the firm has declared a regular dividend of 50.60 per share per year with extra cash dividends to be paid when earnings justify them. Earnings per share for the last several years are as follows: a. Calculate the payout ratio for each year on the basis of the regular $0.60 dividend and the cited EPS. b. Calculate the difference between the regular $0.60 dividend and a 25% payout for each year. c. Bennett has established a policy of paying an extra dividend of $0.25 only when the difference between the regular dividend and a 25% payout amounts to 51 00 or more in which you woul an extra dividend be paid? What would be done with the "extraearnings that are not paid out? d. The firm expects that future earnings per share will continue to fluctuate but will remain above $2.98 per share in most years. What factors should be considered in making a revisit the amount pais as a regular dividend? If the firm. revises the regular dividend, what new amount should it pay? Data Table is [% (Round to the decimal place) % (Round to one decimal place) (Click on the icon located on the top right corner of the data table below in order to % (Round to be decimal place.) copy its contents into a spreadsheet.) % (Round to one decimal place) Year EPS Year EPS 2015 $3.53 2012 $3.26 % (Round to one decimal place.) 2014 $3.05 2011 $2.49 2013 $2.98 2010 $1.11 0% (Round to one decimal place) (Round to the nearest oant Type a negative number to indicate a shortfall between the current Print Done (Round to the nearest cant Type a negative number to indicate a shortfil between the current The dierence between the regular 50,00 dividend and a 25% payout for year 2016 dividend and the 25% goal) The difference between the regular $0.60 dividend and a 26% payout for year 2012 is $(Round to the nearest cont. Type a negative number to ndicate a shortfat between the current dividend and the 25% goal) The difference between the regular $0.60 dividend and a 25% payout for year 2013 (Round to the nearest cent. Type a negative number to indicato a shorthal weet current dividend and the 25% goal) The difference between the regular 50 60 dividend and a 25% payout for year 2014 (Round to the west cent Type a negative number to indicate a short te current Low-regular-and-extra dividend policy Bennett Form Equipment Sales, Inc. is in a highly cyclical business. Although the firm has a target payout ratio of 25%, its board realize that strict adherence to that ratio would result in a fluctuating dividend and create uncertainty for the firm's stockholders. Therefore, the firm has declared a regular dividend of 50.00 per share per year with extra cash dividends to be paid when earnings justify them. Earnings per share for the last several years are as follows a. Calculate the payout ratio for each year on the basis of the regular $0.60 dividend and the cited EPS b. Calculate the difference between the regular $0.60 dividend and a 25% payout for each year. c. Bennett has established a policy of paying an extra dividend of 0.25 only when the difference between the regular dividend and a 25% payout amounts to $100 or more to which year would an extra dividend be paid? What would be done with the extra camings that are not paid out? d. The firm expects that future earnings per share will continue to fuctuate but will remain above $2.98 por share in most years What factors should be considered in making a revisin to the amount pais as a regular dividend if the firm revises the regular dividend, what new amount should pay? . The payout ratio for year 2010 on the basis of the regular $0.00 dividend and the ched EPS 1 % (Round to ono decimal place.) The payout ratio for year 2011 on the basis of the regular $0.60 dividend and the cited EPS is (%. (Round to ona decimal place.) The payout ratio for year 2012 on the basis of the regular $0.60 dividend and the cited EPS is (% (Round to ono decimal place) The puyout ratio for your 2013 on the basis of the regular $0.60 dividend and the ched EPS is []% (Round to che decimal place) The payout ratio for year 2014 on the basis of the regular $0.60 dividend and the cited EPS U% (Round to one decimal place) The payout ratio for year 2015 on the basis of the regular $0.00 dividend and the cited EPS is Round to one decimal place) b. The difference between the regular 80.00 dividend and a 20% payout for year 2010 in (Round to the nearest cert. Type a negative number to indicate a shortfall between the comment dividend and the 25% goal.) The difference between the regular $0.60 dividend and a 25% payout for year 2011 $ (Round to the nearest cent. Type a negative number to indicate a shortfal between the current dividend and the 25% goot) The difference between the regular $0.60 dividend and a 25% payout for year 2012 $(Round to the nearest cent. Type a negative number to indicado a shortfal between the current dividend and the 25% goal) The difference between the regular $0.60 dividend and a 25% payout for year 2013 $(Round to the nearest cont. Type a negative number to indicate a shortfall between the current dividend and the 25% goal.) The difference between the regular $0.60 dividend and a 25% payout for year 2014 is $(Round to the nearest cent. Type a negative number to indicate a shortfall between the current Hind the nel a. Calculate the payout ratio for each year on the basis of the regular $0.60 dividend and the cited EPS b. Calculate the erence between the regular $0 60 dividend and a 25% payout for each year. c. Bennett has established a policy of paying an extra dividend of $0.25 only when the difference between the regular dividend and a 25% payout amounts to $1.00 or more in which year would an extra dividend be paid? What would be done with the "extra" earnings that are not paid out? d. The firm expects that future earnings per share will continue to fluctuate but will remain above $2.98 per share in most years. What factors should be considered in making a revisin to the amount pais as a regular dividend? If the firm revises the regular dividend, what new amount should it pay? dividend and the 25% goal) The difference between the regular $0.80 dividend and a 25% payout for year 2014 is $])(Round to the nearest cent. Type a negative number to indicate a shortfol between the current dividend and the 25% goal) The difference between the regular $0.60 dividend and a 25% payout for year 2015 is (Round to the nearest cent. Type a negative number to indicate a shortfat between the current dividend and the 25% goal.) c. Bennett has established a policy of paying an extra dividend only when the difference between the regular dividend and a 25% payout amounts to $1.00 or more in which year would an extra dividend be paid? What would be done with the extra camings that are not paid out? (Select the best answer below) O A. An extra dividend would be paid in one of the years. The extra cash can be used for additional investment by placing the funds in a short-term investment account B. An extra dividend would be paid in 2015 and 2013. The extra cash can be used for additional investment by placing the funds in a short-term investment account. OC. An extra dividend would be paid in 2014 and 2012. The extra cash can be used for additional investment by placing the funds in a short term investment account OD. An extra dividend would be paid in all the years d. The firm expects that future earnings per share will continue to fluctuate but will remain above $298 per sharo in most years. If the fem revisor the regular dividend, what now amount should it pay? (Select the best answer below.) O A The firm should decrease the regular dividend to $0.25 B. The firm should decrease the regular dividend to 50.50 C. The firm should decrease the regular dividend to $0.05 OO. The firm should increase the regular dividend to 50.75