Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me!! 1. What is the traditional use of options? What is an options overlay? 2. Use the data below for the questions that

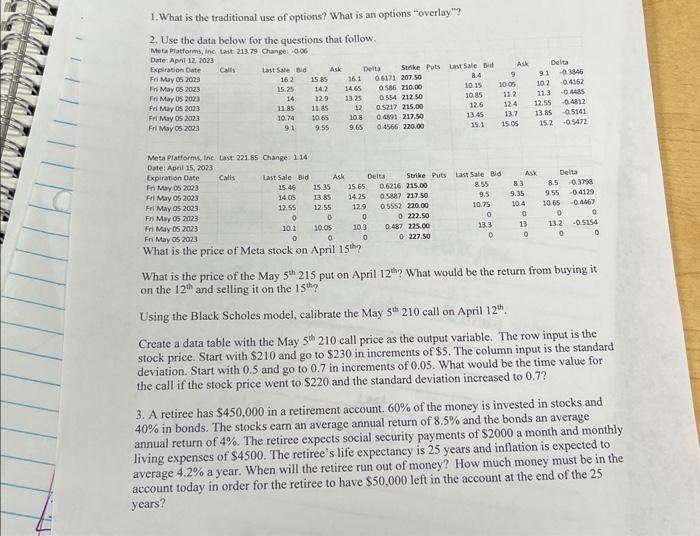

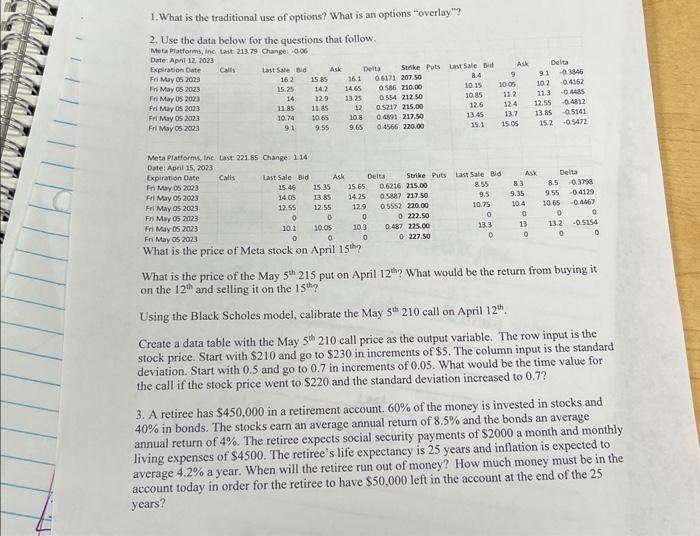

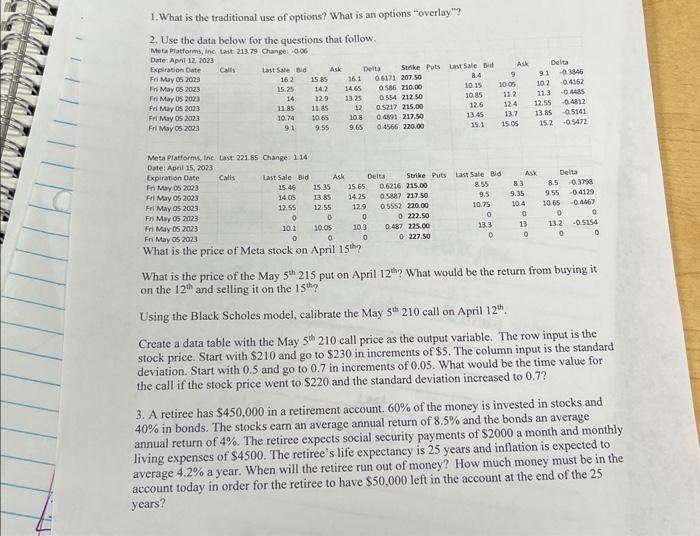

please help me!!  1. What is the traditional use of options? What is an options "overlay"? 2. Use the data below for the questions that follow. Meta Platforms, inc last 21379 Change: aod What is the price of the May 5th215 put on April 12th ? What would be the return from buying it on the 12th and selling it on the 15th ? Using the Black Scholes model, calibrate the May 5th210 call on April 12th. Create a data table with the May 5th210 call price as the output variable. The row input is the stock price. Start with $210 and go to $230 in increments of $5. The column input is the standard deviation. Start with 0.5 and go to 0.7 in increments of 0.05 . What would be the time value for the call if the stock price went to $220 and the standard deviation increased to 0.7 ? 3. A retiree has $450,000 in a retirement account. 60% of the money is invested in stocks and 40% in bonds. The stocks earn an average annual return of 8.5% and the bonds an average annual return of 4%. The retiree expects social security payments of $2000 a month and monthly living expenses of $4500. The retiree's life expectancy is 25 years and inflation is expected to average 4.2% a year. When will the retiree run out of money? How much money must be in the account today in order for the retiree to have $50,000 left in the account at the end of the 25 years? 1. What is the traditional use of options? What is an options "overlay"? 2. Use the data below for the questions that follow. Meta Platforms, inc last 21379 Change: aod What is the price of the May 5th215 put on April 12th ? What would be the return from buying it on the 12th and selling it on the 15th ? Using the Black Scholes model, calibrate the May 5th210 call on April 12th. Create a data table with the May 5th210 call price as the output variable. The row input is the stock price. Start with $210 and go to $230 in increments of $5. The column input is the standard deviation. Start with 0.5 and go to 0.7 in increments of 0.05 . What would be the time value for the call if the stock price went to $220 and the standard deviation increased to 0.7 ? 3. A retiree has $450,000 in a retirement account. 60% of the money is invested in stocks and 40% in bonds. The stocks earn an average annual return of 8.5% and the bonds an average annual return of 4%. The retiree expects social security payments of $2000 a month and monthly living expenses of $4500. The retiree's life expectancy is 25 years and inflation is expected to average 4.2% a year. When will the retiree run out of money? How much money must be in the account today in order for the retiree to have $50,000 left in the account at the end of the 25 years

1. What is the traditional use of options? What is an options "overlay"? 2. Use the data below for the questions that follow. Meta Platforms, inc last 21379 Change: aod What is the price of the May 5th215 put on April 12th ? What would be the return from buying it on the 12th and selling it on the 15th ? Using the Black Scholes model, calibrate the May 5th210 call on April 12th. Create a data table with the May 5th210 call price as the output variable. The row input is the stock price. Start with $210 and go to $230 in increments of $5. The column input is the standard deviation. Start with 0.5 and go to 0.7 in increments of 0.05 . What would be the time value for the call if the stock price went to $220 and the standard deviation increased to 0.7 ? 3. A retiree has $450,000 in a retirement account. 60% of the money is invested in stocks and 40% in bonds. The stocks earn an average annual return of 8.5% and the bonds an average annual return of 4%. The retiree expects social security payments of $2000 a month and monthly living expenses of $4500. The retiree's life expectancy is 25 years and inflation is expected to average 4.2% a year. When will the retiree run out of money? How much money must be in the account today in order for the retiree to have $50,000 left in the account at the end of the 25 years? 1. What is the traditional use of options? What is an options "overlay"? 2. Use the data below for the questions that follow. Meta Platforms, inc last 21379 Change: aod What is the price of the May 5th215 put on April 12th ? What would be the return from buying it on the 12th and selling it on the 15th ? Using the Black Scholes model, calibrate the May 5th210 call on April 12th. Create a data table with the May 5th210 call price as the output variable. The row input is the stock price. Start with $210 and go to $230 in increments of $5. The column input is the standard deviation. Start with 0.5 and go to 0.7 in increments of 0.05 . What would be the time value for the call if the stock price went to $220 and the standard deviation increased to 0.7 ? 3. A retiree has $450,000 in a retirement account. 60% of the money is invested in stocks and 40% in bonds. The stocks earn an average annual return of 8.5% and the bonds an average annual return of 4%. The retiree expects social security payments of $2000 a month and monthly living expenses of $4500. The retiree's life expectancy is 25 years and inflation is expected to average 4.2% a year. When will the retiree run out of money? How much money must be in the account today in order for the retiree to have $50,000 left in the account at the end of the 25 years

please help me!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started