Answered step by step

Verified Expert Solution

Question

1 Approved Answer

....5 10. Of the following individuals who would be a resident or deemed resident of Canada for tax purposes this year? Alex is a

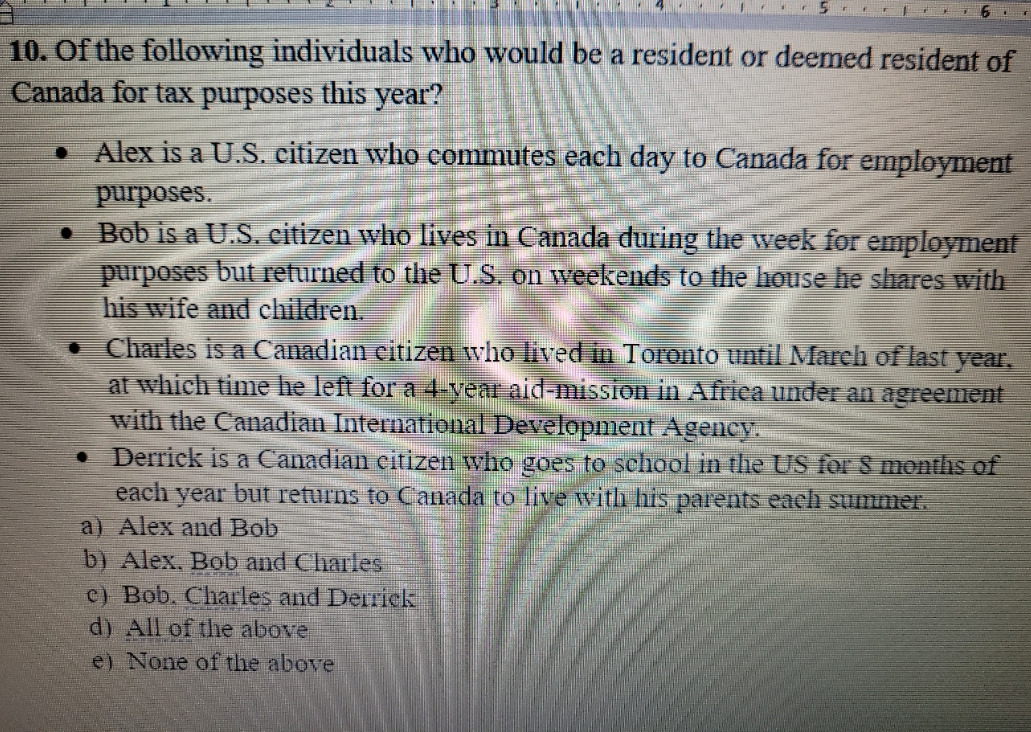

....5 10. Of the following individuals who would be a resident or deemed resident of Canada for tax purposes this year? Alex is a U.S. citizen who commutes each day to Canada for employment purposes. Bob is a U.S. citizen who lives in Canada during the week for employment purposes but returned to the U.S. on weekends to the house he shares with his wife and children. Charles is a Canadian citizen who lived in Toronto until March of last year, at which time he left for a 4-year aid-mission in Africa under an agreement with the Canadian International Development Agency. Derrick is a Canadian citizen who goes to school in the US for 8 months of each year but returns to Canada to live with his parents each summer. Alex and Bob a) b) Alex. Bob and Charles C) Bob. Charles and Derrick d) All of the above e) None of the above ....5 10. Of the following individuals who would be a resident or deemed resident of Canada for tax purposes this year? Alex is a U.S. citizen who commutes each day to Canada for employment purposes. Bob is a U.S. citizen who lives in Canada during the week for employment purposes but returned to the U.S. on weekends to the house he shares with his wife and children. Charles is a Canadian citizen who lived in Toronto until March of last year, at which time he left for a 4-year aid-mission in Africa under an agreement with the Canadian International Development Agency. Derrick is a Canadian citizen who goes to school in the US for 8 months of each year but returns to Canada to live with his parents each summer. Alex and Bob a) b) Alex. Bob and Charles c) Bob. Charles and Derrick d) All of the above e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below For tax purposes in Canada residency is determined by various factors including physical ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started