Answered step by step

Verified Expert Solution

Question

1 Approved Answer

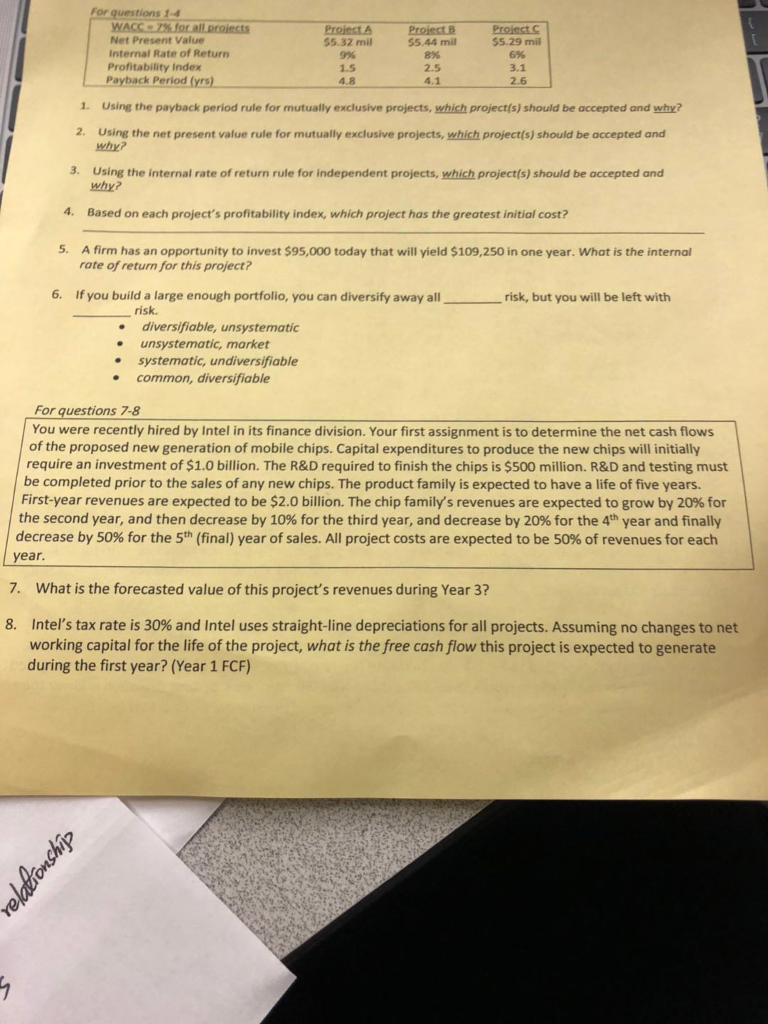

Please help me 7 and 8 For questions 1-4 Project Proiectc 55.44 mil Net Present Value Internal Rate of Return Profitability Index Project A 55.32

Please help me 7 and 8

For questions 1-4 Project Proiectc 55.44 mil Net Present Value Internal Rate of Return Profitability Index Project A 55.32 mil 9% 1.5 4.8 896 2.5 4.1 $5.29 mil 6% 3.1 2.6 Payback Period (yrs) 1. Using the payback period rule for mutually exclusive projects, which project(s) should be accepted and why? 2. Using the net present value rule for mutually exclusive projects, which project(s) should be accepted and why? 3. Using the internal rate of return rule for independent projects, which project(s) should be accepted and 4. Based on each project's profitability index, which project has the greatest initial cost? why? 5. A firm has an opportunity to invest $95,000 today that will yield $109,250 in one year. What is the internal rate of return for this project? 6. If you build a large enough portfolio, you can diversify away allrisk, but you will be left with risk. . diversifiable, unsystematic . unsystematic, market e systematic, undiversifiable e common, diversifiable For questions 7-8 You were recently hired by Intel in its finance division. Your first assignment is to determine the net cash flows of the proposed new generation of mobile chips. Capital expenditures to produce the new chips will initially require an investment of $1.0 billion. The R&D required to finish the chips is $500 million. R&D and testing must be completed prior to the sales of any new chips. The product family is expected to have a life of five years. First-year revenues are expected to be $2.0 billion. The chip family's revenues are expected to grow by 20% for the second year, and then decrease by 10% for the third year, and decrease by 20% for the 4th year and finally decrease by 50% for the 5th (final) year of sales. All project costs are expected to be 50% of revenues for each year 7. What is the forecasted value of this project's revenues during Year 3? Intel's tax rate is 30% and Intel uses straight-line depreciations for all projects. Assuming no changes to net working capital for the life of the project, what is the free cash flow this project is expected to generate during the first year? (Year 1 FCF) 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started