Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me analyze the project by finding Cash Flows, NPV, and IRR, and please show excel calculations. UFC is considering a proposal to manufacture

Please help me analyze the project by finding Cash Flows, NPV, and IRR, and please show excel calculations.

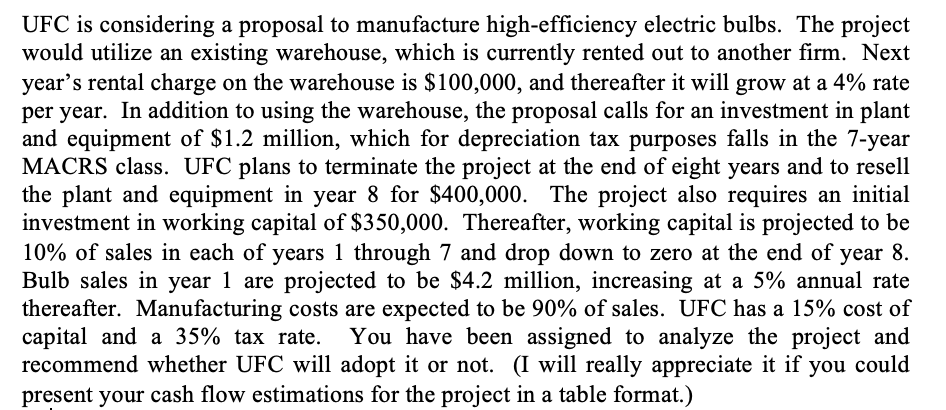

UFC is considering a proposal to manufacture high-efficiency electric bulbs. The project would utilize an existing warehouse, which is currently rented out to another firm. Next year's rental charge on the warehouse is $100,000, and thereafter it will grow at a 4% rate per year. In addition to using the warehouse, the proposal calls for an investment in plant and equipment of $1.2 million, which for depreciation tax purposes falls in the 7-year MACRS class. UFC plans to terminate the project at the end of eight years and to resell the plant and equipment in year 8 for $400,000. The project also requires an initial investment in working capital of $350,000. Thereafter, working capital is projected to be 10% of sales in each of years 1 through 7 and drop down to zero at the end of year 8. Bulb sales in year 1 are projected to be $4.2 million, increasing at a 5% annual rate thereafter. Manufacturing costs are expected to be 90% of sales. UFC has a 15% cost of capital and a 35% tax rate. You have been assigned to analyze the project and recommend whether UFC will adopt it or not. (I will really appreciate it if you could present your cash flow estimations for the project in a table format.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started