Please help me and complete this statement of activities, please

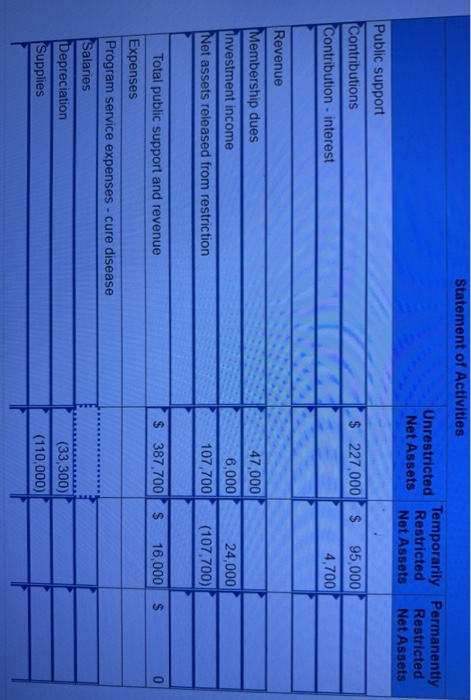

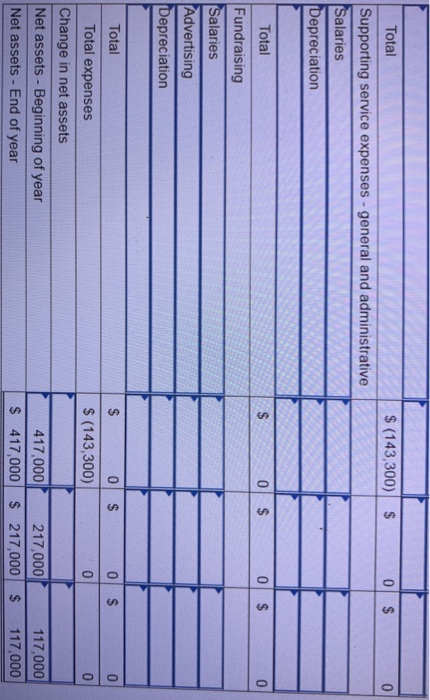

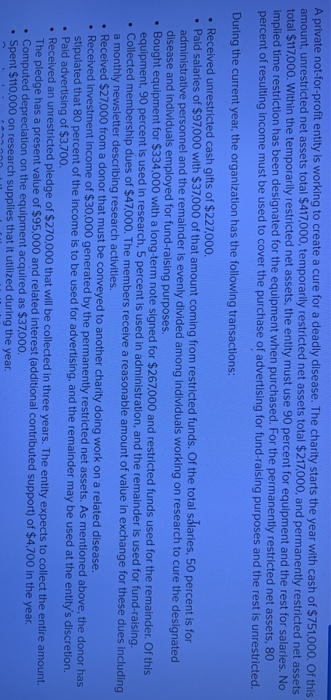

A private not-for-profit entity is working to create a cure for a deadly disease. The charity starts the year with cash of $751,000. Of this amount, unrestricted net assets total $417000, temporarily restricted net assets total $217,000, and permanently restricted net assets total $117000. Within the temporarily restricted net assets, the entity must use 90 percent for equipment and the rest for salaries. No implied time restriction has been designated for the equipment when purchased. For the permanently restricted net assets, 80 percent of resulting income must be used to cover the purchase of advertising for fund-raising purposes and the rest is unrestricted. During the current year, the organization has the following transactions: Received unrestricted cash gifts of $227,000 Paid salar ries of $97,000 with $37,000 of that amount coming from restricted funds. Of the total slaries, 50 percent is for and individuals employed for fund-ralsing purposes administrative personnel and the remainder is evenly divided among individuals working on research to cure the designated disease equipment, 90 percent is used in research. 5 percent is used in administration, and the remainder is used for fund-raising. a monthly newsletter describing research activities . Bought equipment for $334,000 with a long-term note signed for $267,000 and restricted funds used for the remainder. Of this ed membership dues of $47,000. The members receive a reasonable amount of value in exchange for these dues includin 7000 from a donor that must be conveyed to another charity doing work on a related disease. nt Income of $30,000 generated by the permanently restricted net assets. As mentioned above, the do stipulated that 80 percent of the Income is to be used for advertising, and the remainder may be used at thee Paid advertising of $3,700 . Recelved an unrestricted pledge of $270,000 that will ntity's discretion be collected in three years. The entity expects to collect the entire amour The pledge has a present value of $95,000 and related interest (additional contributed support) of $4,700 in the Spent $110,000 on research supplies that it utilized during the ye . Computed depreclation on the equipment acquired as $37,000 Bought equipment for $334,000 with a long-term note signed for $267,000 and restricted funds used for the remainder. Of this equipment, 90 percent is used in research, 5 percent is used in administration, and the remainder is used for fund-raising Collected membership dues of $47000. The members receive a reasonable amount of value in exchange for these dues including a monthly newsletter describing research activities Received $27000 from a donor that must be conveyed to another charity doing work on a related disease. Received investment income of $30,000 generated by the permanently restricted net assets. As mentioned above, the donor has stipulated that 80 percent of the income is to be used for advertising. and the remainder may be used at the entity's discretion. Pald advertising of $3.700. Received an unrestricted pledge of $270,000 that will be collected in three years. The entity expects to collect the entire amount. The pledge has a present value of $95,000 and related interest (additional contributed support) of $4,700 in the year. . Computed depreclation on the equipment acquired as $37000. Spent $110,000 on research supplies that it utilized during the year . Owed salaries of $22.000 at the end of the year. Half of this amount is for individuals doing fund-ralsing and half for individuals doing research. . Recelved a donated painting that qualifies as a museum piece. It has a value of $970,000. Officials do not want to record this gift if possible a. Prepare a statement of activities for this not-for-profit entity for this year b. Prepare a statement of financial position for this not-for-profit entity for this year Statement of Activities Unrestricted Temporarily Permanently Restricted Restricted Net Assets Net Assets Net Assets Public support $ 227,000 95,000 4,700 ontributions ontribution - interest Revenue 47000 Membership dues nvestment income Net assets released from restriction 24,000 6,000 107,700 (107,700) $387,700 S 16,000 S 0 Total public support and revenue Expenses Program service expenses -cure disease alaries epreciation upplies (33,300) (110,000) (143,300 S Total Supporting service expenses-general and administrative Salaries Depreciation 0 Total Fundraising Salaries Advertising Depreciation Total S (143,300) Total expenses Change in net assets Net assets - Beginning of year Net assets - End of year 117,000 417,000217,000 417,000 S 417,000 S 217,000117,000