please help me answer all these questions

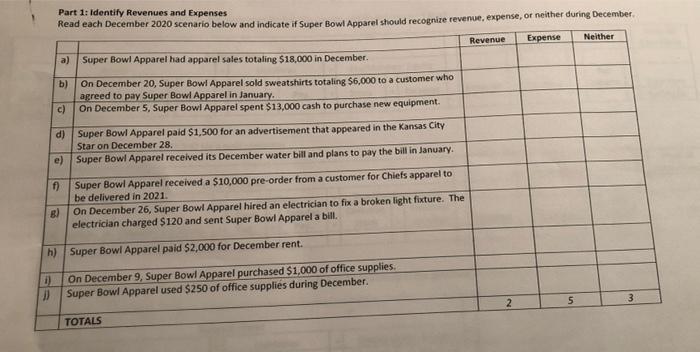

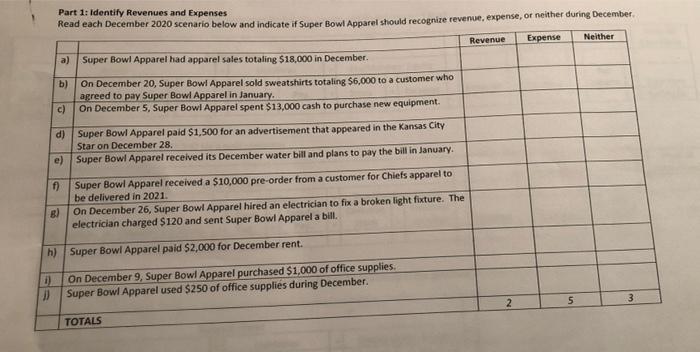

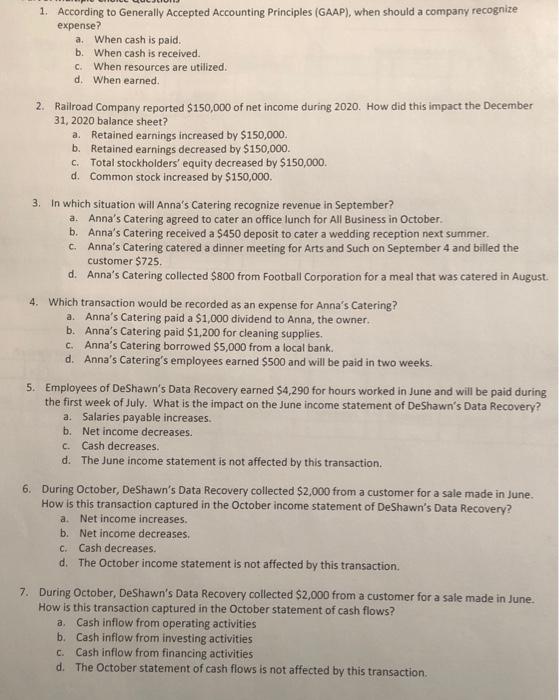

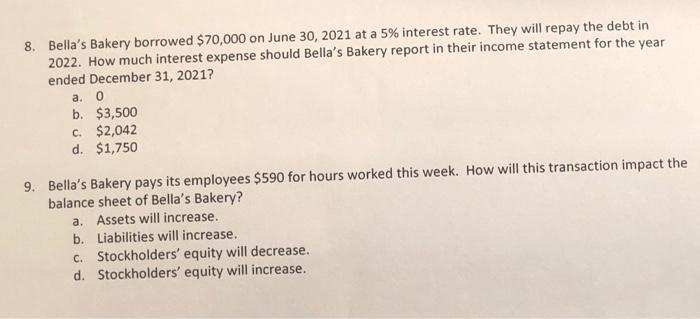

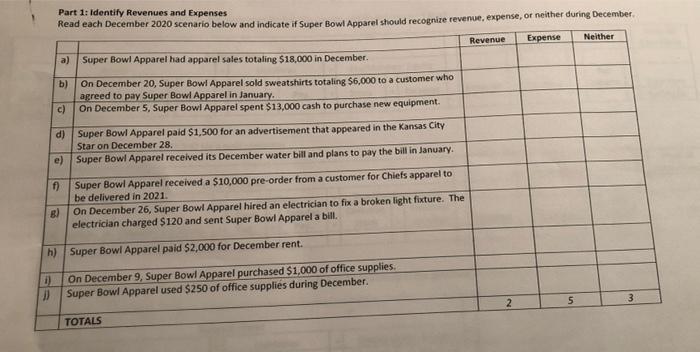

Part 1: Identity Revenues and Expenses Read each December 2020 scenario below and indicate if Super Bowl Apparel should recognize revenue, expense, or neither during December Revenue Expense Neither a) Super Bowl Apparel had apparel sales totaling $18,000 in December b) On December 20, Super Bowl Apparel sold sweatshirts totaling $6,000 to a customer who agreed to pay Super Bowl Apparel in January c) On December 5, Super Bowl Apparel spent $13,000 cash to purchase new equipment. d) Super Bowl Apparel paid $1,500 for an advertisement that appeared in the Kansas City Star on December 28. e) Super Bowl Apparel received its December water bill and plans to pay the bill in January f) Super Bowl Apparel received a $10,000 pre-order from a customer for Chiefs apparel to be delivered in 2021. On December 26, Super Bowl Apparel hired an electrician to fix a broken light fixture. The electrician charged $120 and sent Super Bowl Apparel a bill. B h) Super Bowl Apparel paid $2,000 for December rent. i) On December 9, Super Bowl Apparel purchased $1,000 of office supplies. 3 Super Bowl Apparel used $250 of office supplies during December 2 5 3 TOTALS 1. According to Generally Accepted Accounting Principles (GAAP), when should a company recognize expense? a. When cash is paid. b. When cash is received. When resources are utilized. d. When earned. c. 2. Railroad Company reported $150,000 of net income during 2020. How did this impact the December 31, 2020 balance sheet? a. Retained earnings increased by $150,000, b. Retained earnings decreased by $150,000. C. Total stockholders' equity decreased by $150,000 d. Common stock increased by $150,000 3. In which situation will Anna's Catering recognize revenue in September? a. Anna's Catering agreed to cater an office lunch for All Business in October b. Anna's Catering received a $450 deposit to cater a wedding reception next summer. Anna's Catering catered a dinner meeting for Arts and Such on September 4 and billed the customer $725. d. Anna's Catering collected $800 from Football Corporation for a meal that was catered in August 4. Which transaction would be recorded as an expense for Anna's Catering? a. Anna's Catering paid a $1,000 dividend to Anna, the owner. b. Anna's Catering paid $1,200 for cleaning supplies. c. Anna's Catering borrowed $5,000 from a local bank. d. Anna's Catering's employees earned $500 and will be paid in two weeks. 5. Employees of DeShawn's Data Recovery earned $4,290 for hours worked in June and will be paid during the first week of July. What is the impact on the June income statement of DeShawn's Data Recovery? a. Salaries payable increases. b. Net income decreases. Cash decreases. d. The June income statement is not affected by this transaction. C. 6. During October, DeShawn's Data Recovery collected $2,000 from a customer for a sale made in June. How is this transaction captured in the October income statement of Deshawn's Data Recovery? a. Net income increases. b. Net income decreases C. Cash decreases. d. The October income statement is not affected by this transaction. 7. During October, DeShawn's Data Recovery collected $2,000 from a customer for a sale made in June. How is this transaction captured in the October statement of cash flows? a. Cash inflow from operating activities b. Cash inflow from investing activities C Cash inflow from financing activities d. The October statement of cash flows is not affected by this transaction 8. Bella's Bakery borrowed $70,000 on June 30, 2021 at a 5% interest rate. They will repay the debt in 2022. How much interest expense should Bella's Bakery report in their income statement for the year ended December 31, 2021? 0 b. $3,500 C. $2,042 d. $1,750 a. 9. Bella's Bakery pays its employees $590 for hours worked this week. How will this transaction impact the balance sheet of Bella's Bakery? a. Assets will increase. b. Liabilities will increase. C. Stockholders' equity will decrease. d. Stockholders' equity will increase