Please help me answer Journal entries starting November 30-Dec 31

and check my entries if it is correct

Do the adjusting balances too

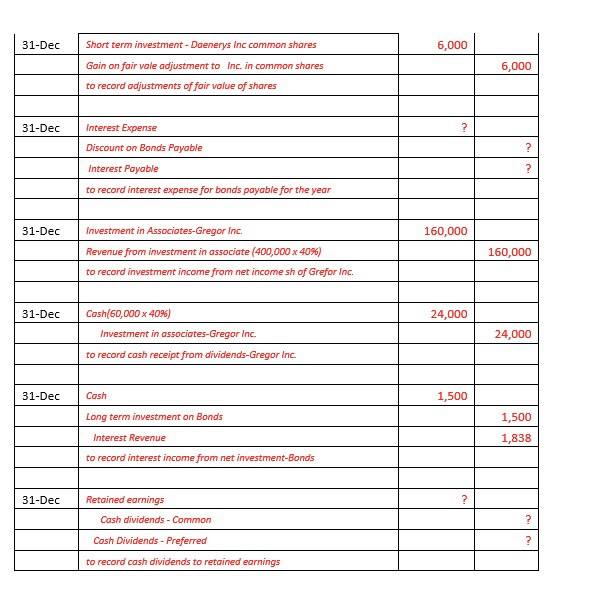

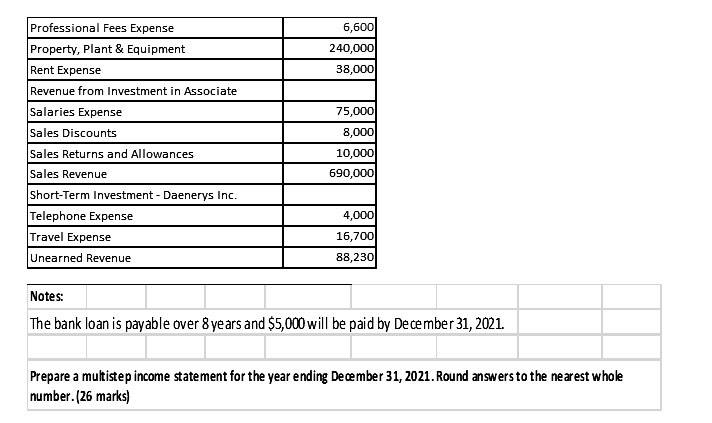

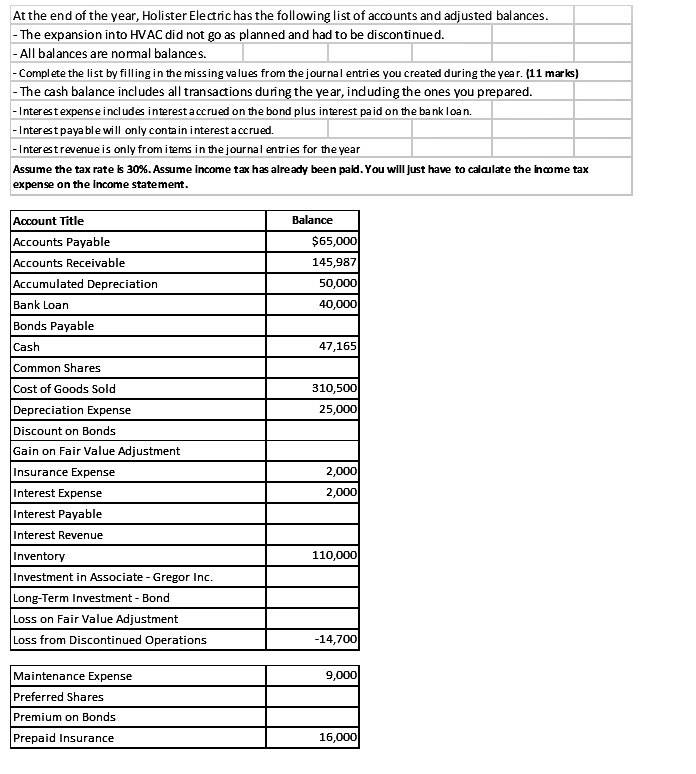

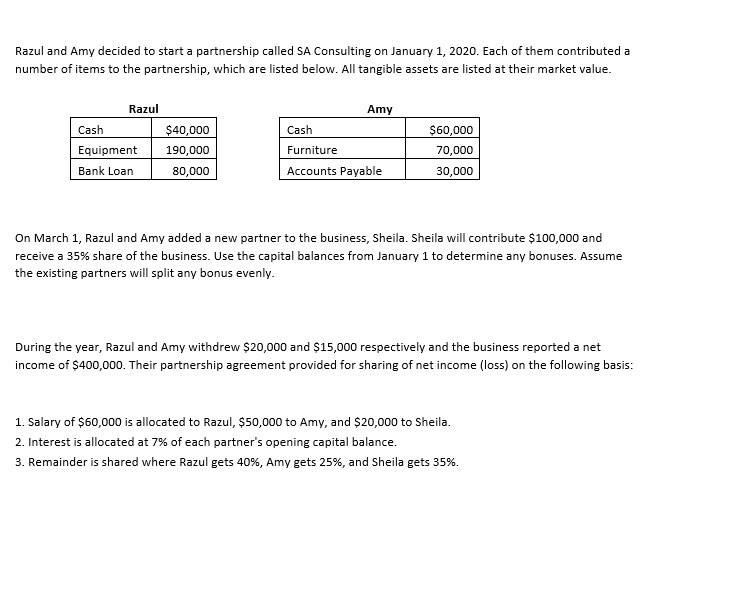

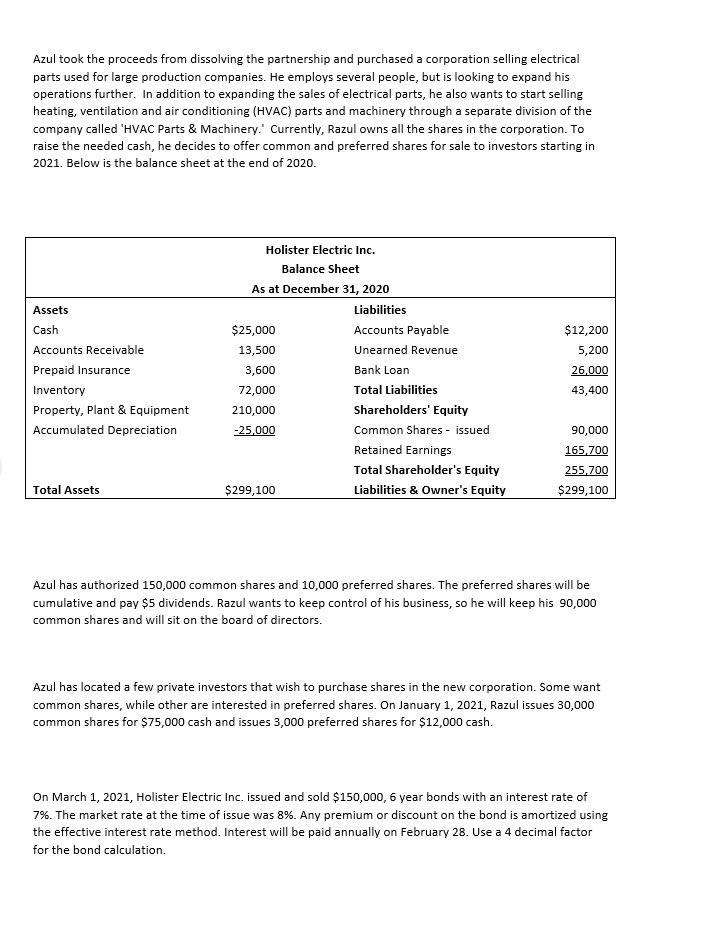

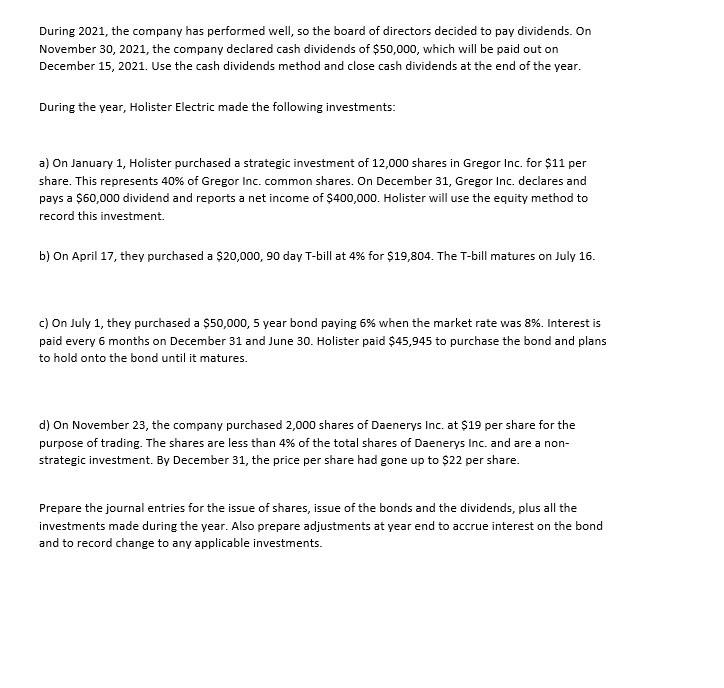

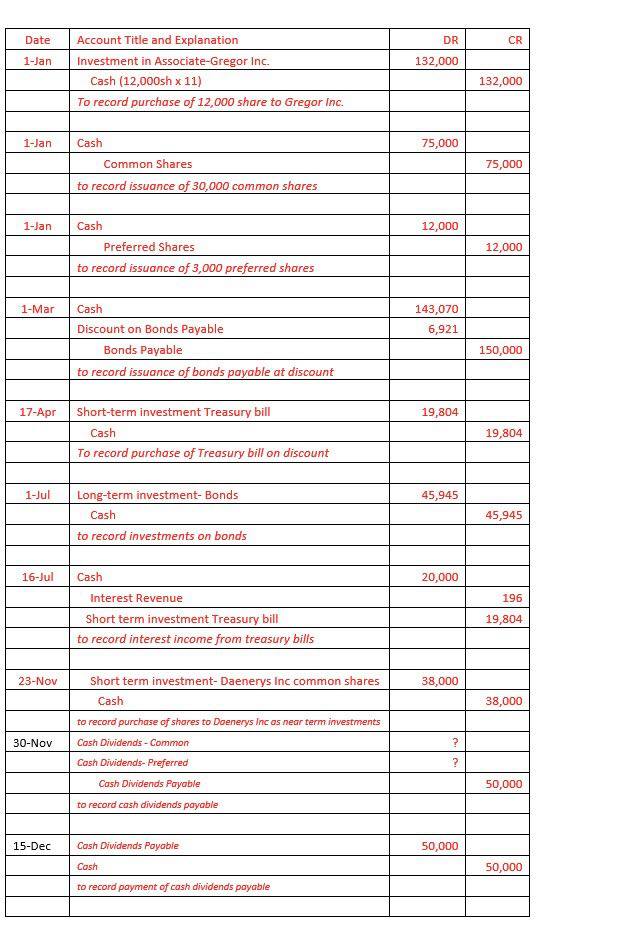

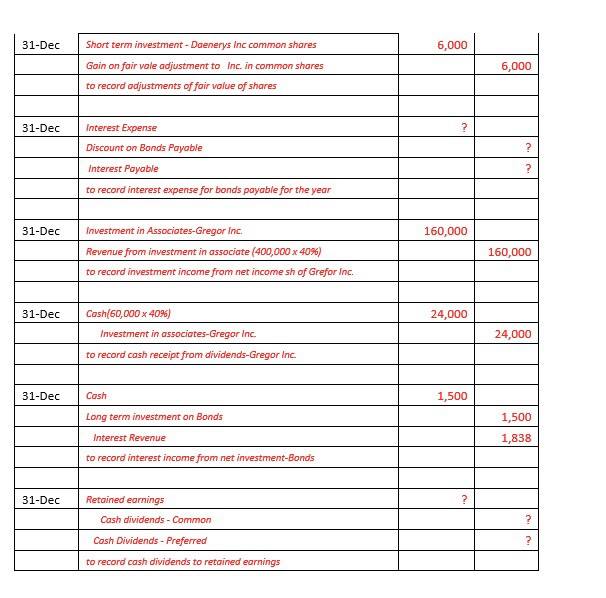

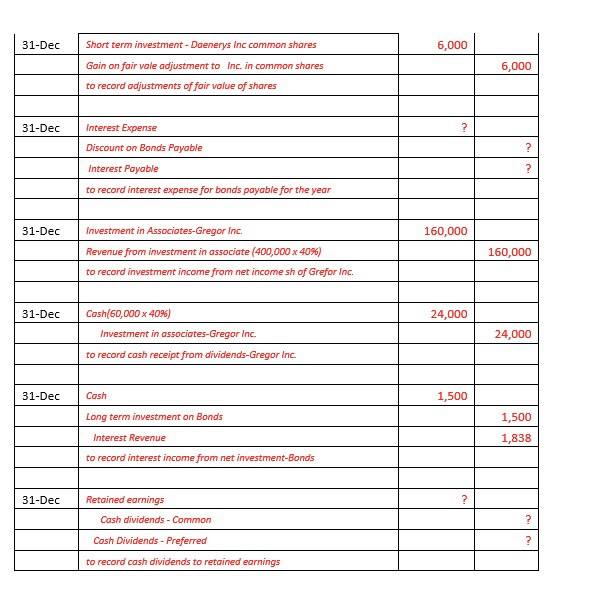

Professional Fees Expense 6,600 Property, Plant & Equipment 240,000 Rent Expense 38,000 Revenue from Investment in Associate Salaries Expense 75,000 Sales Discounts 8,000 Sales Returns and Allowances 10,000 Sales Revenue 690,000 Short-Term Investment - Daenerys Inc. Telephone Expense 4,000 Travel Expense 16,700 Unearned Revenue 88,230 Notes: The bank loan is payable over 8 years and $5,000 will be paid by December 31, 2021. Prepare a multistep income statement for the year ending December 31, 2021. Round answers to the nearest whole number. (26 marks)At the end of the year, Holister Electric has the following list of accounts and adjusted balances. The expansion into HVAC did not go as planned and had to be discontinued. - All balances are normal balances Complete the list by filling in the missing values from the journal entries you created during the year. (11 marks) -The cash balance includes all transactions during the year, induding the ones you prepared. Interest expense includes interest accrued on the bond plus interest paid on the bank loan. Interest payable will only conte in interest accrued Interest revenue is only from items in the journal entries for the year Assume the tax rate is 30%. Assume Income tax has already been pald. You will just have to calculate the Income tax expense on the Income statement. Account Title Balance Accounts Payable 65 Accounts Receivable 145,987 Accumulated Depreciation 50,000 Bank Loan 10,000 Bonds Payable Cash 47,165 Common Shares Cost of Goods Sold 310,500 Depreciation Expense 25,000 Discount on Bonds Gain on Fair Value Adjustment Insurance Expense 2,000 Interest Expense 2,000 Interest Payable Interest Revenue Inventory 110,000 Investment in Associate - Gregor Inc. Long-Term Investment - Bond Loss on Fair Value Adjustment Loss from Discontinued Operations 14,700 Maintenance Expense 9,000 Preferred Shares Premium on Bonds Prepaid Insurance 16,000Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020. Each of them contributed a number of items to the partnership, which are listed below. All tangible assets are listed at their market value. Razul Amy Cash $40,000 Cast $60,000 Equipment 190,000 Furniture 70,000 Bank Loan 80,000 Accounts Payable 30,000 On March 1, Razul and Amy added a new partner to the business, Sheila. Sheila will contribute $100,000 and receive a 35%% share of the business. Use the capital balances from January 1 to determine any bonuses. Assume the existing partners will split any bonus evenly. During the year, Razul and Amy withdrew $20,000 and $15,000 respectively and the business reported a net income of $400,000. Their partnership agreement provided for sharing of net income (loss) on the following basis: 1. Salary of $60,000 is allocated to Razul, $50,000 to Amy, and $20,000 to Sheila. 2. Interest is allocated at 7% of each partner's opening capital balance. 3. Remainder is shared where Razul gets 40%, Amy gets 25%, and Sheila gets 35%.Azul took the proceeds from dissolving the partnership and purchased a corporation selling electrical parts used for large production companies. He employs several people, but is looking to expand his operations further. In addition to expanding the sales of electrical parts, he also wants to start selling heating ventilation and air conditioning {H'v'AC} parts and machinery through a separate division of the company called 'HVAE Parts 3: Machinery.' Currently, l-iazul owns all the shares in the corporation. To raise the needed cash, he decides to offer corn mon and preferred shares for sale to investors starting in 2021. Below is the balance sheet at the end of 2010. I-lolister Electric inc. Balance Sheet As at December 31., 2020 Assets Liabilities Cash Accounts Payable $12,200 Accounts Receivable Linearned Revenue 5,200 Prepaid insurance Bank Loan m inventory Total Liabilities 43,400 Property, Plant Br Equipment Sha reholders' Equity Accumulated Depreciation Common Shares - issued 90,000 Retained Earnings 165 T00 Total shareholder's Equity 255 ?00 Total Assets liabilities E. wner's Equity $290,100 Azul has authorized 150,000 common shares and 10,000 preferred shares. The preferred shares will be cumulative and pay $5 dividends. Fiazul wanE to keep control of his business, so he will lceep his 50,000 common shares and will sit on the board of directors. Azul has located a fewI private investors that wish to purchase shares in the new corporation. Some want common shares, While other are interested in preferred shares. On January 1, 2021, Razul issues 30,000 common shares for $15,000 cash and issues 3,000 preferred shares for $12,000 cash. On March 1, 2011, Holister Electric inc. issued and sold $150,000, 6 year bonds with an interest rate of Ir'. The market rate at the time of issue was 096. Anyr premium or discount on the bond is amortized using the effective interest rate method. Interest will be paid annually on February 23. Use a 4 decimal factor for the bond calculation. During 2021, the company has performed well, so the board of directors decided to pay dividends. On November 30, 2021, the company declared cash dividends of $50,000, which will be paid out on December 15, 2021. Use the cash dividends method and close cash dividends at the end of the year. During the year, Holister Electric made the following investments: a) On January 1, Hollister purchased a strategic investment of 12,000 shares in Gregor Inc. for $11 per share. This represents 40% of Gregor Inc. common shares. On December 31, Gregor Inc. declares and pays a $60,000 dividend and reports a net income of $400,000. Holister will use the equity method to record this investment. b) On April 17, they purchased a $20,000, 90 day T-bill at 4% for $19,804. The T-bill matures on July 16. c) On July 1, they purchased a $50,000, 5 year bond paying 6% when the market rate was 8%. Interest is paid every 6 months on December 31 and June 30. Holister paid $45,945 to purchase the bond and plans to hold onto the bond until it matures. d) On November 23, the company purchased 2,000 shares of Daenerys Inc. at $19 per share for the purpose of trading. The shares are less than 4% of the total shares of Daenerys Inc. and are a non- strategic investment. By December 31, the price per share had gone up to $22 per share. Prepare the journal entries for the issue of shares, issue of the bonds and the dividends, plus all the investments made during the year. Also prepare adjustments at year end to accrue interest on the bond and to record change to any applicable investments.Date Account Title and Explanation DR CR 1-Jan Investment in Associate-Gregor Inc. 132,000 Cash (12,000sh x 11) 132,000 To record purchase of 12,000 share to Gregor Inc. 1-Jan Cash 75,000 Common Shares 75,000 to record issuance of 30,000 common shares 1-Jan Cash 12,000 Preferred Shares 12,000 to record issuance of 3,000 preferred shores 1-Mar Cash 143,070 Discount on Bonds Payable 6,921 Bonds Payable 150,000 to record issuance of bonds payable at discount 17-Apr Short-term investment Treasury bill 19 804 Cash 19,804 To record purchase of Treasury bill on discount 1-Jul Long-term investment- Bonds 45.945 Cash 45.945 to record investments on bonds 16-Jul Cash 20,000 Interest Revenue 196 Short term investment Treasury bill 19,804 to record interest income from treasury bills 23-Nov Short term investment- Daenerys Inc common shares 38,000 Cash 38,000 to record purchase of shores to Daenerys Inc as near term investments 30-Nov Cash Dividends - Common Cash Dividends- Preferred Cash Dividends Payable 50.000 to record cash dividends payable 15-Dec Cash Dividends Payable 50.000 Cash 50,000 to record payment of cash dividends payable31-Dec Short term investment - Daenerys Inc common shores 6,000 Gain on fair vale adjustment to Inc. in common shores 6,000 to record adjustments of four volue of shores 31-Dec Interest Expense 2 Discount on Bonds Payable Interest Poyable to record interest expense for bands payable for the year 31-Dec Investment in Associates-Gregor Inc. 160,000 Revenue from investment in associate (400,070 x 40% 160,000 to record investment income from net income sh of Grefor Inc. 31-Dec Cosh (60,000 x 4035) 24,000 Investment in associates-Gregor Inc. 24.000 to record cash receipt from dividends-Gregor Inc 31-Dec Cosh 1,500 Long term investment on Bonds 1,500 Interest Revenue 1,838 to record interest income from net investment-Bonds 31-Dec Retained earnings Cash dividends - Common Cash Dividends - Preferred to record cash dividends to retained earnings