Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me answer part a. it is 32 marks. please view both pictures as they are for the same question. would really appreciate it

please help me answer part a. it is 32 marks. please view both pictures as they are for the same question. would really appreciate it if you answer by 4pm. please include as much description as possible. thanks

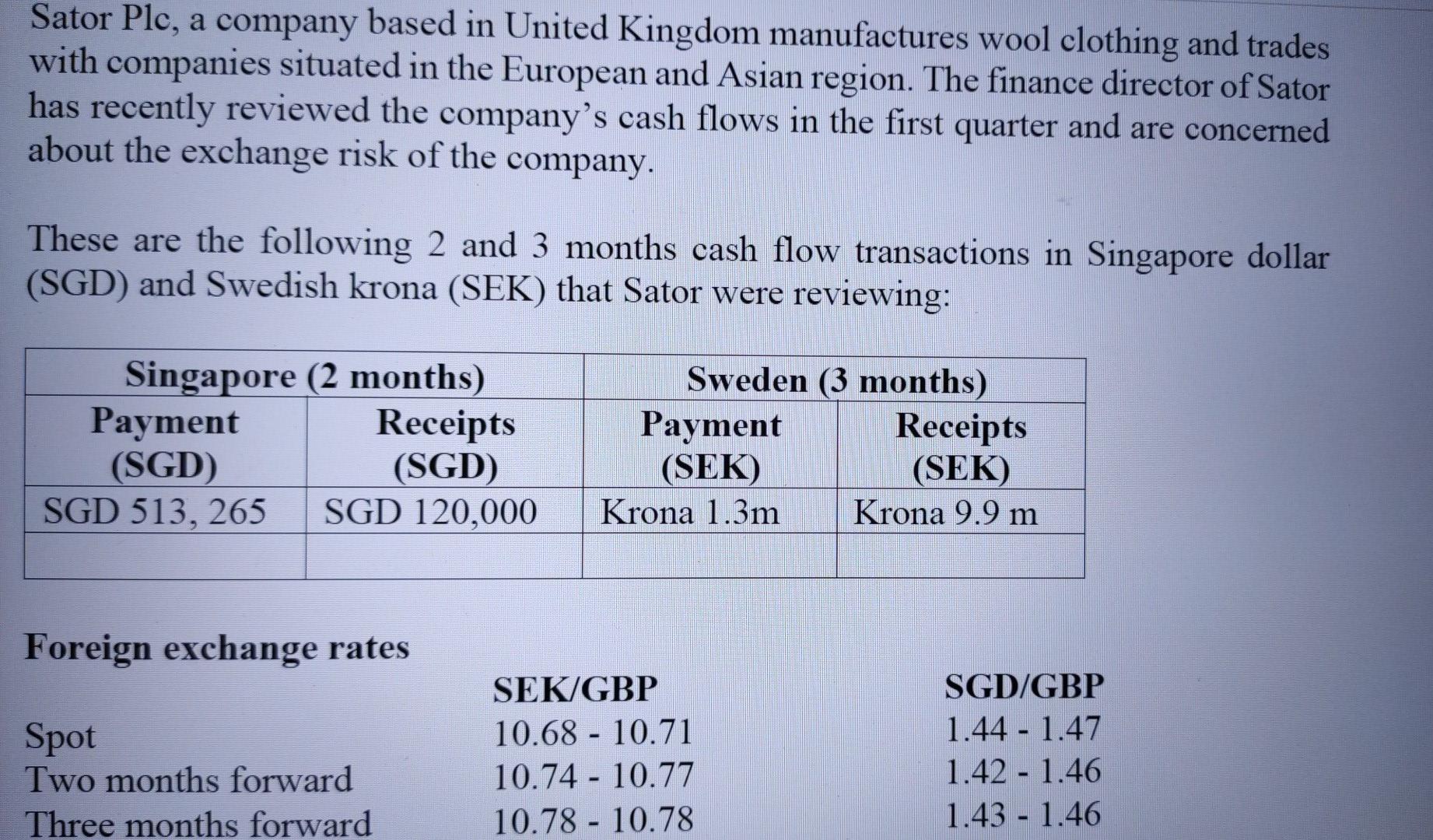

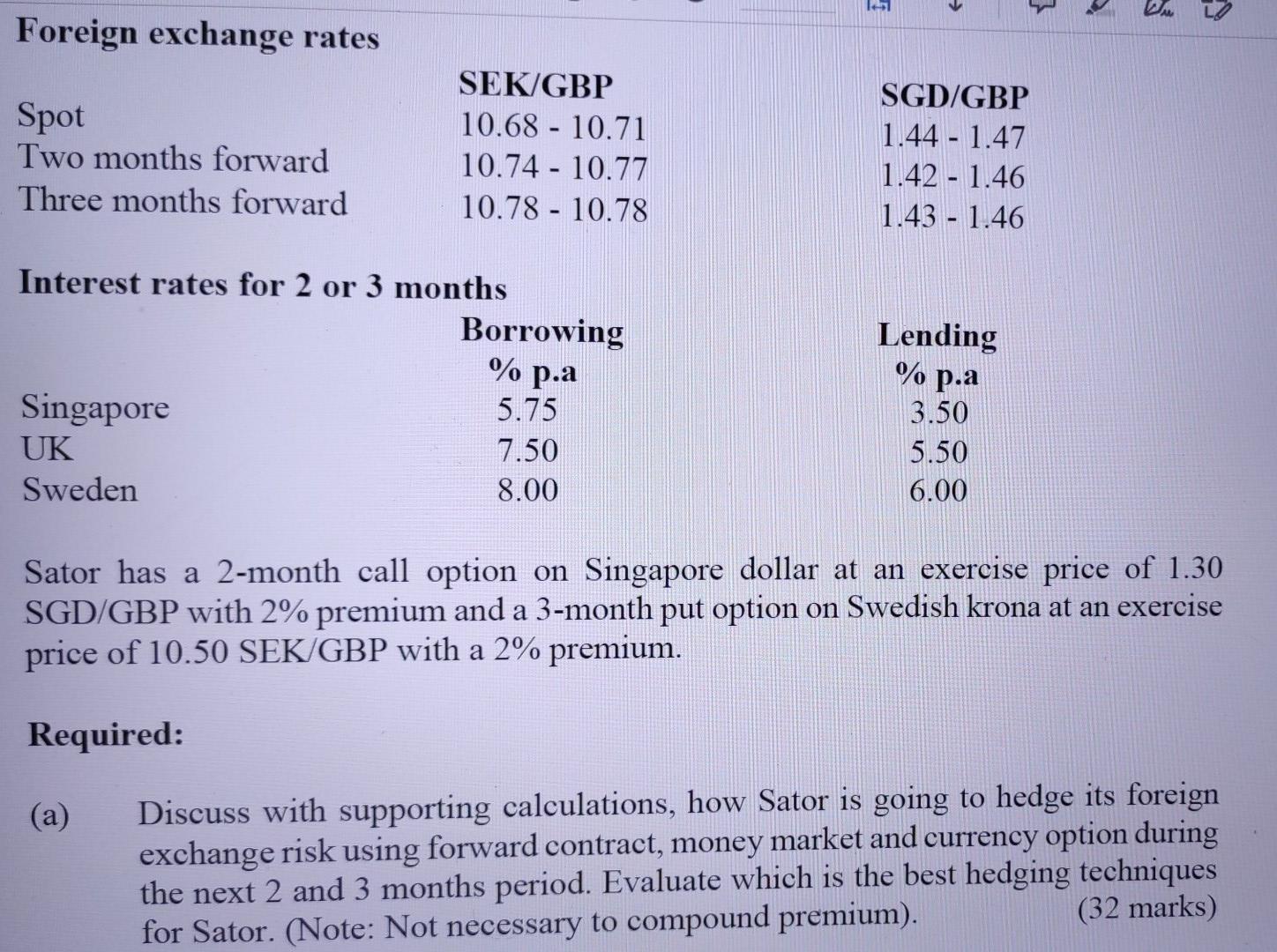

Sator Plc, a company based in United Kingdom manufactures wool clothing and trades with companies situated in the European and Asian region. The finance director of Sator has recently reviewed the company's cash flows in the first quarter and are concerned about the exchange risk of the company. These are the following 2 and 3 months cash flow transactions in Singapore dollar (SGD) and Swedish krona (SEK) that Sator were reviewing: Singapore (2 months) Payment Receipts (SGD) (SGD) SGD 513, 265 SGD 120,000 Sweden (3 months) Payment Receipts (SEK) (SEK) Krona 1.3m Krona 9.9 m Foreign exchange rates Spot Two months forward Three months forward SEK/GBP 10.68 - 10.71 10.74 - 10.77 10.78 - 10.78 SGD/GBP 1.44 - 1.47 1.42 - 1.46 1.43 - 1.46 les 1 > Di Foreign exchange rates Spot Two months forward Three months forward SEK/GBP 10.68 - 10.71 10.74 - 10.77 10.78 - 10.78 SGD/GBP 1.44 - 1.47 1.42 - 1.46 1.43 - 1.46 Interest rates for 2 or 3 months Borrowing Lending % p.a % p.a Singapore UK Sweden 5.75 7.50 8.00 3.50 5.50 6.00 Sator has a 2-month call option on Singapore dollar at an exercise price of 1.30 SGD/GBP with 2% premium and a 3-month put option on Swedish krona at an exercise price of 10.50 SEK/GBP with a 2% premium. Required: (a) Discuss with supporting calculations, how Sator is going to hedge its foreign exchange risk using forward contract, money market and currency option during the next 2 and 3 months period. Evaluate which is the best hedging techniques for Sator. (Note: Not necessary to compound premium). (32 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started