Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME ANSWER PARTS (a - i) FOR QUESTION #1 Also, in part (i) The concepts in chapter 13 just in to valuing, speculating,

PLEASE HELP ME ANSWER PARTS (a - i) FOR QUESTION #1

Also, in part (i) The concepts in chapter 13 just in to valuing, speculating, hedging future trading

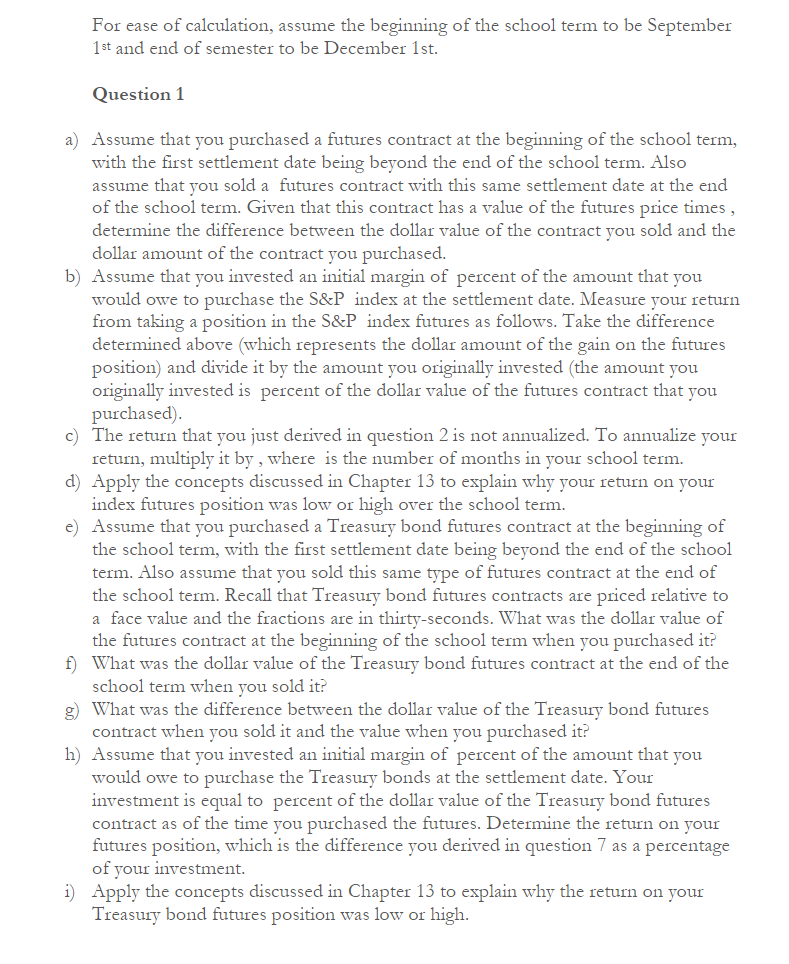

For ease of calculation, assume the beginning of the school term to be September 1st and end of semester to be December 1st. Question 1 a) Assume that you purchased a futures contract at the beginning of the school term, with the first settlement date being beyond the end of the school term. Also assume that you sold a futures contract with this same settlement date at the end of the school term. Given that this contract has a value of the futures price times, determine the difference between the dollar value of the contract you sold and the dollar amount of the contract you purchased. b) Assume that you invested an initial margin of percent of the amount that you would owe to purchase the S&P index at the settlement date. Measure your return from taking a position in the S&P index futures as follows. Take the difference determined above (which represents the dollar amount of the gain on the futures position) and divide it by the amount you originally invested (the amount you originally invested is percent of the dollar value of the futures contract that you purchased) c) The return that you just derived in question 2 is not annualized. To annualize your retur, multiply it by, where is the number of months in your school term. d) Apply the concepts discussed in Chapter 13 to explain why your return on your index futures position was low or high over the school term. e) Assume that you purchased a Treasury bond futures contract at the beginning of the school term, with the first settlement date being beyond the end of the school term. Also assume that you sold this same type of futures contract at the end of the school term. Recall that Treasury bond futures contracts are priced relative to a face value and the fractions are in thirty-seconds. What was the dollar value of the futures contract at the beginning of the school term when you purchased it? f) What was the dollar value of the Treasury bond futures contract at the end of the school term when you sold it? g) What was the difference between the dollar value of the Treasury bond futures contract when you sold it and the value when you purchased it? h) Assume that you invested an initial margin of percent of the amount that you would owe to purchase the Treasury bonds at the settlement date. Your investment is equal to percent of the dollar value of the Treasury bond futures contract as of the time you purchased the futures. Determine the return on your futures position, which is the difference you derived in question 7 as a percentage of your investment. i) Apply the concepts discussed in Chapter 13 to explain why the return on your Treasury bond futures position was low or high. For ease of calculation, assume the beginning of the school term to be September 1st and end of semester to be December 1st. Question 1 a) Assume that you purchased a futures contract at the beginning of the school term, with the first settlement date being beyond the end of the school term. Also assume that you sold a futures contract with this same settlement date at the end of the school term. Given that this contract has a value of the futures price times, determine the difference between the dollar value of the contract you sold and the dollar amount of the contract you purchased. b) Assume that you invested an initial margin of percent of the amount that you would owe to purchase the S&P index at the settlement date. Measure your return from taking a position in the S&P index futures as follows. Take the difference determined above (which represents the dollar amount of the gain on the futures position) and divide it by the amount you originally invested (the amount you originally invested is percent of the dollar value of the futures contract that you purchased) c) The return that you just derived in question 2 is not annualized. To annualize your retur, multiply it by, where is the number of months in your school term. d) Apply the concepts discussed in Chapter 13 to explain why your return on your index futures position was low or high over the school term. e) Assume that you purchased a Treasury bond futures contract at the beginning of the school term, with the first settlement date being beyond the end of the school term. Also assume that you sold this same type of futures contract at the end of the school term. Recall that Treasury bond futures contracts are priced relative to a face value and the fractions are in thirty-seconds. What was the dollar value of the futures contract at the beginning of the school term when you purchased it? f) What was the dollar value of the Treasury bond futures contract at the end of the school term when you sold it? g) What was the difference between the dollar value of the Treasury bond futures contract when you sold it and the value when you purchased it? h) Assume that you invested an initial margin of percent of the amount that you would owe to purchase the Treasury bonds at the settlement date. Your investment is equal to percent of the dollar value of the Treasury bond futures contract as of the time you purchased the futures. Determine the return on your futures position, which is the difference you derived in question 7 as a percentage of your investment. i) Apply the concepts discussed in Chapter 13 to explain why the return on your Treasury bond futures position was low or highStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started