PLEASE HELP ME ANSWER THE FOLLOWING IN GOOD ACCOUNTING FORM

1.

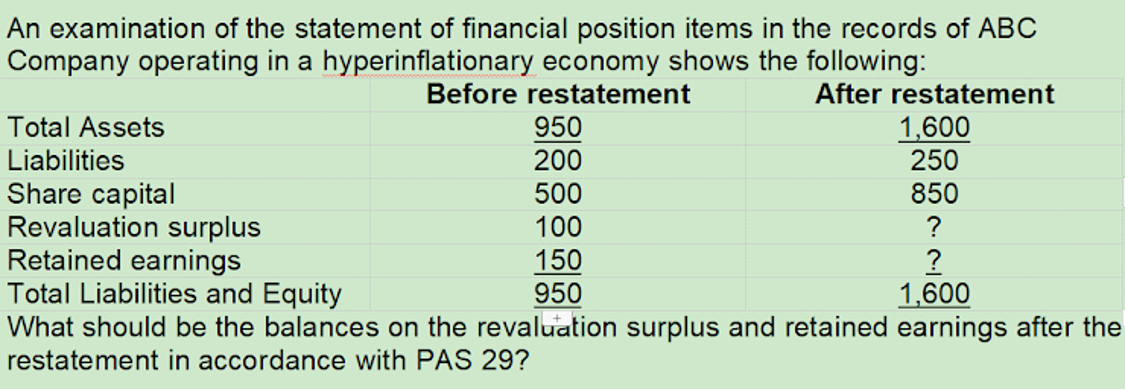

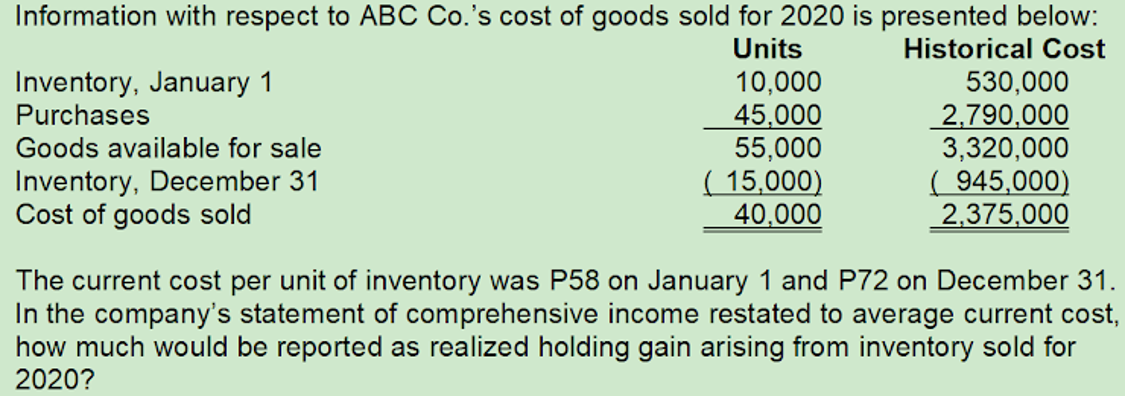

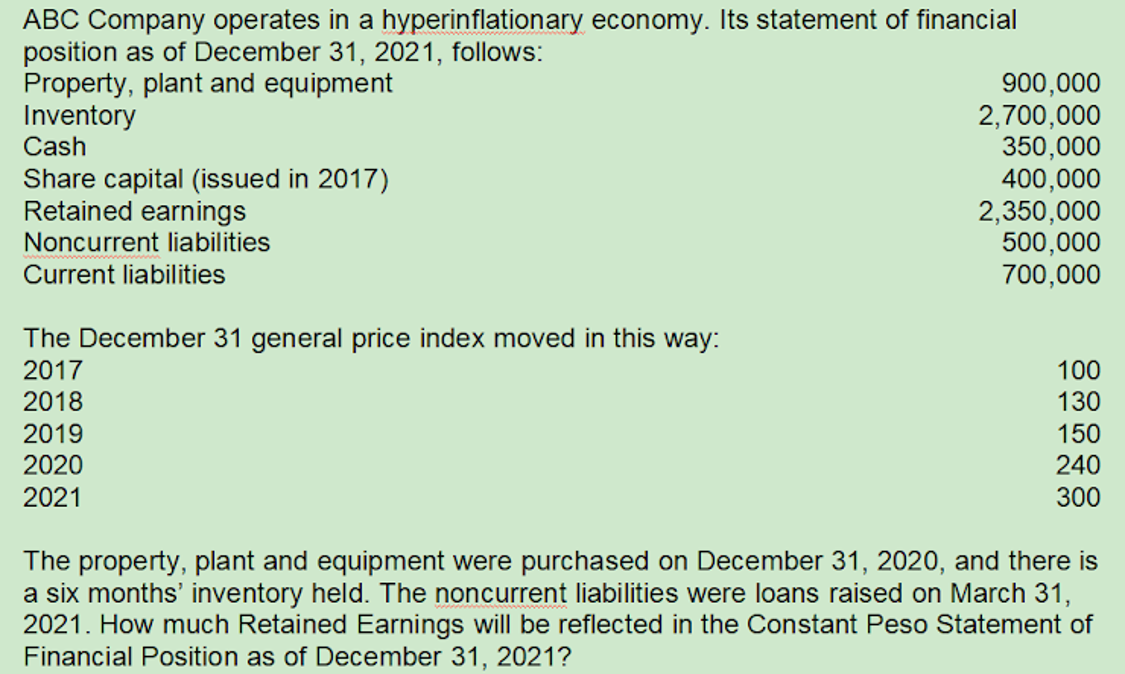

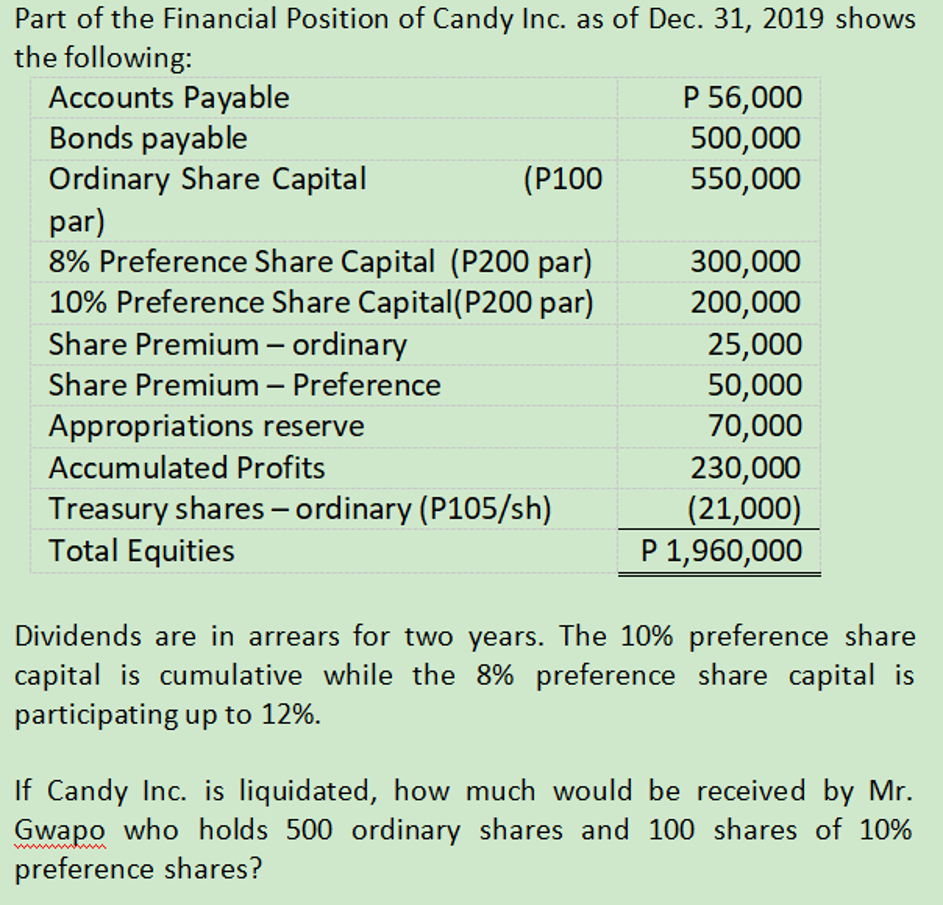

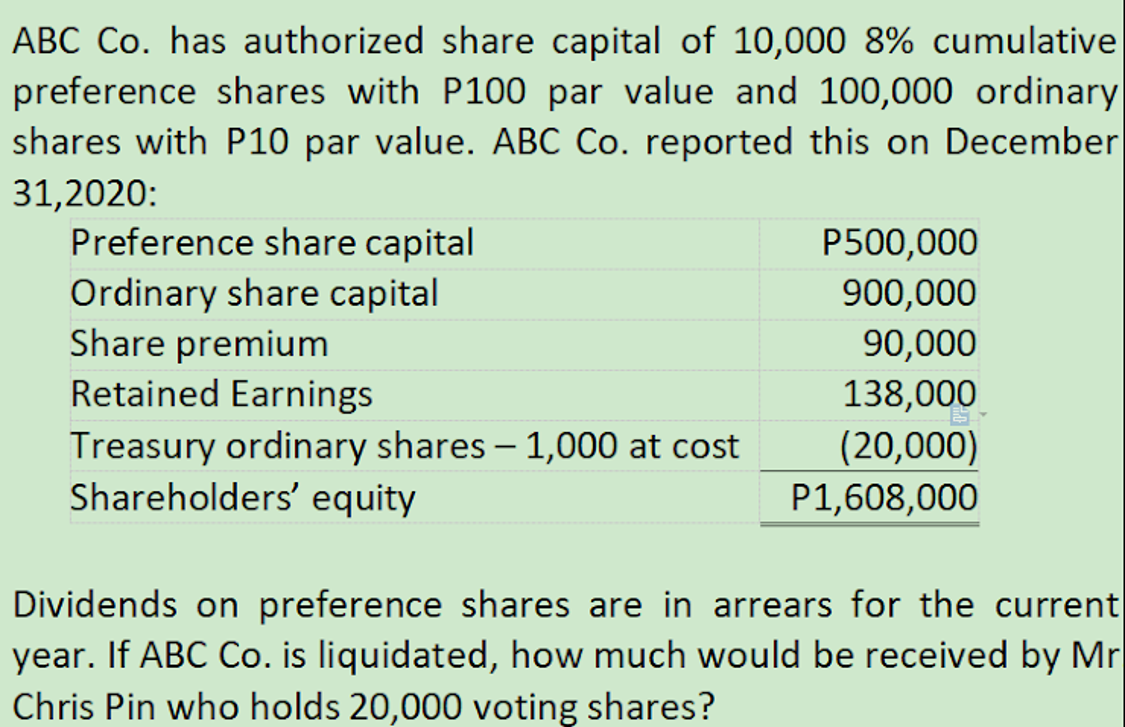

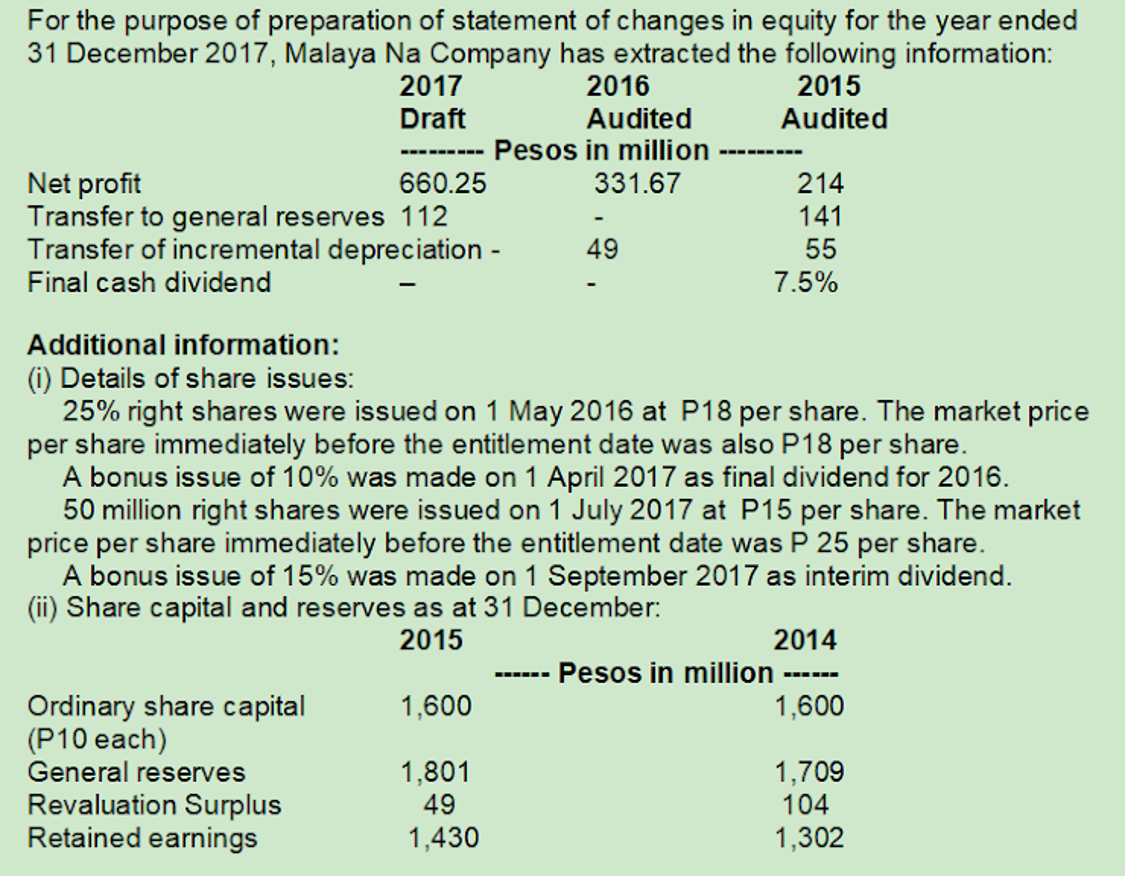

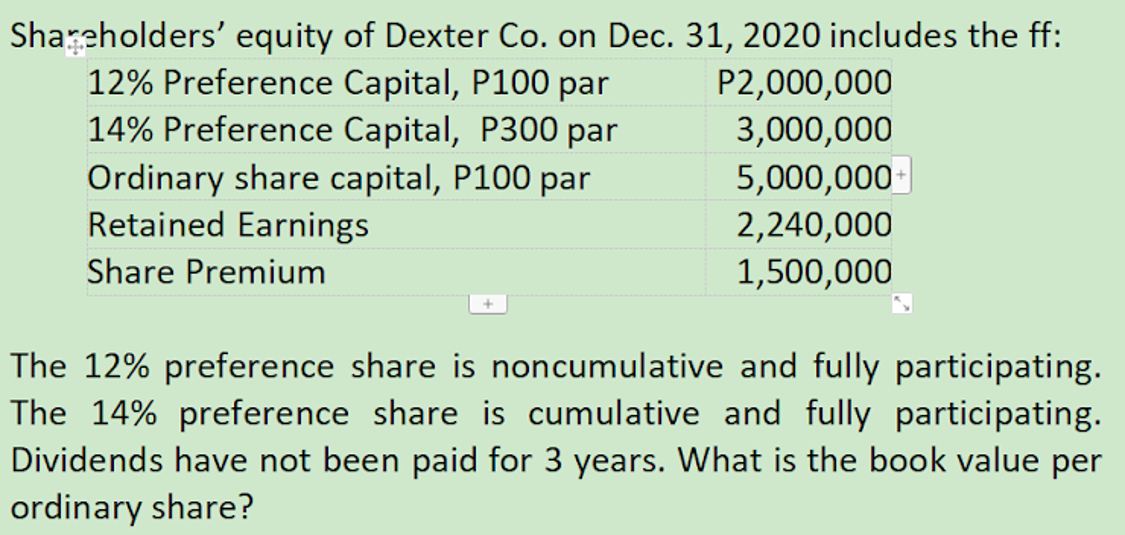

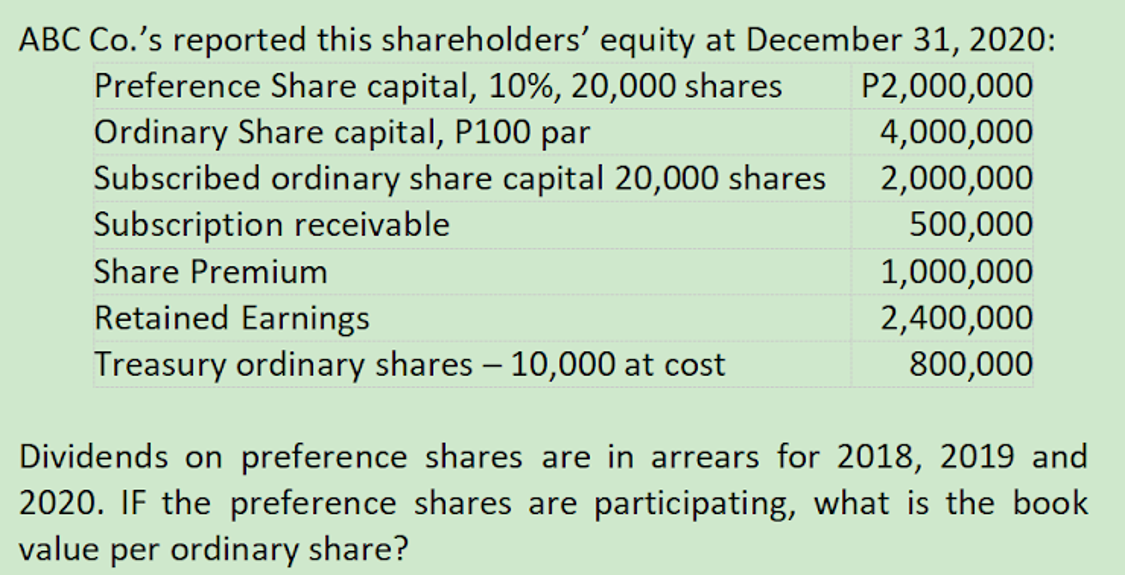

An examination of the statement of financial position items in the records of ABC Company operating in a hyperinflationary economy shows the following: Before restatement After restatement Total Assets 950 1,600 Liabilities 200 250 Share capital 500 850 Revaluation surplus 100 ? Retained earnings 150 ? Total Liabilities and Equity 950 1,600 What should be the balances on the revaluation surplus and retained earnings after the restatement in accordance with PAS 29?Information with respect to ABC Co.'s cost of goods sold for 2020 is presented below: Units Historical Cost Inventory, January 1 10,000 530,000 Purchases 45,000 2,790,000 Goods available for sale 55,000 3,320,000 Inventory, December 31 15,000) ( 945,000) Cost of goods sold 40,000 2,375,000 The current cost per unit of inventory was P58 on January 1 and P72 on December 31. In the company's statement of comprehensive income restated to average current cost, how much would be reported as realized holding gain arising from inventory sold for 2020?ABC Company operates in a hyperinflationary economy. Its statement of financial position as of December 31, 2021, follows: Property, plant and equipment 900,000 Inventory 2,700,000 Cash 350,000 Share capital (issued in 2017) 400,000 Retained earnings 2,350,000 Noncurrent liabilities 500,000 Current liabilities 700,000 The December 31 general price index moved in this way: 2017 100 2018 130 2019 150 2020 240 2021 300 The property, plant and equipment were purchased on December 31, 2020, and there is a six months' inventory held. The noncurrent liabilities were loans raised on March 31, 2021. How much Retained Earnings will be reflected in the Constant Peso Statement of Financial Position as of December 31, 2021?Part of the Financial Position of Candy Inc. as of Dec. 31, 2019 shows the following: Accounts Payable P 56,000 Bonds payable 500,000 Ordinary Share Capital (P100 550,000 par) 8% Preference Share Capital (P200 par) 300,000 10% Preference Share Capital(P200 par) 200,000 Share Premium - ordinary 25,000 Share Premium - Preference 50,000 Appropriations reserve 70,000 Accumulated Profits 230,000 Treasury shares - ordinary (P105/sh) (21,000) Total Equities P 1,960,000 Dividends are in arrears for two years. The 10% preference share capital is cumulative while the 8% preference share capital is participating up to 12%. If Candy Inc. is liquidated, how much would be received by Mr. Gwapo who holds 500 ordinary shares and 100 shares of 10% preference shares?ABC Co. has authorized share capital of 10,000 8% cumulative preference shares with P100 par value and 100,000 ordinary shares with P10 par value. ABC Co. reported this on December 31,2020: Preference share capital P500,000 Ordinary share capital 900,000 Share premium 90,000 Retained Earnings 138,000 Treasury ordinary shares - 1,000 at cost (20,000) Shareholders' equity P1,608,000 Dividends on preference shares are in arrears for the current year. If ABC Co. is liquidated, how much would be received by Mr Chris Pin who holds 20,000 voting shares?For the purpose of preparation of statement of changes in equity for the year ended 31 December 2017. Malaya Na Company has extracted the following information: 2017 2016 201 5 Draft Audited Audited ------ Pesos in million ------ Net prot 660.25 331.67 214 Transfer to general reserves 1 12 - 141 Transfer of inc remental depreciation - 49 55 Final cash dividend - _ 7.5% Additional information: (i) Details of share issues: 25% right shares were issued on 1 May 2016 at P18 per share. The market price per share immediately before the entitiement date was also P18 per share. A bonus issue of 10% was made on 1 April 2017 as final dividend for 2016. 50 million right shares were issued on 1 July 2017 at P15 per share. The market price per share immediately before the entitlement date was P 25 per share. A bonus issue of 15% was made on 1 September 2017 as interim dividend. (ii) Share capital and reserves as at 31 December. 2015 2014 - Pesos in million Ordinary share capital 1.600 1.600 (P10 each) General reserves 1 .801 1 .709 Revaluation Surplus 49 104 Retained earnings 1 .430 1 .302 Shareholders' equity of Dexter Co. on Dec. 31, 2020 includes the ff: 12% Preference Capital, P100 par P2,000,000 14% Preference Capital, P300 par 3,000,000 Ordinary share capital, P100 par 5,000,000 Retained Earnings 2,240,000 Share Premium 1,500,000 The 12% preference share is noncumulative and fully participating. The 14% preference share is cumulative and fully participating. Dividends have not been paid for 3 years. What is the book value per ordinary share?ABC Co.'s reported this shareholders' equity at December 31, 2020: Preference Share capital, 10%, 20,000 shares P2,000,000 Ordinary Share capital, P100 par 4,000,000 Subscribed ordinary share capital 20,000 shares 2,000,000 Subscription receivable 500,000 Share Premium 1,000,000 Retained Earnings 2,400,000 Treasury ordinary shares - 10,000 at cost 800,000 Dividends on preference shares are in arrears for 2018, 2019 and 2020. IF the preference shares are participating, what is the book value per ordinary share