Please help me answer the questions:

Questions:

1. If the rate of economic growth in the economy is 3% in a particular year, can we expect share prices to rise by 3% that year? Explain your answer.

2. Of what importance do you think the publication of economic and financial data by firms and governments is in affecting share prices?

Below is the case study:

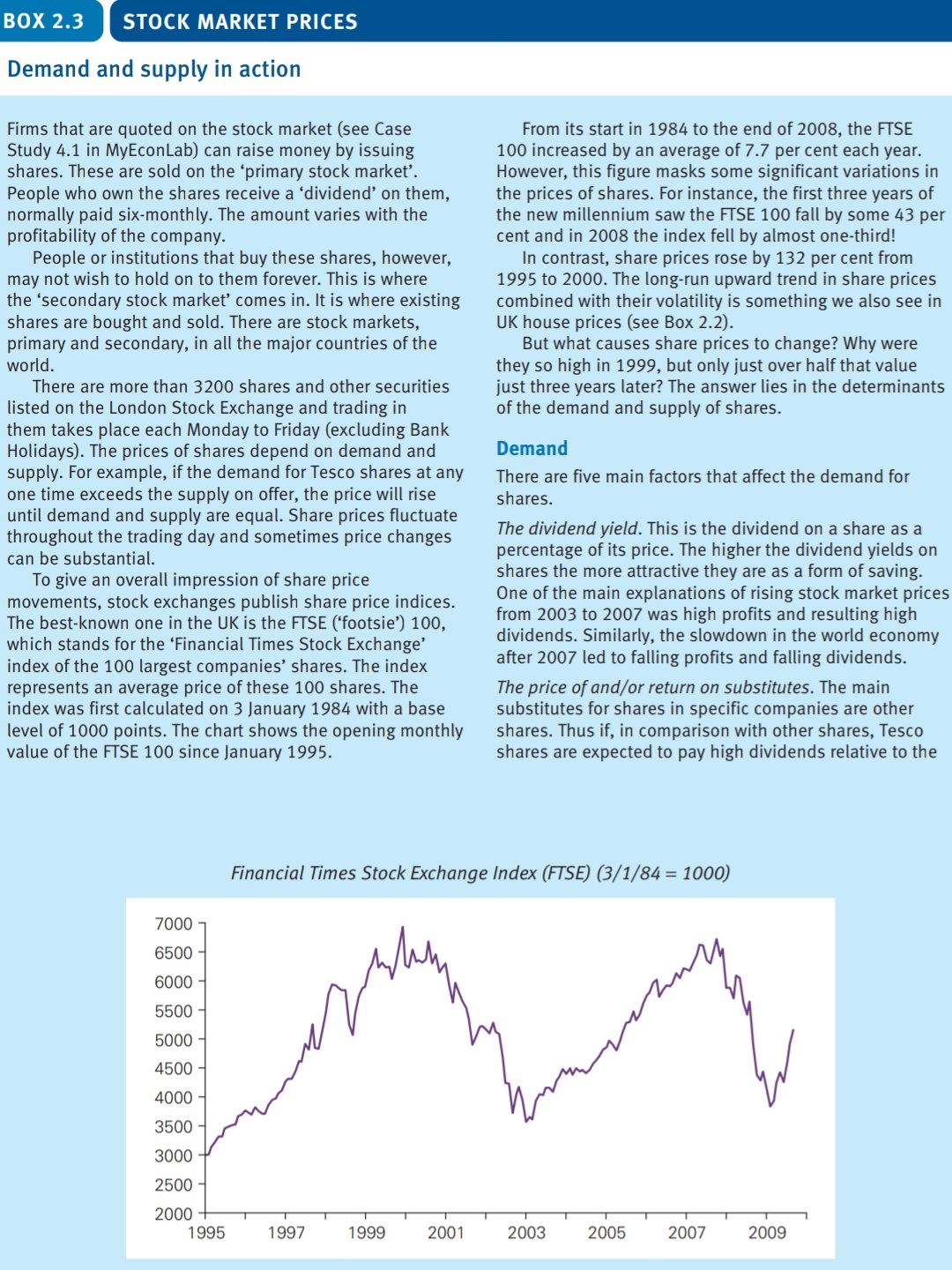

BOX 2.3 STOCK MARKET PRICES Demand and supply in action Firms that are quoted on the stock market (see Ca5e Study 4.1 in MyEconLab] can raise money by issuing shares. These are sold on the 'primary stock market'. People who own the shares receive a 'dividend' on them, normally paid six-monthly. The amount varies with the protability of the company. People or institutions that buy these shares. however. may not wish to hold on to them forever. This is where the 'secondary stock market' comes in. It is where existing shares are bought and sold. There are stock markets. primary and secondary, in all the major countries ofthe world. There are more than 3200 shares and other securities listed on the London Stock Exchange and trading in them takes place each Monday to Friday (excluding Bank Holidays). The prices of shares depend on demand and supply. For example, ifthe demand for Tesco shares at any one time exceeds the supply on offer. the price will rise until demand and supply are equal. Share prices uctuate throughout the trading day and sometimes price changes can be substantial. To give an overall impression of share price movements, stock exchanges publish share price indices. The best-known one in the UK is the FI'SE ('footsie') 100, which stands for the 'Financial Times Stock Exchange' index of the 100 largest companies' shares. The index represents an average price of these 100 shares. The index was rst calculated on 3 January 1984 with a base level of 1000 points. The chart shows the opening monthly value ofthe FI'SE 100 since January 1995. From its start in 1984 to the end of 2008, the FTSE 100 increased by an average of 7.7 per cent each year. However. this gure masks some signicant variations in the prices of shares. For instance, the rst three years of the new millennium saw the FiSE 100 fall by some 13 per cent and in 2008 the index fell by almost one-third! In contrast, share prices rose by 132 per cent from 1995 to 2000. The long-run upward trend in share prices combined with their volatility is something we also see in UK house prices (see Box 2.2). But what causes share prices to change? Why were they so high in 1999, but only just over half that value just three years later? The answer lies in the determinants of the demand and supply of shares. Demand There are ve main factors that affect the demand for shares. The dividend yield. This is the dividend on a share as a percentage of its price. The higher the dividend yields on shares the more attractive they are as a form of saving. One of the main explanations of rising stock market prices from 2003 to 2007 was high prots and resulting high dividends. Similarly, the slowdown in the world economy after 2007 led to falling prots and falling dividends. The price of and/or return on substitutes. The main substitutes for shares in specic companies are other shares. Thus if. in comparison with other shares, Tesco shares are expected to pay high dividends relative to the Financial Times Stock Exchange index WSB (3/1/84 = 1000) 7000 6500 6000 5500 5000 4500 4000 3500 3000 2500 2000 1995 1997 1999 2001 2003 2005 2007 2009 share price, people will buy Tesco shares. As far as shares in general are concerned, the main substitutes are other forms of saving. Thus if the interest rate on savings accounts in banks and building societies fell, people with such accounts would be tempted to take their money out and buy shares instead. Another major substitute is property. If house prices rise rapidly, as they did at the start of the 20005 (see Box 2.2), this will reduce the demand for shares as many people switch to buying property in anticipation of even higher prices. if house price growth is weak or even negative. as it was during the rst half of the 19905. this makes shares relatively more attractive as an investment and can boost the demand for them. Of course. other factors may affect bath house prices and shares in the same way. Thus the 'credit crunch' of the late 20005, when nance became both harder and more expensive to obtain. re5ulted in both falling house prices and falling share prices as the economy slowed down and prots fell. incomes. If the economy is growing rapidly and peeple's inc0mes are thus rising rapidly. they are likely to buy more shares. For instance. in the second half ofthe 19905. when household sector disposable income grew by an average of 3 per cent per year, share prices rose rapidly (see chart). Wealth. 'Wealth' or 'net worth' is the accumulated value of people's financial and physical assets, less any financial liabilities (see Chapter 8)). The households sector's wealth increased in the second half of the 19905 and people used their increased wealth to buy shares. it was a similar picture in the mid-20005. Much of the wealth worldwide was in relatively 'llquid' form i.e. in a form that can easily be turned into cash (and hence used to buy shares). Expectations. In both the mid- to late 19805 and the 19905. people expected share prices to go on rising. in the 19805 there was a sense that the UK economy had undergone a transformation enabling permanently higher rates of economic growth. In the case ofthe late 19905. reforms to policy-making. including central bank independence (see Chapter 12). again suggested better economic times lay ahead and an end to 'boom and bust'. These positive sentiments encouraged people to buy shares and pushed prices up even more. Of courseI this can further fuel speculation and further share buying. By contrast. the early and late 20005 saw confidence shaken. Negative sentiment helps to push prices down as people hold back from buying. If this negative sentiment persists it can cause signicant falls. In the early part of the decade many countries experienced a temporary slowing of economic growth. This combined with other negative factors, such as the 11 September 2001 attack on the World Trade Center and various corporate scandals, such as the accounting fraud concerning the giant US company Enron. In the late 20005, there was a global nancial crisis followed by a severe economic slowdown. Stock markets plummeted. Between October 2007 and 2008 the FTSE 100 fell by almost a half (see chart). Furthermore the FTSE and other stock markets around the world moved wildly as investors tried to gauge of the severity of the crisis. Share prices moved sharply in respOnse to releases of economic data. rms' trading gures and policy initiatives designed to stabilise the nancial system and to get banks lending again. Supply The factors affecting supply are largely the same as those affecting demand. but in the opposite direction. If the return on alternative forms of saving falls, people with shares are likely to hold on to them, as they represent a better form of saving. The supply of shares to the market will fall. If inc0mes or wealth rises. people again are likely to want to hold on to their shares. As far as expectations are concerned, if people believe that share prices will rise. they will hold on to the shares they have. Supply to the market will fall. thereby pushing up prices. If, however. they believe that prices will fall. as they did in 2008. they will sell their shares now before prices do fall. Supply will increase. driving down the price. Share prices and business Companies are crucially affected by their share price. If a company's share price falls. this is taken as a sign that 'the market' is losing confidence in the company. This will make it more difcult to raise nance. not only by issuing additional shares In the primary market. but also from banks. It will also make the company more vulnerable to a takeover bid. This Is where one company seeks to buy out another by offering to buy all its shares. A takeover will succeed if the owners of more than half ofthe company's shares vote to accept the offered price. Shareholders are more likely to agree to the takeover if the com pany's shares have not being doing very well recently. 3 per cent in a particular year, can we expect share prices to rise by 3 per cent that year? Explain your answer. 2. Of what importance do you think the publication of economic and nancial data by rms and governments is in affecting share prices? 1. if the rate of economic growth in the economy is