Answered step by step

Verified Expert Solution

Question

1 Approved Answer

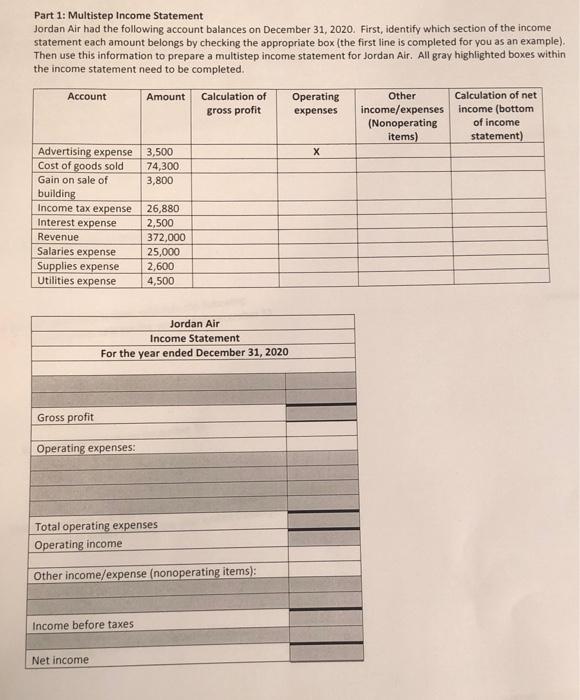

please help me answer the two pages Part 1: Multistep Income Statement Jordan Air had the following account balances on December 31, 2020. First, identify

please help me

answer the two pages

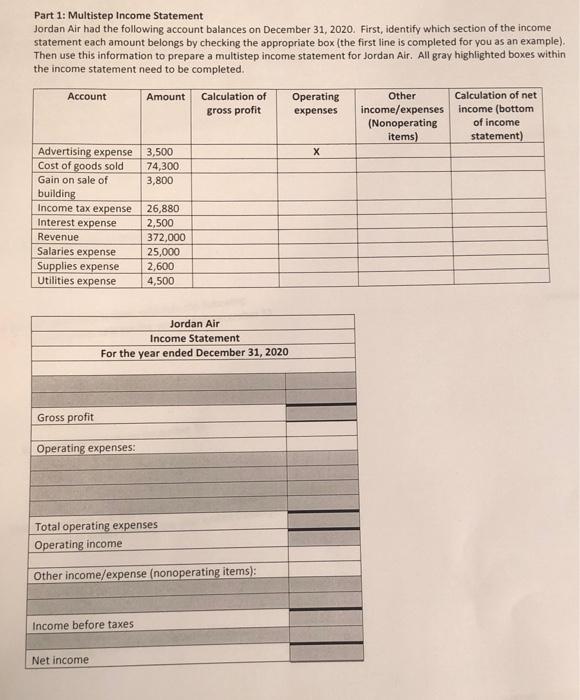

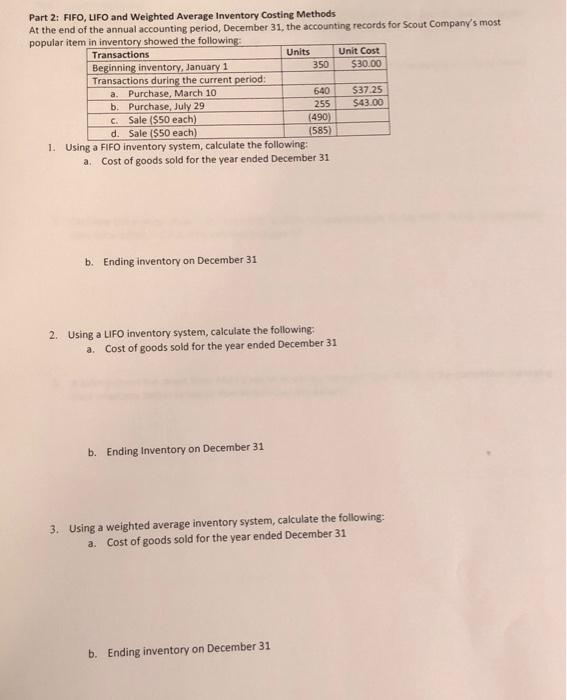

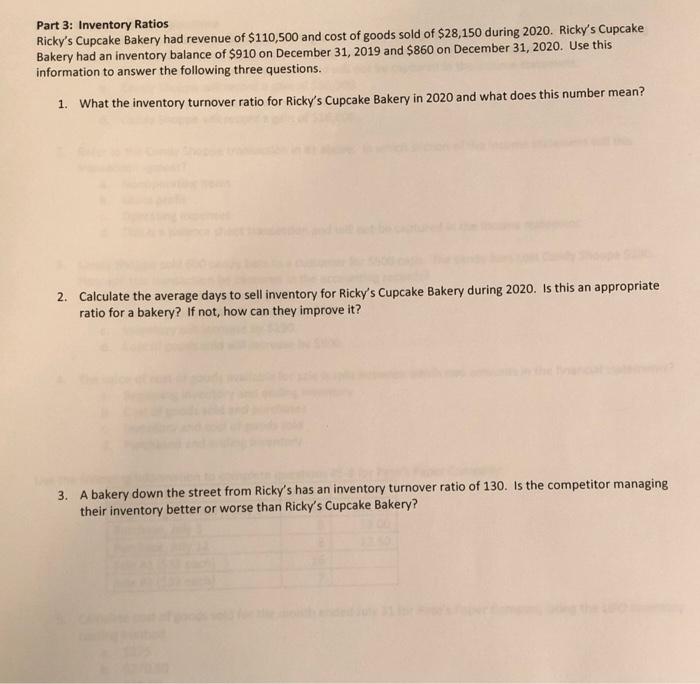

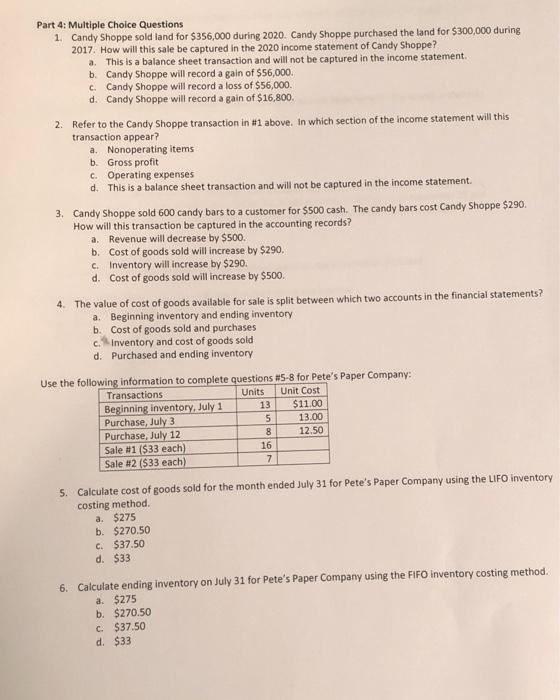

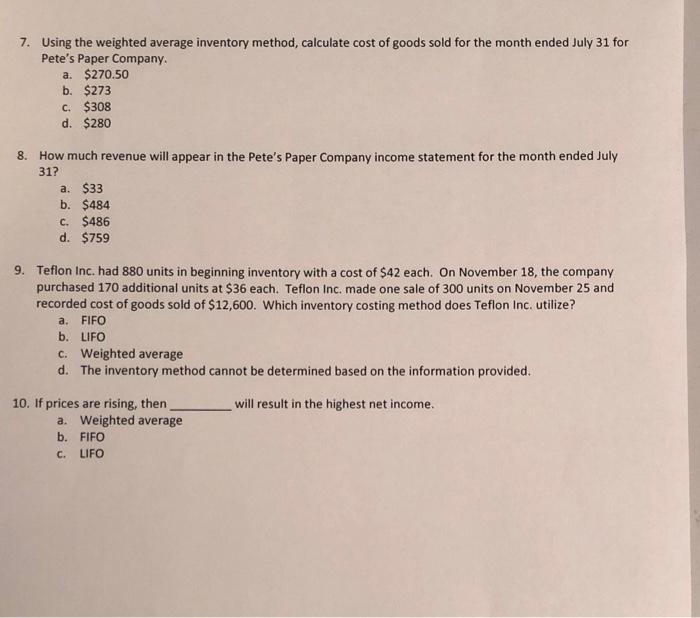

Part 1: Multistep Income Statement Jordan Air had the following account balances on December 31, 2020. First, identify which section of the income statement each amount belongs by checking the appropriate box (the first line is completed for you as an example). Then use this information to prepare a multistepincome statement for Jordan Air. All gray highlighted boxes within the income statement need to be completed. Account Amount Calculation of Operating Other Calculation of net gross profit expenses income/expenses income (bottom (Nonoperating of income items) statement) Advertising expense 3,500 Cost of goods sold 74,300 Gain on sale of 3,800 building Income tax expense 26,880 Interest expense 2,500 Revenue 372,000 Salaries expense 25,000 Supplies expense 2,600 Utilities expense 4,500 Jordan Air Income Statement For the year ended December 31, 2020 Gross profit Operating expenses: Total operating expenses Operating income Other income/expense (nonoperating items): Income before taxes Net income Part 2: FIFO, LIFO and Weighted Average Inventory Costing Methods At the end of the annual accounting period, December 31, the accounting records for Scout Company's most popular item in inventory showed the following: Transactions Units Unit Cost Beginning inventory, January 1 350 $30.00 Transactions during the current period: a. Purchase, March 10 640 $37.25 b. Purchase, July 29 255 $43.00 C. Sale ($50 each) (490) d. Sale ($50 each) 1585) 1. Using a FIFO inventory system, calculate the following: a. Cost of goods sold for the year ended December 31 b. Ending inventory on December 31 2. Using a LIFO inventory system, calculate the following: a. Cost of goods sold for the year ended December 31 b. Ending Inventory on December 31 3. Using a weighted average inventory system, calculate the following: a. Cost of goods sold for the year ended December 31 b. Ending inventory on December 31 Part 3: Inventory Ratios Ricky's Cupcake Bakery had revenue of $110,500 and cost of goods sold of $28,150 during 2020. Ricky's Cupcake Bakery had an inventory balance of $910 on December 31, 2019 and $860 on December 31, 2020. Use this information to answer the following three questions. 1. What the inventory turnover ratio for Ricky's Cupcake Bakery in 2020 and what does this number mean? 2. Calculate the average days to sell inventory for Ricky's Cupcake Bakery during 2020. Is this an appropriate ratio for a bakery? If not, how can they improve it? 3. A bakery down the street from Ricky's has an inventory turnover ratio of 130. Is the competitor managing their inventory better or worse than Ricky's Cupcake Bakery? Part 4: Multiple Choice Questions 1. Candy Shoppe sold land for $356,000 during 2020. Candy Shoppe purchased the land for $300,000 during 2017. How will this sale be captured in the 2020 income statement of Candy Shoppe? a. This is a balance sheet transaction and will not be captured in the income statement. b. Candy Shoppe will record a gain of $56,000. c. Candy Shoppe will record a loss of $56,000. d. Candy Shoppe will record a gain of $16,800 2. Refer to the Candy Shoppe transaction in #1 above. In which section of the income statement will this transaction appear? a. Nonoperating items b. Gross profit c. Operating expenses d. This is a balance sheet transaction and will not be captured in the income statement 3. Candy Shoppe sold 600 candy bars to a customer for $500 cash. The candy bars cost Candy Shoppe $290. How will this transaction be captured in the accounting records? a. Revenue will decrease by $500. b. Cost of goods sold will increase by $290, c. Inventory will increase by $290. d. Cost of goods sold will increase by $500. 4. The value of cost of goods available for sale is split between which two accounts in the financial statements? a. Beginning inventory and ending inventory b. Cost of goods sold and purchases c. Inventory and cost of goods sold d. Purchased and ending inventory Use the following information to complete questions #5-8 for Pete's Paper Company: Transactions Units Unit Cost Beginning inventory, July 1 13 $11.00 Purchase, July 3 5 13.00 Purchase, July 12 8 12.50 Sale #1 ($33 each) 16 Sale #2 (533 each) 7 5. Calculate cost of goods sold for the month ended July 31 for Pete's Paper Company using the LIFO inventory costing method a. $275 b. $270.50 c. $37.50 d. $33 6. Calculate ending inventory on July 31 for Pete's Paper Company using the FIFO inventory costing method. a. $275 b. $270.50 c. $37.50 d. $33 7. Using the weighted average inventory method, calculate cost of goods sold for the month ended July 31 for Pete's Paper Company a. $270.50 b. $273 C. $308 d. $280 8. How much revenue will appear in the Pete's Paper Company income statement for the month ended July 31? a. $33 b. $484 C. $486 d. $759 9. Teflon Inc. had 880 units in beginning inventory with a cost of $42 each. On November 18, the company purchased 170 additional units at $36 each. Teflon Inc. made one sale of 300 units on November 25 and recorded cost of goods sold of $12,600. Which inventory costing method does Teflon Inc. utilize? a. FIFO b. LIFO c. Weighted average d. The inventory method cannot be determined based on the information provided. will result in the highest net income. 10. If prices are rising, then a. Weighted average b. FIFO C. LIFO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started