PLEASE HELP ME ANSWER THESE 3 INVENTORY VALUATION PROBLEMS

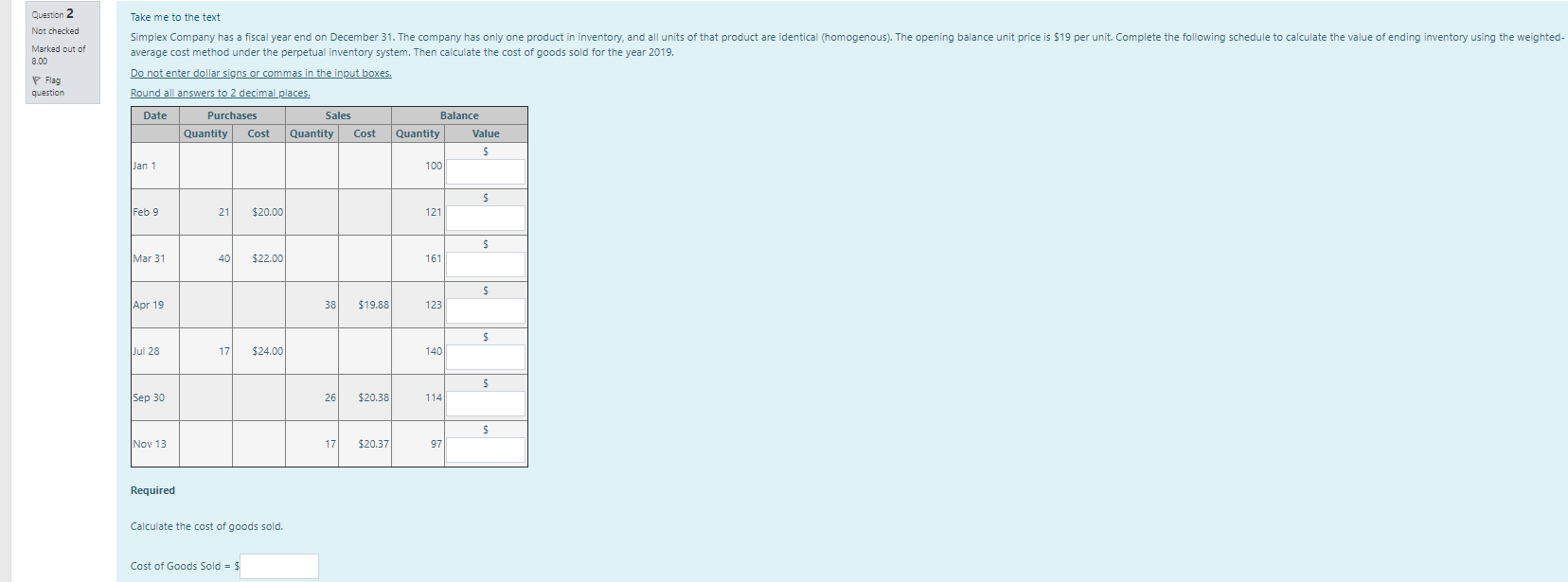

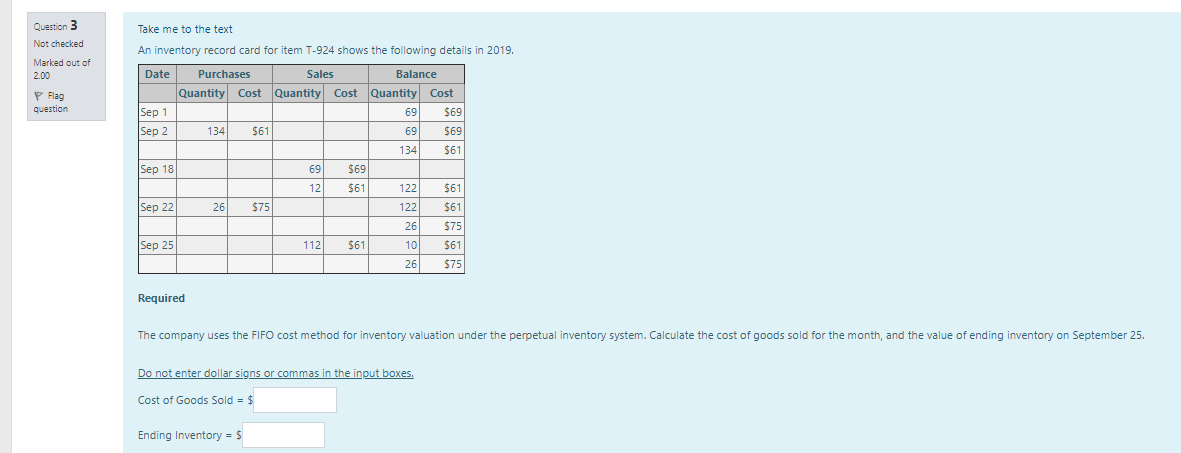

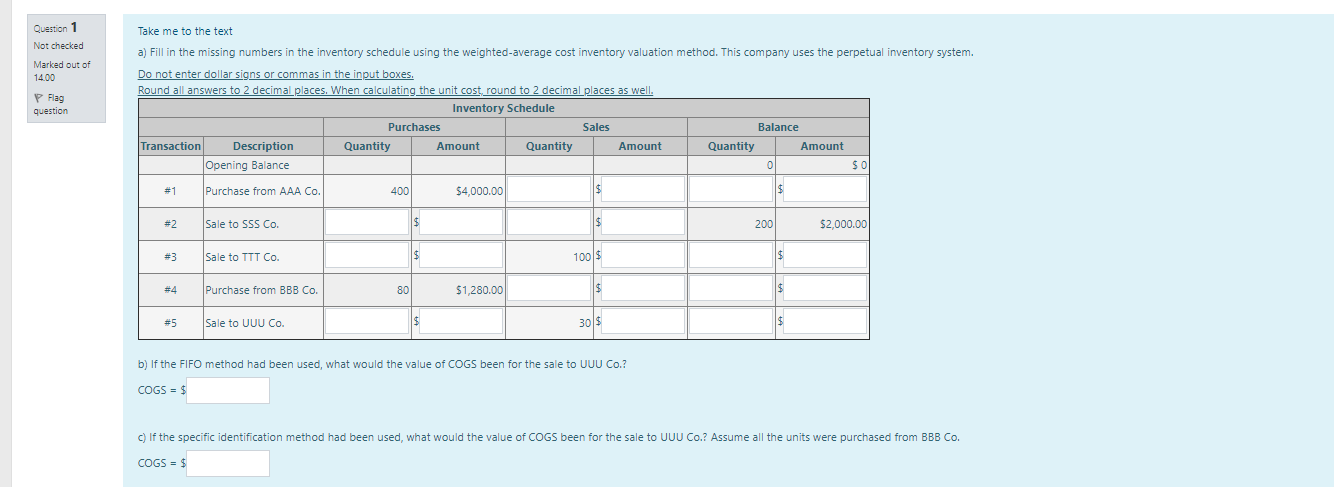

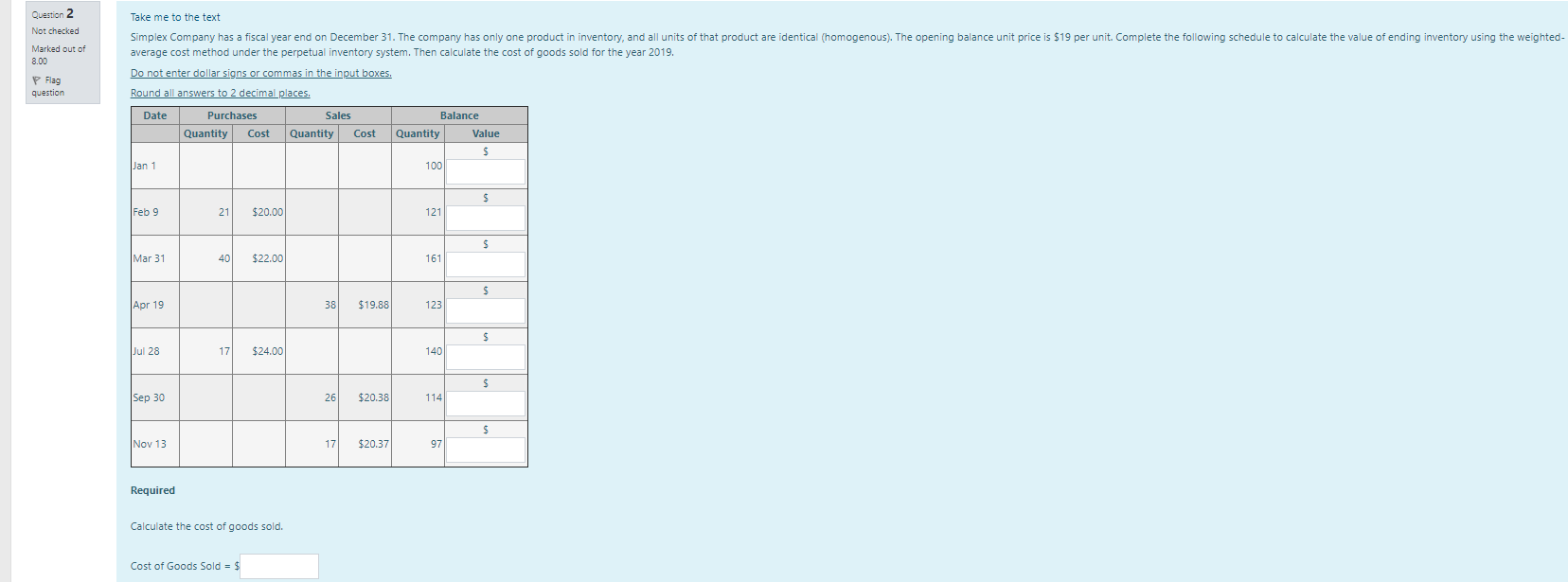

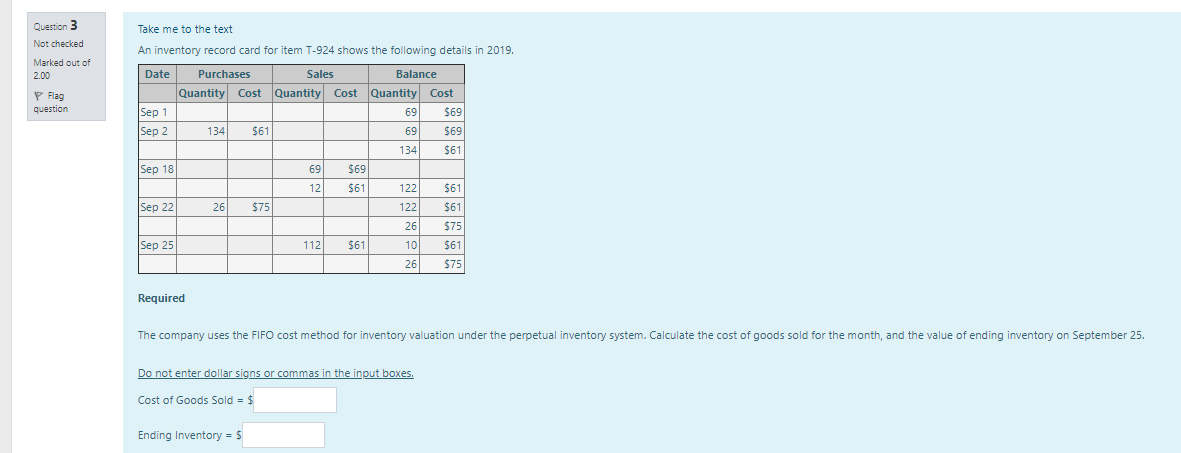

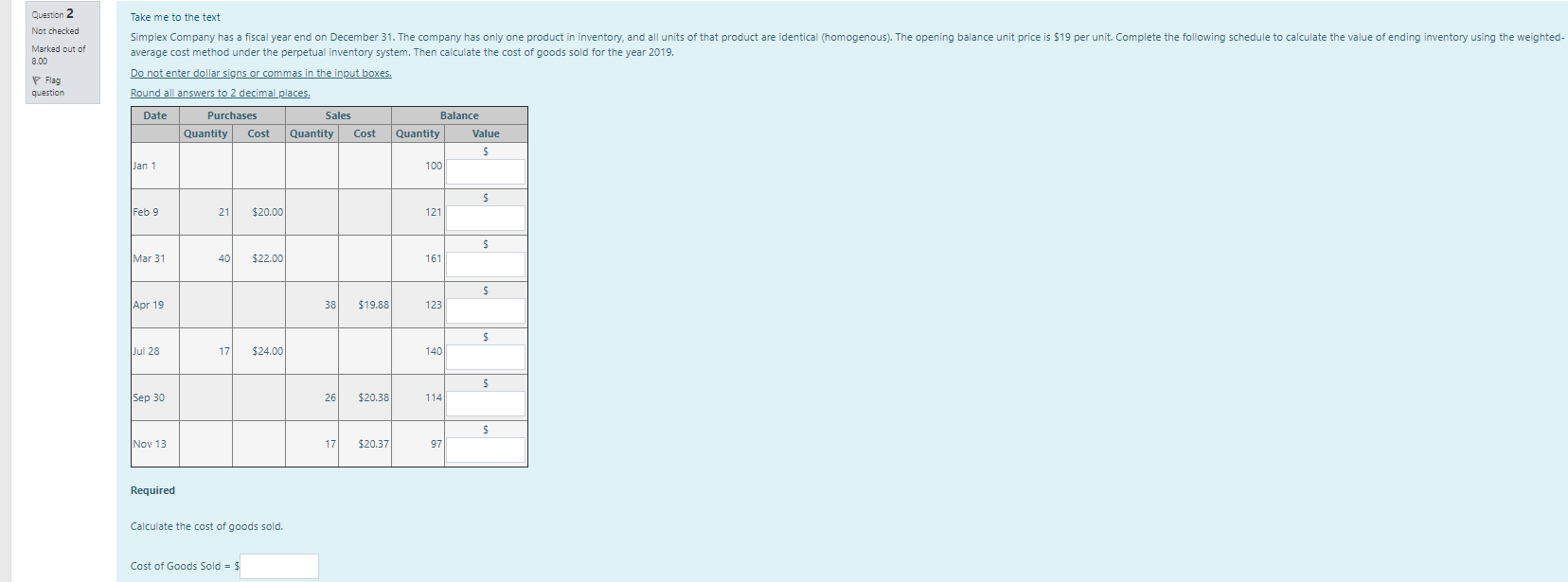

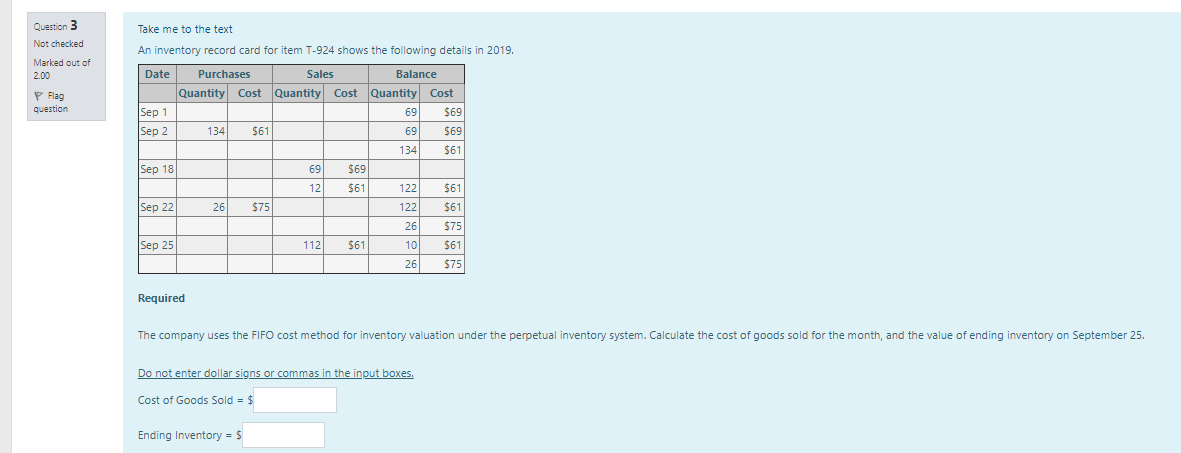

Question 1 Take me to the text Not checked a) Fill in the missing numbers in the inventory schedule using the weighted-average cost inventory valuation method. This company uses the perpetual inventory system. Marked out of 14.00 Do not enter dollar signs or commas in the input boxes. Flag Round all answers to 2 decimal places. When calculating the unit cost, round to 2 decimal places as well. question Inventory Schedule Purchases Sales Balance Transaction Description Quantity Amount Quantity Amount Quantity Amount Opening Balance 0 $0 #1 Purchase from AAA Co. 400 $4,000.00 #2 Sale to SSS Co. 200 $2,000.00 #3 Sale to TTT Co. 100 $ #4 Purchase from BBB Co. 80 $1,280.00 #5 Sale to UUU Co. $ 30 $ b) If the FIFO method had been used, what would the value of COGS been for the sale to UUU Co.? COGS = $ c) If the specific identification method had been used, what would the value of COGS been for the sale to UUU Co.? Assume all the units were purchased from BBB Co. COGS = $Question 2 Take me to the text Not checked Marked out of Simplex Company has a fiscal year end on December 31. The company has only one product in inventory, and all units of that product are identical (homogenous). The opening balance unit price is $19 per unit. Complete the following schedule to calculate the value of ending inventory using the weighted- 8.00 average cost method under the perpetual inventory system. Then calculate the cost of goods sold for the year 2019. Flag Do not enter dollar signs or commas in the input boxes. question Round all answers to 2 decimal places. Date Purchases Sales Balance Quantity Cost Quantity Cost |Quantity Value $ Jan 1 100 $ Feb9 21 $20.00 12 Mar 31 40 $22.00 161 Apr 19 38 $19.88 123 $ Jul 28 17 $24.00 140 $ Sep 30 26 $20.38 114 $ Nov 13 17 $20.37 97 Required Calculate the cost of goods sold. Cost of Goods Sold = $Question 3 Take me to the text Not checked An inventory record card for item T-924 shows the following details in 2019. Marked out of 2.00 Date Purchases Sales Balance P Flag Quantity Cost Quantity Cost Quantity Cost question Sep 1 69 569 Sep 2 134 $61 69 $69 134 $61 Sep 18 69 $69 12 $61 122 $61 Sep 22 26 $75 122 26 $75 Sep 25 12 $61 10 $61 26 $75 Required The company uses the FIFO cost method for inventory valuation under the perpetual inventory system. Calculate the cost of goods sold for the month, and the value of ending inventory on September 25. Do not enter dollar signs or commas in the input boxes. Cost of Goods Sold = $ Ending Inventory = $