Please help me answer these problem with solution. Thank you

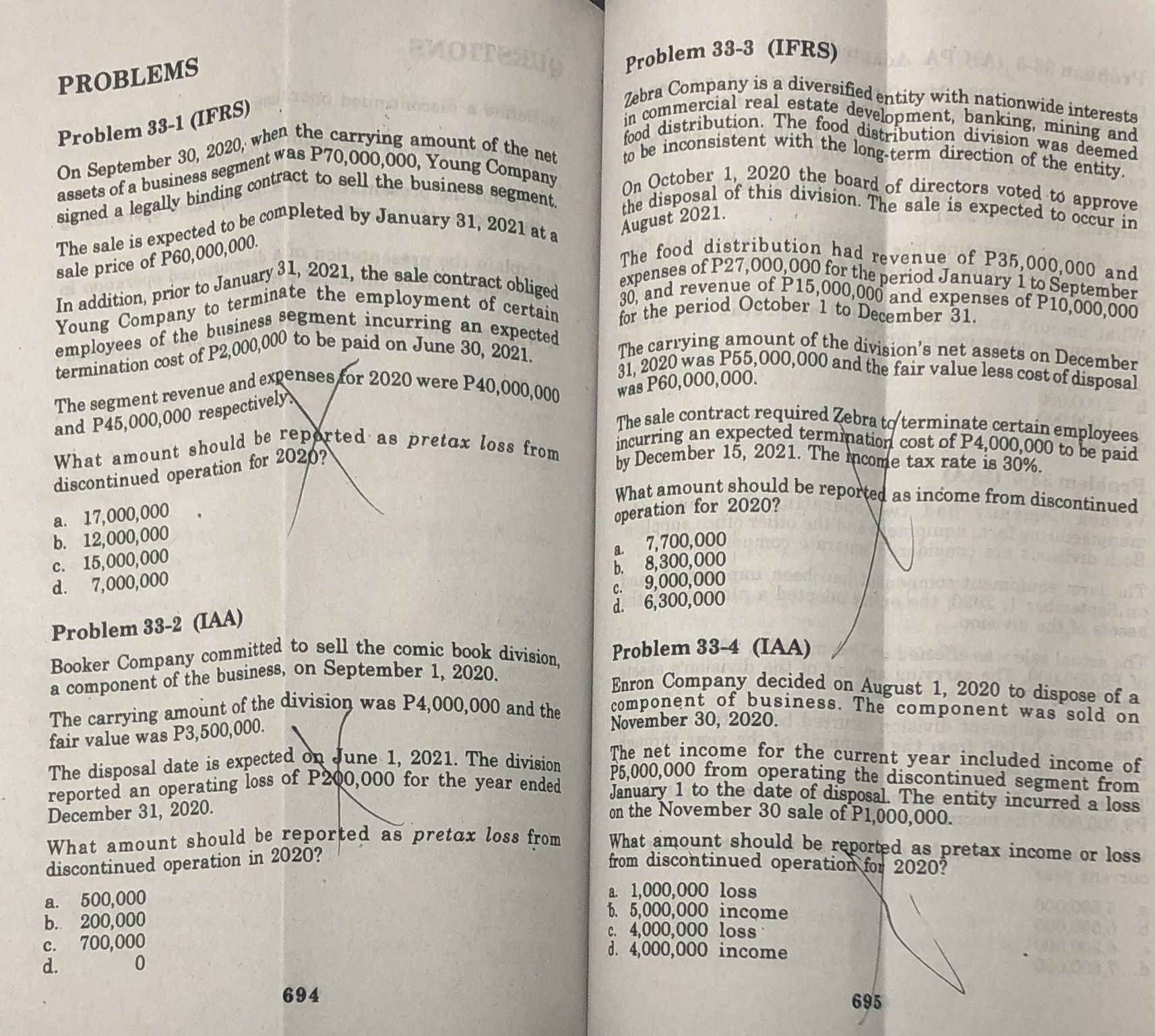

PROBLEMS Problem 33-3 (IFRS) Problem 33-1 (IFRS) Zebra Company is a diversified entity with nationwide interests in commercial real estate On September 30, 2020, when the carrying amount of the net food distribution. The food distri state development, banking, mining and assets of a business segment was P70,000,000, Young Company distribution division was deemed signed a legally binding contract to sell the business segment. to be inconsistent with the long-term direction of the entity. The sale is expected to be completed by January 31, 2021 at a On October 1, 2020 the board of directors voted to approve the disposal of this division. The sale is expected to occur in August 2021. sale price of P60,000,000. in addition, prior to January 31, 2021, the sale contract obliged The food distribution had revenue of P35,000,000 and Young Company to terminate the employment of certain enses of P27,000,000 for the period January 1 to September employees of the business segment incurring an expected 30, and revenue of P 15,000,000 and expenses of P10,000,000 for the period October 1 to December 31. termination cost of P2,000,000 to be paid on June 30, 2021. The segment revenue and expenses for 2020 were P40,000,000 The carrying amount of the division's net assets on December 31, 2020 was P65,000,000 and the fair value less cost of disposal and P45,000,000 respectively. was P60,000,000. What amount should be reported as pretax loss from The sale contract required Zebra to terminate certain employees discontinued operation for 2020? incurring an expected termination cost of P4,000,000 to be paid by December 15, 2021. The income tax rate is 30%. a. 17,000,000 What amount should be reported as income from discontinued b. 12,000,000 operation for 2020? C. 15,000,000 7,700,000 d. 7,000,000 5p 8,300,000 9,000,000 Problem 33-2 (LAA) 6,300,000 Booker Company committed to sell the comic book division, a component of the business, on September 1, 2020. Problem 33-4 (IAA) The carrying amount of the division was P4,000,000 and the Enron Company decided on August 1, 2020 to dispose of a fair value was P3,500,000. component of business. The component was sold on November 30, 2020. The disposal date is expected on June 1, 2021. The division reported an operating loss of P200,000 for the year ended The net income for the current year included income of P5,000,000 from operating the discontinued segment from December 31, 2020. January 1 to the date of disposal. The entity incurred a loss What amount should be reported as pretax loss from on the November 30 sale of P1,000,000. discontinued operation in 2020? ! What amount should be reported as pretax income or loss from discontinued operation for 2020? a. 500,000 a. 1,000,000 loss b. 200,000 b. 5,000,000 income C. 700,000 4,000,000 loss d. 4,000,000 income 694 695