Please help me answer these problems.

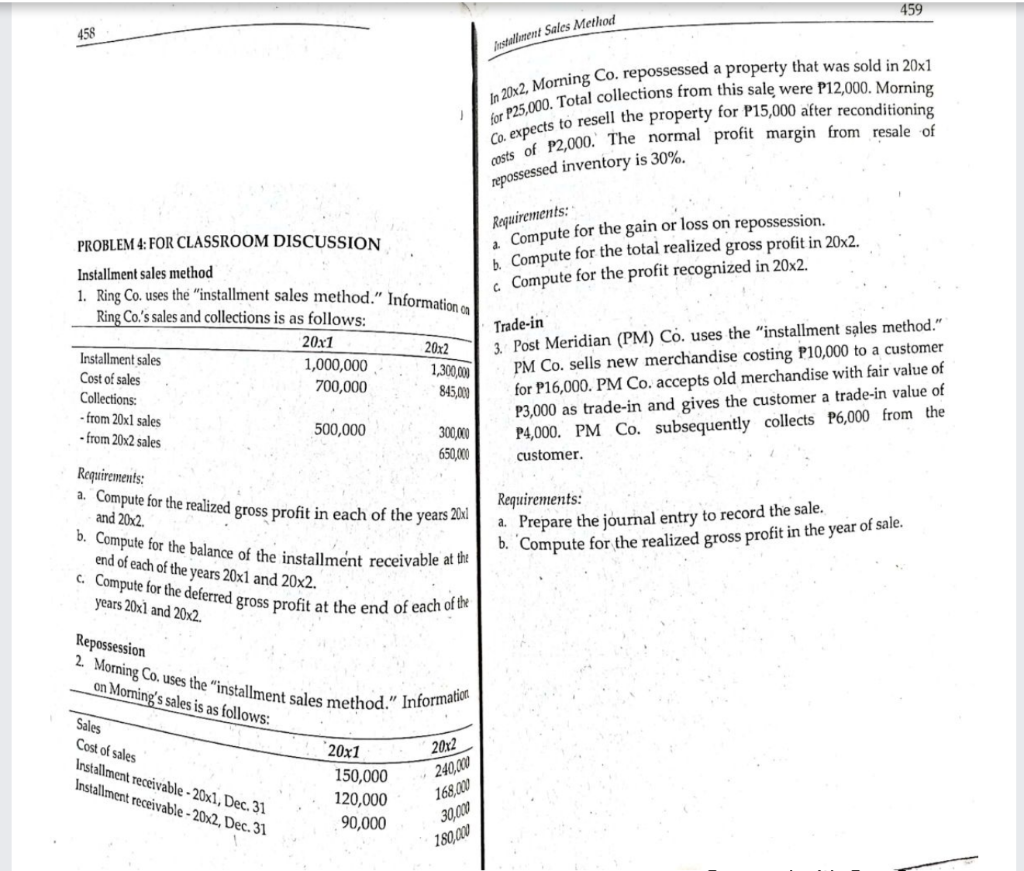

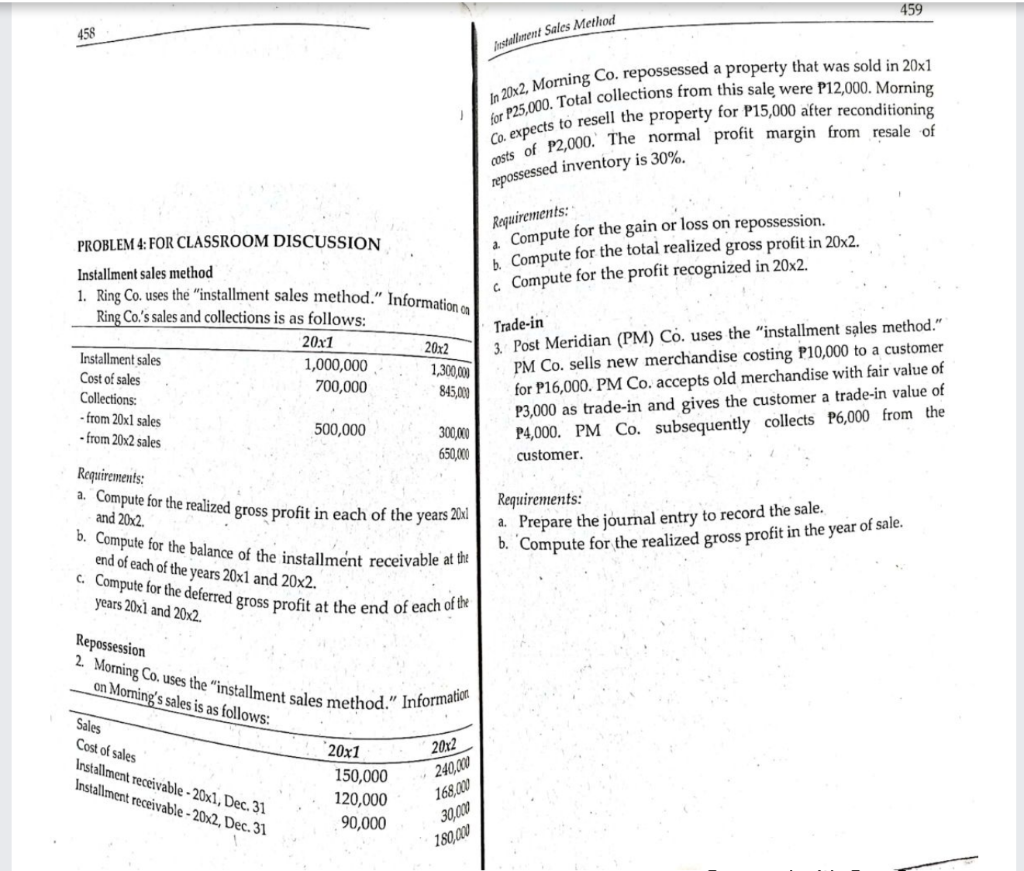

In 20x2, Morning Co. repossessed a property that was sold in 20x1 for P25,000. Total collections from this sale were P12,000. Morning Co. expects to resell the property for P15,000 after reconditioning costs of P2,000. The normal profit margin from resale of b. Compute for the balance of the installment receivable at the C. Compute for the deferred gross profit at the end of each of the 2. Morning Co. uses the "installment sales method." Information 459 458 Mestalliment Sales Method repossessed inventory is 30%. Requirements: a Compute for the gain or loss on repossession. b. Compute for the total realized gross profit in 20x2. c Compute for the profit recognized in 20x2. PROBLEM 4: FOR CLASSROOM DISCUSSION Installment sales method 1. Ring Co. uses the "installment sales method. Information ca Ring Co.'s sales and collections is as follows: 20x1 20x2 Installment sales 1,000,000 1,300,000 Cost of sales 700,000 Collections: - from 20x1 sales 500,000 300,000 - from 20x2 sales 650,000 845,00 Trade-in 3. Post Meridian (PM) C. uses the "installment sales method." PM Co. sells new merchandise costing P10,000 to a customer for P16,000. PM Co. accepts old merchandise with fair value of P3,000 as trade-in and gives the customer a trade-in value of P4,000. PM Co. subsequently collects P6,000 from the customer. Requirements: a. Compute for the realized gross profit in each of the years 20x1 and 2022. Requirements: a. Prepare the journal entry to record the sale. b. Compute for the realized gross profit in the year of sale. end of each of the years 20x1 and 20x2. years 20x1 and 20x2. Repossession on Morning's sales is as follows: Sales Cost of sales Installment receivable - 20x1, Dec. 31 Installment receivable - 20x2, Dec. 31 2012 20x1 150,000 120,000 90,000 240,000 168,00 30,00 180,00 In 20x2, Morning Co. repossessed a property that was sold in 20x1 for P25,000. Total collections from this sale were P12,000. Morning Co. expects to resell the property for P15,000 after reconditioning costs of P2,000. The normal profit margin from resale of b. Compute for the balance of the installment receivable at the C. Compute for the deferred gross profit at the end of each of the 2. Morning Co. uses the "installment sales method." Information 459 458 Mestalliment Sales Method repossessed inventory is 30%. Requirements: a Compute for the gain or loss on repossession. b. Compute for the total realized gross profit in 20x2. c Compute for the profit recognized in 20x2. PROBLEM 4: FOR CLASSROOM DISCUSSION Installment sales method 1. Ring Co. uses the "installment sales method. Information ca Ring Co.'s sales and collections is as follows: 20x1 20x2 Installment sales 1,000,000 1,300,000 Cost of sales 700,000 Collections: - from 20x1 sales 500,000 300,000 - from 20x2 sales 650,000 845,00 Trade-in 3. Post Meridian (PM) C. uses the "installment sales method." PM Co. sells new merchandise costing P10,000 to a customer for P16,000. PM Co. accepts old merchandise with fair value of P3,000 as trade-in and gives the customer a trade-in value of P4,000. PM Co. subsequently collects P6,000 from the customer. Requirements: a. Compute for the realized gross profit in each of the years 20x1 and 2022. Requirements: a. Prepare the journal entry to record the sale. b. Compute for the realized gross profit in the year of sale. end of each of the years 20x1 and 20x2. years 20x1 and 20x2. Repossession on Morning's sales is as follows: Sales Cost of sales Installment receivable - 20x1, Dec. 31 Installment receivable - 20x2, Dec. 31 2012 20x1 150,000 120,000 90,000 240,000 168,00 30,00 180,00