Please help me answer these questions?

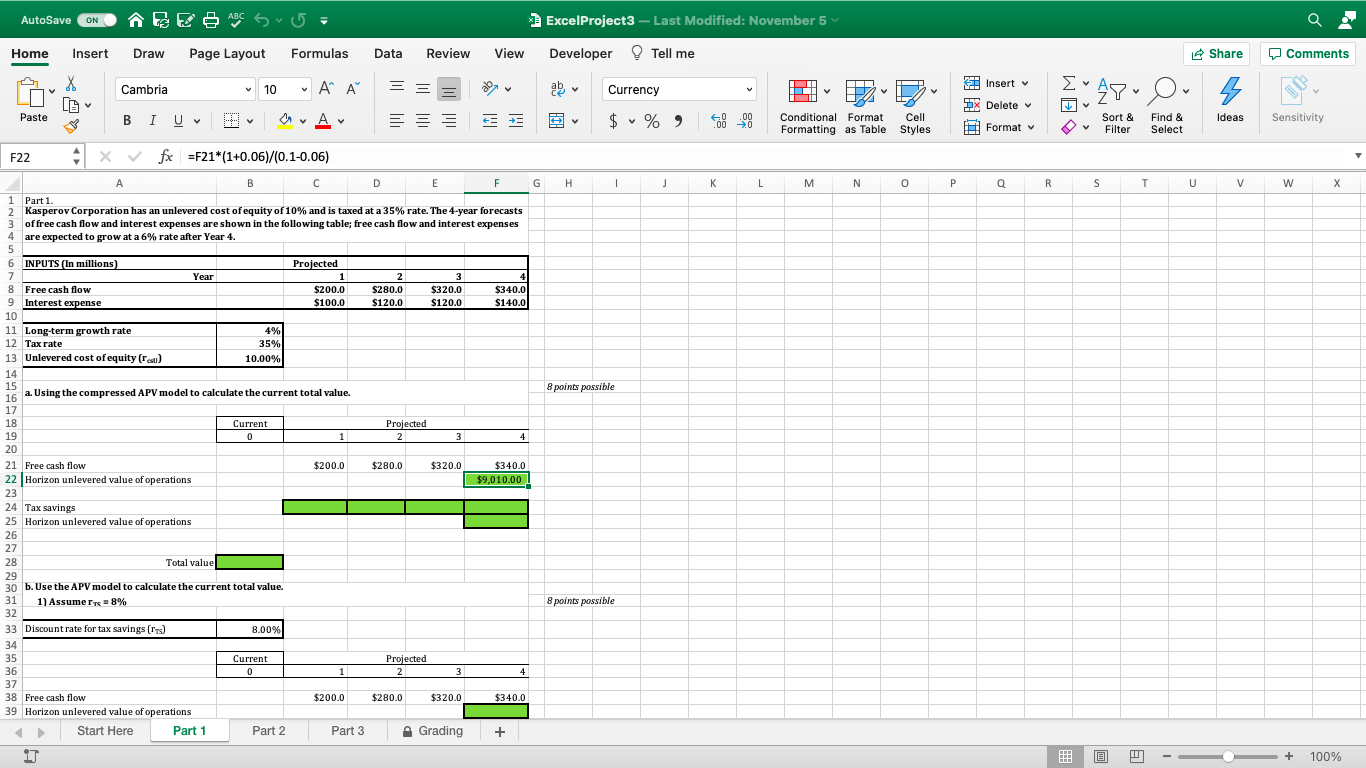

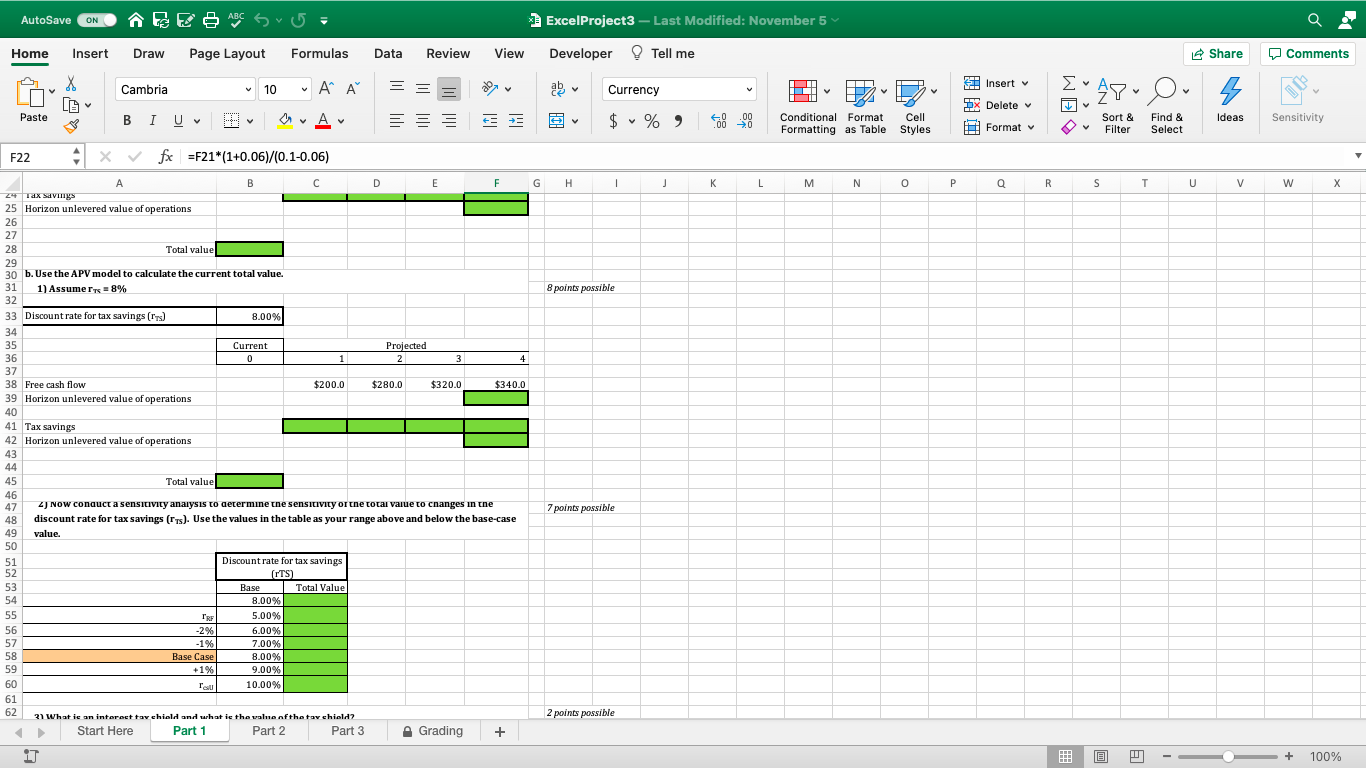

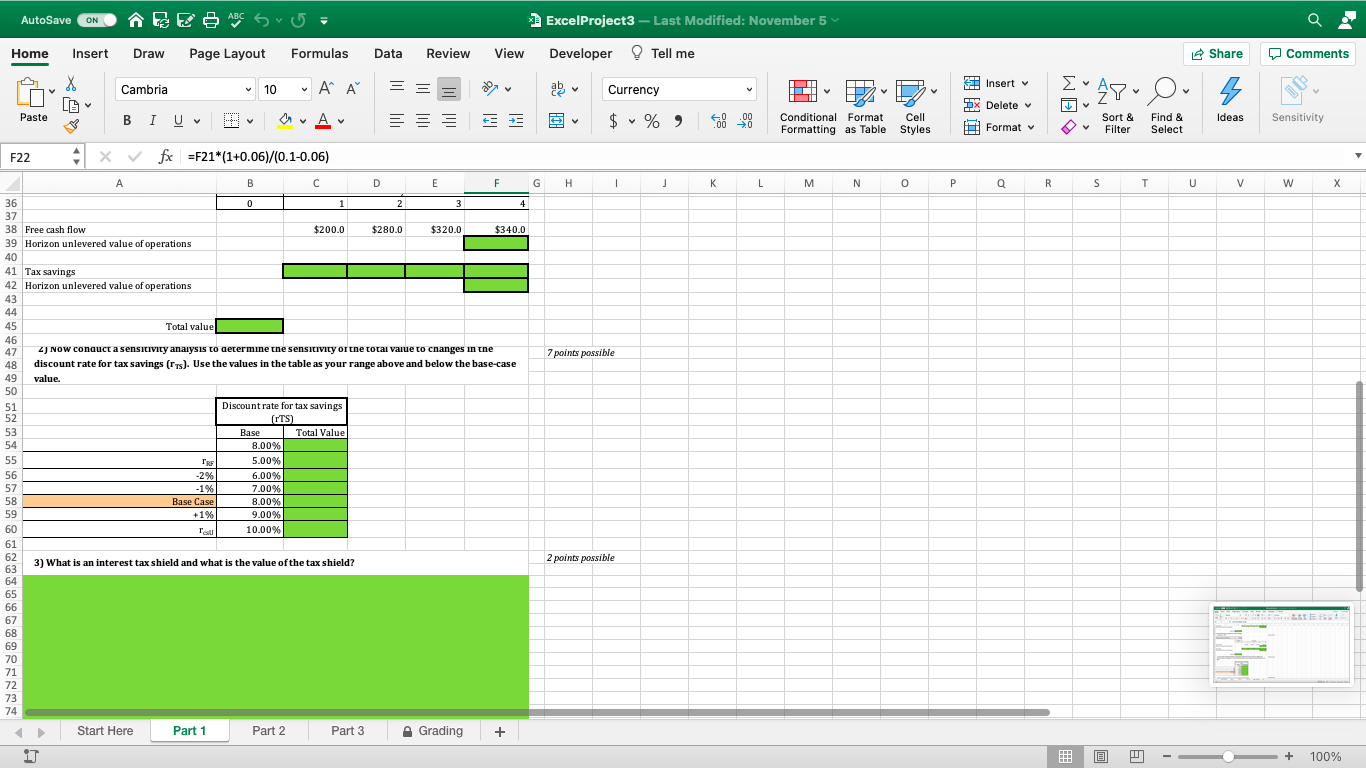

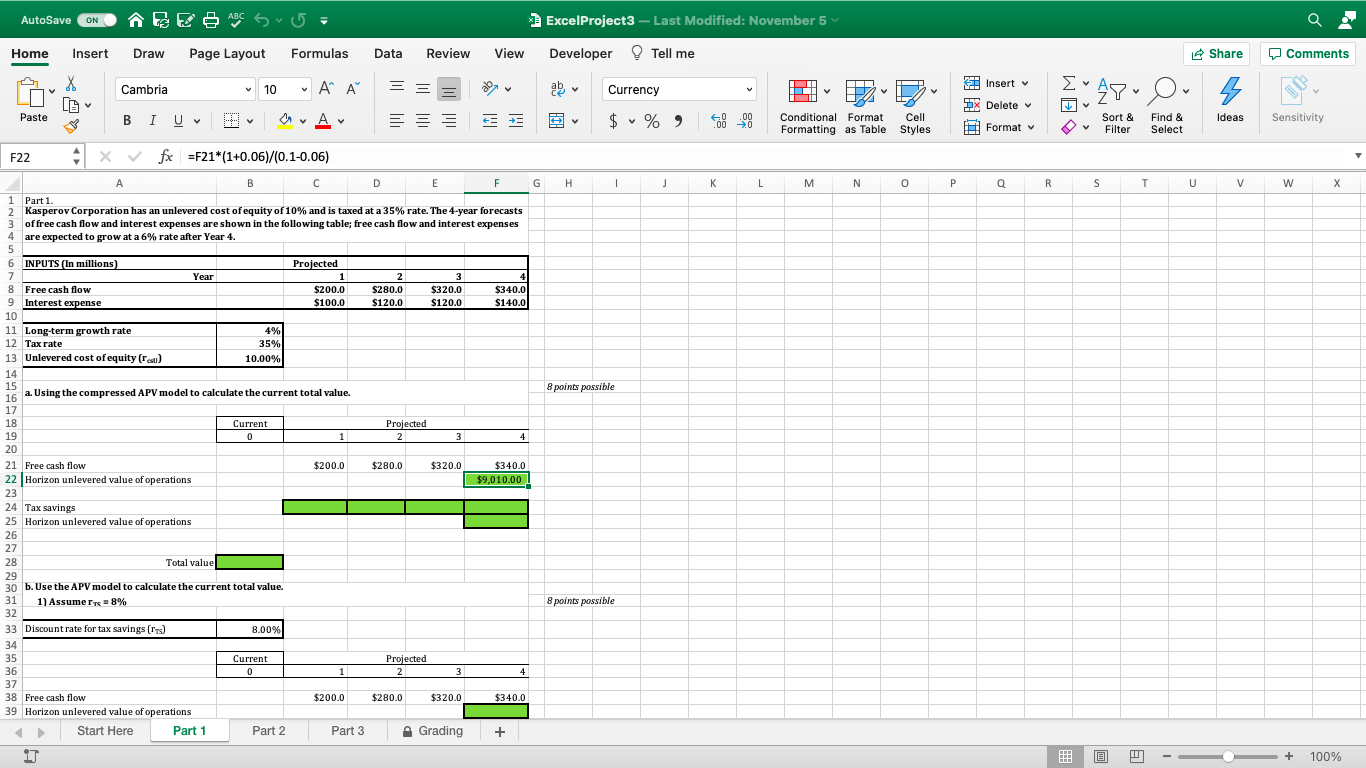

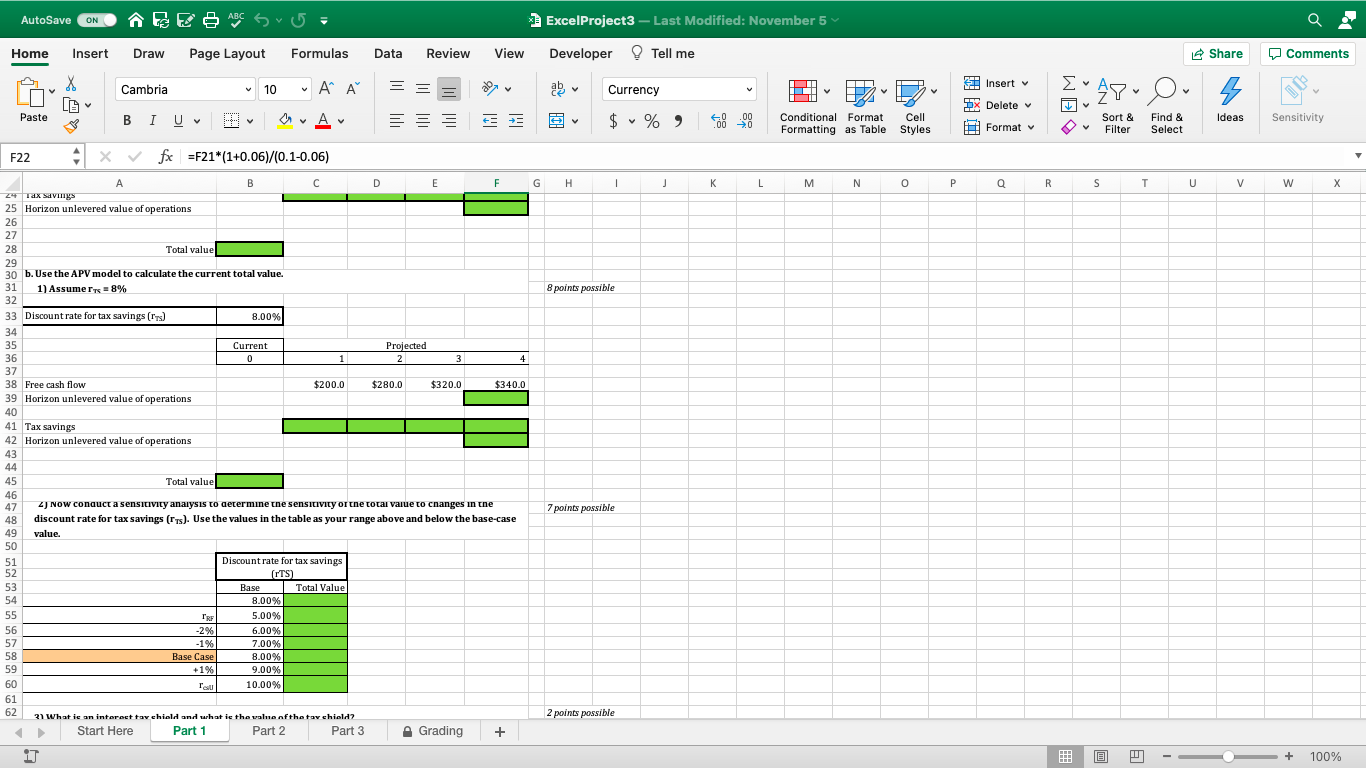

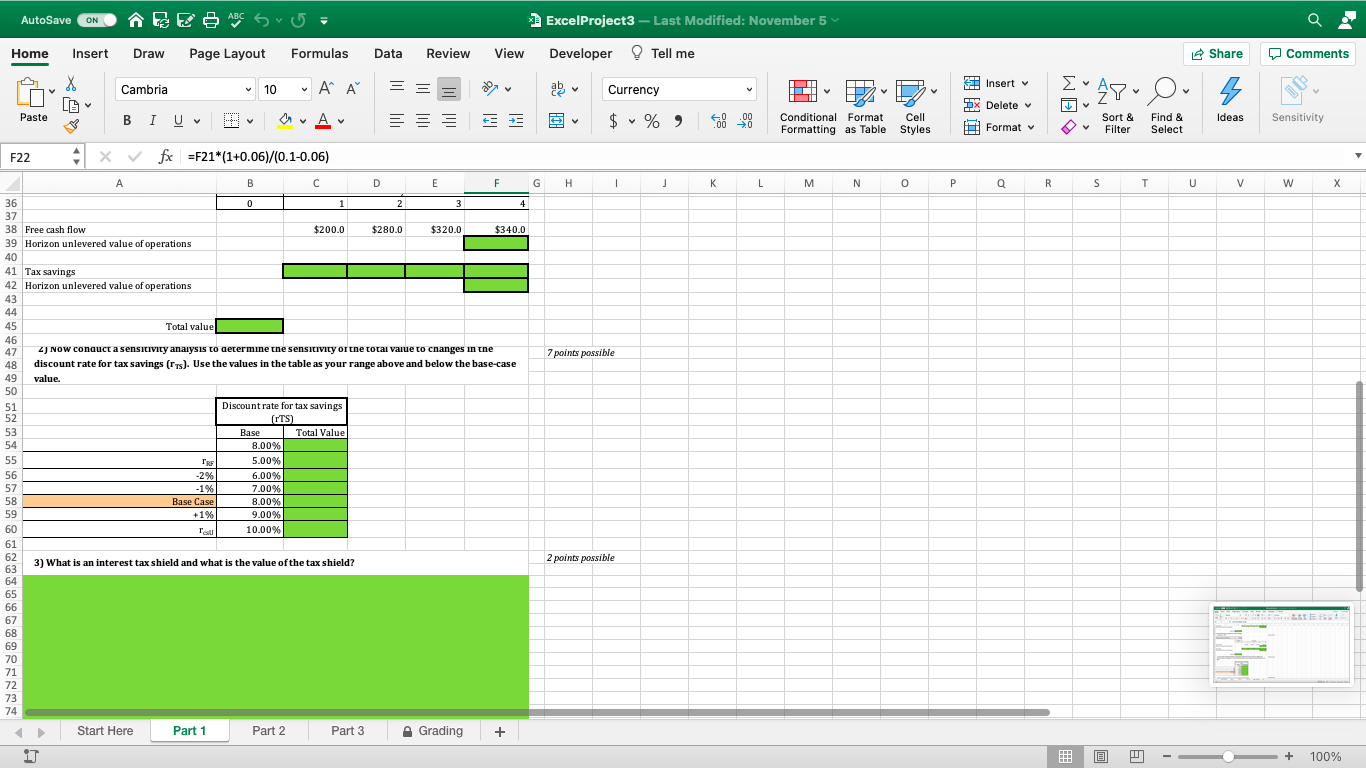

AutoSave ON BE ABC svu ExcelProject 3 - Last Modified: November 5 Home Insert Draw Page Layout Formulas Data Review View Developer Tell me Share 0 Comments Insert v X La Cambria 10 = = . AP Currency [47Or DX Delete Paste V A $ % ) Ideas * Conditional Format Formatting as Table .00 0 Cell Styles Sensitivity Sort & Filter Format v Find & Select F22 4 x fx =F21*(1+0.06)/(0.1-0.06) B D E F G H 1 j K L M N O P P Q R R s T U v w X 8 points possible 1 Part 1. 2 Kasperov Corporation has an unlevered cost of equity of 10% and is taxed at a 35% rate. The 4-year forecasts 3 of free cash flow and interest expenses are shown in the following table; free cash flow and interest expenses 4 are expected to grow at a 6% rate after Year 4. 5 6 INPUTS (In millions Projected 7 7 Year 1 2 3 4 8 Free cash flow $200.0 $280.0 $320.0 $340.0 9 Interest expense $100.0 $120.0 $120.0 $140.0 10 11 Long-term growth rate 4% 12 Tax rate 35% 13 Unlevered cost of equity (rou) 10.00% 14 15 16 a. Using the compressed APV model to calculate the current total value. 17 18 Current Projected 19 0 0 1 2 3 3 4 20 21 Free cash flow $200.0 $280.0 $320.0 $340.0 22 Horizon unlevered value of operations $9.010.00 23 24 Tax savings 25 Horizon unlevered value of operations 26 27 28 Total value 29 30 b. Use the APV model to calculate the current total value. 31 1) Assumer 8% 32 33 Discount rate for tax savings (Trs) 8.00% 34 35 Current Projected 36 0 0 1 2 3 4 37 38 Free cash flow $200.0 $280.0 $320.0 $340.0 39 Horizon unlevered value of operations Start Here Part 1 Part 2 Part 3 Grading 8 points possible + 17 3 + 100% AutoSave ON BE ABC svu ExcelProject 3 - Last Modified: November 5 Home Insert Draw Page Layout Formulas Data Review View Developer Tell me Share 0 Comments X Cambria Insert v 10 . AP = = Currency WE 48- O v DX Delete Paste V A Ideas $ %) * Conditional Format Formatting as Table Cell Styles .00 0 Sensitivity Sort & Filter Format v Find & Select F22 fx =F21*(1+0.06)/(0.1-0.06) H 1 j j K L M N o P P Q R s T U v w X 8 points possible B D 24 Tax Savings 25 Horizon unlevered value of operations 26 27 28 Total value 29 30 b. Use the APV model to calculate the current total value. 31 1) Assumer 8% 32 33 Discount rate for tax savings (rus) 8.00% 34 35 Current Projected 36 0 1 2 3 4 37 38 Free cash flow $200.0 $280.0 $320.0 $340.0 39 Horizon unlevered value of operations 40 41 Tax savings 42 Horizon unlevered value of operations 43 44 45 Total value 46 47 2) NOW conaucta sensitivity analysis to determine the sensitivity or the total value to changes in the 48 discount rate for tax savings (IT). Use the values in the table as your range above and below the base-case 49 value. 50 51 Discount rate for tax savings 52 (ITS) 53 Base Total Value 54 8.00% 55 E'RE 5.00% 56 -2% 6.00% 57 -1% 7.00% 58 Base Case 8.00% 59 +1% 9.00% 60 T 10.00% 61 62 31 What is an interact tav ehield and what is the value of the tav chiold? Start Here Part 1 Part 2 Part 3 Grading + 7 points possible 2 points possible 17 3 + 100% AutoSave ON BE ABC svu ExcelProject 3 - Last Modified: November 5 Home Insert Draw Page Layout Formulas Data Review View Developer Tell me Share 0 Comments X Cambria Insert v 10 . AP = = Currency WE 48- O DX Delete Paste a. Av $ % ) V 00 .00 0 Ideas Sensitivity Conditional Format Formatting as Table Cell Styles Format v Sort & Filter Find & Select F22 4 x fx =F21*(1+0.06)/(0.1-0.06) G H j K L M N o P Q R s T U V w X 7 points possible B D E F 36 0 1 2 3 4 37 38 Free cash flow $200.0 $280.0 $320.0 $340.0 39 Horizon unlevered value of operations 40 41 Tax savings 42 Horizon unlevered value of operations 43 44 45 Total value 46 47 2) NOW conauct a sensitivity analysis to determine the sensitivity of the total value to changes in the 48 discount rate for tax savings (TT). Use the values in the table as your range above and below the base-case 49 value. 50 51 Discount rate for tax savings 52 (ITS) 53 Base Total Value 54 8.00% 55 TRF 5.00% 56 -2% 6.00% 57 -1% 7.00% 58 Base Case 8.00% 59 +1% 9.00% 60 TU 10.00% 61 62 3) What is an interest tax shield and what is the value of the tax shield? 63 64 65 66 67 68 69 70 71 72 73 74 2 points possible Start Here Part 1 Part 2 Part 3 Grading + 1 3 + 100% AutoSave ON BE ABC svu ExcelProject 3 - Last Modified: November 5 Home Insert Draw Page Layout Formulas Data Review View Developer Tell me Share 0 Comments Insert v X La Cambria 10 = = . AP Currency [47Or DX Delete Paste V A $ % ) Ideas * Conditional Format Formatting as Table .00 0 Cell Styles Sensitivity Sort & Filter Format v Find & Select F22 4 x fx =F21*(1+0.06)/(0.1-0.06) B D E F G H 1 j K L M N O P P Q R R s T U v w X 8 points possible 1 Part 1. 2 Kasperov Corporation has an unlevered cost of equity of 10% and is taxed at a 35% rate. The 4-year forecasts 3 of free cash flow and interest expenses are shown in the following table; free cash flow and interest expenses 4 are expected to grow at a 6% rate after Year 4. 5 6 INPUTS (In millions Projected 7 7 Year 1 2 3 4 8 Free cash flow $200.0 $280.0 $320.0 $340.0 9 Interest expense $100.0 $120.0 $120.0 $140.0 10 11 Long-term growth rate 4% 12 Tax rate 35% 13 Unlevered cost of equity (rou) 10.00% 14 15 16 a. Using the compressed APV model to calculate the current total value. 17 18 Current Projected 19 0 0 1 2 3 3 4 20 21 Free cash flow $200.0 $280.0 $320.0 $340.0 22 Horizon unlevered value of operations $9.010.00 23 24 Tax savings 25 Horizon unlevered value of operations 26 27 28 Total value 29 30 b. Use the APV model to calculate the current total value. 31 1) Assumer 8% 32 33 Discount rate for tax savings (Trs) 8.00% 34 35 Current Projected 36 0 0 1 2 3 4 37 38 Free cash flow $200.0 $280.0 $320.0 $340.0 39 Horizon unlevered value of operations Start Here Part 1 Part 2 Part 3 Grading 8 points possible + 17 3 + 100% AutoSave ON BE ABC svu ExcelProject 3 - Last Modified: November 5 Home Insert Draw Page Layout Formulas Data Review View Developer Tell me Share 0 Comments X Cambria Insert v 10 . AP = = Currency WE 48- O v DX Delete Paste V A Ideas $ %) * Conditional Format Formatting as Table Cell Styles .00 0 Sensitivity Sort & Filter Format v Find & Select F22 fx =F21*(1+0.06)/(0.1-0.06) H 1 j j K L M N o P P Q R s T U v w X 8 points possible B D 24 Tax Savings 25 Horizon unlevered value of operations 26 27 28 Total value 29 30 b. Use the APV model to calculate the current total value. 31 1) Assumer 8% 32 33 Discount rate for tax savings (rus) 8.00% 34 35 Current Projected 36 0 1 2 3 4 37 38 Free cash flow $200.0 $280.0 $320.0 $340.0 39 Horizon unlevered value of operations 40 41 Tax savings 42 Horizon unlevered value of operations 43 44 45 Total value 46 47 2) NOW conaucta sensitivity analysis to determine the sensitivity or the total value to changes in the 48 discount rate for tax savings (IT). Use the values in the table as your range above and below the base-case 49 value. 50 51 Discount rate for tax savings 52 (ITS) 53 Base Total Value 54 8.00% 55 E'RE 5.00% 56 -2% 6.00% 57 -1% 7.00% 58 Base Case 8.00% 59 +1% 9.00% 60 T 10.00% 61 62 31 What is an interact tav ehield and what is the value of the tav chiold? Start Here Part 1 Part 2 Part 3 Grading + 7 points possible 2 points possible 17 3 + 100% AutoSave ON BE ABC svu ExcelProject 3 - Last Modified: November 5 Home Insert Draw Page Layout Formulas Data Review View Developer Tell me Share 0 Comments X Cambria Insert v 10 . AP = = Currency WE 48- O DX Delete Paste a. Av $ % ) V 00 .00 0 Ideas Sensitivity Conditional Format Formatting as Table Cell Styles Format v Sort & Filter Find & Select F22 4 x fx =F21*(1+0.06)/(0.1-0.06) G H j K L M N o P Q R s T U V w X 7 points possible B D E F 36 0 1 2 3 4 37 38 Free cash flow $200.0 $280.0 $320.0 $340.0 39 Horizon unlevered value of operations 40 41 Tax savings 42 Horizon unlevered value of operations 43 44 45 Total value 46 47 2) NOW conauct a sensitivity analysis to determine the sensitivity of the total value to changes in the 48 discount rate for tax savings (TT). Use the values in the table as your range above and below the base-case 49 value. 50 51 Discount rate for tax savings 52 (ITS) 53 Base Total Value 54 8.00% 55 TRF 5.00% 56 -2% 6.00% 57 -1% 7.00% 58 Base Case 8.00% 59 +1% 9.00% 60 TU 10.00% 61 62 3) What is an interest tax shield and what is the value of the tax shield? 63 64 65 66 67 68 69 70 71 72 73 74 2 points possible Start Here Part 1 Part 2 Part 3 Grading + 1 3 + 100%