Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer these questions, I need help! I have answered the first few and am stuck :) Please show calculations- Thanks! MEITEN ng

Please help me answer these questions, I need help! I have answered the first few and am stuck :)

Please show calculations- Thanks!

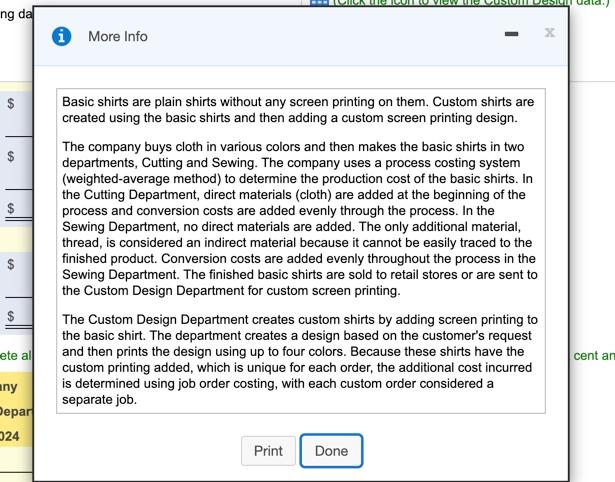

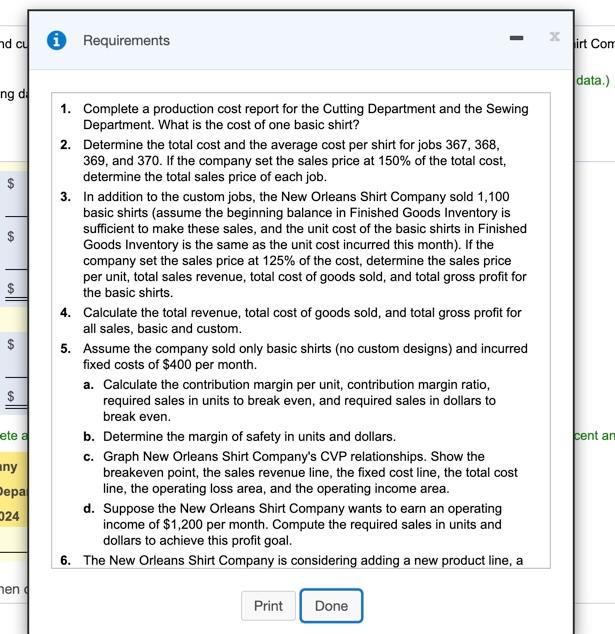

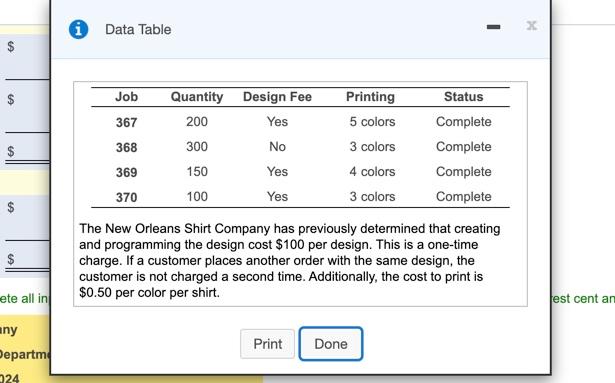

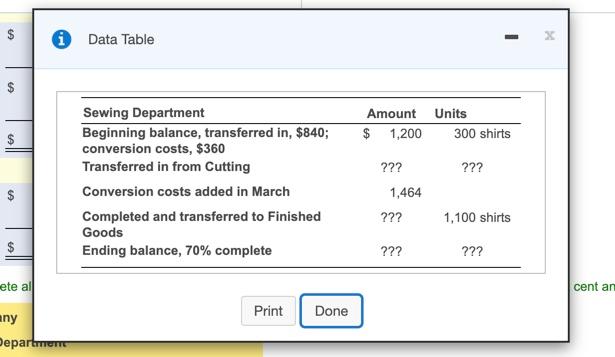

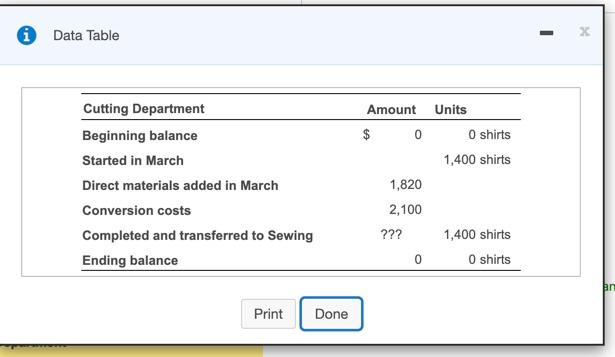

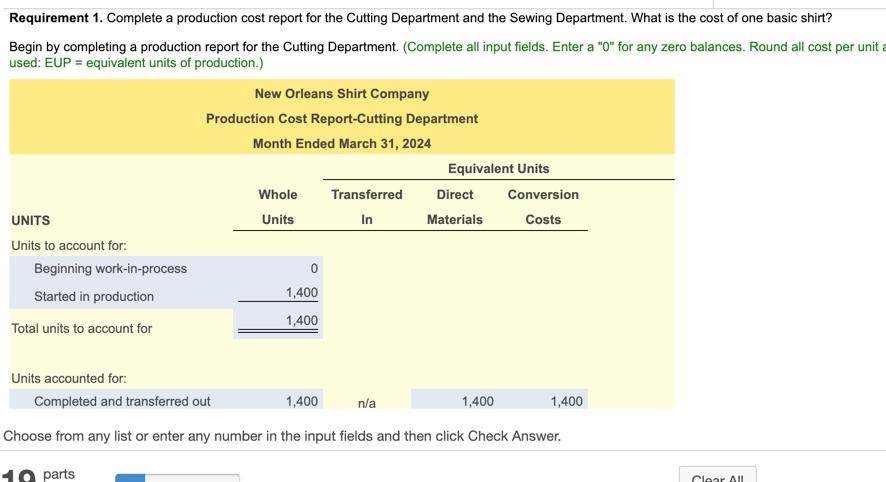

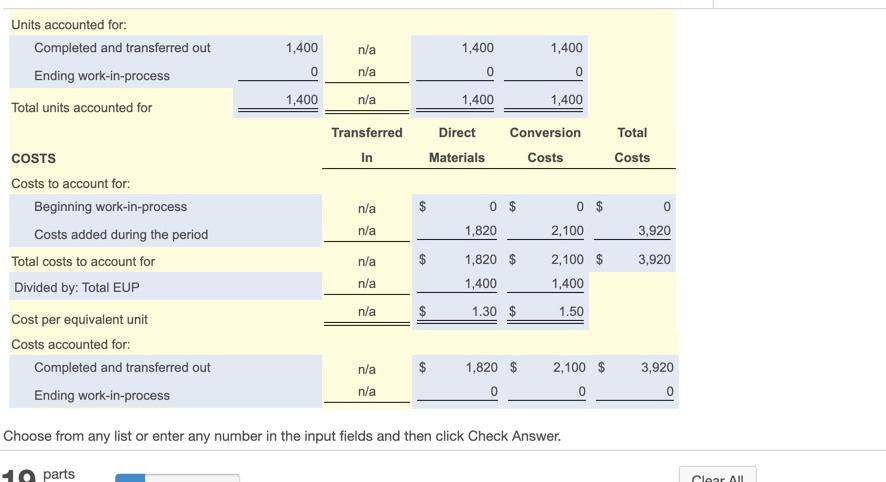

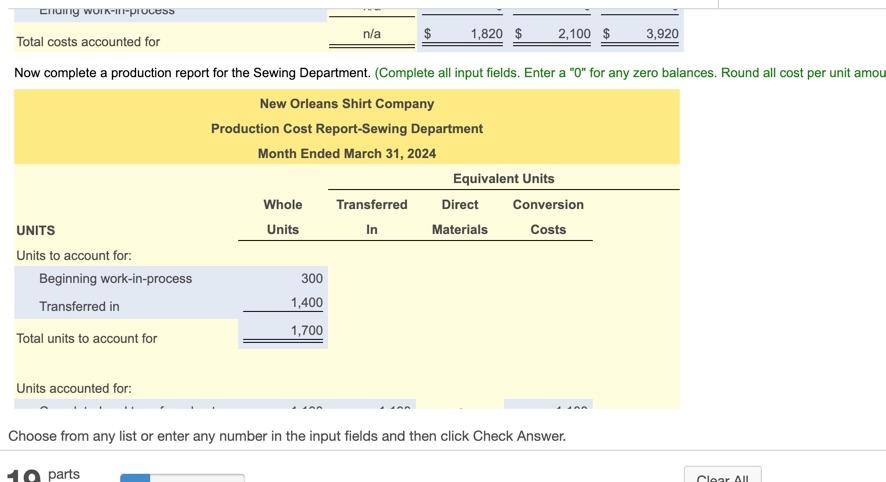

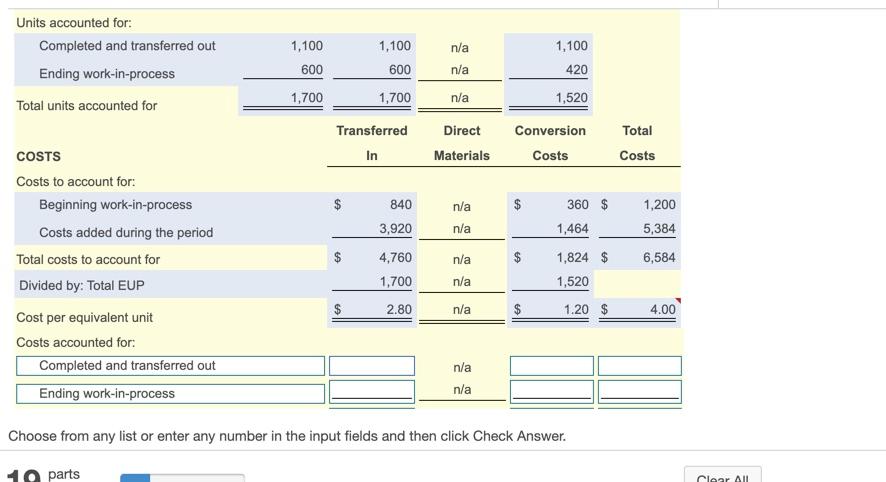

MEITEN ng dal 1 More Info $ $ $ Basic shirts are plain shirts without any screen printing on them. Custom shirts are created using the basic shirts and then adding a custom screen printing design. The company buys cloth in various colors and then makes the basic shirts in two departments, Cutting and Sewing. The company uses a process costing system (weighted average method) to determine the production cost of the basic shirts. In the Cutting Department, direct materials (cloth) are added at the beginning of the process and conversion costs are added evenly through the process. In the Sewing Department, no direct materials are added. The only additional material, thread, is considered an indirect material because it cannot be easily traced to the finished product. Conversion costs are added evenly throughout the process in the Sewing Department. The finished basic shirts are sold to retail stores or are sent to the Custom Design Department for custom screen printing. The Custom Design Department creates custom shirts by adding screen printing to the basic shirt. The department creates a design based on the customer's request and then prints the design using up to four colors. Because these shirts have the custom printing added, which is unique for each order, the additional cost incurred is determined using job order costing, with each custom order considered a separate job. $ $ ete all cent an any Depar 24 Print Done - Requirements X nd cu irt Con data.) ng d $ $ $ $ 1. Complete a production cost report for the Cutting Department and the Sewing Department. What is the cost of one basic shirt? 2. Determine the total cost and the average cost per shirt for jobs 367, 368, 369, and 370. If the company set the sales price at 150% of the total cost, determine the total sales price of each job. 3. In addition to the custom jobs, the New Orleans Shirt Company sold 1,100 basic shirts (assume the beginning balance in Finished Goods Inventory is sufficient to make these sales, and the unit cost of the basic shirts in Finished Goods Inventory is the same as the unit cost incurred this month). If the company set the sales price at 125% of the cost, determine the sales price per unit, total sales revenue, total cost of goods sold, and total gross profit for the basic shirts. 4. Calculate the total revenue, total cost of goods sold, and total gross profit for all sales, basic and custom. 5. Assume the company sold only basic shirts (no custom designs) and incurred fixed costs of $400 per month. a. Calculate the contribution margin per unit, contribution margin ratio, required sales in units to break even, and required sales in dollars to break even b. Determine the margin of safety in units and dollars. C. Graph New Orleans Shirt Company's CVP relationships. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, and the operating income area. d. Suppose the New Orleans Shirt Company wants to earn an operating income of $1,200 per month. Compute the required sales in units and dollars to achieve this profit goal. 6. The New Orleans Shirt Company is considering adding a new product line, a $ ete & cent an any Depa 24 hen a Print Done i Data Table - $ Job Status 367 $ 368 Quantity Design Fee 200 Yes 300 No 150 Yes 100 Yes Printing 5 colors 3 colors 4 colors 3 colors Complete Complete Complete Complete 369 370 GA $ The New Orleans Shirt Company has previously determined that creating and programming the design cost $100 per design. This is a one-time charge. If a customer places another order with the same design, the customer is not charged a second time. Additionally, the cost to print is $0.50 per color per shirt. ete all in jest cent an any Print Done Departm 24 $ Data Table x $ Amount $ 1,200 Units 300 shirts $ ??? ??? Sewing Department Beginning balance, transferred in, $840; conversion costs, $360 Transferred in from Cutting Conversion costs added in March Completed and transferred to Finished Goods Ending balance, 70% complete $ 1,464 ??? 1,100 shirts $ ??? ??? ete all cent an Print Done any Departments Data Table X Amount $ $ 0 Units O shirts 1,400 shirts Cutting Department Beginning balance Started in March Direct materials added in March Conversion costs Completed and transferred to Sewing Ending balance 1,820 2,100 ??? 1,400 shirts O shirts 0 han Print Done Requirement 1. Complete a production cost report for the Cutting Department and the Sewing Department. What is the cost of one basic shirt? Begin by completing a production report for the Cutting Department. (Complete all input fields. Enter a "0" for any zero balances. Round all cost per unita used: EUP = equivalent units of production.) New Orleans Shirt Company Production Cost Report-Cutting Department Month Ended March 31, 2024 Equivalent Units Whole Transferred Direct Conversion UNITS Units In Materials Costs Units to account for: Beginning work-in-process 0 Started in production 1,400 1,400 Total units to account for Units accounted for: Completed and transferred out 1,400 n/a 1,400 1,400 Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All n/a 1,400 1,400 Units accounted for: Completed and transferred out Ending work-in-process Total units accounted for 1,400 0 0 0 n/a n/a 1,400 1,400 1,400 Transferred In Direct Materials Conversion Costs Total Costs n/a $ 0 $ 1,820 0 $ 2,100 0 3,920 n/a n/a 1,820 $ 3,920 COSTS Costs to account for: Beginning work-in-process Costs added during the period Total costs to account for Divided by: Total EUP Cost per equivalent unit Costs accounted for: Completed and transferred out Ending work-in-process 2,100 $ 1,400 n/a 1,400 n/a 1.30 $ 1.50 n/a $ 1,820 $ 2,100 $ 3,920 n/a 0 0 Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All n/a Chung WUIK--process $ Total costs accounted for 1,820 $ 2,100 $ 3,920 Now complete a production report for the Sewing Department. (Complete all input fields. Enter a "0" for any zero balances. Round all cost per unit amou New Orleans Shirt Company Production Cost Report-Sewing Department Month Ended March 31, 2024 Equivalent Units Whole Transferred Direct Conversion UNITS Units In Materials Costs Units to account for: Beginning work-in-process 300 Transferred in 1,400 1,700 Total units to account for Units accounted for: Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All Units accounted for: Completed and transferred out Ending work-in-process 1,100 1,100 n/a 1,100 420 600 600 n/a 1,700 1,700 n/a 1,520 Total units accounted for Conversion Transferred In Direct Materials Total Costs Costs $ 840 $ n/a n/a 360 $ 1,464 1,200 5,384 3,920 4,760 $ 1,824 $ 6,584 COSTS Costs to account for: Beginning work-in-process Costs added during the period Total costs to account for Divided by: Total EUP Cost per equivalent unit Costs accounted for: Completed and transferred out Ending work-in-process n/a n/a 1,700 1,520 $ 2.80 n/a $ 1.20 $ 4.00 n/a n/a Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All MEITEN ng dal 1 More Info $ $ $ Basic shirts are plain shirts without any screen printing on them. Custom shirts are created using the basic shirts and then adding a custom screen printing design. The company buys cloth in various colors and then makes the basic shirts in two departments, Cutting and Sewing. The company uses a process costing system (weighted average method) to determine the production cost of the basic shirts. In the Cutting Department, direct materials (cloth) are added at the beginning of the process and conversion costs are added evenly through the process. In the Sewing Department, no direct materials are added. The only additional material, thread, is considered an indirect material because it cannot be easily traced to the finished product. Conversion costs are added evenly throughout the process in the Sewing Department. The finished basic shirts are sold to retail stores or are sent to the Custom Design Department for custom screen printing. The Custom Design Department creates custom shirts by adding screen printing to the basic shirt. The department creates a design based on the customer's request and then prints the design using up to four colors. Because these shirts have the custom printing added, which is unique for each order, the additional cost incurred is determined using job order costing, with each custom order considered a separate job. $ $ ete all cent an any Depar 24 Print Done - Requirements X nd cu irt Con data.) ng d $ $ $ $ 1. Complete a production cost report for the Cutting Department and the Sewing Department. What is the cost of one basic shirt? 2. Determine the total cost and the average cost per shirt for jobs 367, 368, 369, and 370. If the company set the sales price at 150% of the total cost, determine the total sales price of each job. 3. In addition to the custom jobs, the New Orleans Shirt Company sold 1,100 basic shirts (assume the beginning balance in Finished Goods Inventory is sufficient to make these sales, and the unit cost of the basic shirts in Finished Goods Inventory is the same as the unit cost incurred this month). If the company set the sales price at 125% of the cost, determine the sales price per unit, total sales revenue, total cost of goods sold, and total gross profit for the basic shirts. 4. Calculate the total revenue, total cost of goods sold, and total gross profit for all sales, basic and custom. 5. Assume the company sold only basic shirts (no custom designs) and incurred fixed costs of $400 per month. a. Calculate the contribution margin per unit, contribution margin ratio, required sales in units to break even, and required sales in dollars to break even b. Determine the margin of safety in units and dollars. C. Graph New Orleans Shirt Company's CVP relationships. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, and the operating income area. d. Suppose the New Orleans Shirt Company wants to earn an operating income of $1,200 per month. Compute the required sales in units and dollars to achieve this profit goal. 6. The New Orleans Shirt Company is considering adding a new product line, a $ ete & cent an any Depa 24 hen a Print Done i Data Table - $ Job Status 367 $ 368 Quantity Design Fee 200 Yes 300 No 150 Yes 100 Yes Printing 5 colors 3 colors 4 colors 3 colors Complete Complete Complete Complete 369 370 GA $ The New Orleans Shirt Company has previously determined that creating and programming the design cost $100 per design. This is a one-time charge. If a customer places another order with the same design, the customer is not charged a second time. Additionally, the cost to print is $0.50 per color per shirt. ete all in jest cent an any Print Done Departm 24 $ Data Table x $ Amount $ 1,200 Units 300 shirts $ ??? ??? Sewing Department Beginning balance, transferred in, $840; conversion costs, $360 Transferred in from Cutting Conversion costs added in March Completed and transferred to Finished Goods Ending balance, 70% complete $ 1,464 ??? 1,100 shirts $ ??? ??? ete all cent an Print Done any Departments Data Table X Amount $ $ 0 Units O shirts 1,400 shirts Cutting Department Beginning balance Started in March Direct materials added in March Conversion costs Completed and transferred to Sewing Ending balance 1,820 2,100 ??? 1,400 shirts O shirts 0 han Print Done Requirement 1. Complete a production cost report for the Cutting Department and the Sewing Department. What is the cost of one basic shirt? Begin by completing a production report for the Cutting Department. (Complete all input fields. Enter a "0" for any zero balances. Round all cost per unita used: EUP = equivalent units of production.) New Orleans Shirt Company Production Cost Report-Cutting Department Month Ended March 31, 2024 Equivalent Units Whole Transferred Direct Conversion UNITS Units In Materials Costs Units to account for: Beginning work-in-process 0 Started in production 1,400 1,400 Total units to account for Units accounted for: Completed and transferred out 1,400 n/a 1,400 1,400 Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All n/a 1,400 1,400 Units accounted for: Completed and transferred out Ending work-in-process Total units accounted for 1,400 0 0 0 n/a n/a 1,400 1,400 1,400 Transferred In Direct Materials Conversion Costs Total Costs n/a $ 0 $ 1,820 0 $ 2,100 0 3,920 n/a n/a 1,820 $ 3,920 COSTS Costs to account for: Beginning work-in-process Costs added during the period Total costs to account for Divided by: Total EUP Cost per equivalent unit Costs accounted for: Completed and transferred out Ending work-in-process 2,100 $ 1,400 n/a 1,400 n/a 1.30 $ 1.50 n/a $ 1,820 $ 2,100 $ 3,920 n/a 0 0 Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All n/a Chung WUIK--process $ Total costs accounted for 1,820 $ 2,100 $ 3,920 Now complete a production report for the Sewing Department. (Complete all input fields. Enter a "0" for any zero balances. Round all cost per unit amou New Orleans Shirt Company Production Cost Report-Sewing Department Month Ended March 31, 2024 Equivalent Units Whole Transferred Direct Conversion UNITS Units In Materials Costs Units to account for: Beginning work-in-process 300 Transferred in 1,400 1,700 Total units to account for Units accounted for: Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear All Units accounted for: Completed and transferred out Ending work-in-process 1,100 1,100 n/a 1,100 420 600 600 n/a 1,700 1,700 n/a 1,520 Total units accounted for Conversion Transferred In Direct Materials Total Costs Costs $ 840 $ n/a n/a 360 $ 1,464 1,200 5,384 3,920 4,760 $ 1,824 $ 6,584 COSTS Costs to account for: Beginning work-in-process Costs added during the period Total costs to account for Divided by: Total EUP Cost per equivalent unit Costs accounted for: Completed and transferred out Ending work-in-process n/a n/a 1,700 1,520 $ 2.80 n/a $ 1.20 $ 4.00 n/a n/a Choose from any list or enter any number in the input fields and then click Check Answer. 1 parts Clear AllStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started