Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer these questions possible, 23.-40. Stewart's Home & Garden is considering adding a line of rose bushes to their product selection. The

Please help me answer these questions

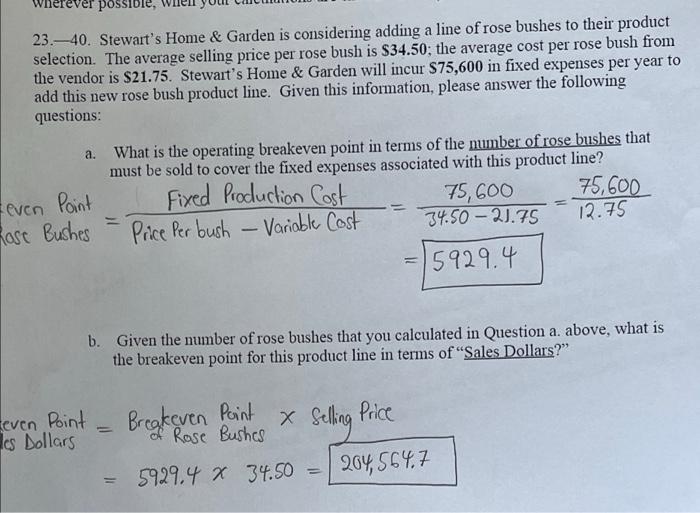

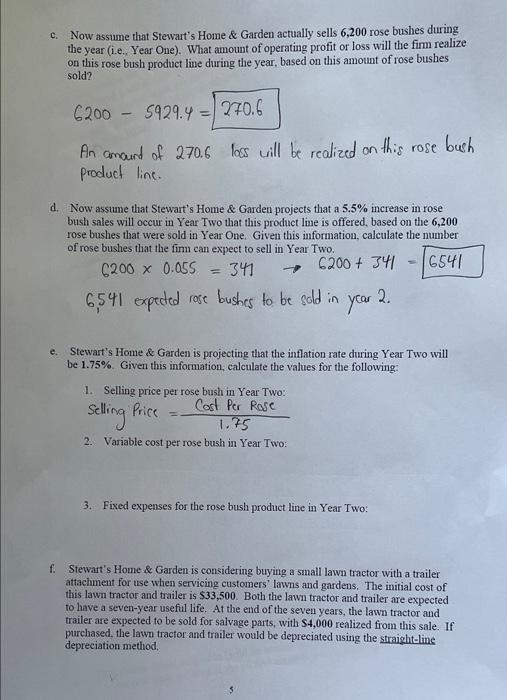

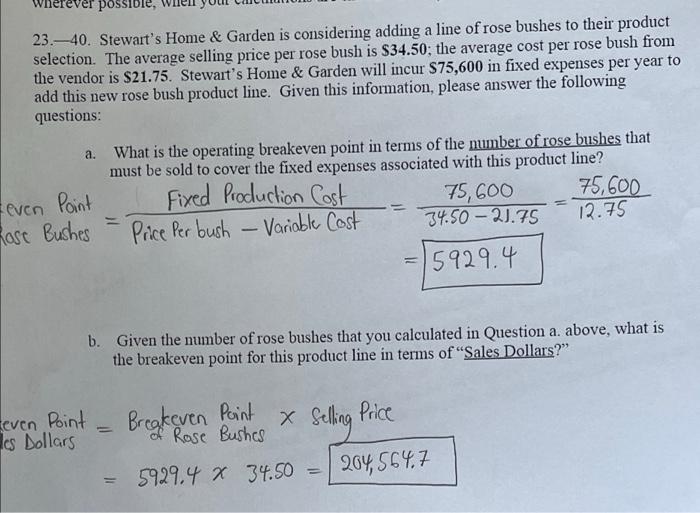

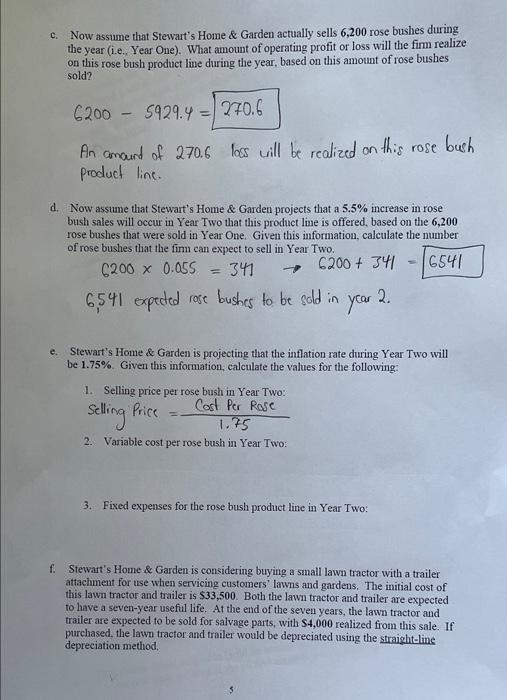

possible, 23.-40. Stewart's Home & Garden is considering adding a line of rose bushes to their product selection. The average selling price per rose bush is $34.50; the average cost per rose bush from the vendor is $21.75. Stewart's Home & Garden will incur S75,600 in fixed expenses per year to add this new rose bush product line. Given this information, please answer the following questions: a. even Point Rose Bushes What is the operating breakeven point in terms of the number of rose bushes that must be sold to cover the fixed expenses associated with this product line? Fixed Production Cost 75,600 75,600 Price Per bush - Variable Cost 34.50 - 20.75 12.75 15929.4 b. Given the number of rose bushes that you calculated in Question a. above, what is the breakeven point for this product line in terms of Sales Dollars?" x Selling even Point - Breakeven Point les Dollars of Rose Bushes 5929.4 x 34.50 Selling Price 204,564.7 C. Now assume that Stewart's Home & Garden actually sells 6,200 rose bushes during the year (i.e., Year One). What amount of operating profit or loss will the firn realize on this rose bush product line during the year, based on this amount of rose bushes sold? 6200 - 5929.4 = 270.6 An amount of 270.6 lows will be realized on this rose bush product line. d. Now assume that Stewart's Home & Garden projects that a 5.5% increase in rose bush sales will occur in Year Two that this product line is offered, based on the 6,200 rose bushes that were sold in Year One. Given this information, calculate the number of rose bushes that the finn can expect to sell in Year Two. 6200 x 0.055 341 6200+ 341 6541 - 6,541 expected rose bushes to be sold in 2. year e. Stewart's Home & Garden is projecting that the inflation rate during Year Two will be 1.75%. Given this information, calculate the values for the following: 1. Selling price per rose bush in Year Two: Cost Per Rose 1.75 2. Variable cost per rose bush in Year Two: Selling Price 3. Fixed expenses for the rose bush product line in Year Two: f. Stewart's Home & Garden is considering buying a small lawn tractor with a trailer attachment for use when servicing customers' lawns and gardens. The initial cost of this lawn tractor and trailer is $33,500. Both the lawn tractor and trailer are expected to have a seven-year useful life. At the end of the seven years, the lawn tractor and trailer are expected to be sold for salvage parts, with $4,000 realized from this sale. If purchased, the lawn tractor and trailer would be depreciated using the straight-line depreciation method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started