Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, help me answer these questions. Thank you! The nominal, risk-free rate on T-bills recently is 4.48%. If the real rate of interest is 0.94%,

Please, help me answer these questions.

Thank you!

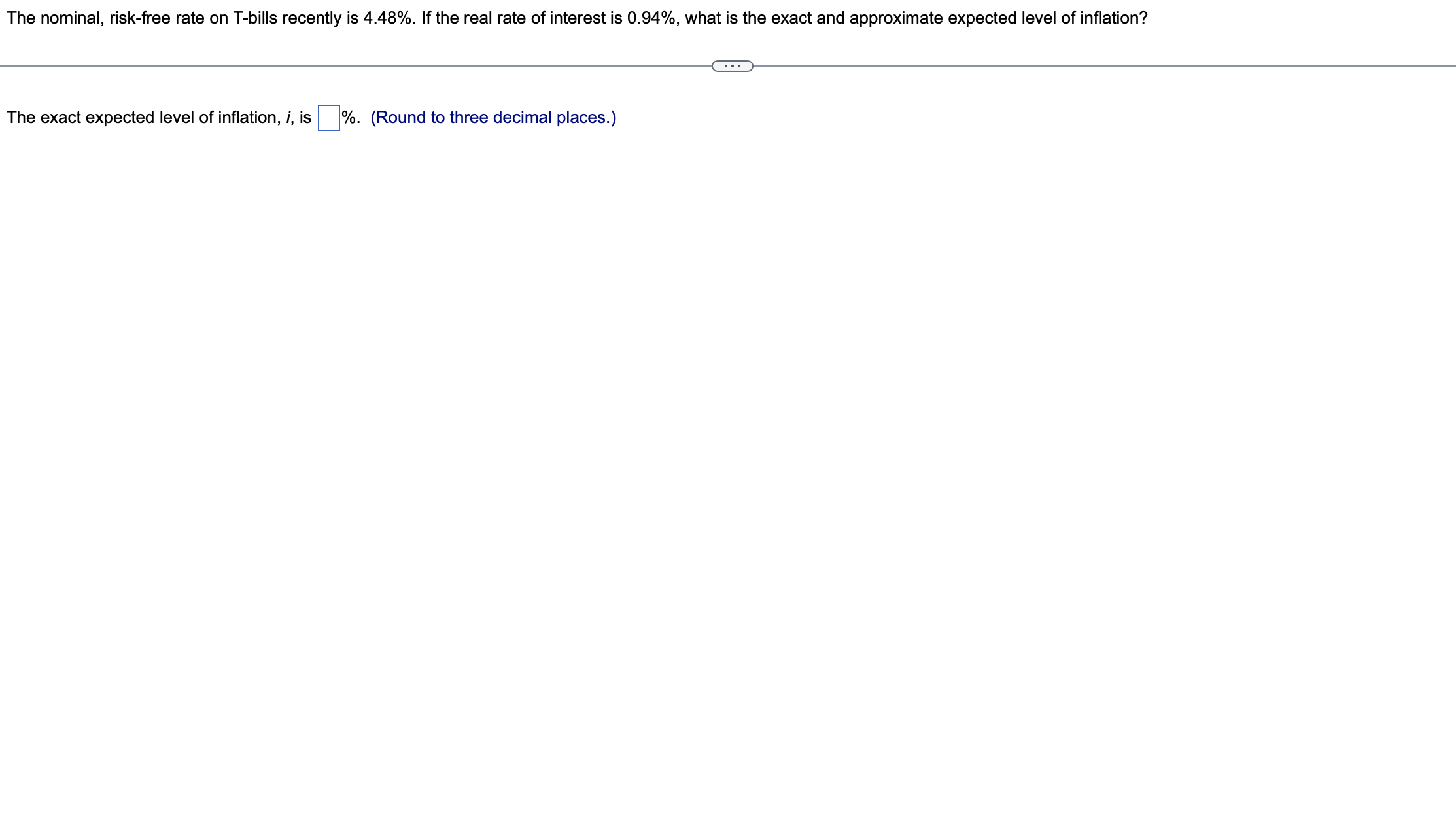

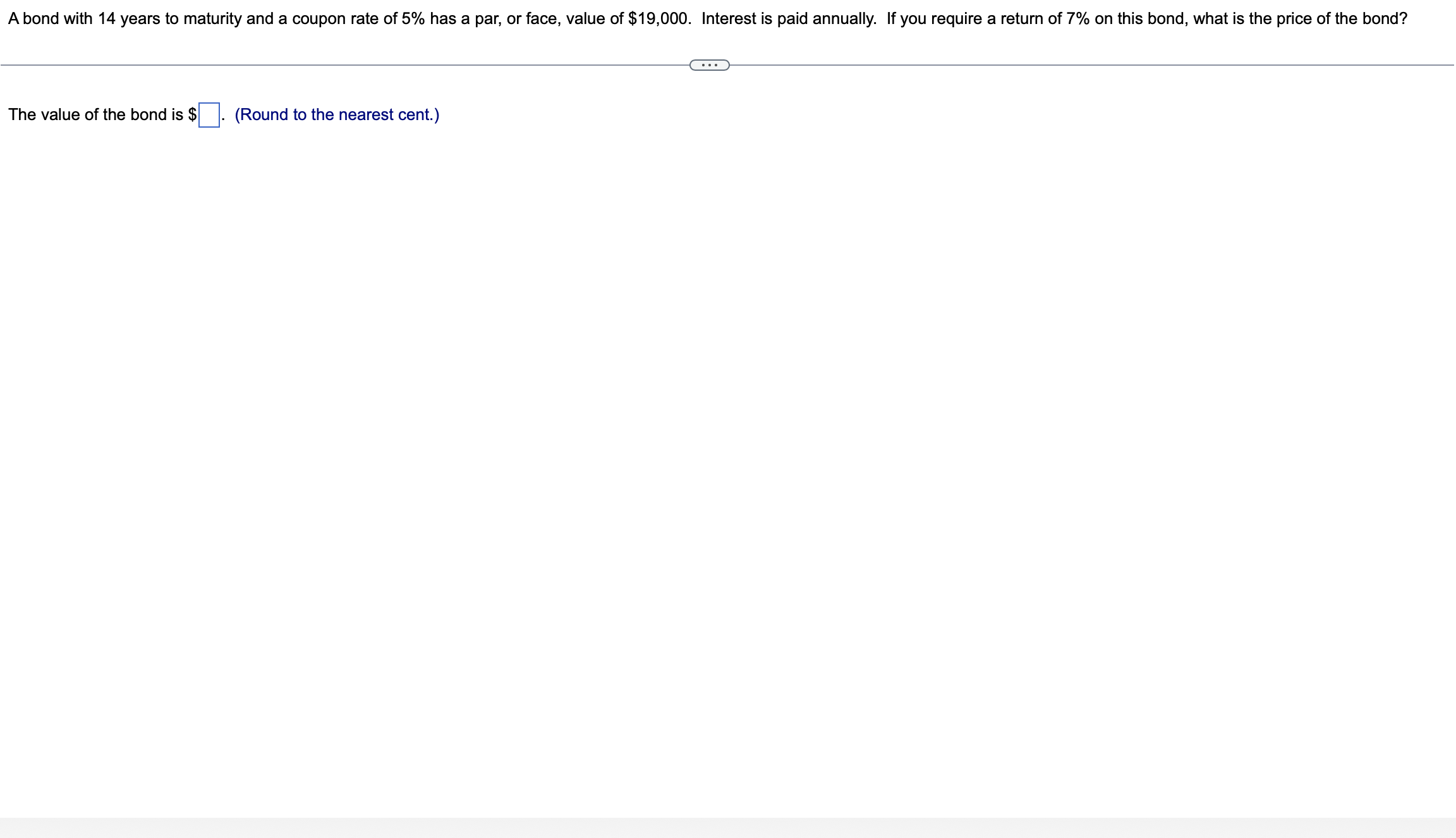

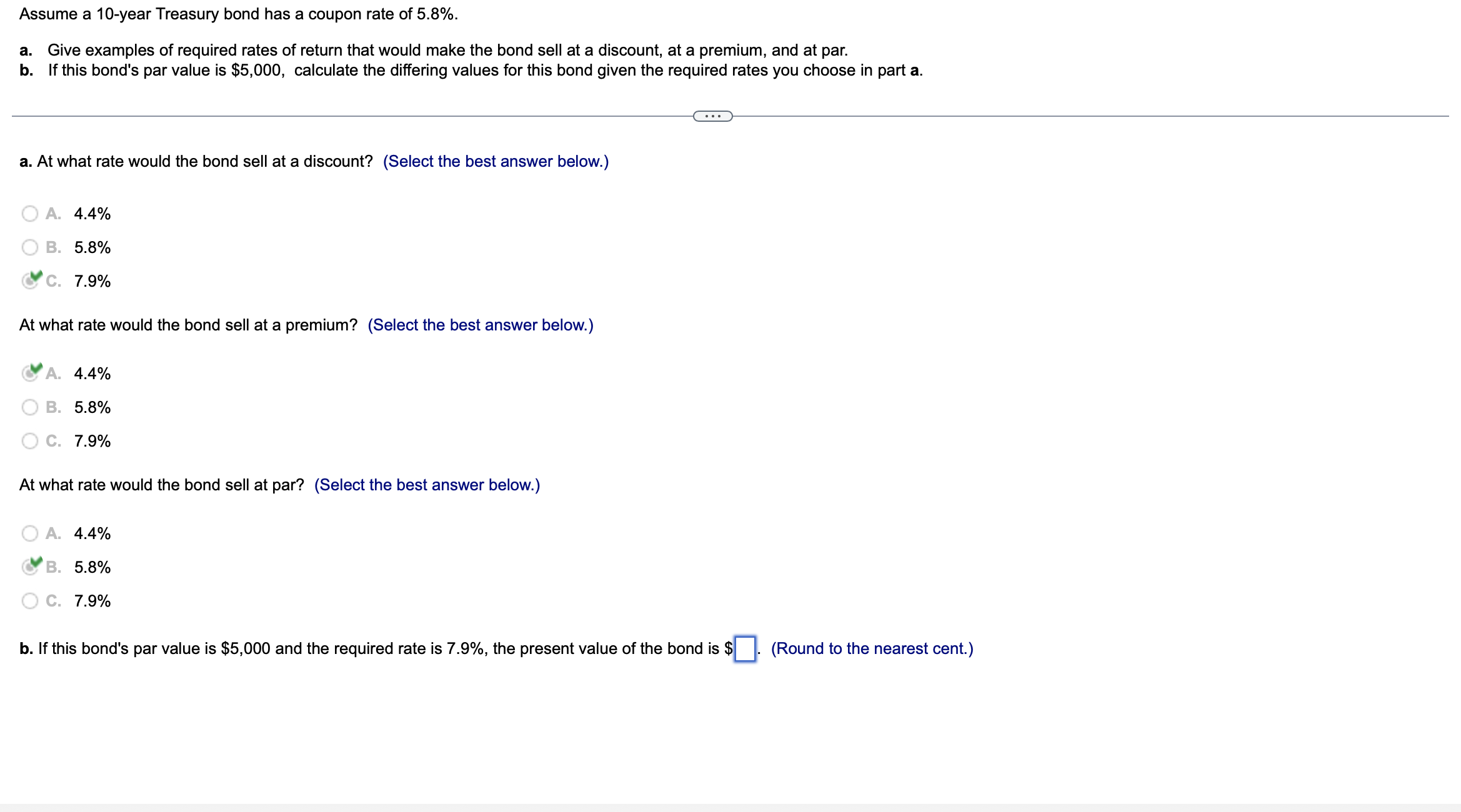

The nominal, risk-free rate on T-bills recently is 4.48%. If the real rate of interest is 0.94%, what is the exact and approximate expected level of inflation? The exact expected level of inflation, i, is \%. (Round to three decimal places.) A bond with 14 years to maturity and a coupon rate of 5% has a par, or face, value of $19,000. Interest is paid annually. If you require a return of 7% on this bond, what is the price of the bond? The value of the bond is $ (Round to the nearest cent.) Assume a 10 -year Treasury bond has a coupon rate of 5.8%. a. Give examples of required rates of return that would make the bond sell at a discount, at a premium, and at par. b. If this bond's par value is $5,000, calculate the differing values for this bond given the required rates you choose in part a. a. At what rate would the bond sell at a discount? (Select the best answer below.) A. 4.4% B. 5.8% C. 7.9% At what rate would the bond sell at a premium? (Select the best answer below.) A. 4.4% B. 5.8% C. 7.9% At what rate would the bond sell at par? (Select the best answer below.) A. 4.4% B. 5.8% C. 7.9% b. If this bond's par value is $5,000 and the required rate is 7.9%, the present value of the bond is $ (Round to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started