Answered step by step

Verified Expert Solution

Question

1 Approved Answer

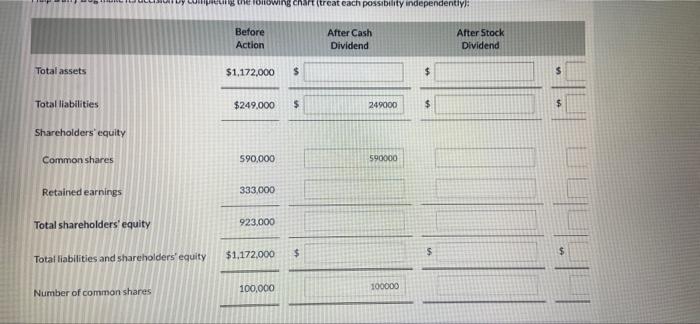

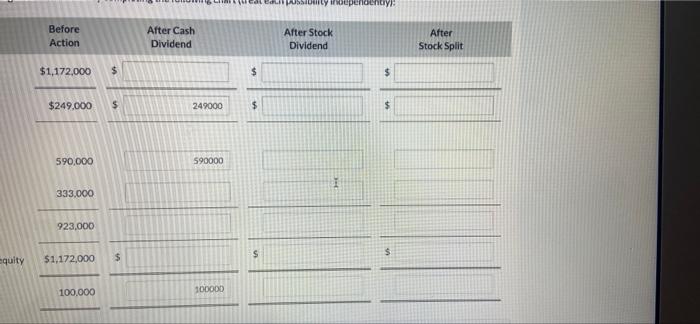

please help me answer this, am not sure how! answer in chart form much appreciated Question 5 of 9 -/1 View Policies Current Attempt in

please help me answer this, am not sure how! answer in chart form much appreciated

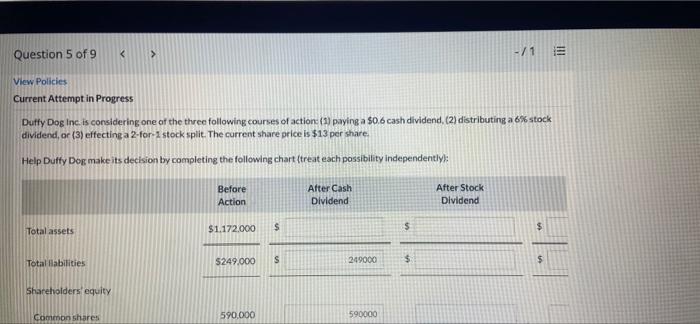

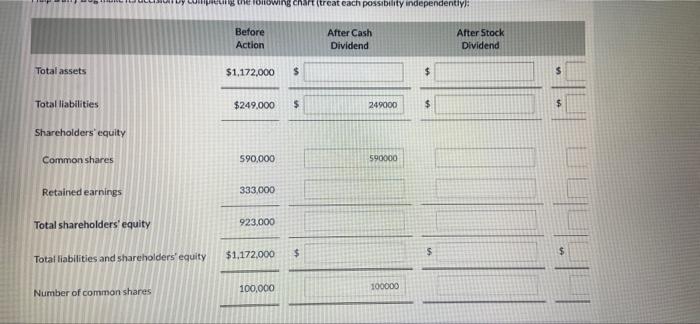

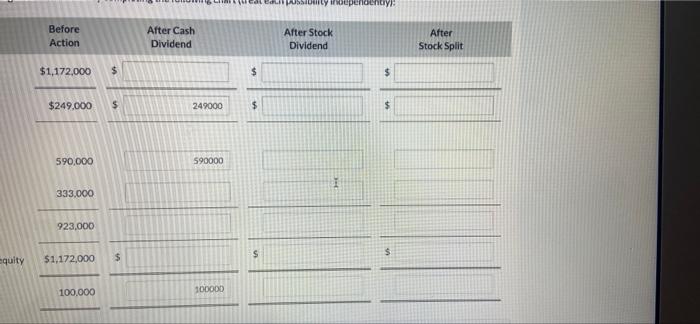

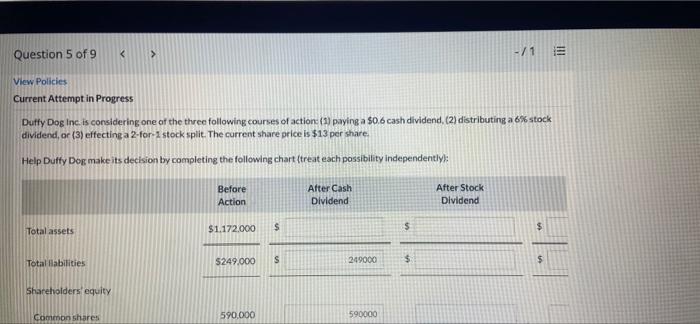

Question 5 of 9 -/1 View Policies Current Attempt in Progress Duffy Dog Inc. is considering one of the three following courses of action (1) paying a $0.6 cash dividend. (2) distributing a 6% stock dividend, or (3) effecting a 2 for 1 stock split. The current share price is $13 per share. Help Duffy Dog make its decision by completing the following chart treat each possibility independently Before Action After Cash Dividend After Stock Dividend $1.172.000 $ $ $ Total assets Total Habilities $249.000 S 249000 $ $ Shareholders equity Common shares 590.000 590000 pe the following chart treat each possibility independently Before Action After Cash Dividend After Stock Dividend Total assets $1,172,000 $ $ $ Total liabilities $249,000 $ 249000 $ $ Shareholders equity Common shares 590,000 590000 Retained earnings 333.000 Total shareholders' equity 923.000 $1,172,000 $ $ Total liabilities and shareholders' equity $ 100,000 Number of common shares 100000 Worty noependent Before Action After Cash Dividend After Stock Dividend After Stock Split $1,172,000 $ $ $ $249.000 $ 249000 $ $ 590,000 590000 333.000 923,000 s $ $ equity $1,172,000 100000 100.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started