PLEASE HELP ME ANSWER THIS ASAP

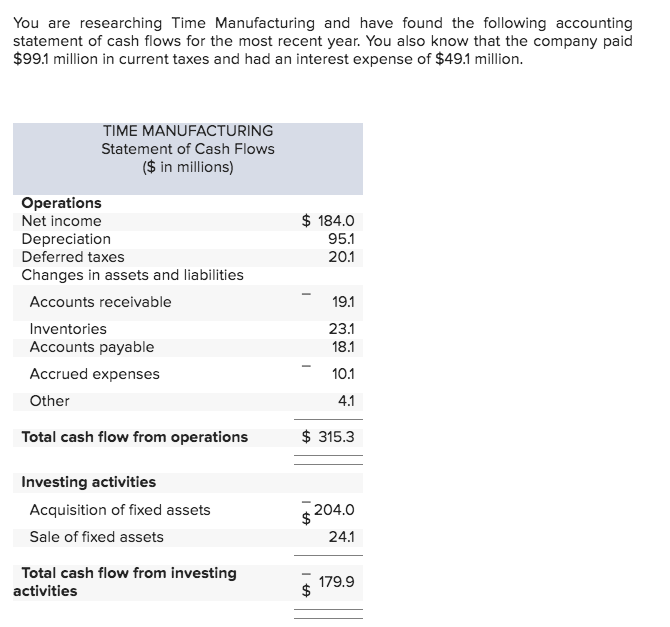

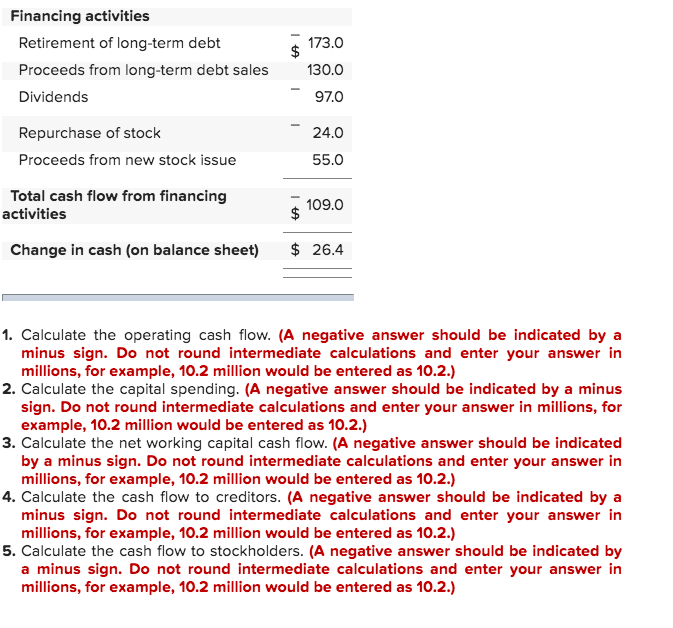

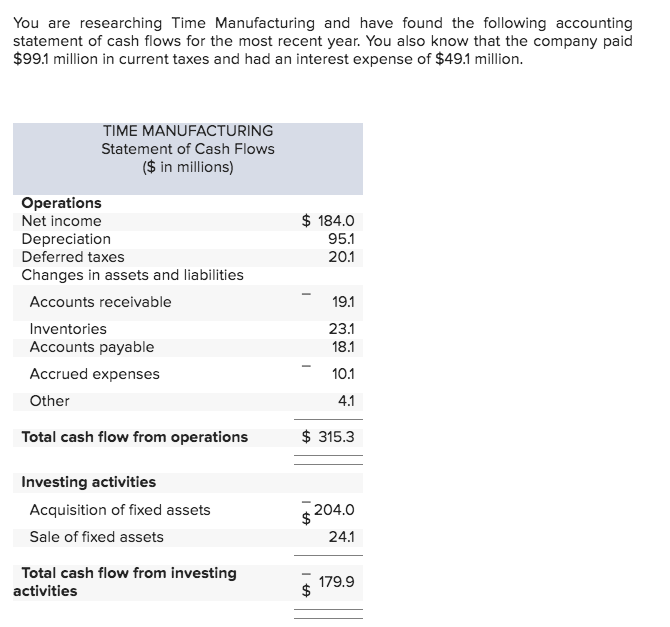

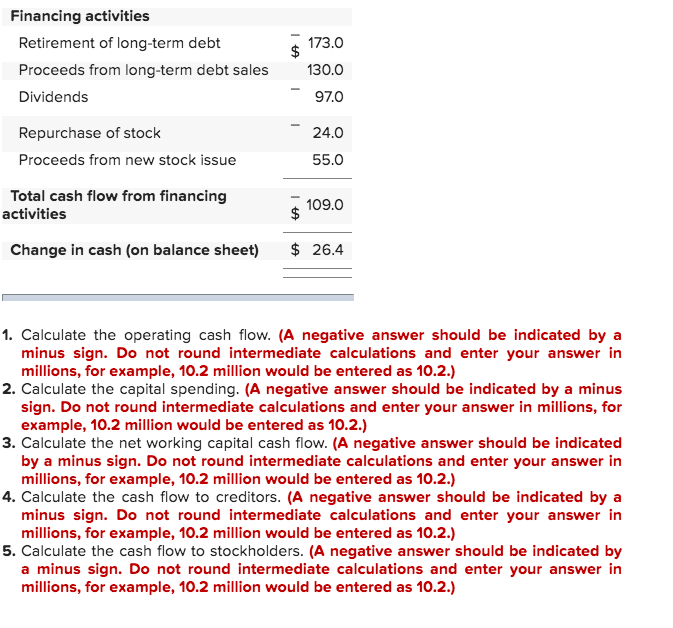

You are researching Time Manufacturing and have found the following accounting statement of cash flows for the most recent year. You also know that the company paid $99.1 million in current taxes and had an interest expense of $49.1 million. TIME MANUFACTURING Statement of Cash Flows ($ in millions) $ 184.0 Operations Net income Depreciation Deferred taxes Changes in assets and liabilities 95.1 20.1 19.1 23.1 Accounts receivable Inventories Accounts payable Accrued expenses Other - 10.1 Total cash flow from operations $ 315.3 Investing activities Acquisition of fixed assets Sale of fixed assets 5204.0 24.1 Total cash flow from investing activities $179.9 HAI Financing activities Retirement of long-term debt Proceeds from long-term debt sales Dividends 173.0 130.0 97.0 I Repurchase of stock Proceeds from new stock issue 24.0 55.0 Total cash flow from financing activities 7 109.0 Change in cash (on balance sheet) $ 26.4 1. Calculate the operating cash flow. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 2. Calculate the capital spending. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 3. Calculate the net working capital cash flow. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 4. Calculate the cash flow to creditors. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 5. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 1. Operating cash flow 2. Capital spending 3. Net working capital cash flow Cash flow to creditors 5. Cash flow to stockholders