Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer this, I need answer in 1 hour thank you so much Number 1-4 1. If an amount being measured involves a

Please help me answer this, I need answer in 1 hour thank you so much

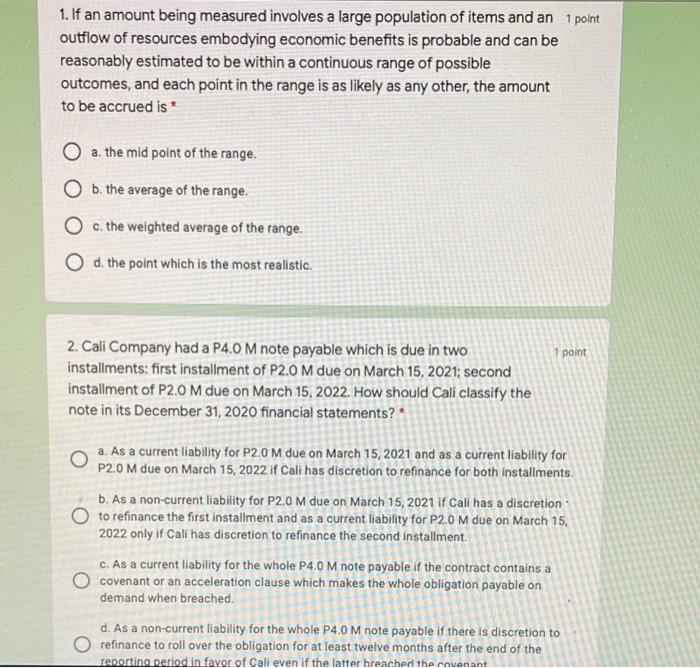

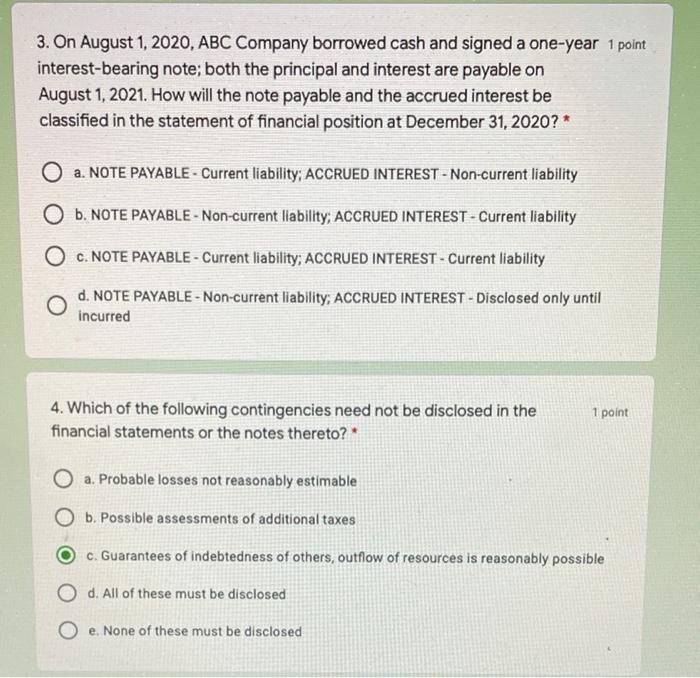

1. If an amount being measured involves a large population of items and an 1 point outflow of resources embodying economic benefits is probable and can be reasonably estimated to be within a continuous range of possible outcomes, and each point in the range is as likely as any other, the amount to be accrued is O a. the mid point of the range. O b. the average of the range. O c. the weighted average of the range. Od the point which is the most realistic. 1 point 2. Cali Company had a P4.0 M note payable which is due in two installments: first installment of P2.0 M due on March 15, 2021; second installment of P2.0 M due on March 15, 2022. How should Cali classify the note in its December 31, 2020 financial statements? O a. As a current liability for P2.0 M due on March 15, 2021 and as a current liability for P2.0 M due on March 15, 2022 if Cali has discretion to refinance for both installments. b. As a non-current liability for P2.0 M due on March 15, 2021 If Cali has a discretion to refinance the first installment and as a current liability for P2.0 M due on March 15, 2022 only if Cali has discretion to refinance the second installment c. As a current liability for the whole P4.0 M note payable if the contract contains a covenant or an acceleration clause which makes the whole obligation payable on demand when breached d. As a non-current liability for the whole P4.0 M note payable if there is discretion to refinance to roll over the obligation for at least twelve months after the end of the reporting period in favor of Cali even if the latter breached the covenant 3. On August 1, 2020, ABC Company borrowed cash and signed a one-year 1 point interest-bearing note; both the principal and interest are payable on August 1, 2021. How will the note payable and the accrued interest be classified in the statement of financial position at December 31, 2020? O a. NOTE PAYABLE - Current liability; ACCRUED INTEREST - Non-current liability O b. NOTE PAYABLE - Non-current liability; ACCRUED INTEREST - Current liability O C. NOTE PAYABLE - Current liability; ACCRUED INTEREST - Current liability d. NOTE PAYABLE - Non-current liability; ACCRUED INTEREST - Disclosed only until incurred 1 point 4. Which of the following contingencies need not be disclosed in the financial statements or the notes thereto? O a. Probable losses not reasonably estimable O b. Possible assessments of additional taxes c. Guarantees of indebtedness of others, outflow of resources is reasonably possible O d. All of these must be disclosed O e. None of these must be disclosed Number 1-4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started