Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me answer this priblem thank you PROBLEMS Problem 3-1A Preparing adjusting entries (monthly)-prepaid expenses L04 Willow Window Washing Services prepares adjustments monthly and

please help me answer this priblem thank you

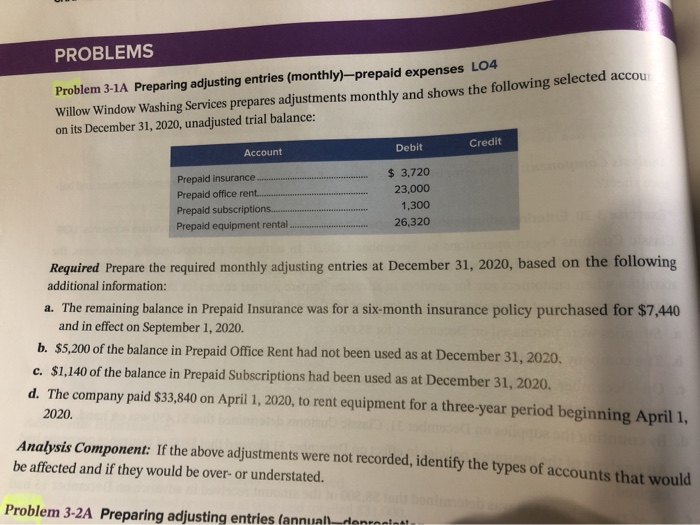

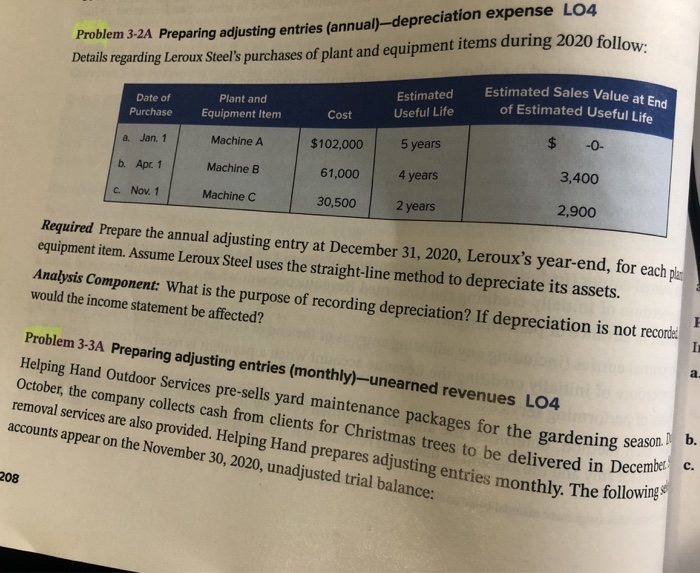

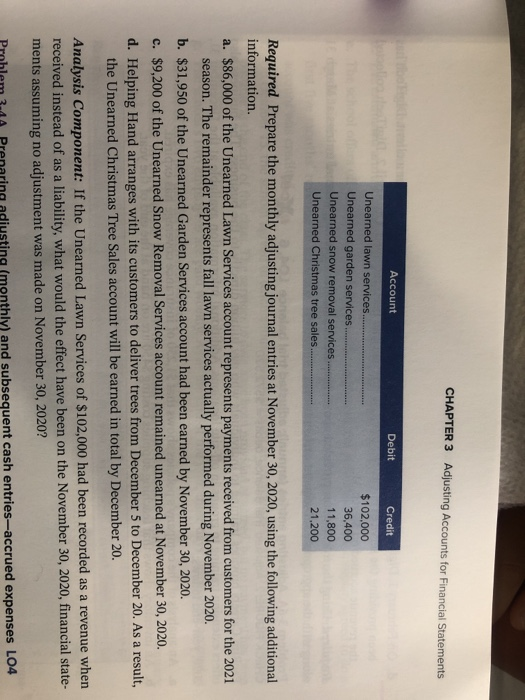

PROBLEMS Problem 3-1A Preparing adjusting entries (monthly)-prepaid expenses L04 Willow Window Washing Services prepares adjustments monthly and shows the following selected accou on its December 31, 2020, unadjusted trial balance: Account Debit Credit Prepaid insurance Prepaid office rent... Prepaid subscriptions Prepaid equipment rental $ 3,720 23,000 1,300 26,320 Required Prepare the required monthly adjusting entries at December 31, 2020, based on the following additional information: a. The remaining balance in Prepaid Insurance was for a six-month insurance policy purchased for $7,440 and in effect on September 1, 2020. b. $5,200 of the balance in Prepaid Office Rent had not been used as at December 31, 2020, c. $1,140 of the balance in Prepaid Subscriptions had been used as at December 31, 2020. d. The company paid $33,840 on April 1, 2020, to rent equipment for a three-year period beginning April 1, 2020. Analysis Component: If the above adjustments were not recorded, identify the types of accounts that would be affected and if they would be over- or understated. Problem 3-2A Preparing adjusting entries (annual). danranta Estimated Sales Value at End October, the company collects cash from clients for Christmas trees to be delivered in December C. removal services are also provided. Helping Hand prepares adjusting entries monthly. The followings Problem 3-2A Preparing adjusting entries (annual)-depreciation expense 404 Details regarding Leroux Steel's purchases of plant and equipment items during 2020 follow: Date of Purchase Plant and Equipment Item Estimated Useful Life of Estimated Useful Life Cost a. Jan. 1 Machine A $102,000 5 years $ -O- b. Apr. 1 Machine B 61,000 4 years 3,400 c. Nov. 1 Machine C 30,500 2 years 2,900 Required Prepare the annual adjusting entry at December 31, 2020, Leroux's year-end, for each plan equipment item. Assume Leroux Steel uses the straight-line method to depreciate its assets. Analysis Component: What is the purpose of recording depreciation? If depreciation is not recorded would the income statement be affected? Problem 3-3A Preparing adjusting entries (monthly)-unearned revenues LO4 Helping Hand Outdoor Services pre-sells yard maintenance packages for the gardening 1 a accounts appear on the November 30, 2020, unadjusted trial balance: season. I b. 208 CHAPTER 3 Adjusting Accounts for Financial Statements Account Debit Credit Unearned lawn services. Unearned garden services Unearned snow removal services Unearned Christmas tree sales $102,000 36,400 11,800 21.200 . Required Prepare the monthly adjusting journal entries at November 30, 2020, using the following additional information. a. $86,000 of the Unearned Lawn Services account represents payments received from customers for the 2021 season. The remainder represents fall lawn services actually performed during November 2020. b. $31,950 of the Unearned Garden Services account had been earned by November 30, 2020. c. $9,200 of the Unearned Snow Removal Services account remained unearned at November 30, 2020. d. Helping Hand arranges with its customers to deliver trees from December 5 to December 20. As a result, the Unearned Christmas Tree Sales account will be earned in total by December 20. Analysis Component: If the Unearned Lawn Services of $102,000 had been recorded as a revenue when received instead of as a liability, what would the effect have been on the November 30, 2020, financial state- ments assuming no adjustment was made on November 30, 2020? adiusting (monthly) and subsequent cash entries-accrued expenses L04 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started