Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer this question 2. POST ACQUISITION VALUE CPI, Inc. is acquiring JW for R470 000 in cash. CPL has 27 000 shares

Please help me answer this question

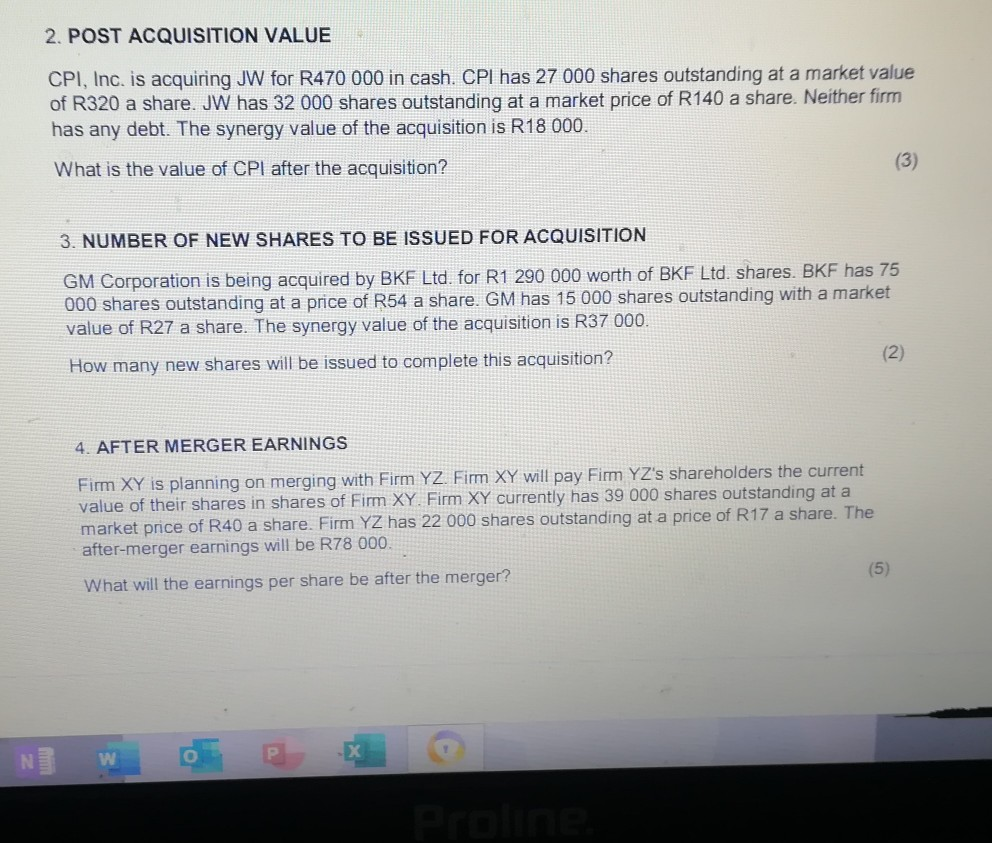

2. POST ACQUISITION VALUE CPI, Inc. is acquiring JW for R470 000 in cash. CPL has 27 000 shares outstanding at a market value of R320 a share. JW has 32 000 shares outstanding at a market price of R140 a share. Neither firm has any debt. The synergy value of the acquisition is R18 000. What is the value of CPI after the acquisition? (3) 3. NUMBER OF NEW SHARES TO BE ISSUED FOR ACQUISITION GM Corporation is being acquired by BKF Ltd. for R1 290 000 worth of BKF Ltd. shares. BKF has 75 000 shares outstanding at a price of R54 a share. GM has 15 000 shares outstanding with a market value of R27 a share. The synergy value of the acquisition is R37 000. How many new shares will be issued to complete this acquisition? 4. AFTER MERGER EARNINGS Firm XY is planning on merging with Firm YZ. Firm XY will pay Firm YZ's shareholders the current value of their shares in shares of Firm XY. Firm XY currently has 39 000 shares outstanding at a market price of R40 a share. Firm YZ has 22 000 shares outstanding at a price of R17 a share. The after-merger earnings will be R78 000. What will the earnings per share be after the mergerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started