Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer this questions! I will give a good review right away! Please neatly write out work and box answer! Please show work

Please help me answer this questions! I will give a good review right away! Please neatly write out work and box answer! Please show work so I can understand it, do not use Excel as it is confusing for me! Please write out the work and show equations! Thank you!

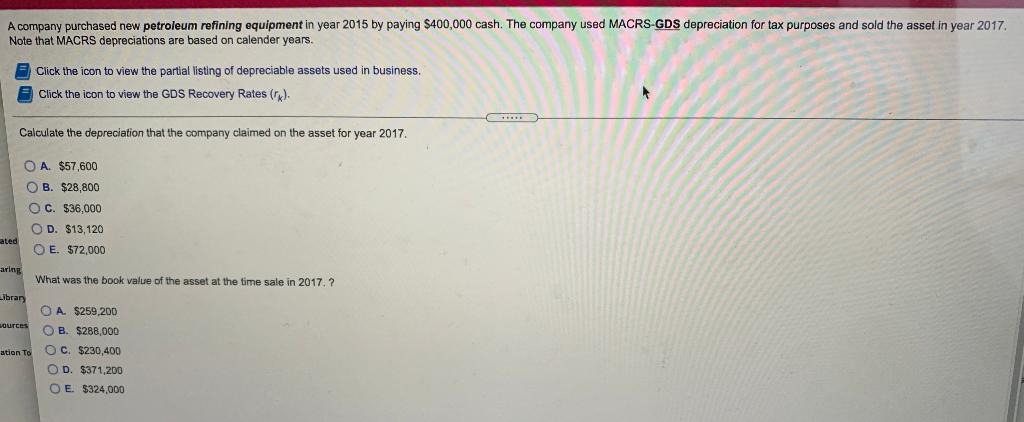

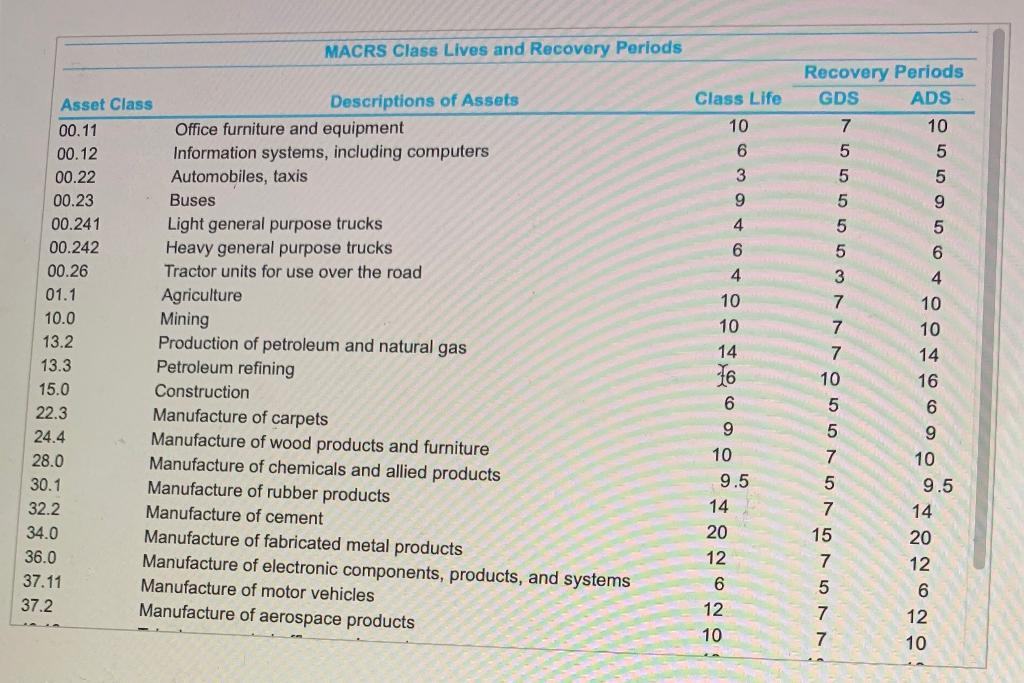

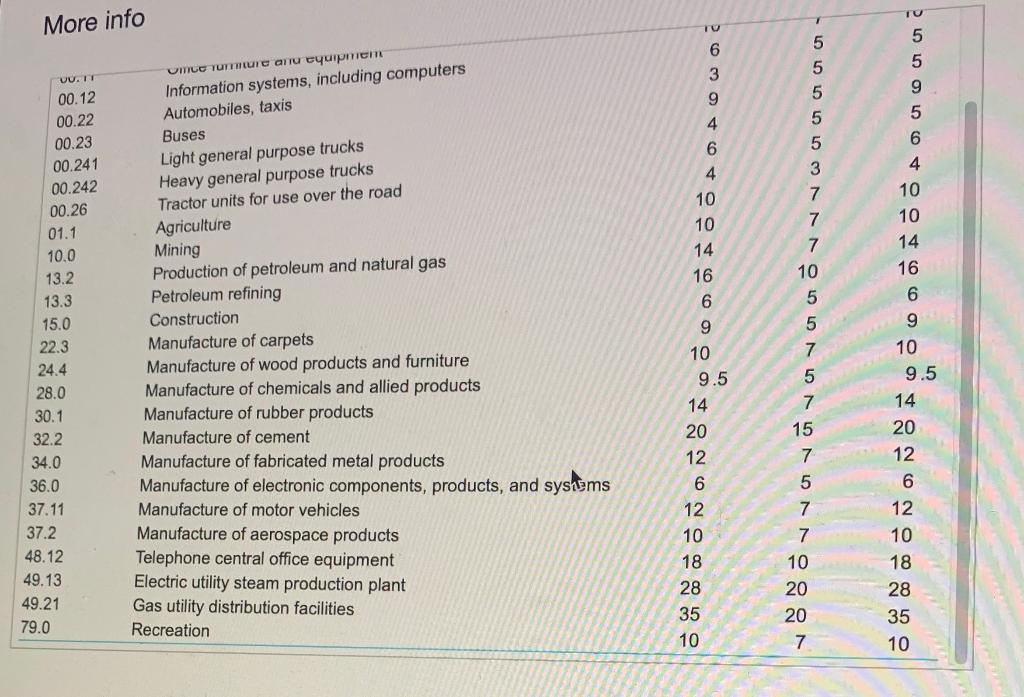

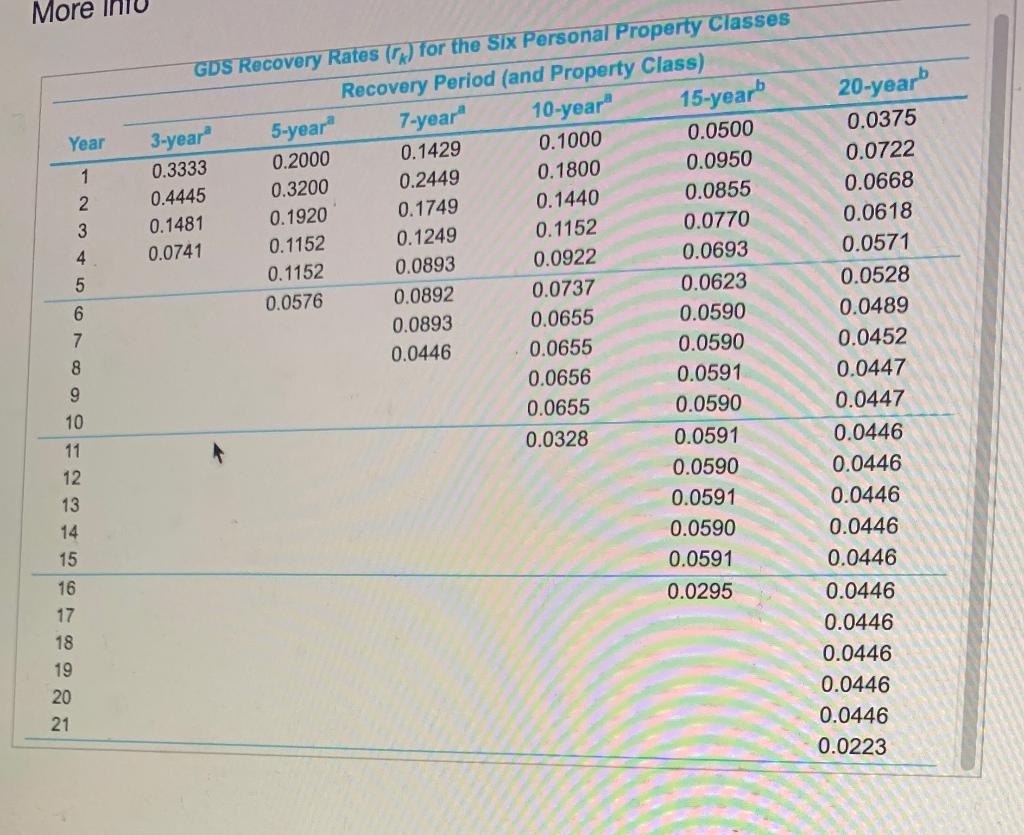

A company purchased new petroleum refining equipment in year 2015 by paying $400,000 cash. The company used MACRS-GDS depreciation for tax purposes and sold the asset in year 2017, Note that MACRS depreciations are based on calender years. Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the GDS Recovery Rates (X). Calculate the depreciation that the company claimed on the asset for year 2017. O A. $57,600 OB. $28,800 O C. $36,000 ated OD. $13,120 O E. $72,000 aring What was the book value of the asset at the time sale in 2017? bran sources A. $259,200 OB. $288,000 ation to C. $230,400 OD. $371,200 O E $324,000 MACRS Class Lives and Recovery Periods Recovery Periods GDS ADS Class Life 10 6 A WOO 10 5 5 g 3 7 5 5 5 5 9 wanaoon on 5 4 6 6 4 5 3 7 4 10 10 Asset Class Descriptions of Assets 00.11 Office furniture and equipment 00.12 Information systems, including computers 00.22 Automobiles, taxis 00.23 Buses 00.241 Light general purpose trucks 00.242 Heavy general purpose trucks 00.26 Tractor units for use over the road 01.1 Agriculture 10.0 Mining 13.2 Production of petroleum and natural gas 13.3 Petroleum refining 15.0 Construction 22.3 Manufacture of carpets 24.4 Manufacture of wood products and furniture 28.0 Manufacture of chemicals and allied products Manufacture of rubber products 32.2 Manufacture of cement 34.0 Manufacture of fabricated metal products 36.0 Manufacture of electronic components, products, and systems 37.11 Manufacture of motor vehicles 37.2 Manufacture of aerospace products 14 7 10 6 9 7 10 9.5 14 20 12 30.1 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 vnovvo voor o 15 6 12 5 7 7 10 More info TU 5 6 5 3 9 9 5 4 6 6 4 4 10 10 DU.11 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 22.3 24.4 28.0 30.1 32.2 Ume Ture and cyurpmiem Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities Recreation 10 10 14 16 6 9 10 9.5 vo o vvovarom voor vruworor or or or 14 20 12 14 16 6 9 10 9.5 14 20 12 6 12 10 18 28 35 10 6 36.0 37.11 37.2 48.12 49.13 49.21 79.0 10 12 10 18 28 35 10 20 More Year 1 2 3 4 5 6 7 8 9 10 GDS Recovery Rates (k) for the Six Personal Property Classes Recovery Period (and Property Class) 15-year 20-year 10-year 7-year" 5-year" 3-year 0.0375 0.0500 0.1000 0.2000 0.1429 0.3333 0.0950 0.2449 0.1800 0.0722 0.3200 0.4445 0.1749 0.1920 0.1481 0.0668 0.0855 0.1440 0.1152 0.1249 0.0741 0.0770 0.1152 0.0618 0.1152 0.0893 0.0922 0.0693 0.0571 0.0576 0.0892 0.0737 0.0623 0.0528 0.0893 0.0655 0.0590 0.0489 0.0446 0.0655 0.0590 0.0452 0.0656 0.0591 0.0447 0.0655 0.0590 0.0447 0.0328 0.0591 0.0446 0.0590 0.0446 0.0591 0.0446 0.0590 0.0446 0.0591 0.0446 0.0295 0.0446 11 12 13 14 15 16 17 18 19 20 21 0.0446 0.0446 0.0446 0.0446 0.0223Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started