Answered step by step

Verified Expert Solution

Question

1 Approved Answer

n n As typical of a start-up business, PNW, LLC expects to generate a current year loss with regular deprecation. As such, PNW, LLC does

n n

n n

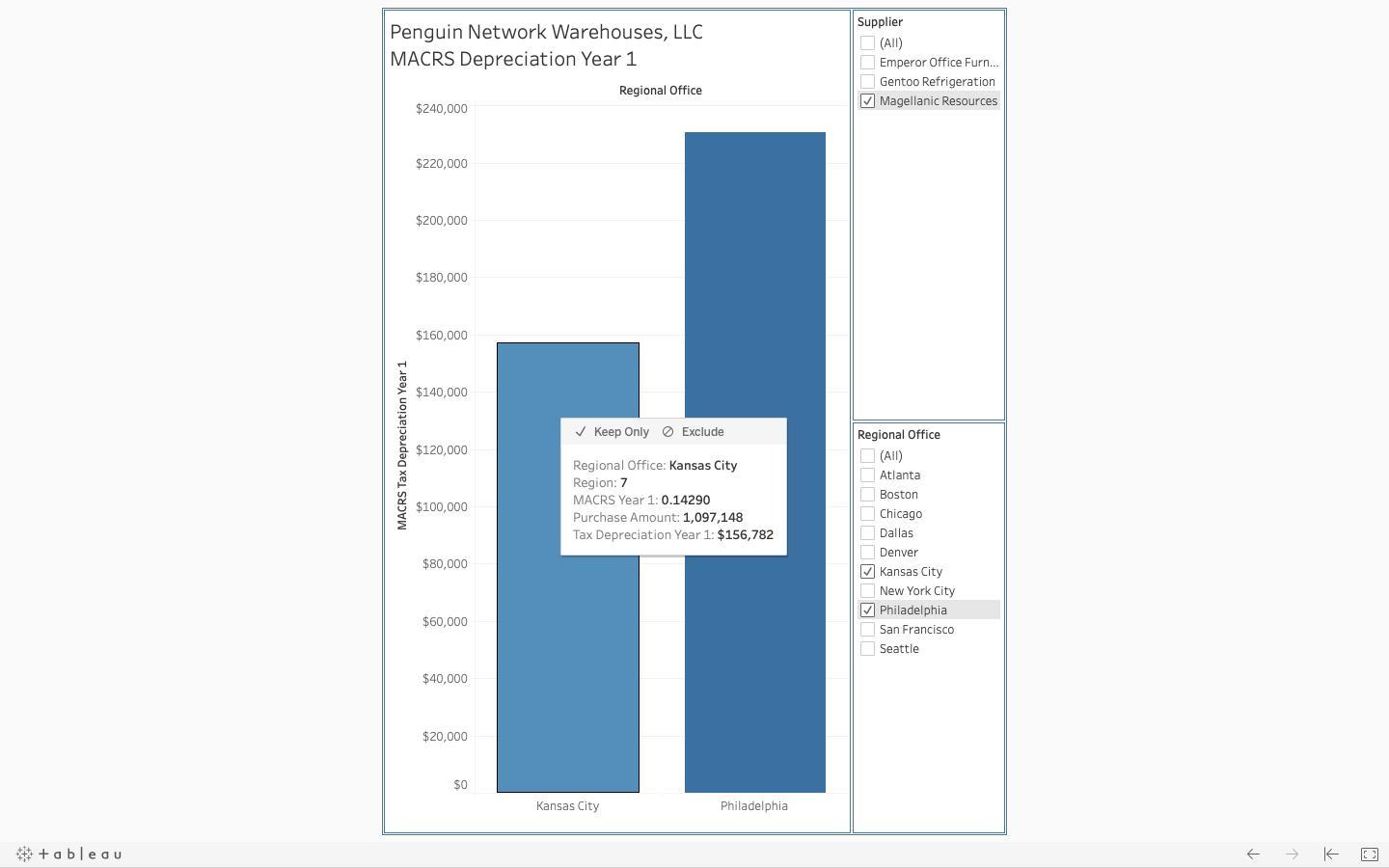

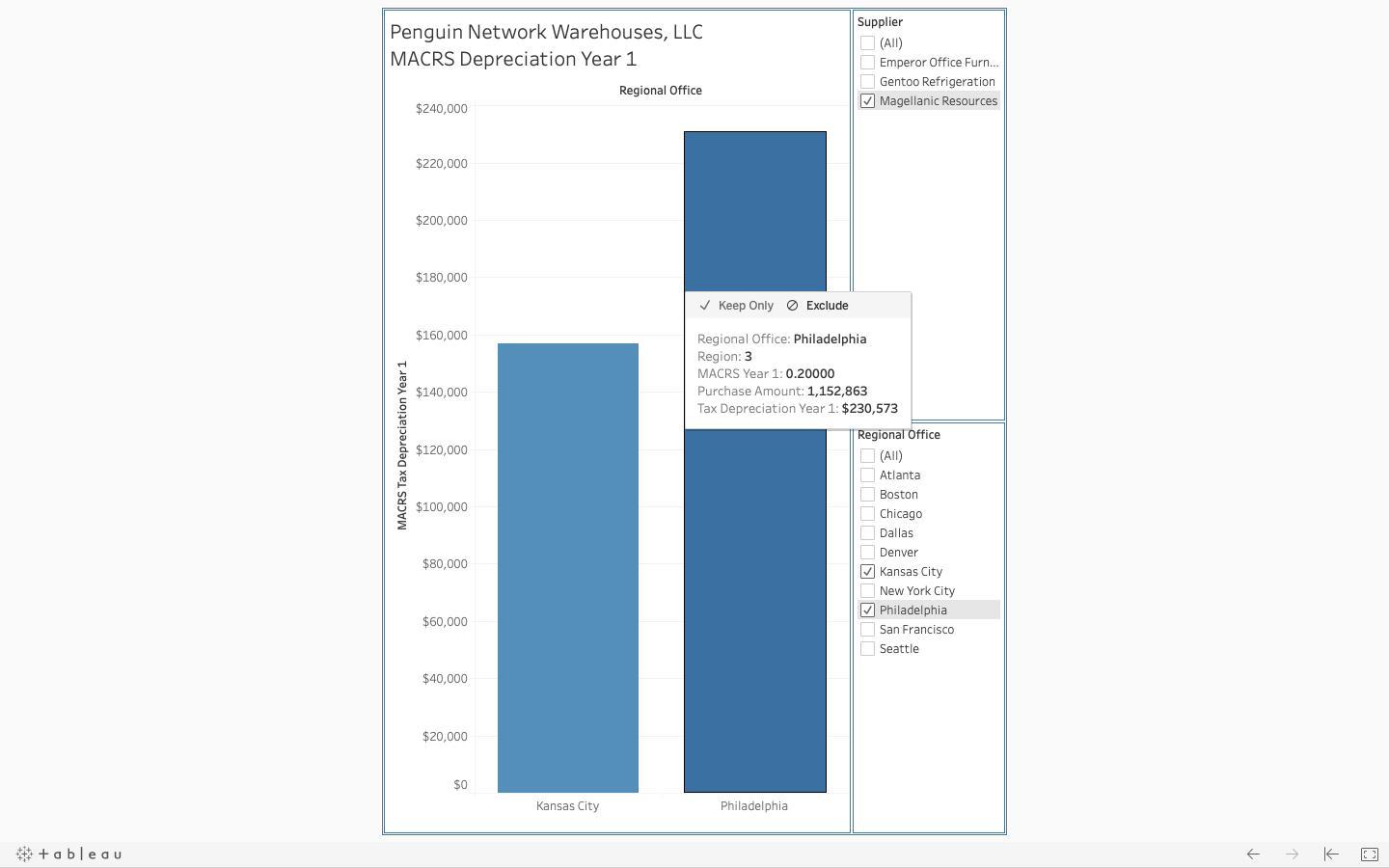

As typical of a start-up business, PNW, LLC expects to generate a current year loss with regular deprecation. As such, PNW, LLC does not elect Section 179 depreciation and elects out of bonus depreciation. PNW, LLC qualifies for the half year convention. Required: 1. How much depreciation is reported by Philadelphia Region 3 on assets purchased from Magellanic Resources? 2. How much depreciation is reported by Kansas City Region 7 on assets purchased from Magellanic Resources? 3. What asset class life was used by Kansas City Region 7 on assets purchased from Magellanic Resources? 4. Did Kansas City Region 7 under or over report depreciation on assets purchased from Magellanic Resources? 5. What is the correct depreciation for Kansas City Region 7 on assets purchased from Magellanic Resources? Complete this question by entering your answers in the tabs below. Req a Reg b Req c Req d Reg e How much depreciation is reported by Philadelphia Region 3 on assets purchased from Magellanic Resources? Depreciation Supplier Penguin Network Warehouses, LLC MACRS Depreciation Year 1 (All) Emperor Office Furn.. Gentoo Refrigeration V Magellanic Resources Regional Office $240,000 $220,000 $200,000 $180,000 $160,000 $140,000 V Keep Only O Exclude Regional Office $120,000 (All) Regional Office: Kansas City Region: 7 MACRS Year 1:0.14290 Atlanta Boston $100,000 Purchase Amount: 1,097,148 Chicago Tax Depreciation Year 1: $156,782 Dallas Denver $80,000 V Kansas City New York City V Philadelphia $60,000 San Francisco Seattle $40,000 $20,000 $0 Kansas City Philadelphia +ableau MACRS Tax Depreciation Year 1 Supplier Penguin Network Warehouses, LLC (All) MACRS Depreciation Year 1 Emperor Office Furn.. Gentoo Refrigeration V Magellanic Resources Regional Office $240,000 $220,000 $200,000 $180,000 V Keep Only O Exclude $160,000 Regional Office: Philadelphia Region: 3 MACRS Year 1:0.20000 Purchase Amount: 1,152,863 Tax Depreciation Year 1: $230,573 $140,000 Regional Office $120,000 (All) Atlanta Boston $100,000 Chicago Dallas Denver $80,000 V Kansas City New York City V Philadelphia $60,000 San Francisco |Seattle $40,000 $20,000 $0 Kansas City Philadelphia * +ableau MACRS Tax Depreciation Year 1

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation is charged on the fixed assets due to their continuous use or due to wear and tear of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started