Answered step by step

Verified Expert Solution

Question

1 Approved Answer

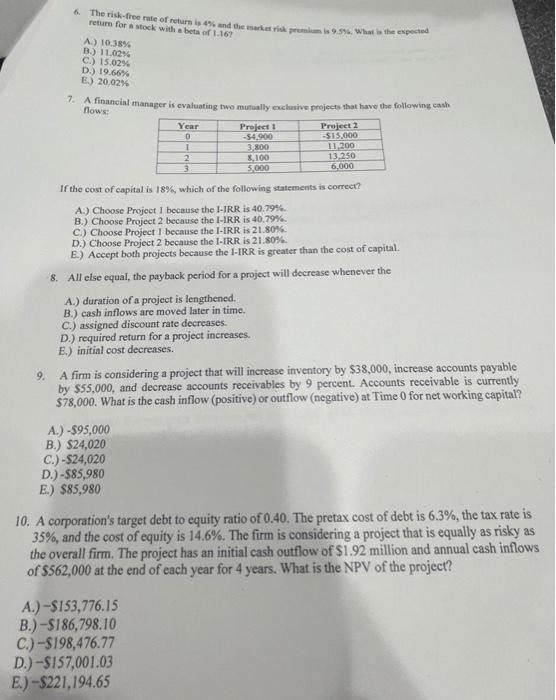

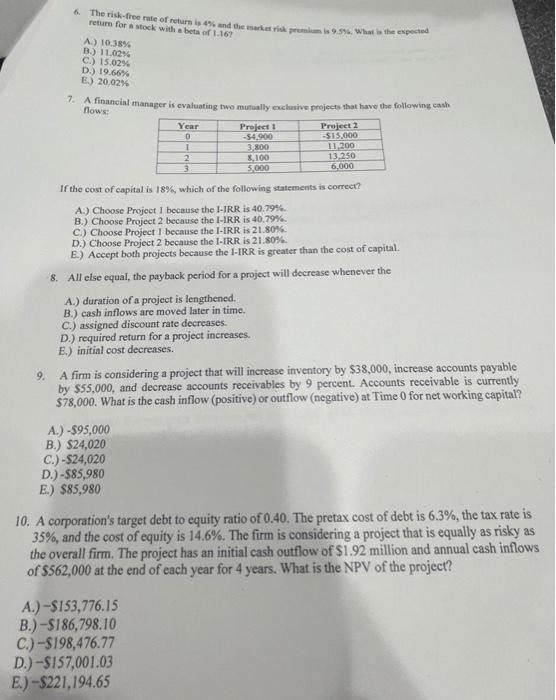

please help me answer this. thank you very much 6. The risk-free rate of return is 4% and the market vick pemilan ba 9.56. What

please help me answer this. thank you very much

6. The risk-free rate of return is 4% and the market vick pemilan ba 9.56. What is the expected return for stock with a bea of 1.167 A.) 10.38% B.) 11.02% C.) 15.02% D.) 19.66% E) 20.02% 1.2. A financial manager is evaluating two muually exclusive projects that have the following cath Year Project Project 2 0 -54.900 -$15.000 1 3.800 11,200 2 8,100 13.250 3 5.000 6,000 If the cost of capital is 18%, which of the following statements is correct? A) Choose Project I because the IRR is 40.79% B.) Choose Project 2 because the I-IRR is 40.79% C.) Choose Project I because the I-IRR is 21.80% D.) Choose Project 2 because the I-IRR is 21.80% E) Accept both projects because the HIRR is greater than the cost of capital. 8. All else equal, the payback period for a project will decrease whenever the A.) duration of a project is lengthened. B.) cash inflows are moved later in time. C.) assigned discount rate decreases. D.) required return for a project increases. E.) initial cost decreases. 9. A firm is considering a project that will increase inventory by $38,000, increase accounts payable by $55.000, and decrease accounts receivables by 9 percent Accounts receivable is currently $78,000. What is the cash inflow (positive) or outflow (negative) at Time 0 for networking capital? A.) -$95,000 B.) $24,020 C.) -24,020 D.) -$85,980 E.) $85,980 10. A corporation's target debt to equity ratio of 0.40. The pretax cost of debt is 6.3%, the tax rate is 35%, and the cost of equity is 14.6%. The firm is considering a project that is equally as risky as the overall firm. The project has an initial cash outflow of $1.92 million and annual cash inflows of $562,000 at the end of each year for 4 years. What is the NPV of the project? A.) -S153,776.15 B.)-$186,798.10 C.) -$198,476.77 D.-$157,001.03 E.) -$221,194.65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started