please help me answer this. thanks

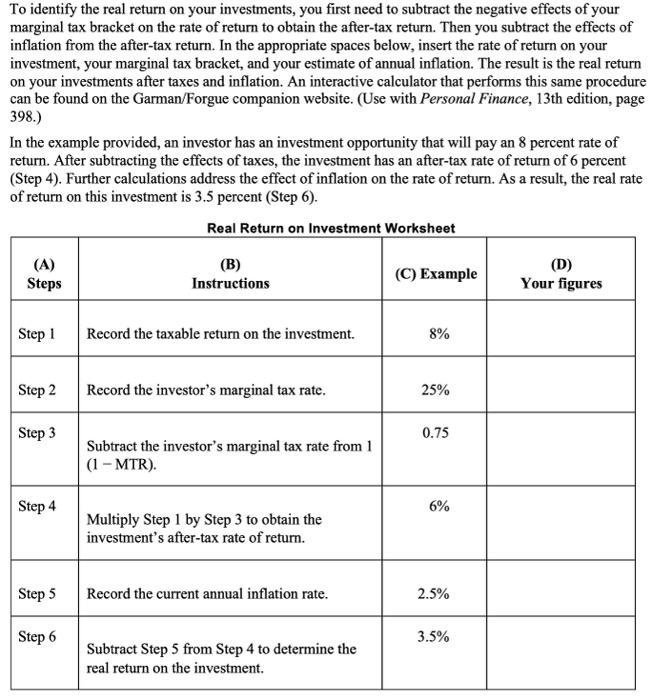

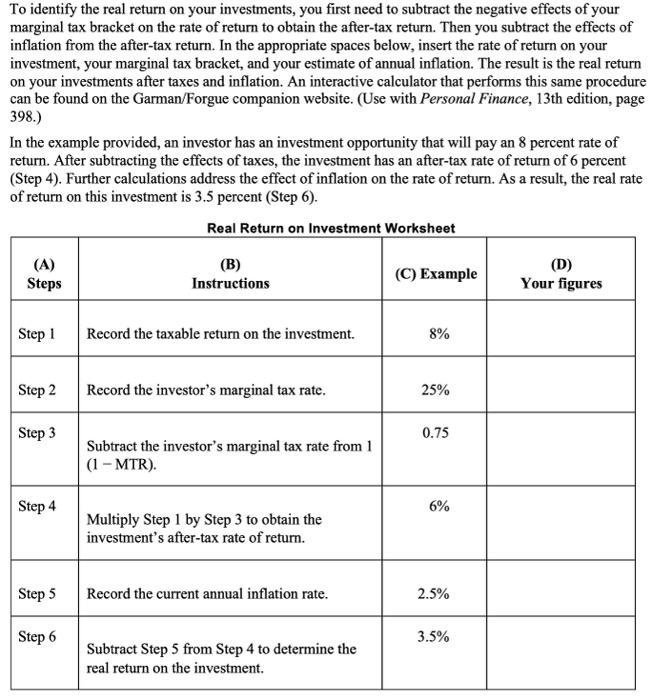

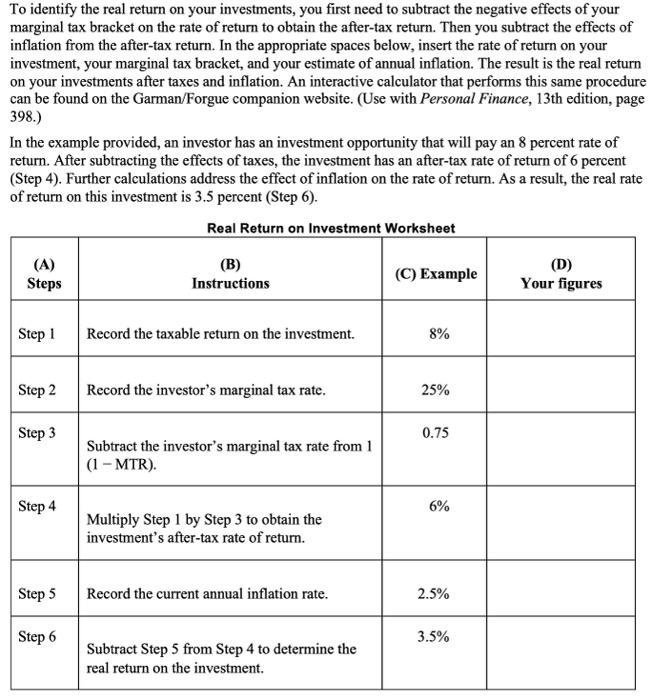

To identify the real return on your investments, you first need to subtract the negative effects of your marginal tax bracket on the rate of return to obtain the after-tax return. Then you subtract the effects of inflation from the after-tax return. In the appropriate spaces below, insert the rate of return on your investment, your marginal tax bracket, and your estimate of annual inflation. The result is the real return on your investments after taxes and inflation. An interactive calculator that performs this same procedure can be found on the Garman/Forgue companion website. (Use with Personal Finance, 13th edition, page 398.) In the example provided, an investor has an investment opportunity that will pay an 8 percent rate of return. After subtracting the effects of taxes, the investment has an after-tax rate of return of 6 percent (Step 4). Further calculations address the effect of inflation on the rate of return. As a result, the real rate of return on this investment is 3.5 percent (Step 6). Real Return on Investment Worksheet (A) Steps (B) Instructions (C) Example (D) Your figures Step 1 Record the taxable return on the investment. 8% Step 2 Record the investor's marginal tax rate. 25% Step 3 0.75 Subtract the investor's marginal tax rate from 1 (1 - MTR). Step 4 6% Multiply Step 1 by Step 3 to obtain the investment's after-tax rate of return. Step 5 Record the current annual inflation rate. 2.5% Step 6 3.5% Subtract Step 5 from Step 4 to determine the real return on the investment. To identify the real return on your investments, you first need to subtract the negative effects of your marginal tax bracket on the rate of return to obtain the after-tax return. Then you subtract the effects of inflation from the after-tax return. In the appropriate spaces below, insert the rate of return on your investment, your marginal tax bracket, and your estimate of annual inflation. The result is the real return on your investments after taxes and inflation. An interactive calculator that performs this same procedure can be found on the Garman/Forgue companion website. (Use with Personal Finance, 13th edition, page 398.) In the example provided, an investor has an investment opportunity that will pay an 8 percent rate of return. After subtracting the effects of taxes, the investment has an after-tax rate of return of 6 percent (Step 4). Further calculations address the effect of inflation on the rate of return. As a result, the real rate of return on this investment is 3.5 percent (Step 6). Real Return on Investment Worksheet (A) Steps (B) Instructions (C) Example (D) Your figures Step 1 Record the taxable return on the investment. 8% Step 2 Record the investor's marginal tax rate. 25% Step 3 0.75 Subtract the investor's marginal tax rate from 1 (1 - MTR). Step 4 6% Multiply Step 1 by Step 3 to obtain the investment's after-tax rate of return. Step 5 Record the current annual inflation rate. 2.5% Step 6 3.5% Subtract Step 5 from Step 4 to determine the real return on the investment