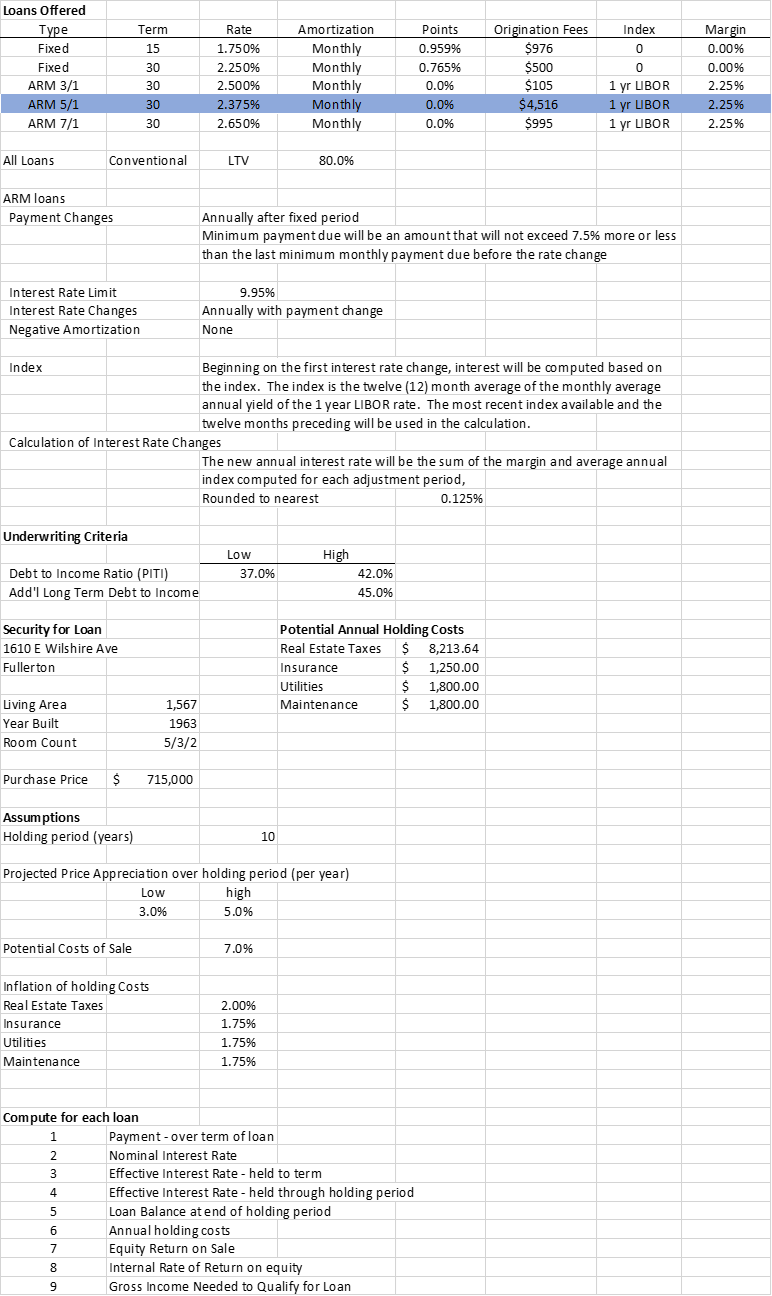

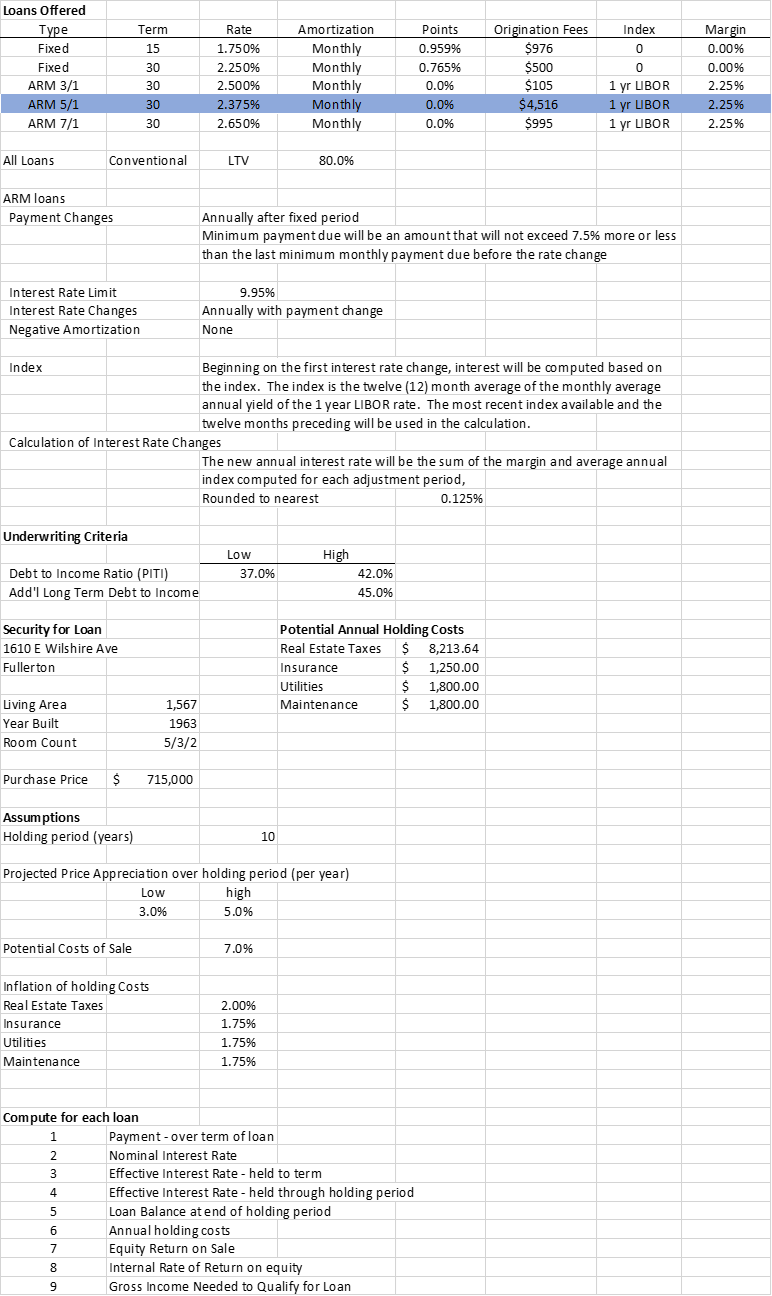

Please help me calculate these 9 calculations for the 5/1 ARM Loan only.

Index Loans Offered Type Fixed Fixed ARM 3/1 ARM 5/1 ARM 7/1 Term 15 30 30 30 30 Rate 1.750% 2.250% 2.50 0% 2.375% 2.650% Amortization Monthly Monthly Monthly Monthly Monthly Points 0.959% 0.765% 0.0% 0.0% 0.0% Origination Fees $976 $500 $105 $4,516 $995 0 0 1 yr LIBOR 1 yr LIBOR 1 yr LIBOR Margin 0.00% 0.00% 2.25% 2.25% 2.25% All Loans Conventional LTV 80.0% ARM loans Payment Changes Annually after fixed period Minimum payment due will be an amount that will not exceed 7.5% more or less than the last minimum monthly payment due before the rate change Interest Rate Limit Interest Rate Changes Negative Amortization 9.95% Annually with payment change None Index Beginning on the first interest rate change, interest will be computed based on the index. The index is the twelve (12) month average of the monthly average annual yield of the 1 year LIBOR rate. The most recent index available and the twelve months preceding will be used in the calculation. Calculation of Interest Rate Changes The new annual interest rate will be the sum of the margin and average annual index computed for each adjustment period, Rounded to nearest 0.125% Underwriting Criteria High Low 37.09 Debt to Income Ratio (PITI) Add'l Long Term Debt to Income 42.0% 45.0% Security for Loan 1610 E Wilshire Ave Fullerton Potential Annual Holding Costs Real Estate Taxes $ 8,213.64 Insurance $ 1,250.00 Utilities S 1,800.00 Maintenance S 1,800.00 Living Area Year Built Room Count 1,567 1963 5/3/2 Purchase Price $ 715,000 Assumptions Holding period (years) 10 year) Projected Price Appreciation over holding period Low high 3.0% 5.0% Potential Costs of Sale 7.0% Inflation of holding Costs Real Estate Taxes Insurance Utilities Maintenance 2.00% 1.75% 1.75% 1.75% Compute for each loan 1 Payment - over term of loan 2 Nominal Interest Rate 3 Effective Interest Rate - held to term 4 Effective Interest Rate - held through holding period 5 Loan Balance at end of holding period 6 Annual holding costs 7 Equity Return on Sale 8 Internal Rate of Return on equity 9 Gross Income Needed to Qualify for Loan Index Loans Offered Type Fixed Fixed ARM 3/1 ARM 5/1 ARM 7/1 Term 15 30 30 30 30 Rate 1.750% 2.250% 2.50 0% 2.375% 2.650% Amortization Monthly Monthly Monthly Monthly Monthly Points 0.959% 0.765% 0.0% 0.0% 0.0% Origination Fees $976 $500 $105 $4,516 $995 0 0 1 yr LIBOR 1 yr LIBOR 1 yr LIBOR Margin 0.00% 0.00% 2.25% 2.25% 2.25% All Loans Conventional LTV 80.0% ARM loans Payment Changes Annually after fixed period Minimum payment due will be an amount that will not exceed 7.5% more or less than the last minimum monthly payment due before the rate change Interest Rate Limit Interest Rate Changes Negative Amortization 9.95% Annually with payment change None Index Beginning on the first interest rate change, interest will be computed based on the index. The index is the twelve (12) month average of the monthly average annual yield of the 1 year LIBOR rate. The most recent index available and the twelve months preceding will be used in the calculation. Calculation of Interest Rate Changes The new annual interest rate will be the sum of the margin and average annual index computed for each adjustment period, Rounded to nearest 0.125% Underwriting Criteria High Low 37.09 Debt to Income Ratio (PITI) Add'l Long Term Debt to Income 42.0% 45.0% Security for Loan 1610 E Wilshire Ave Fullerton Potential Annual Holding Costs Real Estate Taxes $ 8,213.64 Insurance $ 1,250.00 Utilities S 1,800.00 Maintenance S 1,800.00 Living Area Year Built Room Count 1,567 1963 5/3/2 Purchase Price $ 715,000 Assumptions Holding period (years) 10 year) Projected Price Appreciation over holding period Low high 3.0% 5.0% Potential Costs of Sale 7.0% Inflation of holding Costs Real Estate Taxes Insurance Utilities Maintenance 2.00% 1.75% 1.75% 1.75% Compute for each loan 1 Payment - over term of loan 2 Nominal Interest Rate 3 Effective Interest Rate - held to term 4 Effective Interest Rate - held through holding period 5 Loan Balance at end of holding period 6 Annual holding costs 7 Equity Return on Sale 8 Internal Rate of Return on equity 9 Gross Income Needed to Qualify for Loan