Please help me calculate these for BURL. Thank you!

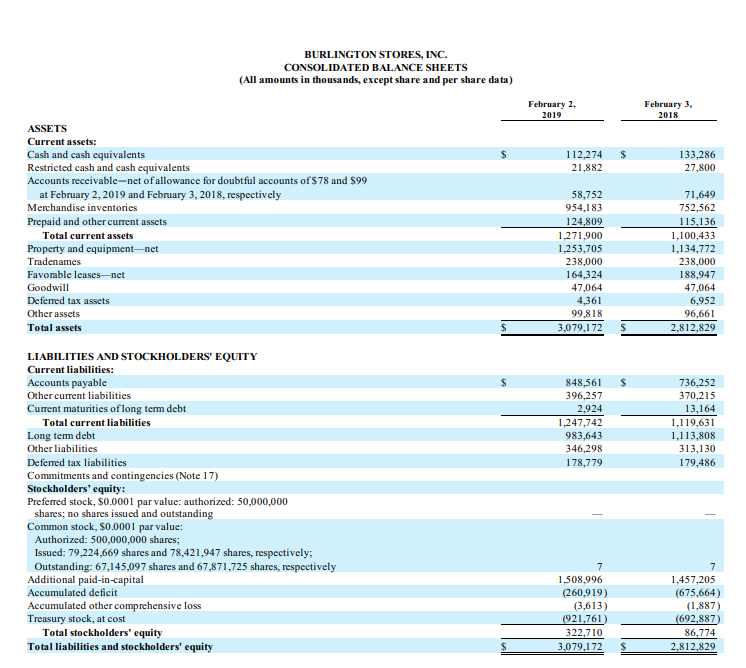

- Working capital

- Current ratio

- Quick ratio

- Accounts receivable turnover (assume all sales are credit sales)

- Average days to collect receivables

- Inventory turnover

- Average days to sell inventory

While BURL provides the balance of their Allowance for Doubtful Accounts, DDS does not. To facilitate comparison calculate this measure using the net realizable value of Accounts Receivable instead of the gross amount of Accounts Receivable.

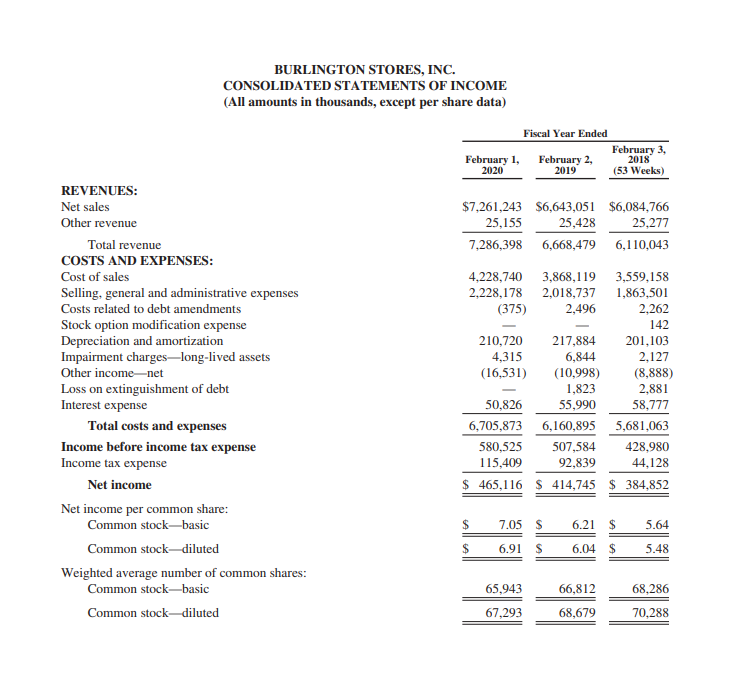

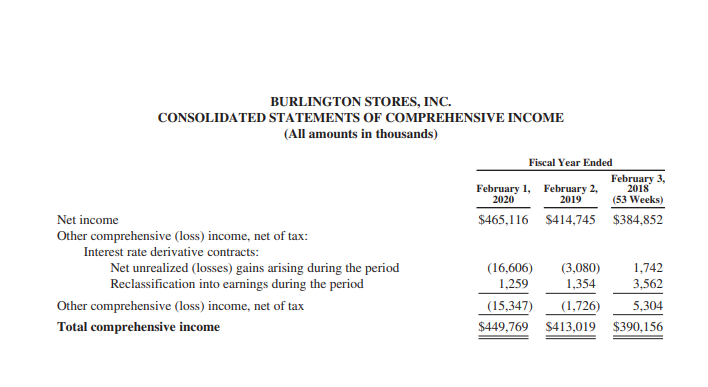

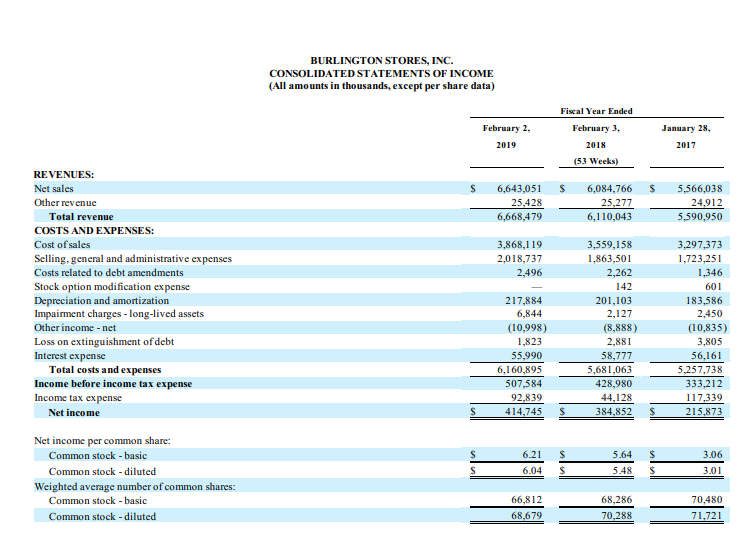

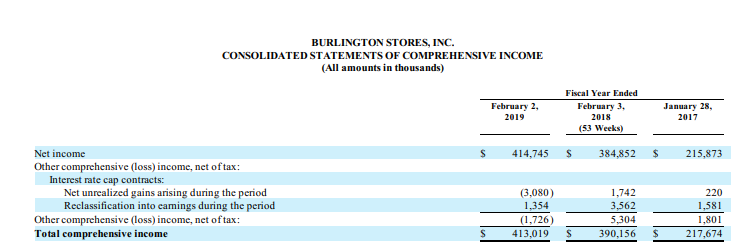

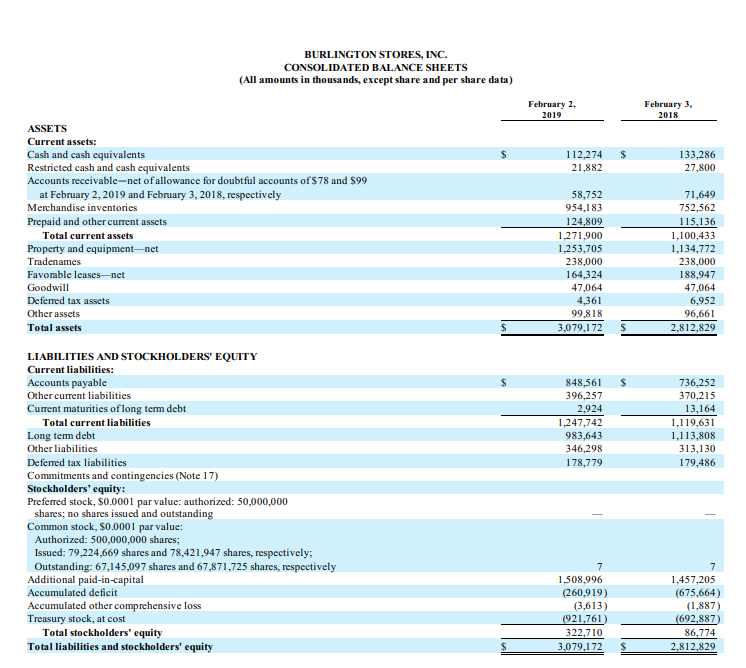

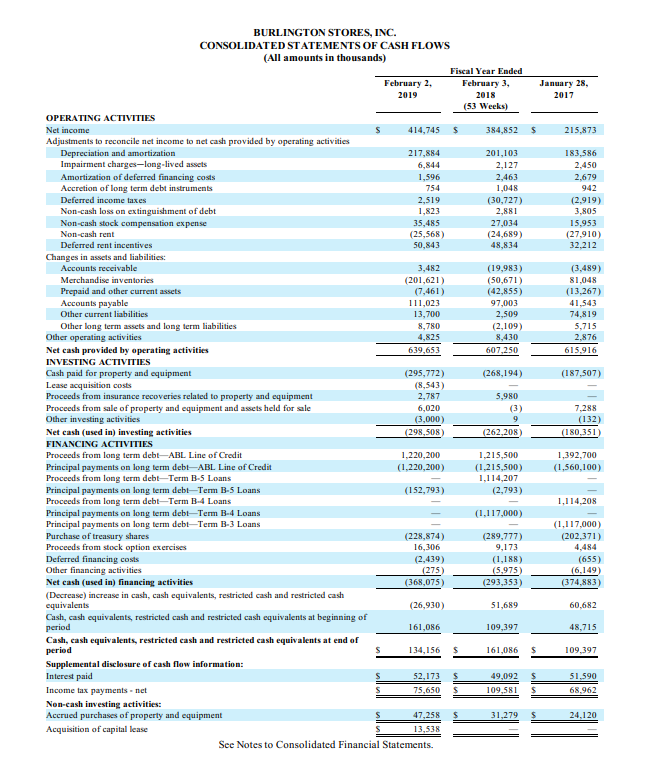

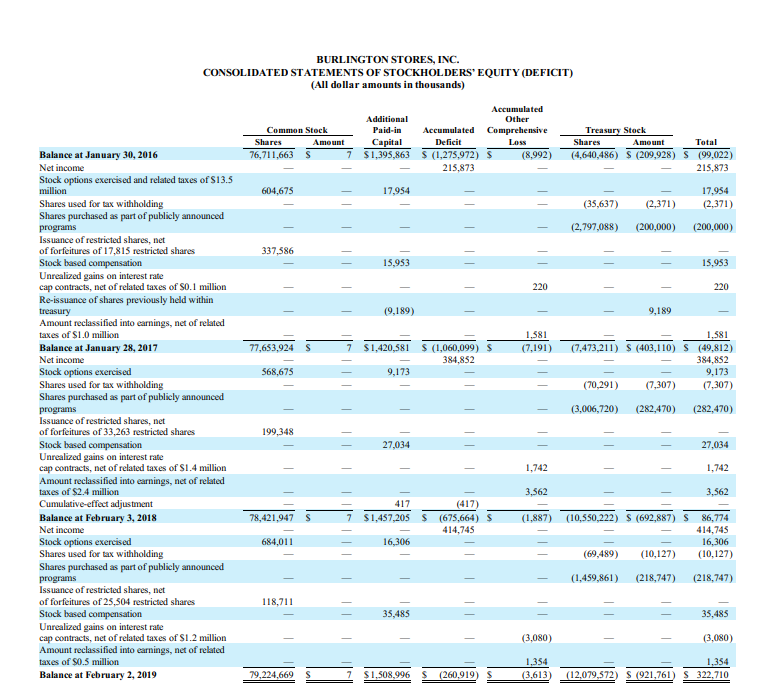

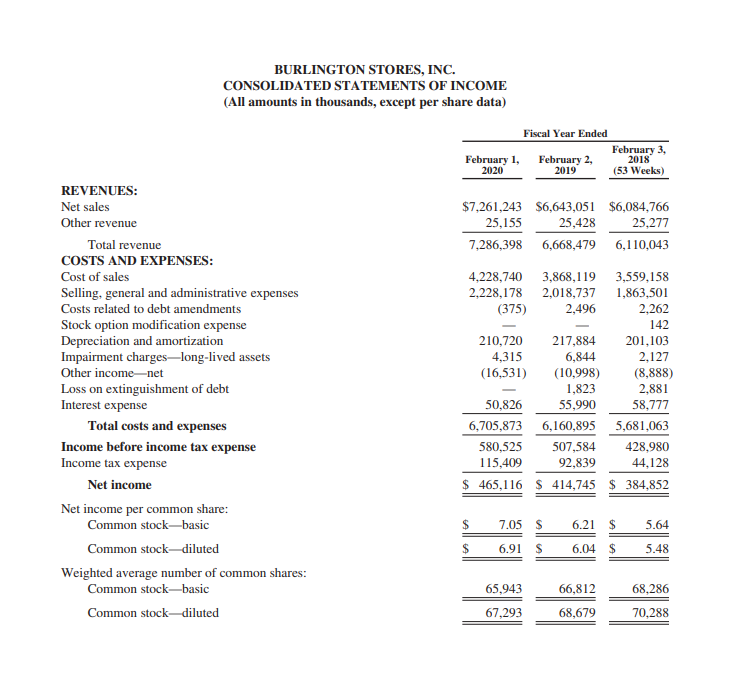

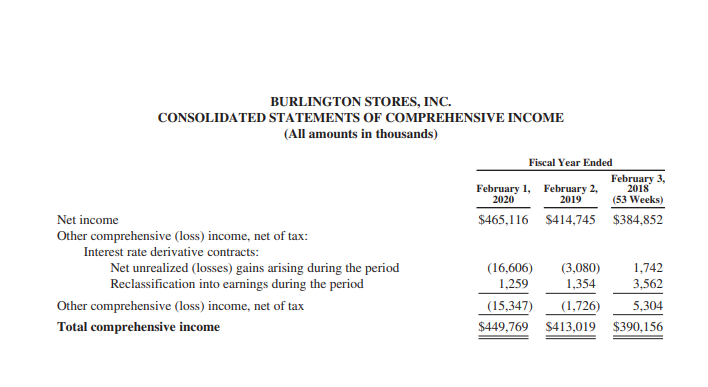

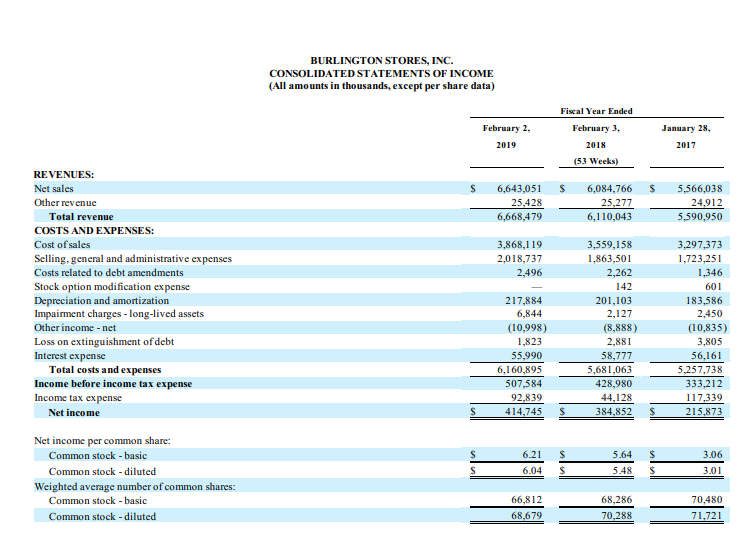

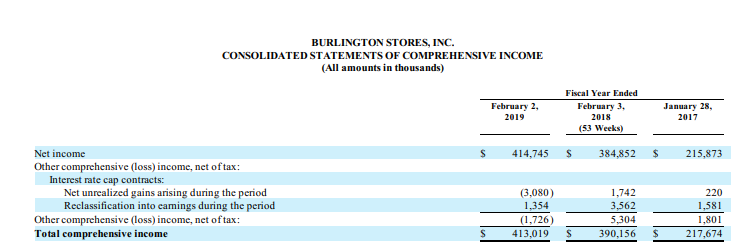

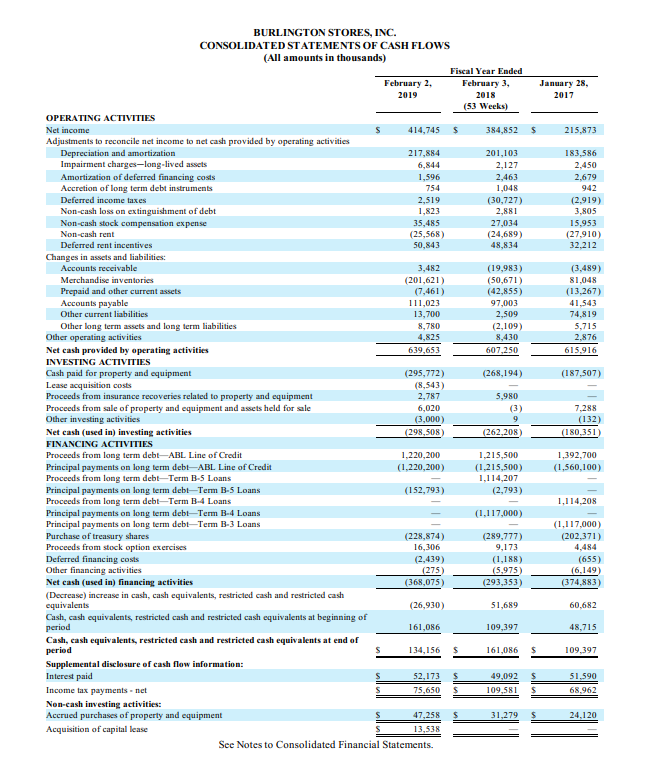

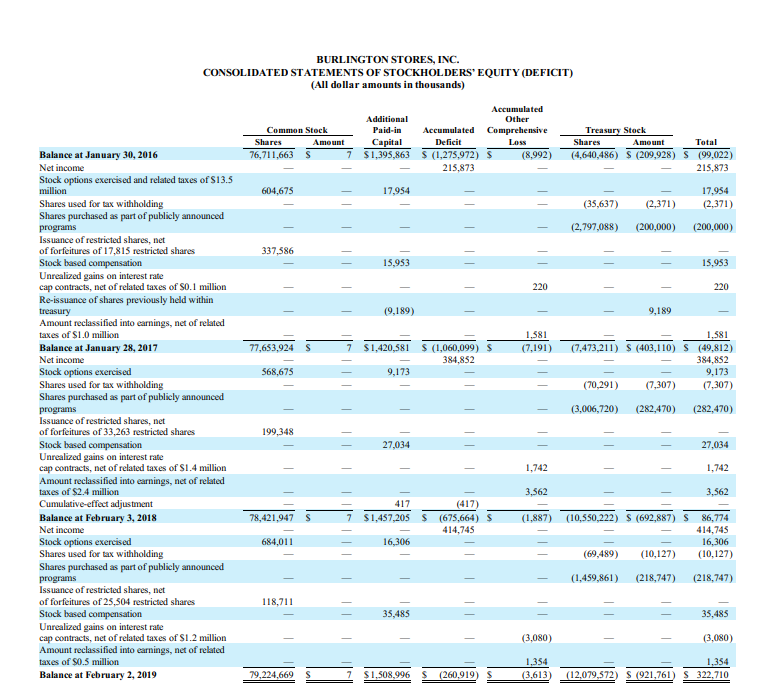

BURLINGTON STORES, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (All amounts in thousands) Fiscal Year Ended February 3, February 1, February 2, 2018 2020 2019 (53 Weeks) $465,116 $414,745 $384.852 Net income Other comprehensive (loss) income, net of tax: Interest rate derivative contracts: Net unrealized (losses) gains arising during the period Reclassification into earnings during the period Other comprehensive (loss) income, net of tax Total comprehensive income (16,606) (3,080) 1,742 1,259 1,354 3,562 (15,347) (1,726) 5,304 $449,769 $413,019 $390,156 BURLINGTON STORES, INC. CONSOLIDATED STATEMENTS OF INCOME (All amounts in thousands, except per share data) February 2, 2019 Fiscal Year Ended February 3, 2018 (53 Weeks) January 28, 2017 s $ 6,643,051 25,428 6,668,479 6,084,766 25,277 6,110,043 5,566,038 24,912 5,590,950 3,868,119 2,018,737 2,496 REVENUES: Net sales Other revenue Total revenue COSTS AND EXPENSES: Cost of sales Selling, general and administrative expenses Costs related to debt amendments Stock option modification expense Depreciation and amortization Impairment charges-long-lived assets Other income - net Loss on extinguishment of debt Interest expense Total costs and expenses Income before income tax expense Income tax expense Net income 217,884 6,844 (10,998) 1,823 55,990 6,160,895 507,584 92.839 414,745 3,559,158 1,863,501 2,262 142 201,103 2,127 (8,888) 2,881 58,777 5,681,063 428,980 44,128 384,852 3,297,373 1,723.251 1,346 601 183,586 2,450 (10,835) 3,805 56,161 5.257,738 333,212 117,339 215,873 S $ $ 3.06 S s 6.21 6.04 $ $ 5.64 5.48 $ $ 3.01 Net income per common share: Common stock - basic Common stock - diluted Weighted average number of common shares: Common stock - basic Common stock - diluted 66,812 68,679 68,286 70,288 70,480 71,721 BURLINGTON STORES, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (All amounts in thousands) February 2, 2019 Fiscal Year Ended February 3, 2018 (53 Weeks) January 28, 2017 414,745 s 384,852 $ 215,873 Net income Other comprehensive (Loss) income, net oftax: Interest rate cap contracts: Net unrealized gains arising during the period Reclassification into camings during the period Other comprehensive (Loss) income, net of tax: Total comprehensive income (3,080) 1,354 (1,726) 413,019 1,742 3,562 5,304 390,156 220 1,581 1,801 217,674 BURLINGTON STORES, INC. CONSOLIDATED BALANCE SHEETS (All amounts in thousands, except share and per share data) February 2. 2019 February 3, 2018 $ 112,274 21,882 133,286 27,800 ASSETS Current assets: Cash and cash equivalents Restricted cash and cash equivalents Accounts receivable-net of allowance for doubtful accounts of $78 and 999 at February 2, 2019 and February 3, 2018, respectively Merchandise inventories Prepaid and other current assets Total current assets Property and equipment-net Tradenames Favorable leases net Goodwill Deferred tax assets Other assets Total assets 58,752 954,183 124,809 1,271,900 1,253,705 238,000 164,324 47,064 4,361 99,818 3,079,172 71,649 752,562 115,136 1,100,433 1,134,772 238,000 188,947 47,064 6,952 96,661 2,812,829 $ 848,561 396,257 2,924 1,247,742 983,643 346,298 178,779 736,252 370,215 13,164 1,119,631 1,113,808 313,130 179,486 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Other current liabilities Current maturities of long term debt Total current liabilities Long term debt Other liabilities Deferred tax liabilities Commitments and contingencies (Note 17) Stockholders' equity: Preferred stock, $0.0001 par value: authorized: 50,000,000 shares; no shares issued and outstanding Common stock, $0.0001 par value: Authorized: 500,000,000 shares; Issued: 79,224,669 shares and 78,421,947 shares, respectively; Outstanding: 67,145,097 shares and 67,871,725 shares, respectively Additional paid-in-capital Accumulated deficit Accumulated other comprehensive loss Treasury stock, at cost Total stockholders' equity Total liabilities and stockholders' equity 7 1,508,996 (260,919) (3,613) (921,761) 322,710 3,079,172 7 1,457,205 (675,664) (1,887) (692.887) 86,774 2,812.829 January 28, 2017 $ 215,873 183,586 2,450 2,679 942 (2.919) 3.805 15,953 (27,910) 32,212 (3,489) 81,048 (13,267) 41,543 74,819 5,715 2,876 615,916 (187,507) BURLINGTON STORES, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (All amounts in thousands) Fiscal Year Ended February 2 February 3, 2019 2018 (53 Weeks) OPERATING ACTIVITIES Net income 414,745 384,852 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 217,884 201,103 Impairment charges-long-lived assets 6,844 2,127 Amortization of deferred financing costs 1,596 2,463 Accretion of long term debt instruments 754 1,048 Deferred income taxes 2,519 (30,727) Non-cash loss on extinguishment of debt 1,823 2,881 Non-cash stock compensation expense 35,485 27,034 Non-cash rent (25,568) (24,689) Deferred rent incentives 50,843 48,834 Changes in assets and liabilities: Accounts receivable 3,482 (19,983) Merchandise inventories (201,621) (50,671) Prepaid and other current assets (7,461) (42,855) Accounts payable 111,023 97,003 Other current liabilities 13,700 2,509 Other long term assets and long term liabilities 8,780 (2,109) Other operating activities 4,825 8,430 Net cash provided by operating activities 639,653 607,250 INVESTING ACTIVITIES Cash paid for property and equipment (295,772) (268,194) Lease acquisition costs (8,543) Proceeds from insurance recoveries related to property and equipment 2,787 5,980 Proceeds from sale of property and equipment and assets held for sale 6,020 (3) Other investing activities (3.000) Net cash (used in) investing activities (298,508 (262,208) FINANCING ACTIVITIES Proceeds from long term debt-ABL Line of Credit 1,220,200 1,215,500 Principal payments on long term debt-ABL Line of Credit (1,220,200) (1,215,500) Proceeds from long term debt-Term B-5 Loans 1,114,207 Principal payments on long term debt-Term B-5 Loans (152,793) (2,793) Proceeds from long term debt-Term B-4 Loans Principal payments on long term debt-Term 3-4 Loans (1,117,000) Principal payments on long term debt-Term B-3 Loans Purchase of treasury shares (228,874) (289,777) Proceeds from stock option exercises 16,306 9,173 Deferred financing costs (2,439) (1,188) Other financing activities (275) (5,975) Net cash (used in) financing activities (368,075) (293,353) (Decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents (26,930) 51,689 Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period 161,086 109,397 Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period 134,156 161,086 Supplemental disclosure of cash flow information: Interest paid s 52,173 $ 49,092 Income tax payments - net 75,650 $ 109,581 Non-cash investing activities: Accrued purchases of property and equipment S 47.258 31,279 Acquisition of capital lease 13,538 See Notes to Consolidated Financial Statements. 7.288 (132) (180,351 1,392,700 (1,560,100) 1,114,208 (1.117.000) (202,371) 4,484 (655) (6.149) (374,883 60.682 48,715 $ 109,397 $ $ 51,590 68,962 S 24,120 BURLINGTON STORES, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) (All dollar amounts in thousands) Common Stock Shares Amount 76,711,663 Accumulated Additional Other Paid-in Accumulated Comprehensive Capital Deficit Loss $1,395,863 $ (1,275,972) S (8.992) 215.873 Treasury Stock Shares Amount Total (4,640,486) S (209,928) S (99,022 215,873 604,675 17,954 17,954 (2,371) (35,637) (2,371) (2,797,088) (200,000) (200,000) 337,586 15,953 15,953 - 220 220 (9,189) 9,189 77,653,924 7 $1,420,581 1.581 (7.191) $ (1,060,099) S 384,852 1,581 (7,473,211) $ (403,110) S (49,812) 384,852 9,173 (70,291) (7,307) (7,307) 568,675 9,173 Balance at January 30, 2016 Net income Stock options exercised and related taxes of $13.5 million Shares used for tax withholding Shares purchased as part of publicly announced programs Issuance of restricted shares, net of forfeitures of 17,815 restricted shares Stock based compensation Unrealized gains on interest rate cap contracts, net of related taxes of S0.1 million Re-issuance of shares previously held within treasury Amount reclassified into earnings, net of related taxes of $1.0 million Balance at January 28, 2017 Net income Stock options exercised Shares used for tax withholding Shares purchased as part of publicly announced programs Issuance of restricted shares, net of forfeitures of 33,263 restricted shares Stock based compensation Unrealized gains on interest rate cap contracts, net of related taxes of $1.4 million Amount reclassified into earnings, net of related taxes of $2.4 million Cumulative effect adjustment Balance at February 3, 2018 Net income Stock options exercised Shares used for tax withholding Shares purchased as part of publicly announced programs Issuance of restricted shares, net of forfeitures of 25.504 restricted shares Stock based compensation Unrealized gains on interest rate cap contracts, net of related taxes of SI.2 million Amount reclassified into earnings, net of related taxes of $0.5 million Balance at February 2, 2019 ITIL SILI (3,006,720) (282,470) (282,470) 199,348 27,034 27,034 1.742 1,742 3,562 3,562 417 $ 1,457,205 $ 78,421,947 (417) (675,664) $ 414,745 (1.887) (10,550,222) $ (692,887) S 86,774 414,745 16,306 (69,489) (10,127) (10,127) 684,011 III 16,306 (1,459,861) (218,747) (218,747) 1 118,711 35,485 35,485 (3,080) (3.080) 1,354 (3,613) 1.354 322,710 79,224,669 $1.508,996 (260,919) (12.079,572) S (921,761)