Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me complete form 1 1 2 0 Schedule C based the below information. Please get the Form 1 1 2 0 Schedule C

Please help me complete form Schedule C based the below information. Please get the Form Schedule C from IRS website.

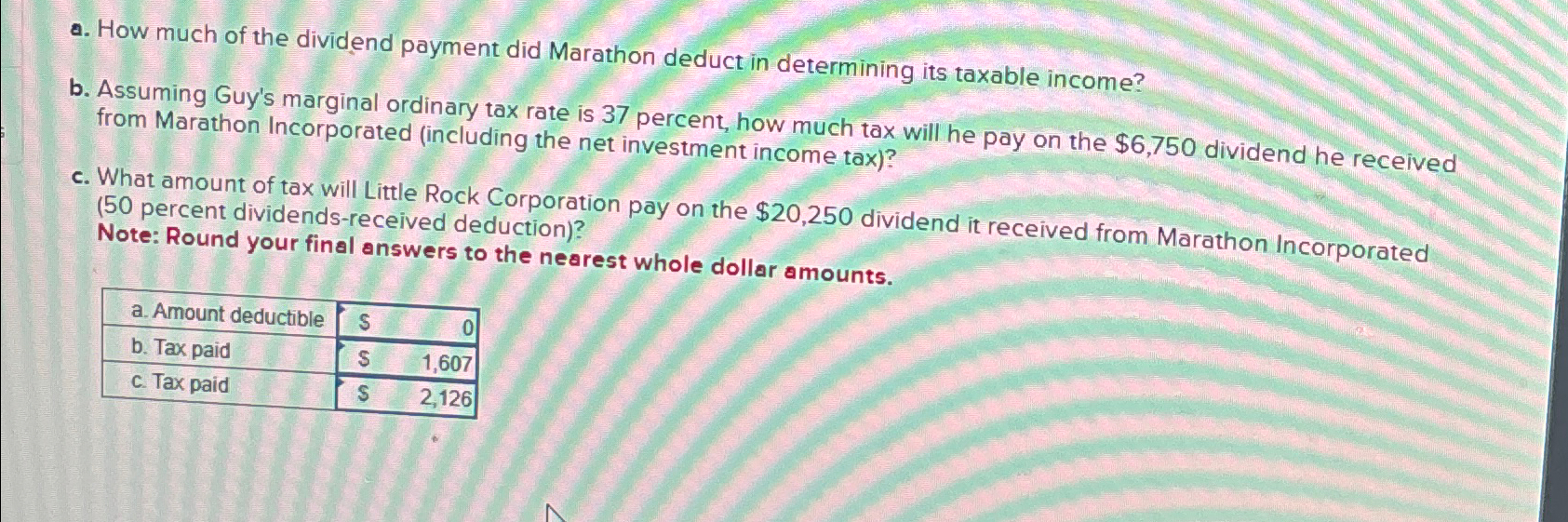

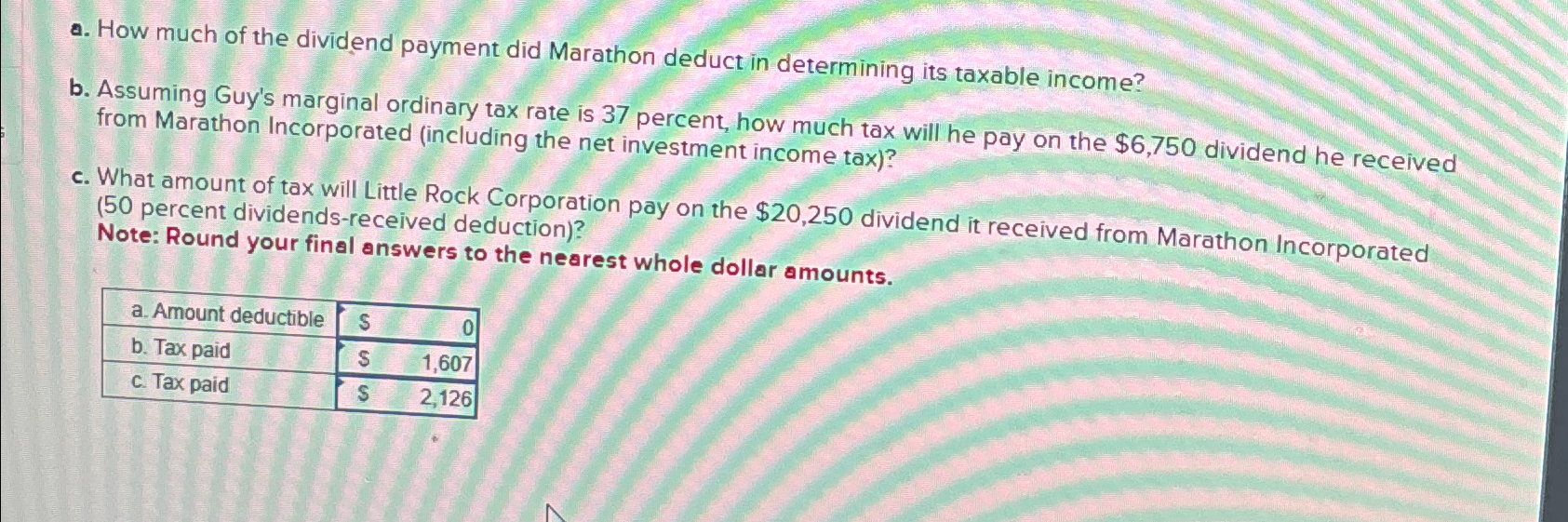

a How much of the dividend payment did Marathon deduct in determining its taxable income?

b Assuming Guy's marginal ordinary tax rate is percent, how much tax will he pay on the $ dividend he received from Marathon Incorporated including the net investment income tax

c What amount of tax will Little Rock Corporation pay on the $ dividend it received from Marathon Incorporated percent dividendsreceived deduction

Note: Round your final answers to the nearest whole dollar amounts.

tablea Amount deductible,Sb Tax paid,Sc Tax paid,$

Required information

The following information applies to the questions displayed below.

Marathon Incorporated a C corporation reported $ of taxable income in the current year. During the year, it distributed $ as dividends to its shareholders as follows:

$ to Guy, a percent individual shareholder.

$ to Little Rock Corporation, a percent shareholder C corporation

$ to other shareholders.

Note: Leave no answer blank. Enter zero if applicable.

d Complete Form Schedule C for Little Rock Corporation to reflect its dividendsreceived deduction use the most recent Form Schedule available

Note: Use the tax rules regardless of the year on the form.

Note: Visit the IRS website and download Form Schedule C Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started