Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me complete the necessary consolidated journal entries and create a consolidated worksheet for the following information: On 1/1/Y1, the Parent paid $1,200,000 cash

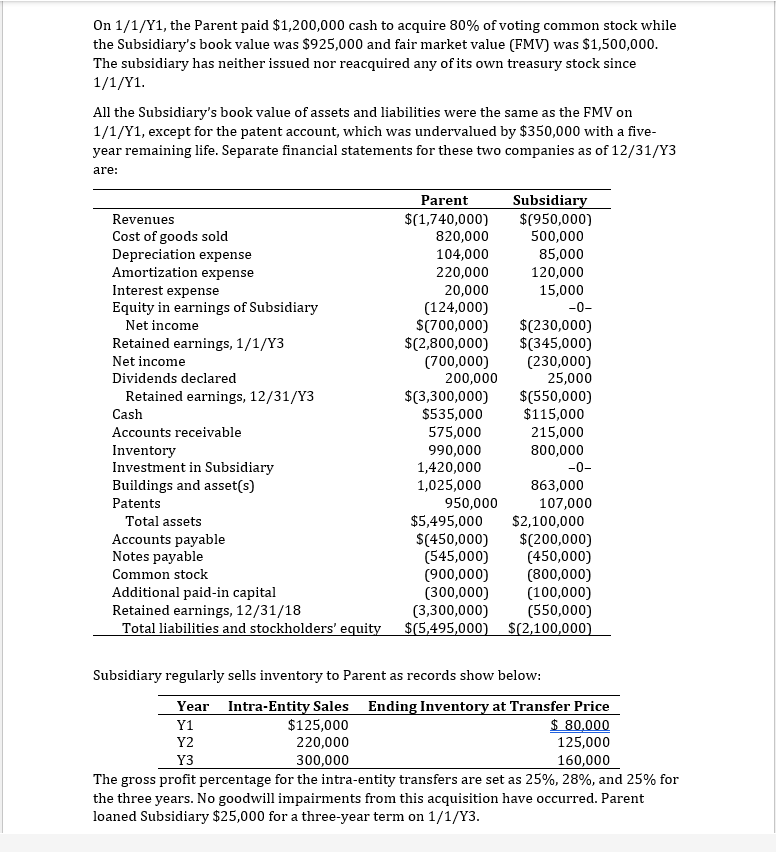

Please help me complete the necessary consolidated journal entries and create a consolidated worksheet for the following information:

On 1/1/Y1, the Parent paid $1,200,000 cash to acquire 80% of voting common stock while the Subsidiary's book value was $925,000 and fair market value (FMV) was $1,500,000. The subsidiary has neither issued nor reacquired any of its own treasury stock since 1/1/Y1 All the Subsidiary's book value of assets and liabilities were the same as the FMV on 1/1/Y1, except for the patent account, which was undervalued by $350,000 with a fiveyear remaining life. Separate financial statements for these two companies as of 12/31/Y3 are: Subsidiary regularly sells inventory to Parent as records show below: The gross profit percentage for the intra-entity transfers are set as 25%,28%, and 25% for the three years. No goodwill impairments from this acquisition have occurred. Parent loaned Subsidiary $25,000 for a three-year term on 1/1/Y3. On 1/1/Y1, the Parent paid $1,200,000 cash to acquire 80% of voting common stock while the Subsidiary's book value was $925,000 and fair market value (FMV) was $1,500,000. The subsidiary has neither issued nor reacquired any of its own treasury stock since 1/1/Y1 All the Subsidiary's book value of assets and liabilities were the same as the FMV on 1/1/Y1, except for the patent account, which was undervalued by $350,000 with a fiveyear remaining life. Separate financial statements for these two companies as of 12/31/Y3 are: Subsidiary regularly sells inventory to Parent as records show below: The gross profit percentage for the intra-entity transfers are set as 25%,28%, and 25% for the three years. No goodwill impairments from this acquisition have occurred. Parent loaned Subsidiary $25,000 for a three-year term on 1/1/Y3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started