please help me complete these accounting questions ASAP

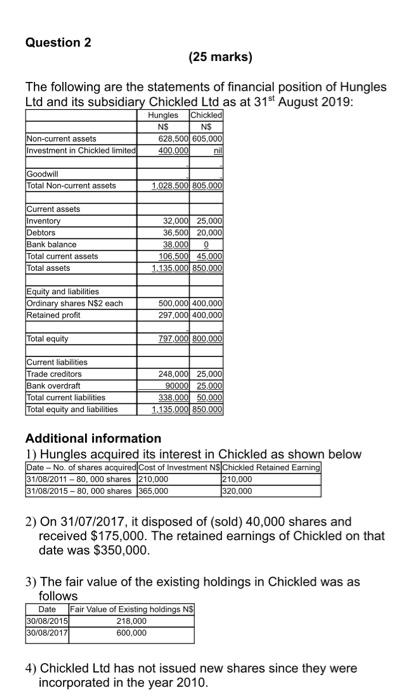

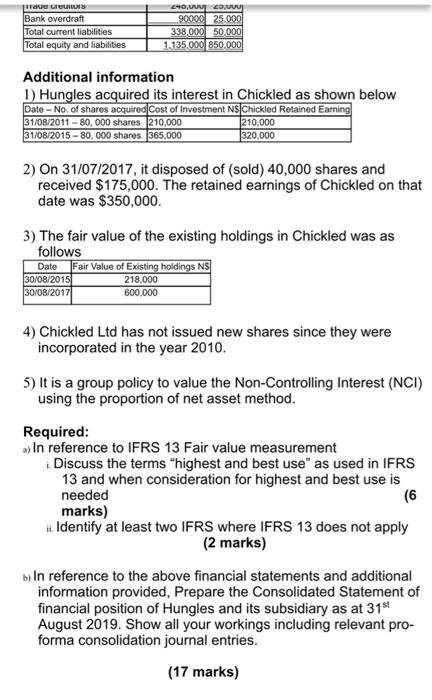

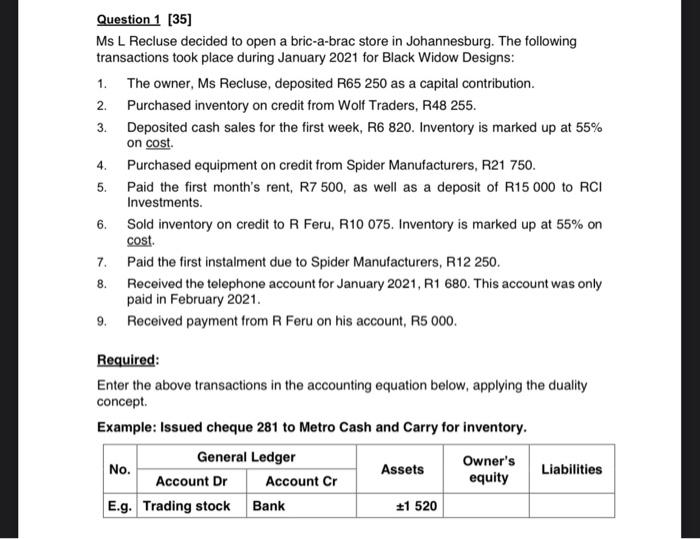

Question 2 (25 marks) The following are the statements of financial position of Hungles Ltd and its subsidiary Chickled Ltd as at 31st August 2019: Hungles Chickled NS NS 628,500 605,000 400.000 nil Non-current assets Investment in Chickled limited Goodwill Total Non-current assets 1,028.500 805.000 Current assets Inventory Debtors Bank balance Total current assets Total assets 32,000 25,000 36,500 20,000 38,000 O 106,500 45,000 1.135.000 850.000 Equity and liabilities Ordinary shares N$2 each Retained profit 500,000 400,000 297.000 400.000 Total equity 797.000 800.000 Current liabilities Trade creditors Bank overdraft Total current liabilities Total equity and liabilities 248,000 25,000 90000 25.000 338,000 50.000 1.135,000 850.000 Additional information 1) Hungles acquired its interest in Chickled as shown below Date -- No. of shares acquired Cost of Investment NS Chickled Retained Earning 31/08/2011 - 80,000 shares 210,000 210.000 31/08/2015 -80,000 shares 365,000 320,000 2) On 31/07/2017, it disposed of (sold) 40,000 shares and received $175,000. The retained earnings of Chickled on that date was $350,000 3) The fair value of the existing holdings in Chickled was as follows Date Fair Value of Existing holdings NS 30/08/2015 218,000 30/08/2017 600,000 4) Chickled Ltd has not issued new shares since they were incorporated in the year 2010. aut Bank overdraft Total current liabilities Total equity and liabilities 240V COUT 90000 25.000 338.000 50.000 1.135.000 850.000 Additional information 1) Hungles acquired its interest in Chickled as shown below Date - No. of shares acquired Cost of Investment N$ Chickled Retained Earning 31/08/2011 - 80, 000 shares 210,000 210.000 31/08/2015 - 80,000 shares (365,000 320,000 2) On 31/07/2017, it disposed of (sold) 40,000 shares and received $175,000. The retained earnings of Chickled on that date was $350,000 3) The fair value of the existing holdings in Chickled was as follows Date Fair Value of Existing holdings NS 30/08/2015 218,000 30/08/2017 600,000 4) Chickled Ltd has not issued new shares since they were incorporated in the year 2010. 5) It is a group policy to value the Non-Controlling Interest (NCI) using the proportion of net asset method. Required: a) In reference to IFRS 13 Fair value measurement Discuss the terms "highest and best use" as used in IFRS 13 and when consideration for highest and best use is needed (6 marks) 1. Identify at least two IFRS where IFRS 13 does not apply (2 marks) b) In reference to the above financial statements and additional information provided, Prepare the Consolidated Statement of financial position of Hungles and its subsidiary as at 31 August 2019. Show all your workings including relevant pro- forma consolidation journal entries. (17 marks) 3. 4. Question 1 [35] Ms L Recluse decided to open a bric-a-brac store in Johannesburg. The following transactions took place during January 2021 for Black Widow Designs: 1. The owner, Ms Recluse, deposited R65 250 as a capital contribution. 2. Purchased inventory on credit from Wolf Traders, R48 255. Deposited cash sales for the first week, R6 820. Inventory is marked up at 55% on cost Purchased equipment on credit from Spider Manufacturers, R21 750. 5. Paid the first month's rent, R7 500, as well as a deposit of R15 000 to RCI Investments. 6. Sold inventory on credit to R Feru, R10 075. Inventory is marked up at 55% on cost 7. Paid the first instalment due to Spider Manufacturers, R12 250. Received the telephone account for January 2021, R1 680. This account was only paid in February 2021. 9. Received payment from R Feru on his account, R5 000. 8. Required: Enter the above transactions in the accounting equation below, applying the duality concept Example: Issued cheque 281 to Metro Cash and Carry for inventory. General Ledger No. Owner's Assets Liabilities Account Dr Account Cr equity E.g. Trading stock Bank +1 520 Question 2 (25 marks) The following are the statements of financial position of Hungles Ltd and its subsidiary Chickled Ltd as at 31st August 2019: Hungles Chickled NS NS 628,500 605,000 400.000 nil Non-current assets Investment in Chickled limited Goodwill Total Non-current assets 1,028.500 805.000 Current assets Inventory Debtors Bank balance Total current assets Total assets 32,000 25,000 36,500 20,000 38,000 O 106,500 45,000 1.135.000 850.000 Equity and liabilities Ordinary shares N$2 each Retained profit 500,000 400,000 297.000 400.000 Total equity 797.000 800.000 Current liabilities Trade creditors Bank overdraft Total current liabilities Total equity and liabilities 248,000 25,000 90000 25.000 338,000 50.000 1.135,000 850.000 Additional information 1) Hungles acquired its interest in Chickled as shown below Date -- No. of shares acquired Cost of Investment NS Chickled Retained Earning 31/08/2011 - 80,000 shares 210,000 210.000 31/08/2015 -80,000 shares 365,000 320,000 2) On 31/07/2017, it disposed of (sold) 40,000 shares and received $175,000. The retained earnings of Chickled on that date was $350,000 3) The fair value of the existing holdings in Chickled was as follows Date Fair Value of Existing holdings NS 30/08/2015 218,000 30/08/2017 600,000 4) Chickled Ltd has not issued new shares since they were incorporated in the year 2010. aut Bank overdraft Total current liabilities Total equity and liabilities 240V COUT 90000 25.000 338.000 50.000 1.135.000 850.000 Additional information 1) Hungles acquired its interest in Chickled as shown below Date - No. of shares acquired Cost of Investment N$ Chickled Retained Earning 31/08/2011 - 80, 000 shares 210,000 210.000 31/08/2015 - 80,000 shares (365,000 320,000 2) On 31/07/2017, it disposed of (sold) 40,000 shares and received $175,000. The retained earnings of Chickled on that date was $350,000 3) The fair value of the existing holdings in Chickled was as follows Date Fair Value of Existing holdings NS 30/08/2015 218,000 30/08/2017 600,000 4) Chickled Ltd has not issued new shares since they were incorporated in the year 2010. 5) It is a group policy to value the Non-Controlling Interest (NCI) using the proportion of net asset method. Required: a) In reference to IFRS 13 Fair value measurement Discuss the terms "highest and best use" as used in IFRS 13 and when consideration for highest and best use is needed (6 marks) 1. Identify at least two IFRS where IFRS 13 does not apply (2 marks) b) In reference to the above financial statements and additional information provided, Prepare the Consolidated Statement of financial position of Hungles and its subsidiary as at 31 August 2019. Show all your workings including relevant pro- forma consolidation journal entries. (17 marks) 3. 4. Question 1 [35] Ms L Recluse decided to open a bric-a-brac store in Johannesburg. The following transactions took place during January 2021 for Black Widow Designs: 1. The owner, Ms Recluse, deposited R65 250 as a capital contribution. 2. Purchased inventory on credit from Wolf Traders, R48 255. Deposited cash sales for the first week, R6 820. Inventory is marked up at 55% on cost Purchased equipment on credit from Spider Manufacturers, R21 750. 5. Paid the first month's rent, R7 500, as well as a deposit of R15 000 to RCI Investments. 6. Sold inventory on credit to R Feru, R10 075. Inventory is marked up at 55% on cost 7. Paid the first instalment due to Spider Manufacturers, R12 250. Received the telephone account for January 2021, R1 680. This account was only paid in February 2021. 9. Received payment from R Feru on his account, R5 000. 8. Required: Enter the above transactions in the accounting equation below, applying the duality concept Example: Issued cheque 281 to Metro Cash and Carry for inventory. General Ledger No. Owner's Assets Liabilities Account Dr Account Cr equity E.g. Trading stock Bank +1 520