Answered step by step

Verified Expert Solution

Question

1 Approved Answer

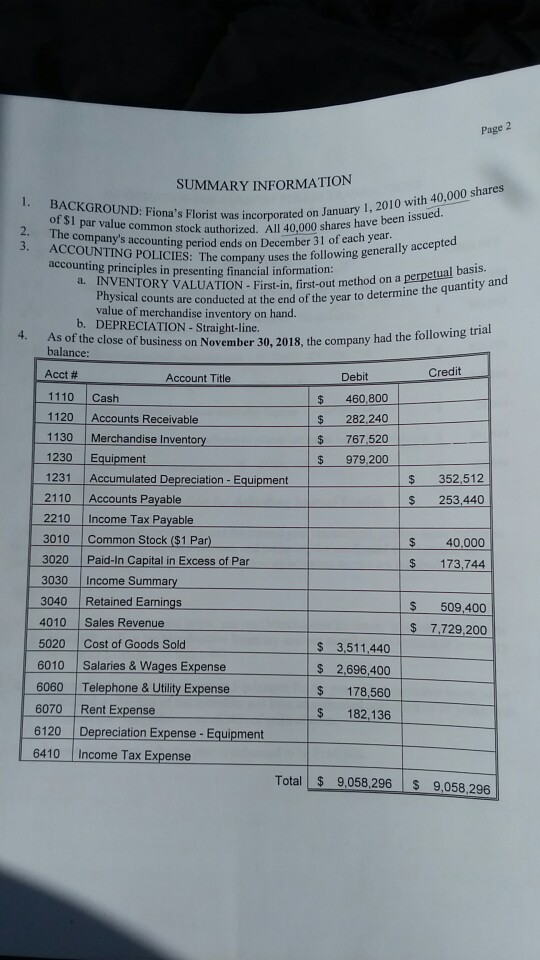

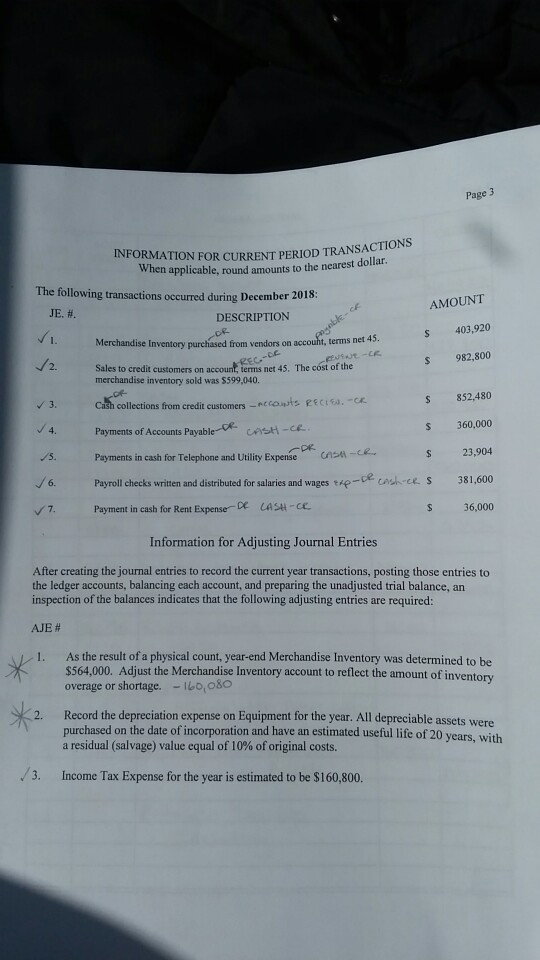

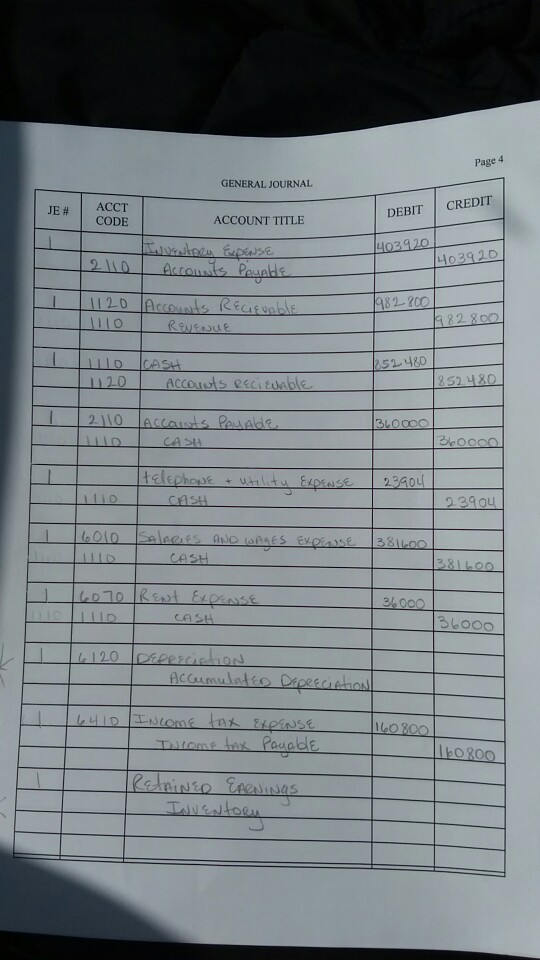

please help me complete this! I'm not sure if what I've already filled in is correct. Page 2 SUMMARY INFORMATION 1. BACKGROUND: Fiona's Florist was

please help me complete this! I'm not sure if what I've already filled in is correct.

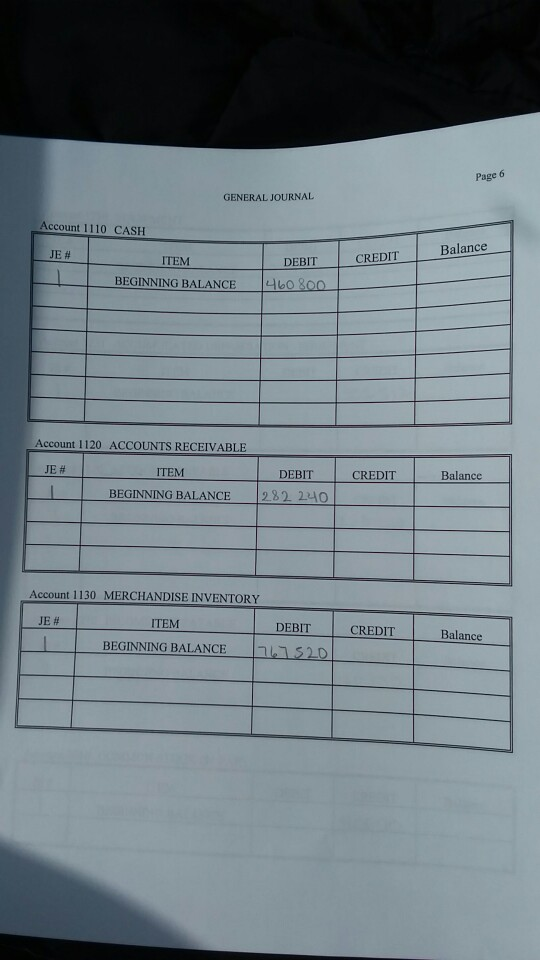

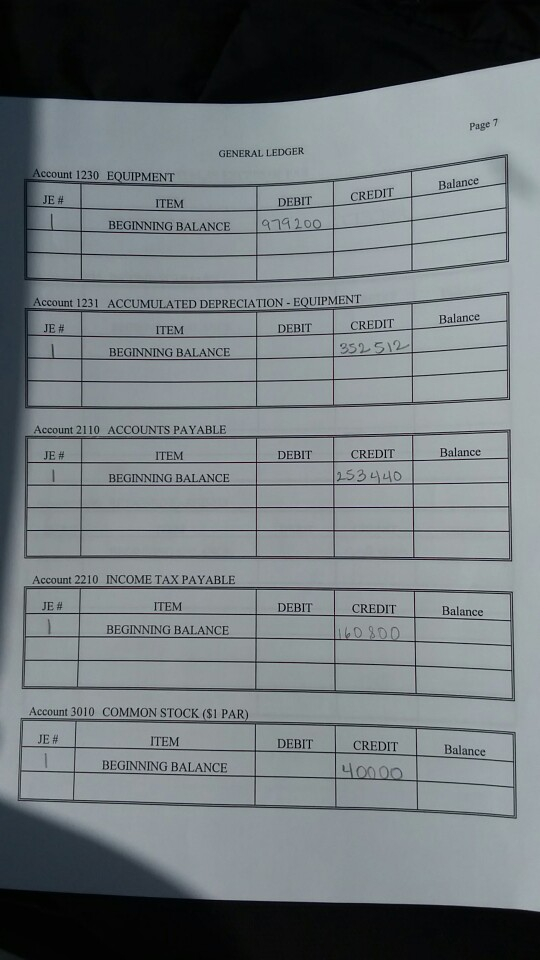

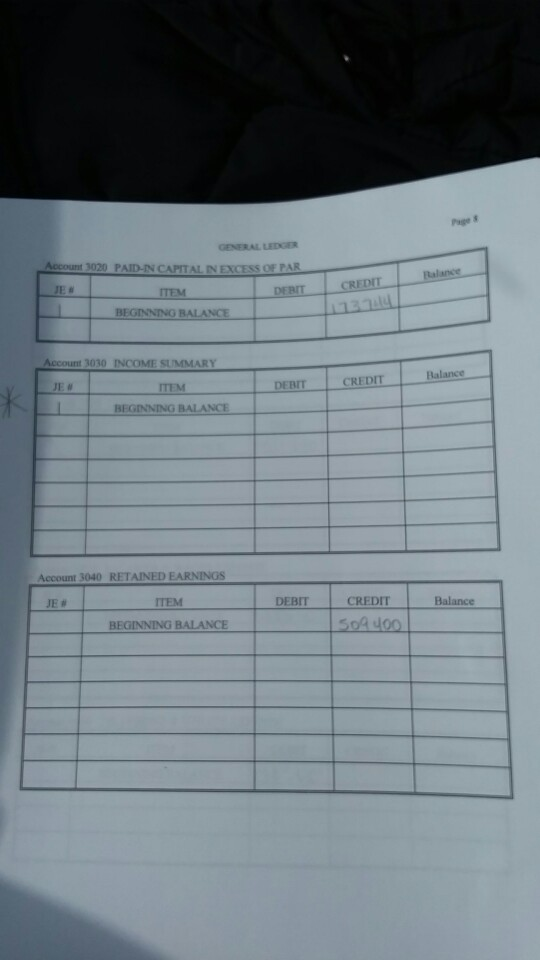

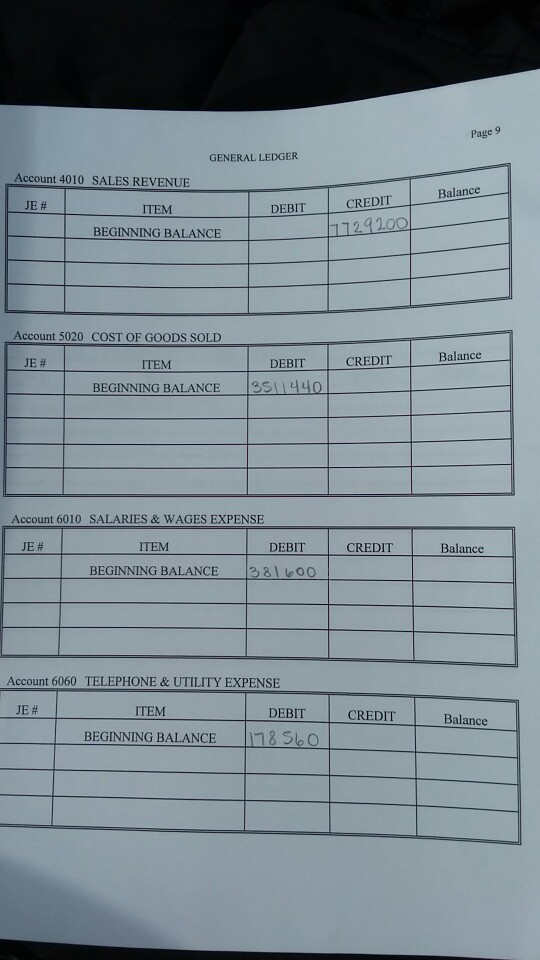

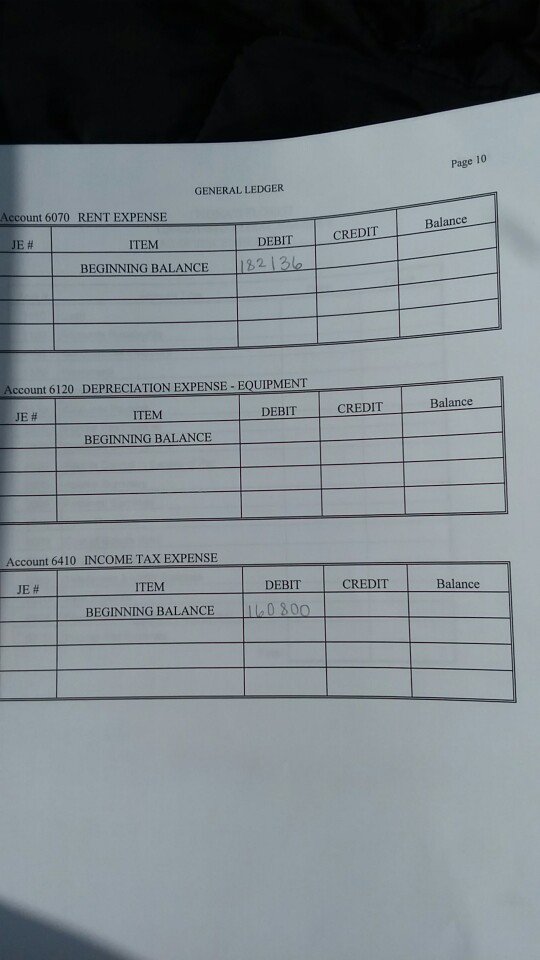

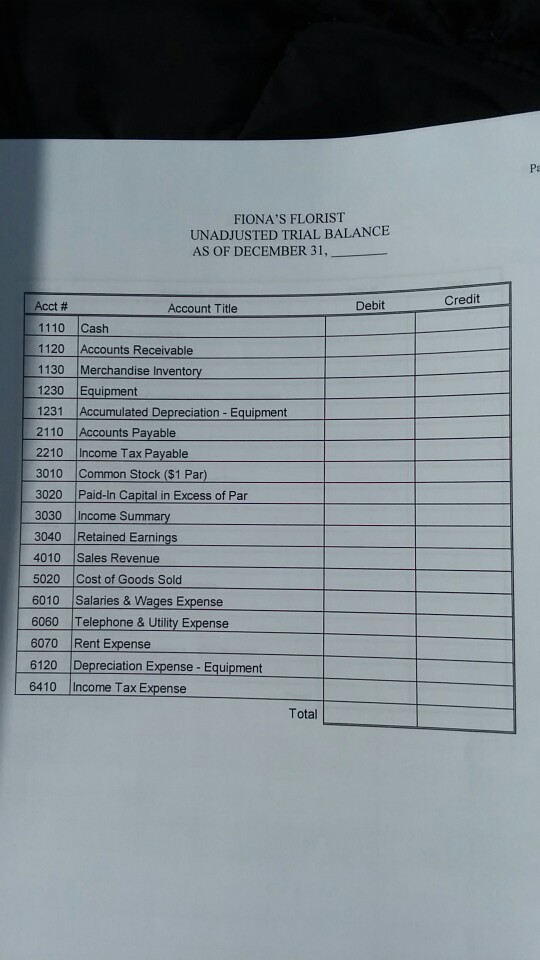

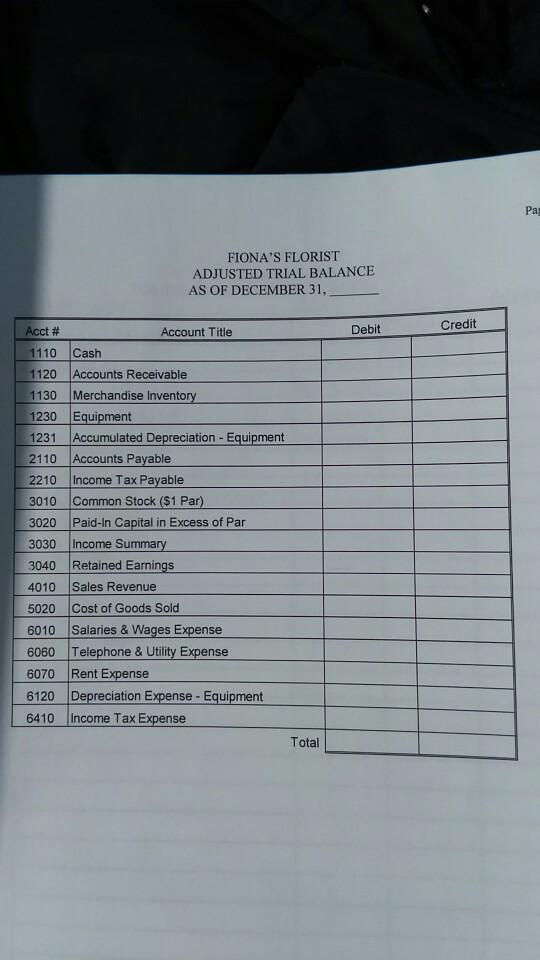

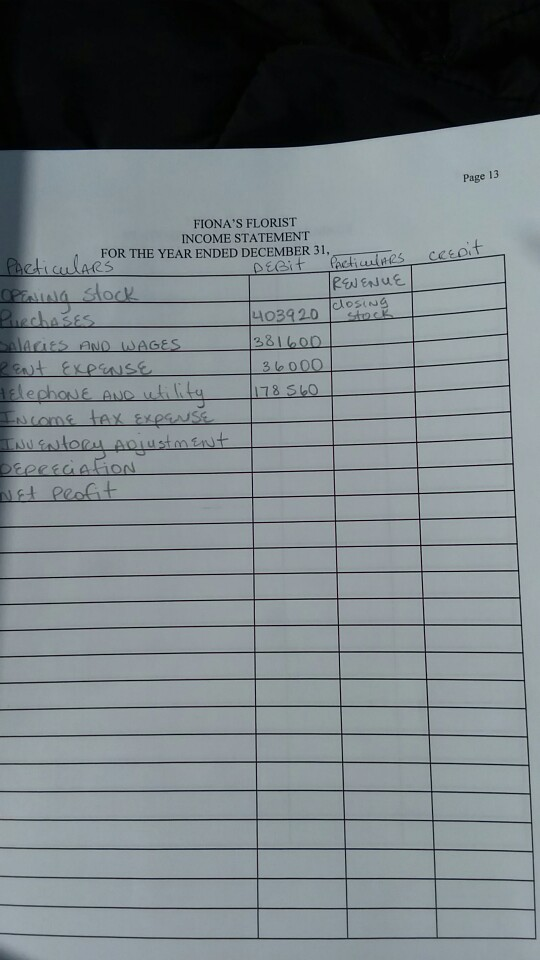

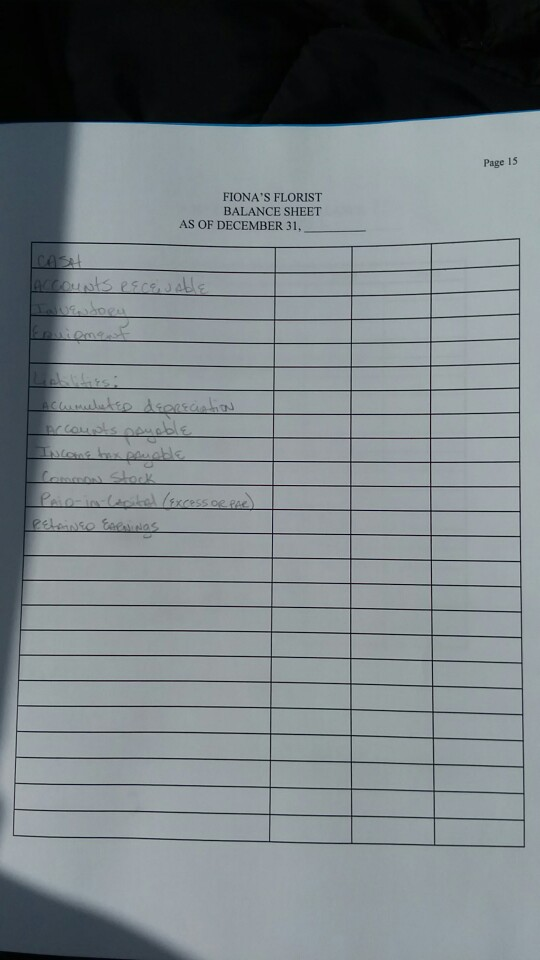

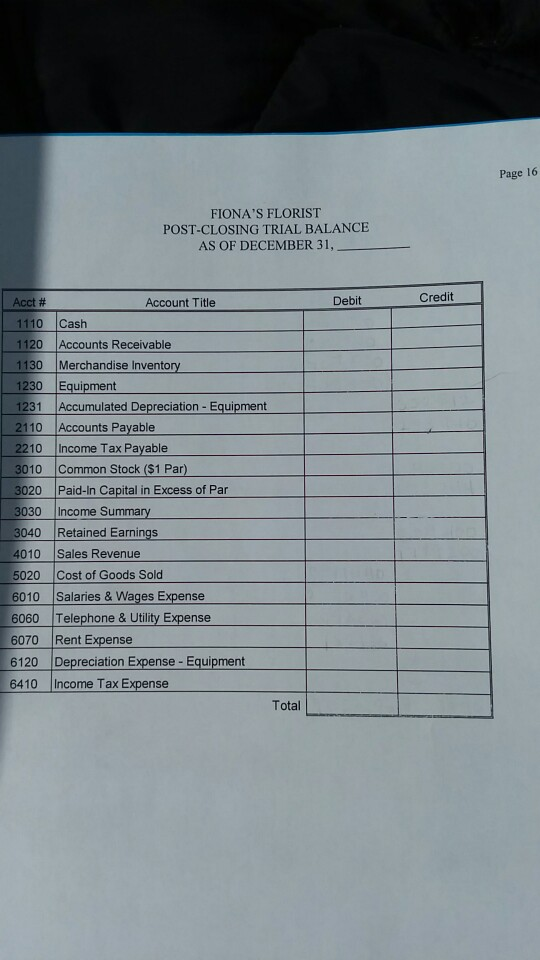

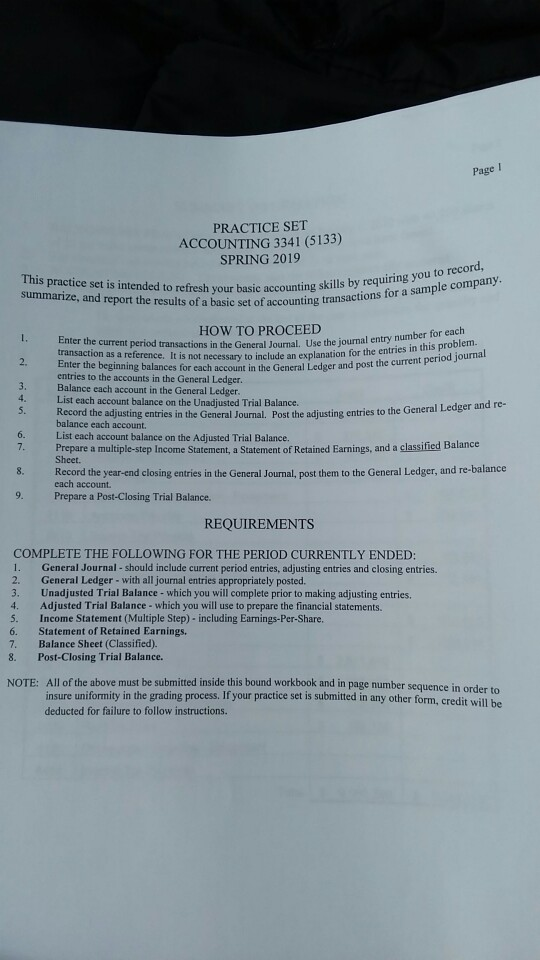

Page 2 SUMMARY INFORMATION 1. BACKGROUND: Fiona's Florist was incorporated on Januara anuary 1, 2010 with 40,000 shares of $1 The company's accounting ACCOUNTING POLI accou common stock authorized. All 40.000 shares have been issued ng period ends on December 31 of each year. 2. 3. CIES: The co nting principles in presenting financial information npany uses the following generally accepted thod on a perpetual basiv and counts are conducted at the end of the year to determine the quantity an a. INVENTORY VALUATION- First-in, first-out method on a hysical value of merchandise inventory on hand. b. DEPRECIATION-Straight-line. .As of the close of business on November 30, 2018, the company had the followin balance Acct # Credit Account Title Debit 1110 Cash 1120 Accounts Receivable 1130 Merchandise Inventory 1230 Equipment 1231 Accumulated Depreciation - Equipment 2110 Accounts Payable 2210 Income Tax Payable 3010 Common Stock ($1 Par 3020 Paid-In Capital in Excess of Par 3030 Income Summary 3040 Retained Earnings 4010 Sales Revenue 5020 Cost of Goods Sold 6010 Salaries & Wages Expense $ 460,800 $ 282.240 s 767.520 $ 979,200 352,512 $ 253,440 40,000 $ 173,744 S 509,400 $ 7,729,200 S 3,511,440 S 2,696,400 $ 178,560 $182,136 6060 Telephone& Utility Expense 6070 Rent Expense 6120 Depreciation Expense - Equipment 6410 Income Tax Expense Total 9,058,296 S 9,058,296 Page 3 INFORMATION FOR CURRENT PERIOD When applicable, round amounts to the nearest dollar The following transactions occurred during December 20 18 AMOUNT 403,920 S 982,800 JE. #. DESCRIPTION ise Inventory purchased from vendors on accou terms net 45. 2. REC merchandise inventory sold was $599,040 S 852,480 S 360,000 23,904 6. Payroll checks written and distributed for salaries and wages e-e chcs381,600 collections from credit customers nccots REciEa.c Payments of Accounts PayableCR cnst-ce Payments in cash for Telephone and Utility Expense 4. n-ce 7. Payment in cash for Rent Expense E LASH-CO 36,000 Information for Adjusting Journal Entries After creating the journal entries to record the current year transactions, posting those entries to the ledger accounts, balancing each account, and preparing the unadjusted trial balance, an inspection of the balances indicates that the following adjusting entries are required: AJE # As the result of a physical count, year-end Merchandise Inventory was determined to be $564,000. Adjust the Merchandise Inventory account to reflect the amount of invent overage or shortage. bo,o8o 1. ory Record the depreciation expense on Equipment for the year. All depreciable assets purchased on the date of incorporation and have an estimated useful life of 20 years, with a residual (salvage) value equal of 10% of original costs. 2. were 3. Income Tax Expense for the year is estimated to be $160,800. Page 4 GENERAL JOURNAL JE# | ACCT CODE ACCOUNT TITLE DEBIT CREDIT 402 420 120 CAsu Page 6 GENERAL JOURNAL Account 1110 CASH ITEM DEBIT CREDIT BEGINNING BALANCE 14u0 Account 1120 ACCOUNTS RECEIVABLE ITEM DEBIT CREDIT Balance BEGINNING BALANCE 282 240 Account 1130 MERCHANDISE INVENTORY JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE Page 7 GENERAL LEDGER Account 1230 EQUIPMENT Balance JE# ITEM CREDIT DEBIT BEGINNING BALANCE474100 Account 1231 ACCUMULATED DEPRECIATION- EQUIPMEN Balance ITEM DEBIT CREDIT BEGINNING BALANCE 952S12 Account 2110 ACCOUNTS PAYABLE ITEM BEGINNING BALANCE JE # DEBIT CREDIT Balance 153 LLID Account 2210 INCOME TAX PAYABLE ITEM DEBIT CREDIT Balance BEGINNING BALANCE ITEM DEBIT CREDIT Balance BEGINNING BALANCE Page 9 GENERAL LEDGER Account 4010 SALES REVENUE JE# ITEM DEBITCREDIT Balance 2 BEGINNING BALANCE Account 5020 COST OF GOODS SOLD Balance JE# DEBIT CREDIT ITEM Account 6010 SALARIES&WAGES EXPENSE JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE 38o Account 6060 TELEPHONE & UTILITY EXPENSE JE# ITEM DEBIT Balance BEGINNING BALANCE |178560 Page 10 GENERAL LEDGER Account 6070 RENT EXPENSE JE# Balance ITEM CREDIT DEBIT BEGINNING BALANCE 2. Account 6120 DEPRECIATION EXPENSE - EQUIPMENT JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE Account 6410 INCOME TAX EXPENSE JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE Pa FIONA'S FLORIST UNADJUSTED TRIAL BALANCE AS OF DECEMBER 31, Debit Credit Acct # 1110 Cash 1120 Accounts Receivable Account Title 2110 Accounts Payable 2210 Income Tax Payable 3020 Paid-In Capital in Excess of Par 3030 Income SummarY 3040 Retained Earnings 4010 Sales Revenue 5020 Cost of Goods Sold 6010 Salaries & Wages Expense 6060 Telephone&Utility Expense 6070 Rent Expense 6120 Depreciation Expense- Equipment 6410 Income Tax Expense Total Page 13 FIONA'S FLORIST INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31 ARS 403920 losi 2 Page 14 FIONA'S FLORIST STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, Page 15 FIONA'S FLORIST BALANCE SHEET AS OF DECEMBER 31, Page 16 FIONA'S FLORIST POST-CLOSING TRIAL BALANCE AS OF DECEMBER 31, Debit Credit Account Title 1110 Cash 1120 Accounts Receivable 1130 Merchandise Inventory 1230 Equipment 1231 Accumulated Depreciation Equipment 2110 Accounts Payable 2210 Income Tax Payable 3020 Paid-in Capital in Excess of Par 3030 Income Summary 3040 Retained Earnings 4010 Sales Revenue 5020 Cost of Goods Sold 6010 Salaries & Wages Expense 6060 Telephone & Utility Expense 6070 Rent Expense 6410 Income Tax Expense Total Page I PRACTICE SET ACCOUNTING 3341 (5133) SPRING 2019 This practice set is intended to basic accoun summarize, and report the results of a basic set of accounting transactions for a refresh your basic accounting skills by requiring you to record, HOW TO PROCEED number for each 1. 2. 3. Enter the current period transactions in the General Journal. Use the journal entry transaction as a reference. It is not necessary to include an explanation for t the entries in this problem. st the curre nt period journal entries to the accounts in the General Ledger. Balance each account in the General Ledger List each account balance on the Unadjusted Trial Balance. Record the adjusting entries in the General Journal. Post the adjusting entries to the Gener 4. al Ledger and re- balance each account. 6. List each account balance on the Adjusted Trial Balance. 7. Prepare a multiple-step Income Statement, a Statement of Retained Earnings, and a classified Balance 8. Record the year-end closing entries in the General Journal, post them to the General Ledger, and re 9. Balance each account Prepare a Post-Closing Trial Balance. REQUIREMENTS COMPLETE THE FOLLOWING FOR THE PERIOD CURRENTLY ENDED: I. General Journal - should include current period entries, adjusting entries and closing entries. 2. General Ledger- with all journal entries appropriately posted. 3. Unadjusted Trial Balance - which you will complete prior to making adjusting entries. 4. Adjusted Trial Balance-which you will use to prepare the financial statements. 5. Income Statement (Multiple Step)- including Earnings-Per-Share. 6. Statement of Retained Earnings. 7. Balance Sheet (Classified) 8. Post-Closing Trial Balance. All of the above must be submitted inside this bound workbook and in page numb insure uniformity in the grading process. If your practice set is submitted in any other form, credit will be deducted for failure to follow instructions. NOTE: sequence in order toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started