Answered step by step

Verified Expert Solution

Question

1 Approved Answer

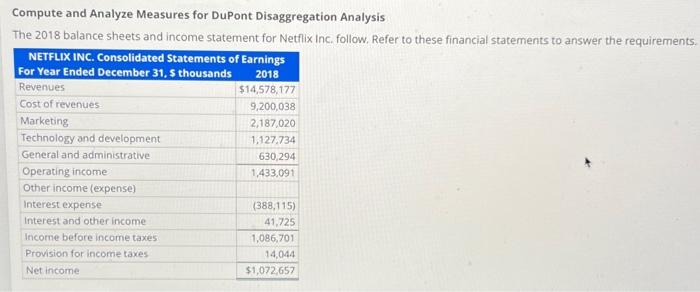

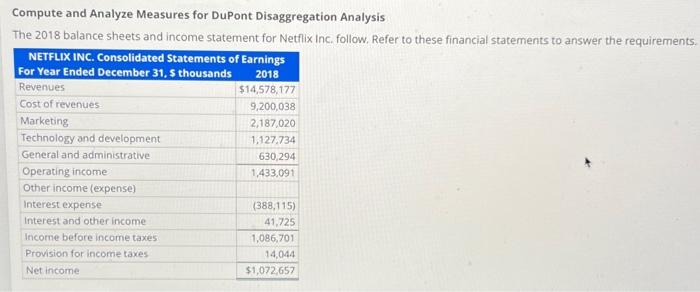

please help me! Compute and Analyze Measures for DuPont Disaggregation Analysis The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these

please help me!

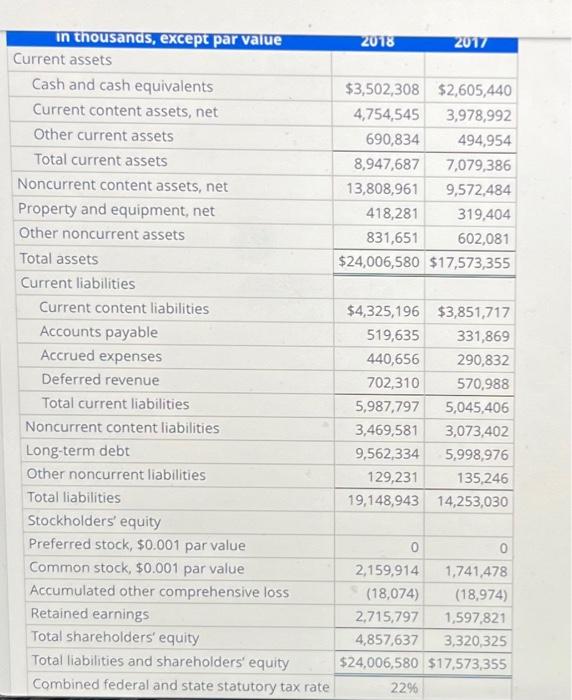

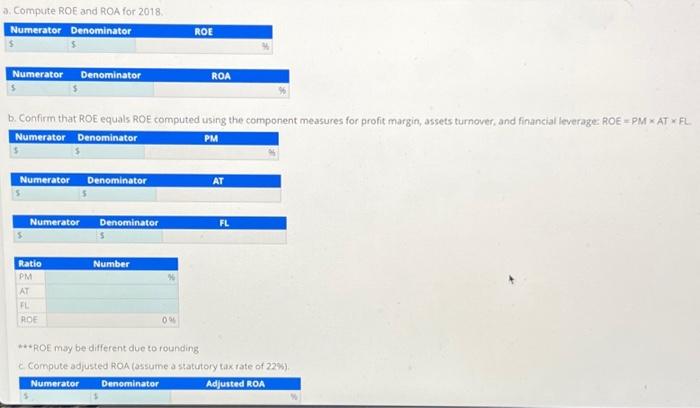

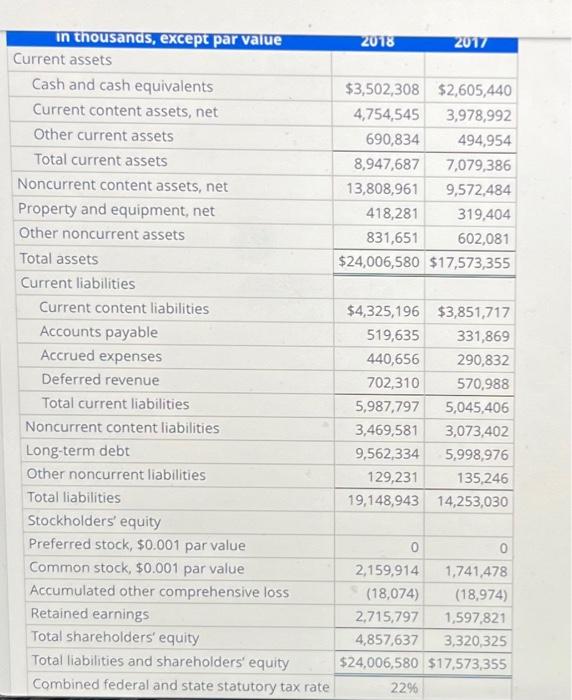

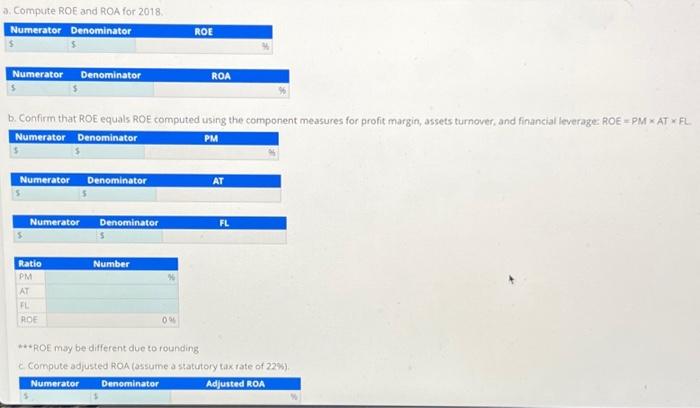

Compute and Analyze Measures for DuPont Disaggregation Analysis The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. In thousanas, except par value 2018 2017 Current assets Cash and cash equivalents Current content assets, net Other current assets Total current assets Noncurrent content assets, net Property and equipment, net Other noncurrent assets Total assets Current liabilities Current content liabilities Accounts payable Accrued expenses Deferred revenue Total current liabilities Noncurrent content liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity Preferred stock, \$0.001 par value Common stock, $0.001 par value Accumulated other comprehensive loss Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Combined federal and state statutory tax rate $3,502,308 $2,605,440 4,754,545 3,978,992 8 \begin{tabular}{|r|r|} \hline 8,947,687 & 7,079,386 \\ \hline 13,808,961 & 9,572,484 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline 13,808,961 & 9,572,484 \\ \hline 418,281 & 319,404 \\ \hline 831,651 & 602,081 \\ \hline$24,006,580 & $17,573,355 \\ \hline \hline \end{tabular} $4,325,196$3,851,717 \begin{tabular}{|l|r|} \hline 519,635 & 331,869 \\ \hline 440,656 & 290,832 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 440,656 & 290,832 \\ \hline 702,310 & 570,988 \\ \hline 5,987,797 & 5,045,406 \\ \hline 3,469,581 & 3,073,402 \\ \hline 9,562,334 & 5,998,976 \\ \hline 129,231 & 135,246 \\ \hline 19,148,943 & 14,253,030 \\ \hline \end{tabular} 0 \begin{tabular}{rr} 0,159,914 & 0 \\ \hline 1,741,478 \end{tabular} (18,074) (18,974) 2,715,797 \begin{tabular}{|r|} \hline 1,597,821 \\ \hline 3,320,325 \\ \hline 7,573,355 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline 4,857,637 & 3,320,325 \\ \hline$24,006,580 & $17,573,355 \\ \hline \end{tabular} a. Compute ROE and ROA for 2018. b. Confirm that ROE equals ROE computed using the component measures for profit margin, assets turnover, and finaneial leverage: ROE = PM AT FL. ***ROE may be different due to rounding c. Compute adjusted ROA (assume a statutory tax rate of 22% )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started