Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me correct the wrong answers for each part. Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In

Please help me correct the wrong answers for each part.

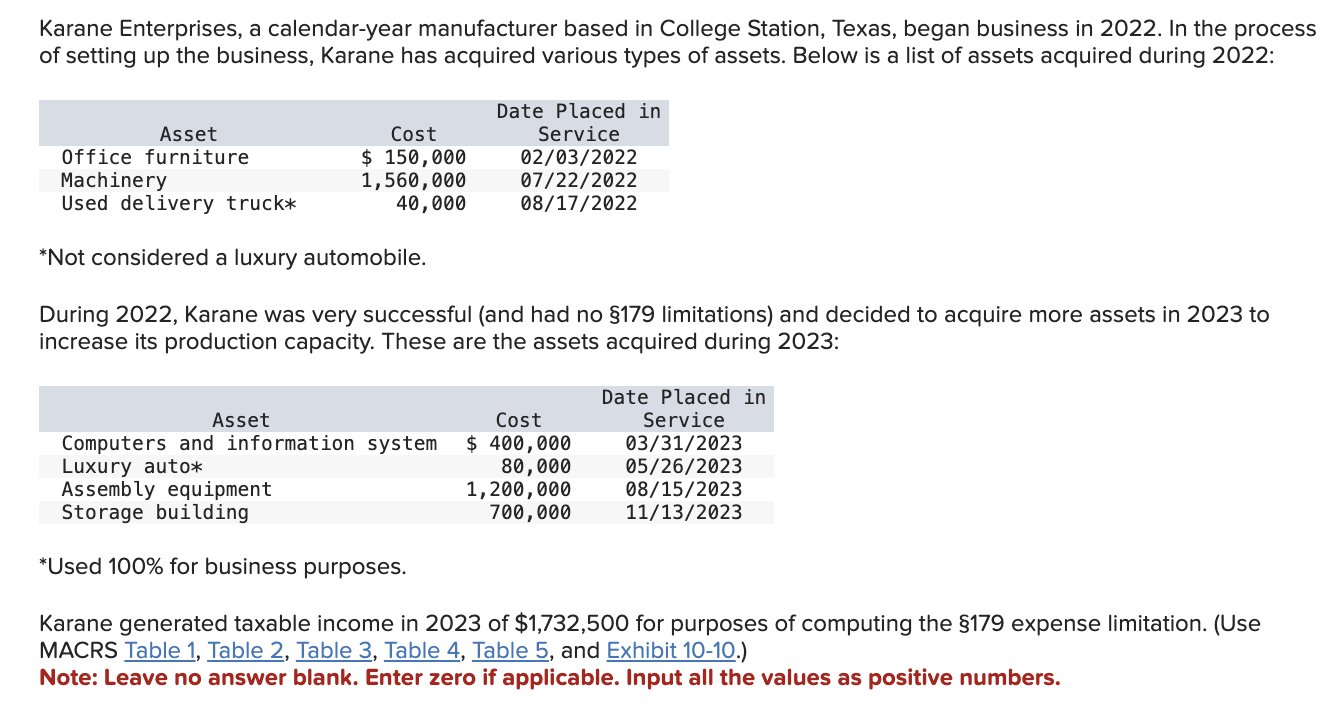

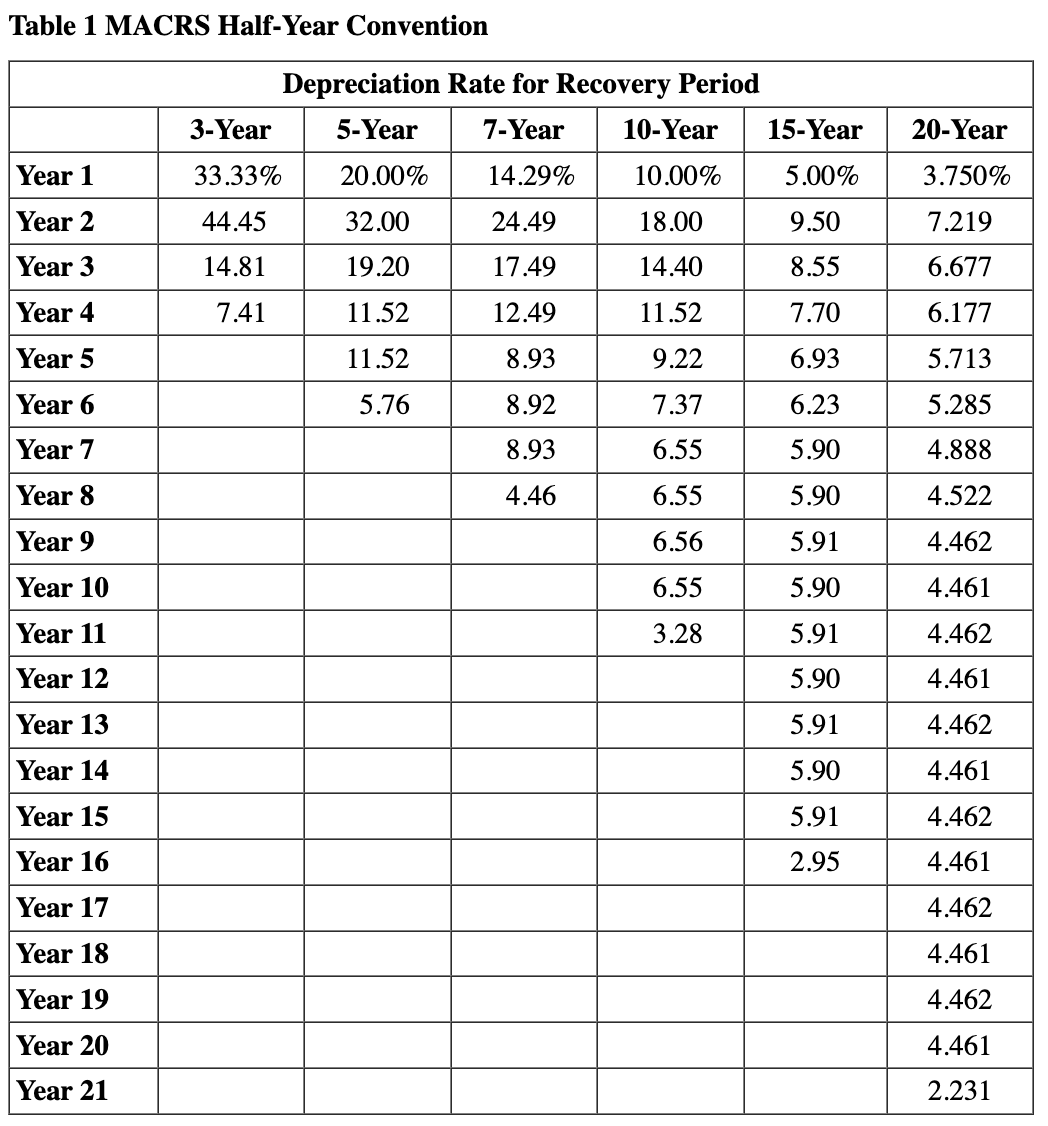

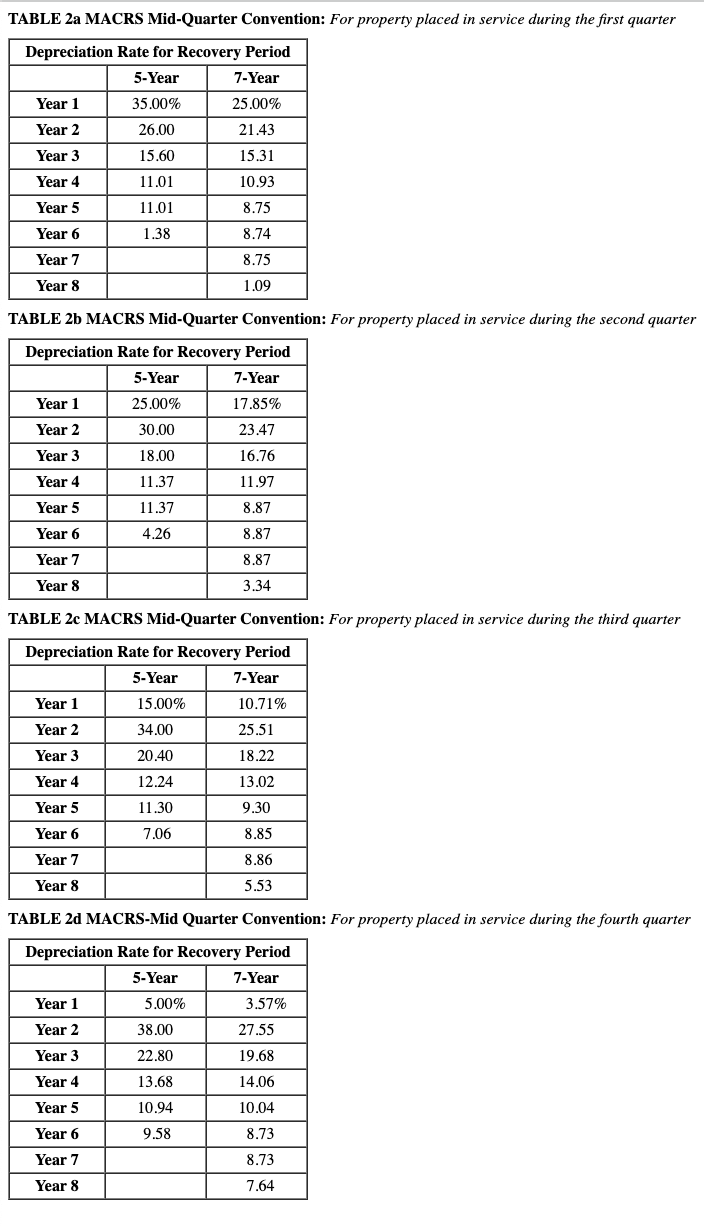

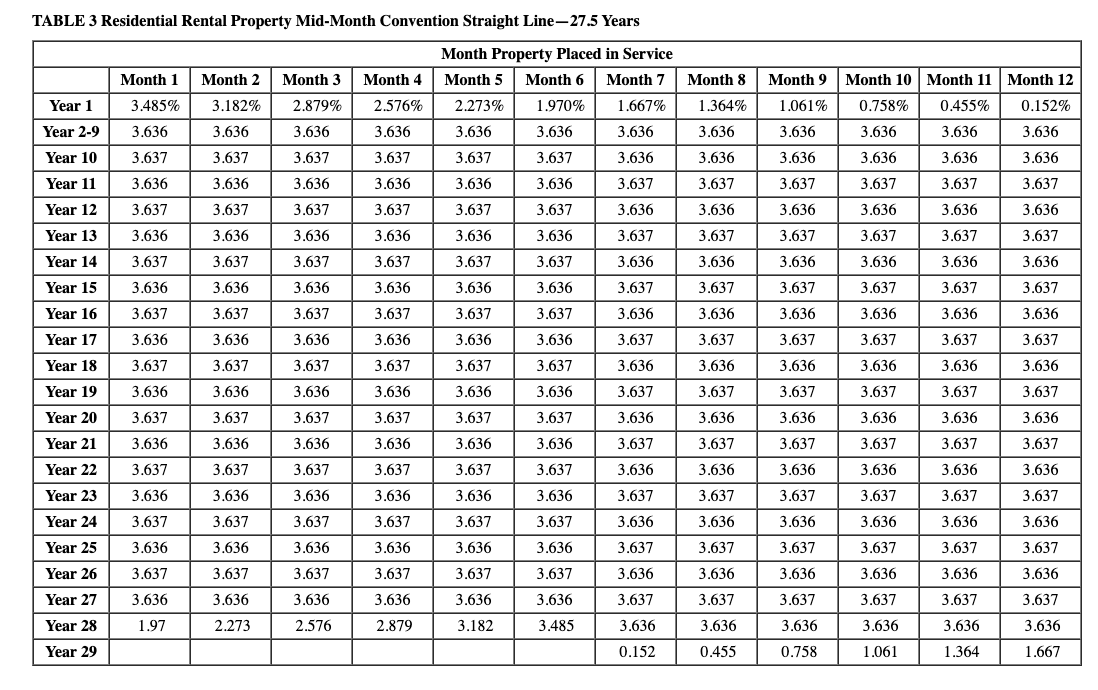

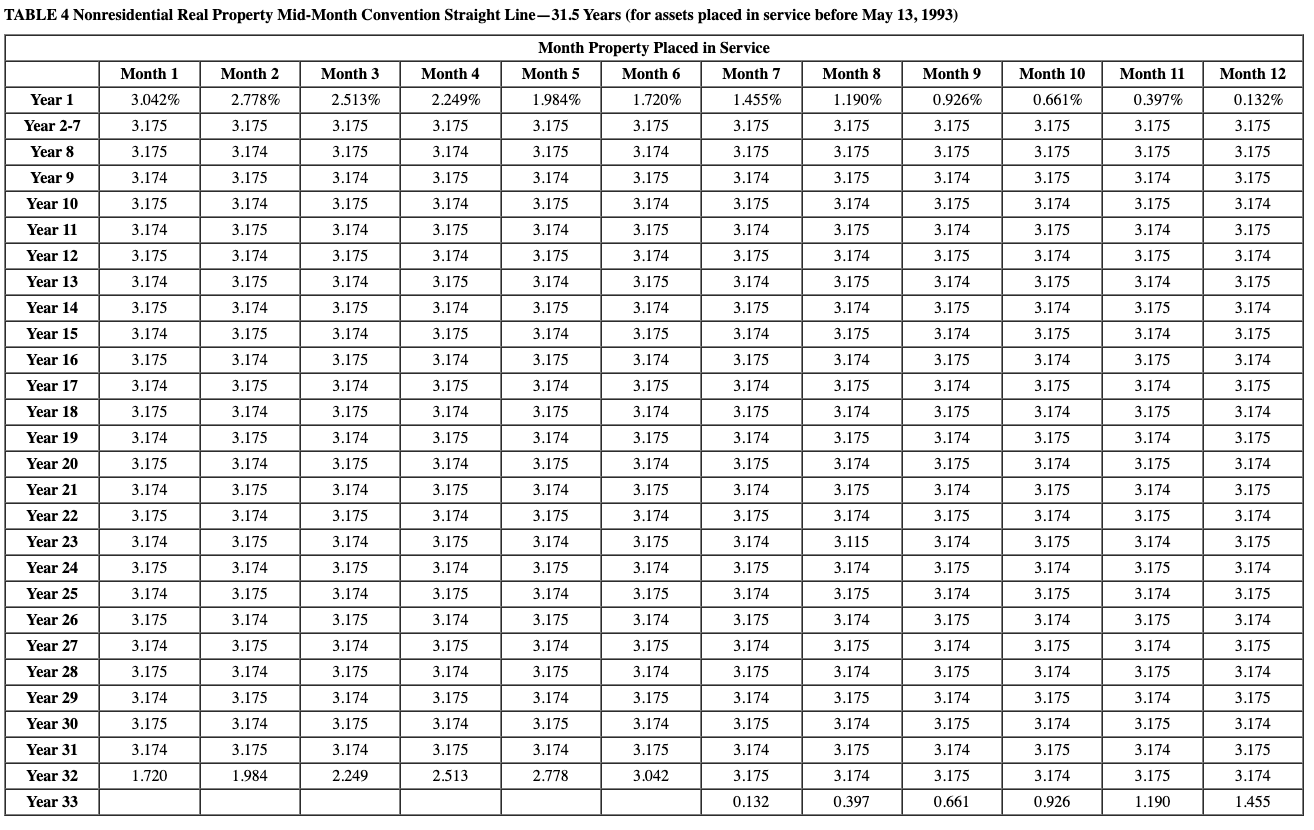

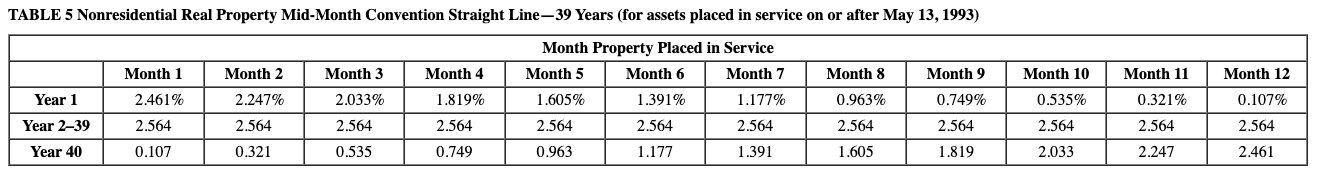

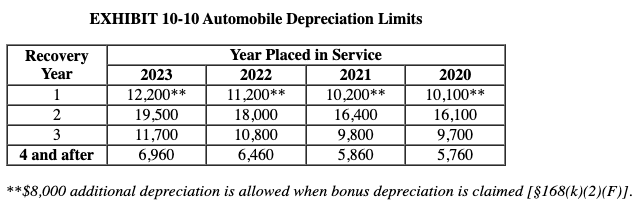

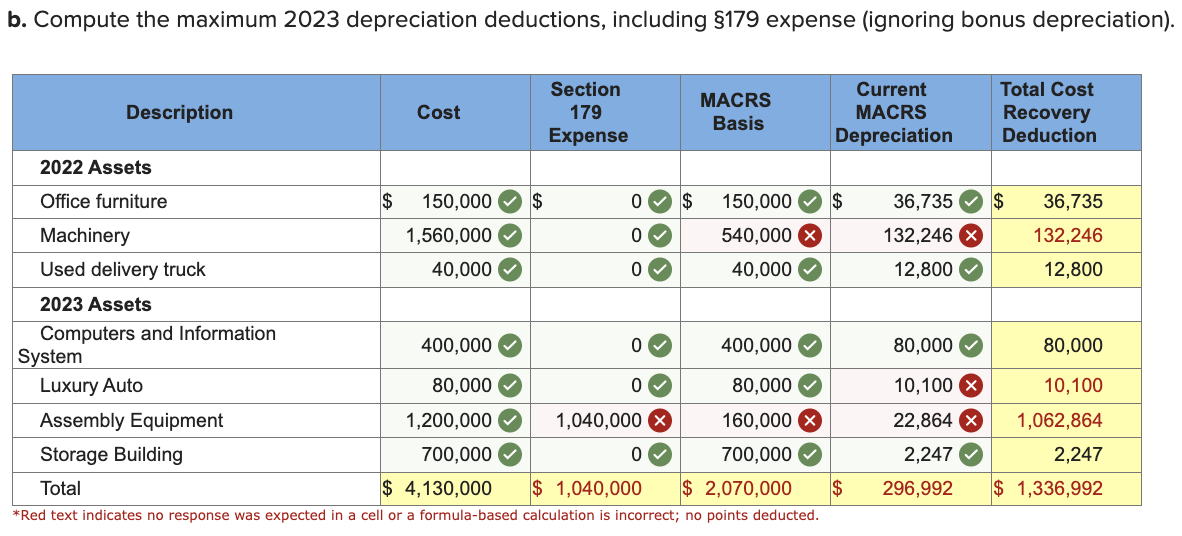

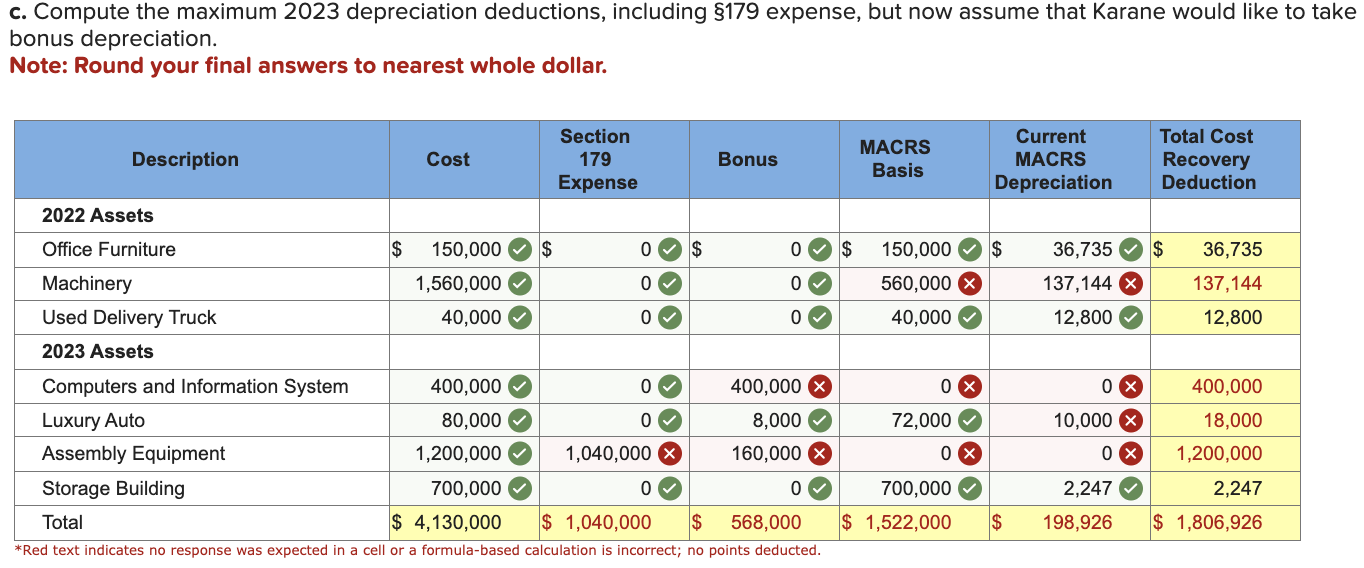

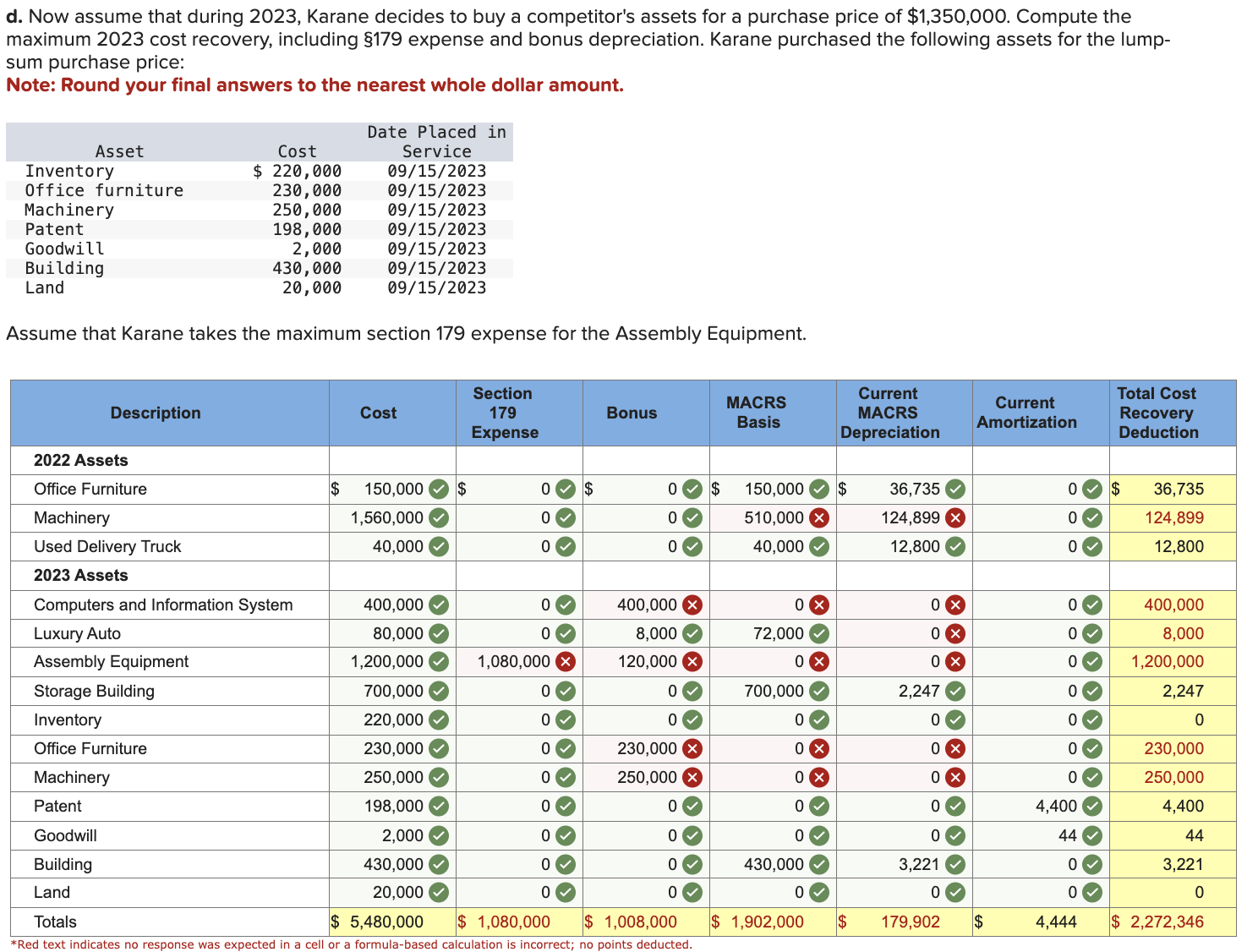

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2022: *Not considered a luxury automobile. During 2022, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2023 to increase its production capacity. These are the assets acquired during 2023: *Used 100% for business purposes. Karane generated taxable income in 2023 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Table 1 MACRS Half-Year Convention \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3-Year & 5-Year & 7-Year & 10-Year & 15-Year & 20-Year \\ \hline Year 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% & 3.750% \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 8.55 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 6.93 & 5.713 \\ \hline Year 6 & & 5.76 & 8.92 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 5.91 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 5.91 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2.231 \\ \hline \end{tabular} TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13, 1993) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month Property Placed in Service } \\ \hline & Month 1 & Month 2 & Month 3 & Month 4 & Month 5 & Month 6 & Month 7 & Month 8 & Month 9 & Month 10 & Month 11 & Month 12 \\ \hline Year 1 & 3.042% & 2.778% & 2.513% & 2.249% & 1.984% & 1.720% & 1.455% & 1.190% & 0.926% & 0.661% & 0.397% & 0.132% \\ \hline Year 2-7 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 \\ \hline Year 8 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 & 3.175 \\ \hline Year 9 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 10 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 11 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 12 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 13 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 14 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 15 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 16 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 17 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 18 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 19 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 20 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 21 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 22 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 23 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.115 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 24 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 25 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 26 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 27 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 28 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 29 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 30 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 31 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 \\ \hline Year 32 & 1.720 & 1.984 & 2.249 & 2.513 & 2.778 & 3.042 & 3.175 & 3.174 & 3.175 & 3.174 & 3.175 & 3.174 \\ \hline Year 33 & & & & & & & 0.132 & 0.397 & 0.661 & 0.926 & 1.190 & 1.455 \\ \hline \end{tabular} TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month Property Placed in Service } \\ \hline & Month 1 & Month 2 & Month 3 & Month 4 & Month 5 & Month 6 & Month 7 & Month 8 & Month 9 & Month 10 & Month 11 & Month 12 \\ \hline Year 1 & 2.461% & 2.247% & 2.033% & 1.819% & 1.605% & 1.391% & 1.177% & 0.963% & 0.749% & 0.535% & 0.321% & 0.107% \\ \hline Year 2-39 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 40 & 0.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} EXHIBIT 10-10 Automobile Depreciation Limits $8,000 additional depreciation is allowed when bonus depreciation is claimed [$168(k)(2)(F)]. b. Compute the maximum 2023 depreciation deductions, including $179 expense (ignoring bonus depreciation). c. Compute the maximum 2023 depreciation deductions, including $179 expense, but now assume that Karane would like to tak bonus depreciation. Note: Round your final answers to nearest whole dollar. d. Now assume that during 2023 , Karane decides to buy a competitor's assets for a purchase price of $1,350,000. Compute the maximum 2023 cost recovery, including $179 expense and bonus depreciation. Karane purchased the following assets for the lumpsum purchase price: Note: Round your final answers to the nearest whole dollar amount. Assume that Karane takes the maximum section 179 expense for the Assembly EquipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started