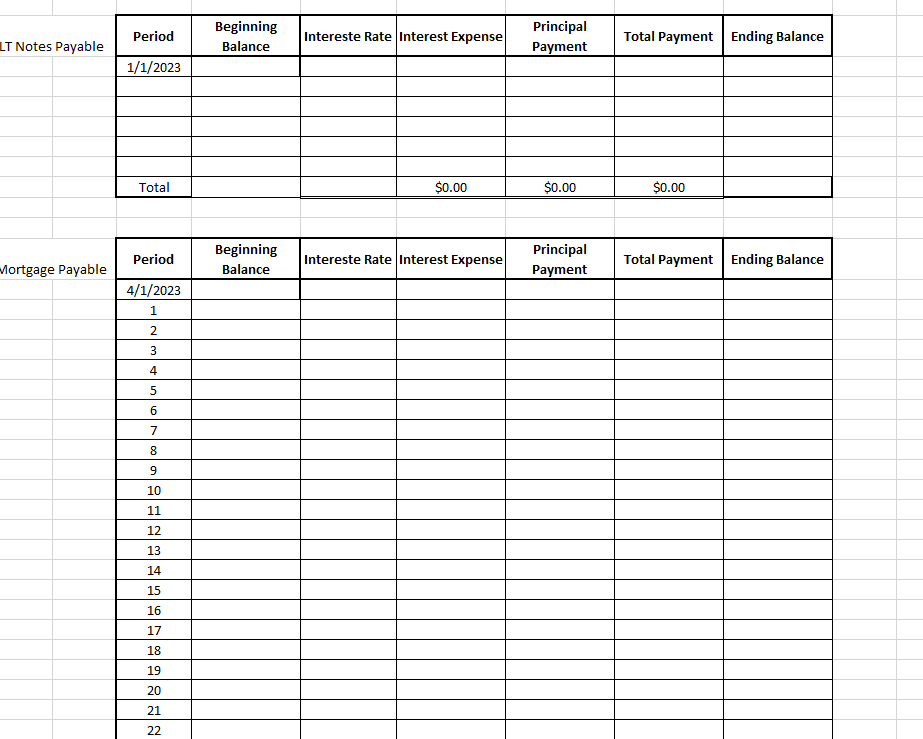

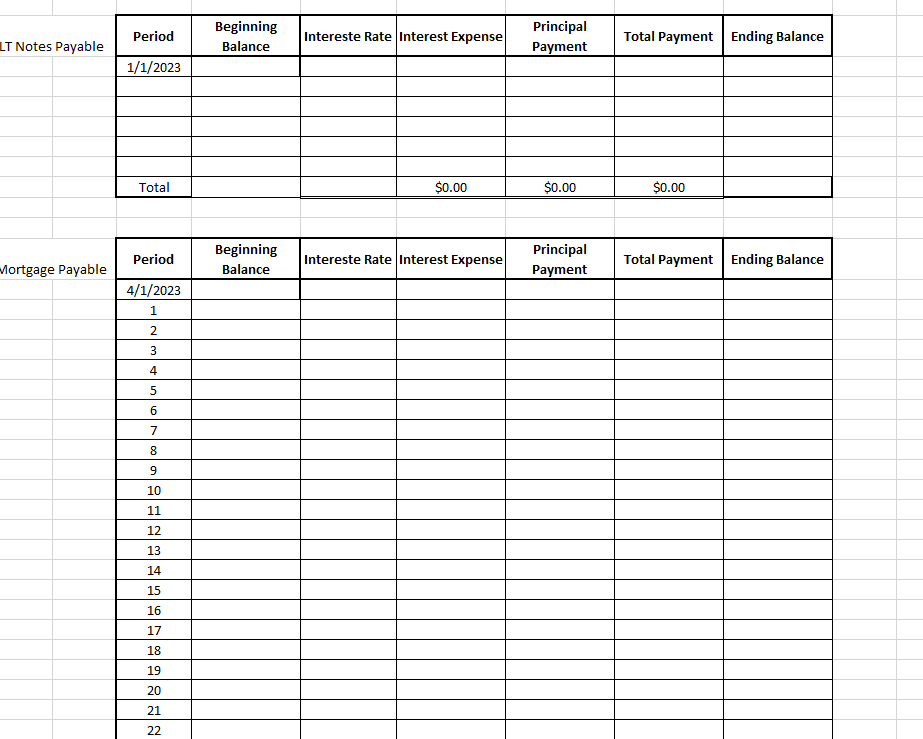

Please help me create amortization table with this

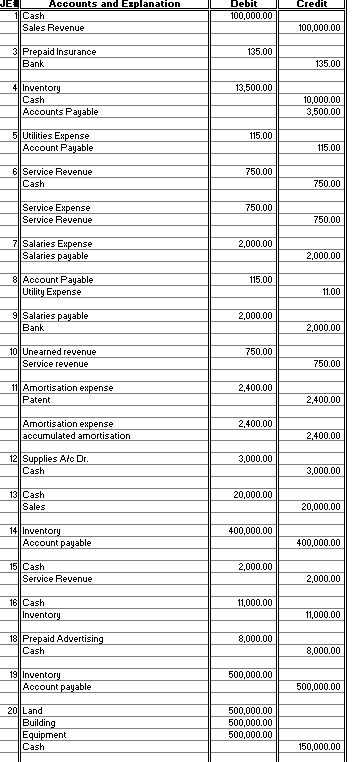

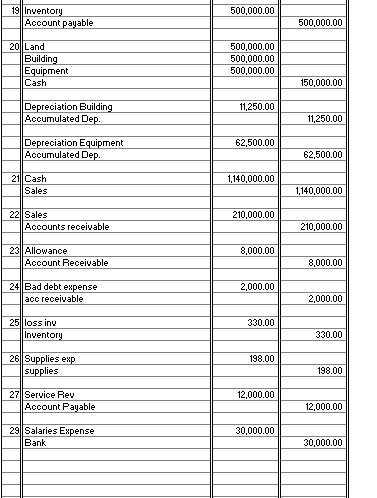

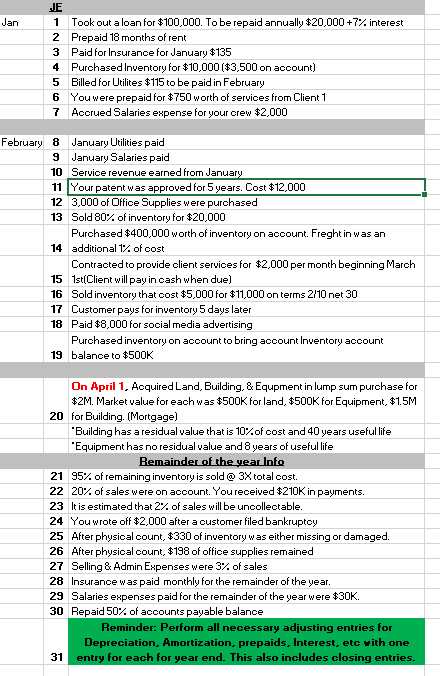

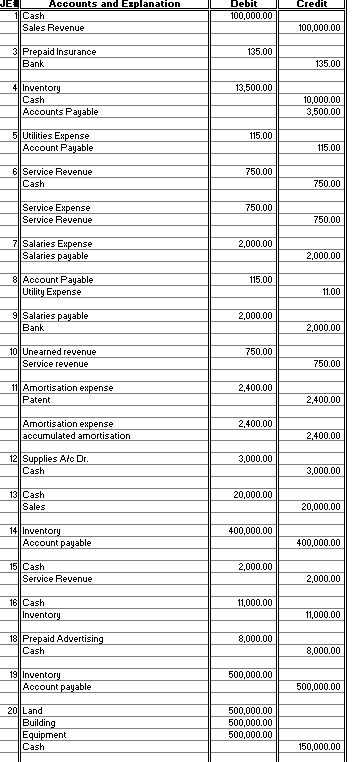

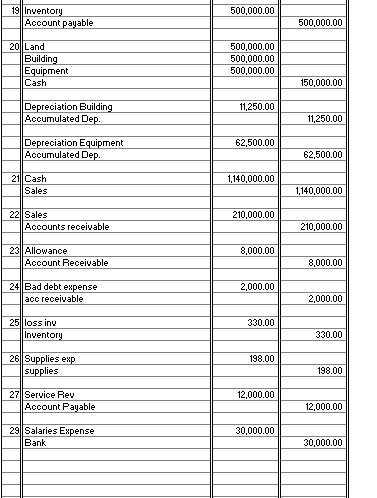

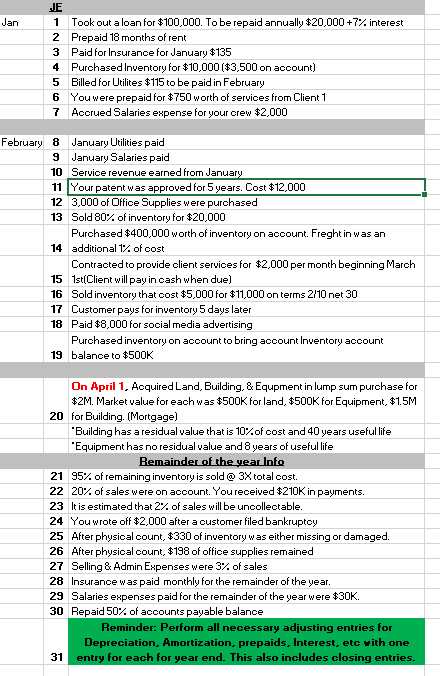

JJE Took out a loan for $100,000. To be repaid annually $20,000+7% interest 2 Prepaid 18 months of rent 3 Paid for Insurance for January $135 4 Purchased lnventory for $10,000 ( $3,500 on acoount) 5 Billed for Utilites $115 to be paid in February 6 Youwere prepaid for $750 worth of services from Client 1 7 Acorued Salaries expense for your crew $2,000 February 8 January Urilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Dffice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on account. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on acoount to bring acoount Inventory acoount 19 balanoe to $500K On April 1, Acquired Land, Building, \& Equpment in lump sumpurchase for $2M. Market walue for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Remainder of the year Info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on acoount. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc with one 31 entry for each for year end. This also includes closing entries. \begin{tabular}{|c|c|c|c|c|c|c|} \hline Period & Beginning Balance & Intereste Rate & Interest Expense & Principal Payment & Total Payment & Ending Balance \\ \hline 1/1/2023 & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline Total & & & $0.00 & $0.00 & $0.00 & \\ \hline \end{tabular} JJE Took out a loan for $100,000. To be repaid annually $20,000+7% interest 2 Prepaid 18 months of rent 3 Paid for Insurance for January $135 4 Purchased lnventory for $10,000 ( $3,500 on acoount) 5 Billed for Utilites $115 to be paid in February 6 Youwere prepaid for $750 worth of services from Client 1 7 Acorued Salaries expense for your crew $2,000 February 8 January Urilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Dffice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on account. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on acoount to bring acoount Inventory acoount 19 balanoe to $500K On April 1, Acquired Land, Building, \& Equpment in lump sumpurchase for $2M. Market walue for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Remainder of the year Info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on acoount. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc with one 31 entry for each for year end. This also includes closing entries. \begin{tabular}{|c|c|c|c|c|c|c|} \hline Period & Beginning Balance & Intereste Rate & Interest Expense & Principal Payment & Total Payment & Ending Balance \\ \hline 1/1/2023 & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline Total & & & $0.00 & $0.00 & $0.00 & \\ \hline \end{tabular}