Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me do these questions In the memo, you should: - Address the following questions: 1. What was the overall purpose of the procedures

Please help me do these questions

Please help me do these questions

In the memo, you should:

- Address the following questions:

1. What was the overall purpose of the procedures you performed to the audit?

2. How did you perform the procedures?

3. What did each procedure reveal?

4. What are your overall conclusions/recommendations given these findings?

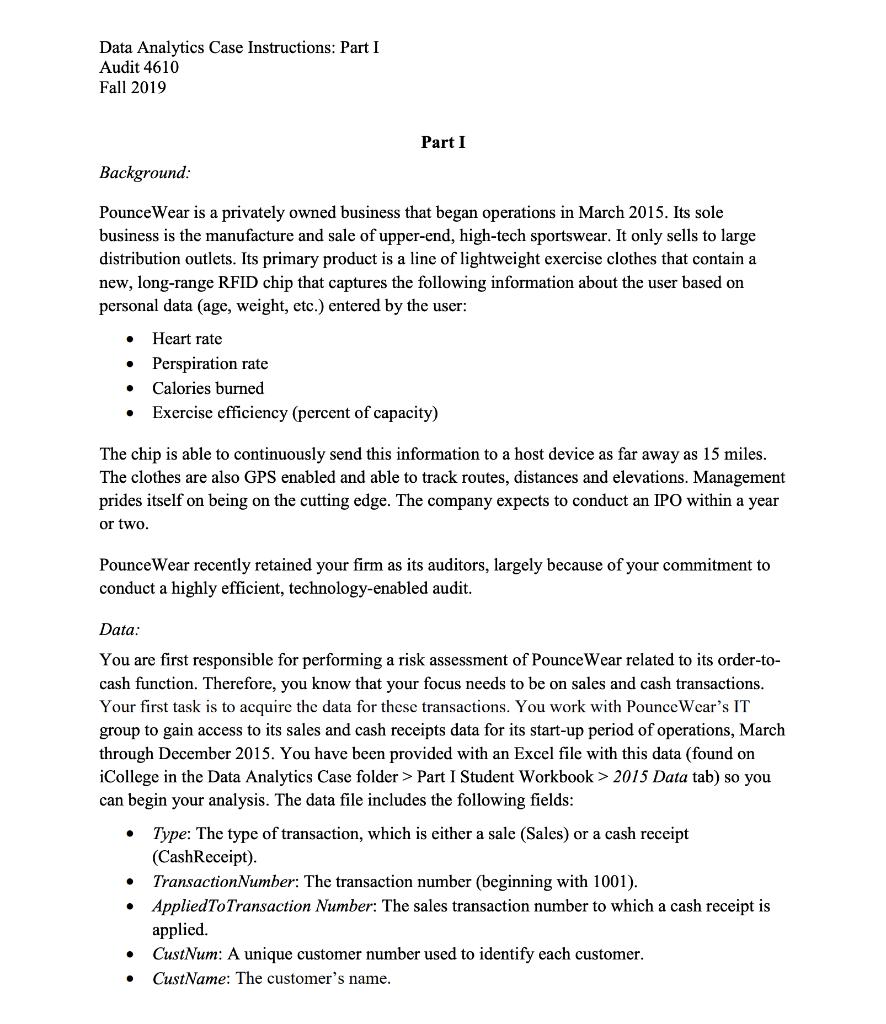

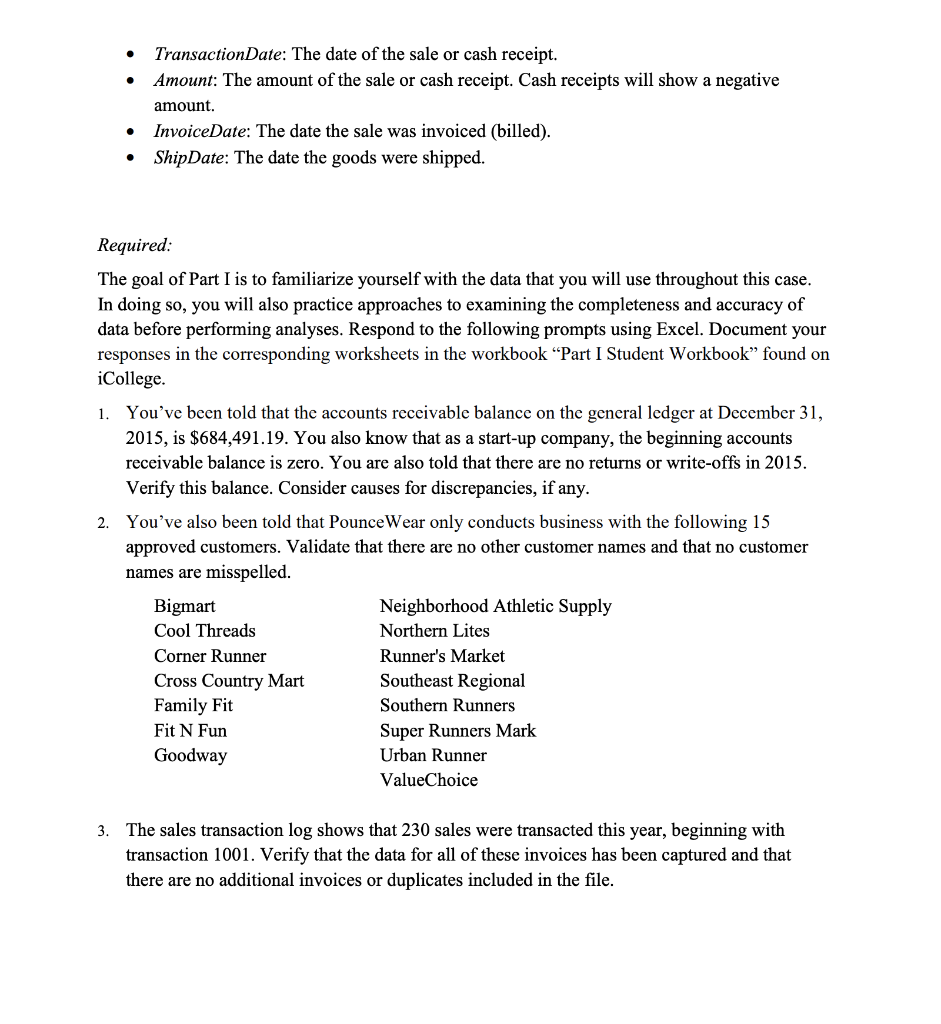

Data Analytics Case Instructions: Part I Audit 4610 Fall 2019 Part I Background: PounceWear is a privately owned business that began operations in March 2015. Its sole business is the manufacture and sale of upper-end, high-tech sportswear. It only sells to large distribution outlets. Its primary product is a line of lightweight exercise clothes that contain a new, long-range RFID chip that captures the following information about the user based on personal data (age, weight, etc.) entered by the user: Heart rate Perspiration rate Calories burned Exercise efficiency (percent of capacity) The chip is able to continuously send this information to a host device as far away as 15 miles. The clothes are also GPS enabled and able to track routes, distances and elevations. Management prides itself on being on the cutting edge. The company expects to conduct an IPO within a year or two. Pounce Wear recently retained your firm as its auditors, largely because of your commitment to conduct a highly efficient, technology-enabled audit. Data: You are first responsible for performing a risk assessment of Pounce Wear related to its order-to- cash function. Therefore, you know that your focus needs to be on sales and cash transactions. Your first task is to acquire the data for these transactions. You work with PounceWear's IT group to gain access to its sales and cash receipts data for its start-up period of operations, March through December 2015. You have been provided with an Excel file with this data (found on iCollege in the Data Analytics Case folder > Part I Student Workbook > 2015 Data tab) so you can begin your analysis. The data file includes the following fields: Type: The type of transaction, which is either a sale (Sales) or a cash receipt (CashReceipt). Transaction Number: The transaction number (beginning with 1001). AppliedToTransaction Number: The sales transaction number to which a cash receipt is applied. CustNum: A unique customer number used to identify each customer. CustName: The customer's name. TransactionDate: The date of the sale or cash receipt. Amount: The amount of the sale or cash receipt. Cash receipts will show a negative amount. InvoiceDate: The date the sale was invoiced (billed). ShipDate: The date the goods were shipped. Required: The goal of Part I is to familiarize yourself with the data that you will use throughout this case. In doing so, you will also practice approaches to examining the completeness and accuracy of data before performing analyses. Respond to the following prompts using Excel. Document your responses in the corresponding worksheets in the workbook Part I Student Workbook found on iCollege. 1. You've been told that the accounts receivable balance on the general ledger at December 31, 2015, is $684,491.19. You also know that as a start-up company, the beginning accounts receivable balance is zero. You are also told that there are no returns or write-offs in 2015. Verify this balance. Consider causes for discrepancies, if any. 2. You've also been told that PounceWear only conducts business with the following 15 approved customers. Validate that there are no other customer names and that no customer names are misspelled. Bigmart Neighborhood Athletic Supply Cool Threads Northern Lites Corner Runner Runner's Market Cross Country Mart Southeast Regional Family Fit Southern Runners Fit N Fun Super Runners Mark Goodway Urban Runner ValueChoice 3. The sales transaction log shows that 230 sales were transacted this year, beginning with transaction 1001. Verify that the data for all of these invoices has been captured and that there are no additional invoices or duplicates included in the file. Evaluation: The assignment is worth 25 points: 10 points for the Excel portion, and 15 points for a one-page memo. Both the memo and Excel file should be prepared as if they are to be included in the audit work papers, meaning they serve two purposes: (1) To document the evidence underlying the audit opinion that is eventually given, and (2) to inform other auditors (for example, a reviewer or the auditor performing your duties in a later year) of the nature, extent, timing, and results of the procedure such that the other auditor could reperform the procedure. For the Excel portion, you should: - Utilize a reasonably advanced level of skill to obtain the correct answers to the prompts. Leave in Excel functions/formulas where applicable. Use professional formatting, worthy of including in the audit documentation, which allows a user to easily identify the key information. In the memo, you should: - Address the following questions: o What was the overall purpose of the procedures you performed to the audit? o How did you perform the procedures? o What did each procedure reveal? o What are your overall conclusions/recommendations given these findings? Use professional tone, grammar, and formatting. Do not write as if you are responding to a list of questions for class. Be warned: This, and all writing assignments in class, are held to a high standard of professionalism for tone, grammar and formatting. I recommend that all group members take the time to read and edit writing assignments before turning them in. - Use 11 point font, 1.5 spacing, and 1-inch margins. Do not exceed one page. Upload your completed file to iCollege (Assessments > Assignments > Analytics Project Part I) by 2PM on 9/23/19 for the MW section (7PM on 9/24/19 for the Tuesday section). Save your document following this example for a group consisting of John Smith, Jane Doe, and Mick Jagger, who are in a group together in the MW class: Partl.Doe J Jagger M_Smith J_MW.xls + Notice that the last names are in ABC order. Data Analytics Case Instructions: Part I Audit 4610 Fall 2019 Part I Background: PounceWear is a privately owned business that began operations in March 2015. Its sole business is the manufacture and sale of upper-end, high-tech sportswear. It only sells to large distribution outlets. Its primary product is a line of lightweight exercise clothes that contain a new, long-range RFID chip that captures the following information about the user based on personal data (age, weight, etc.) entered by the user: Heart rate Perspiration rate Calories burned Exercise efficiency (percent of capacity) The chip is able to continuously send this information to a host device as far away as 15 miles. The clothes are also GPS enabled and able to track routes, distances and elevations. Management prides itself on being on the cutting edge. The company expects to conduct an IPO within a year or two. Pounce Wear recently retained your firm as its auditors, largely because of your commitment to conduct a highly efficient, technology-enabled audit. Data: You are first responsible for performing a risk assessment of Pounce Wear related to its order-to- cash function. Therefore, you know that your focus needs to be on sales and cash transactions. Your first task is to acquire the data for these transactions. You work with PounceWear's IT group to gain access to its sales and cash receipts data for its start-up period of operations, March through December 2015. You have been provided with an Excel file with this data (found on iCollege in the Data Analytics Case folder > Part I Student Workbook > 2015 Data tab) so you can begin your analysis. The data file includes the following fields: Type: The type of transaction, which is either a sale (Sales) or a cash receipt (CashReceipt). Transaction Number: The transaction number (beginning with 1001). AppliedToTransaction Number: The sales transaction number to which a cash receipt is applied. CustNum: A unique customer number used to identify each customer. CustName: The customer's name. TransactionDate: The date of the sale or cash receipt. Amount: The amount of the sale or cash receipt. Cash receipts will show a negative amount. InvoiceDate: The date the sale was invoiced (billed). ShipDate: The date the goods were shipped. Required: The goal of Part I is to familiarize yourself with the data that you will use throughout this case. In doing so, you will also practice approaches to examining the completeness and accuracy of data before performing analyses. Respond to the following prompts using Excel. Document your responses in the corresponding worksheets in the workbook Part I Student Workbook found on iCollege. 1. You've been told that the accounts receivable balance on the general ledger at December 31, 2015, is $684,491.19. You also know that as a start-up company, the beginning accounts receivable balance is zero. You are also told that there are no returns or write-offs in 2015. Verify this balance. Consider causes for discrepancies, if any. 2. You've also been told that PounceWear only conducts business with the following 15 approved customers. Validate that there are no other customer names and that no customer names are misspelled. Bigmart Neighborhood Athletic Supply Cool Threads Northern Lites Corner Runner Runner's Market Cross Country Mart Southeast Regional Family Fit Southern Runners Fit N Fun Super Runners Mark Goodway Urban Runner ValueChoice 3. The sales transaction log shows that 230 sales were transacted this year, beginning with transaction 1001. Verify that the data for all of these invoices has been captured and that there are no additional invoices or duplicates included in the file. Evaluation: The assignment is worth 25 points: 10 points for the Excel portion, and 15 points for a one-page memo. Both the memo and Excel file should be prepared as if they are to be included in the audit work papers, meaning they serve two purposes: (1) To document the evidence underlying the audit opinion that is eventually given, and (2) to inform other auditors (for example, a reviewer or the auditor performing your duties in a later year) of the nature, extent, timing, and results of the procedure such that the other auditor could reperform the procedure. For the Excel portion, you should: - Utilize a reasonably advanced level of skill to obtain the correct answers to the prompts. Leave in Excel functions/formulas where applicable. Use professional formatting, worthy of including in the audit documentation, which allows a user to easily identify the key information. In the memo, you should: - Address the following questions: o What was the overall purpose of the procedures you performed to the audit? o How did you perform the procedures? o What did each procedure reveal? o What are your overall conclusions/recommendations given these findings? Use professional tone, grammar, and formatting. Do not write as if you are responding to a list of questions for class. Be warned: This, and all writing assignments in class, are held to a high standard of professionalism for tone, grammar and formatting. I recommend that all group members take the time to read and edit writing assignments before turning them in. - Use 11 point font, 1.5 spacing, and 1-inch margins. Do not exceed one page. Upload your completed file to iCollege (Assessments > Assignments > Analytics Project Part I) by 2PM on 9/23/19 for the MW section (7PM on 9/24/19 for the Tuesday section). Save your document following this example for a group consisting of John Smith, Jane Doe, and Mick Jagger, who are in a group together in the MW class: Partl.Doe J Jagger M_Smith J_MW.xls + Notice that the last names are in ABC orderStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started