PLEASE HELP ME!!!!!!!

PLEASE HELP ME!!!!!!!

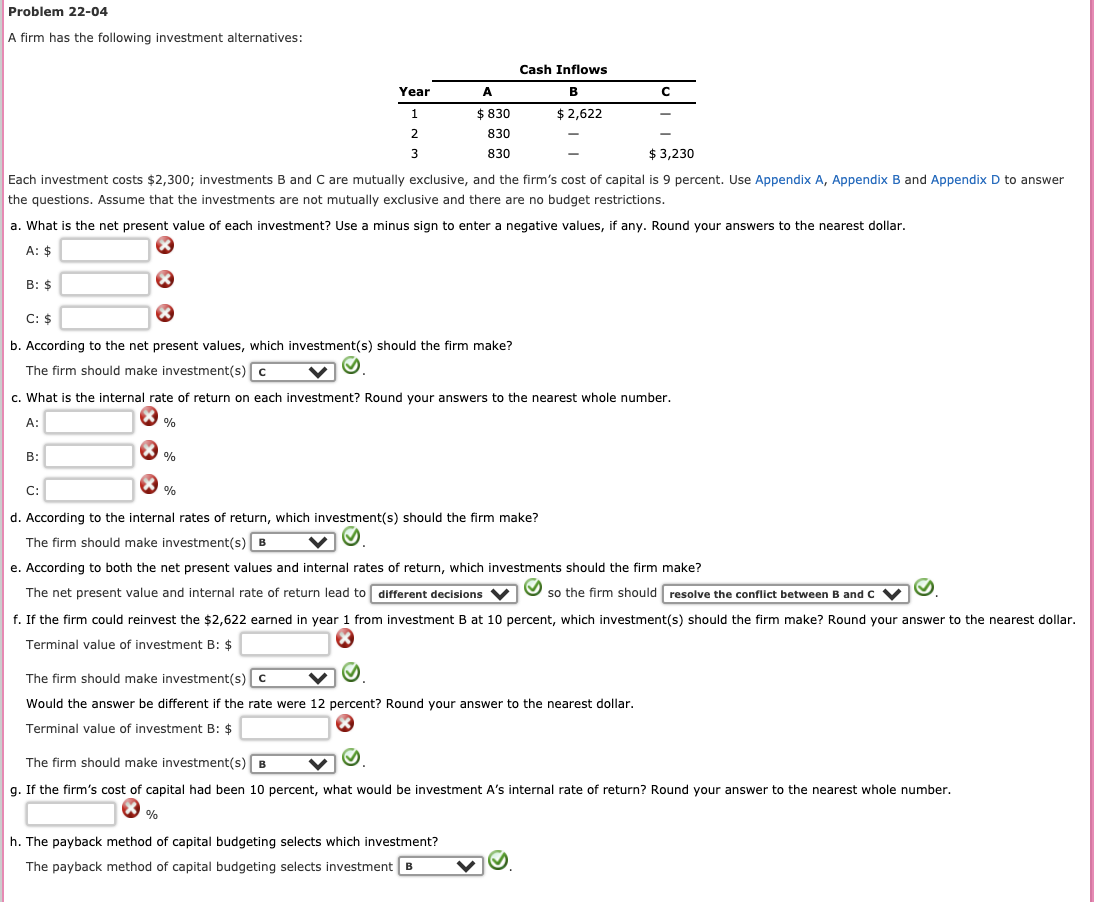

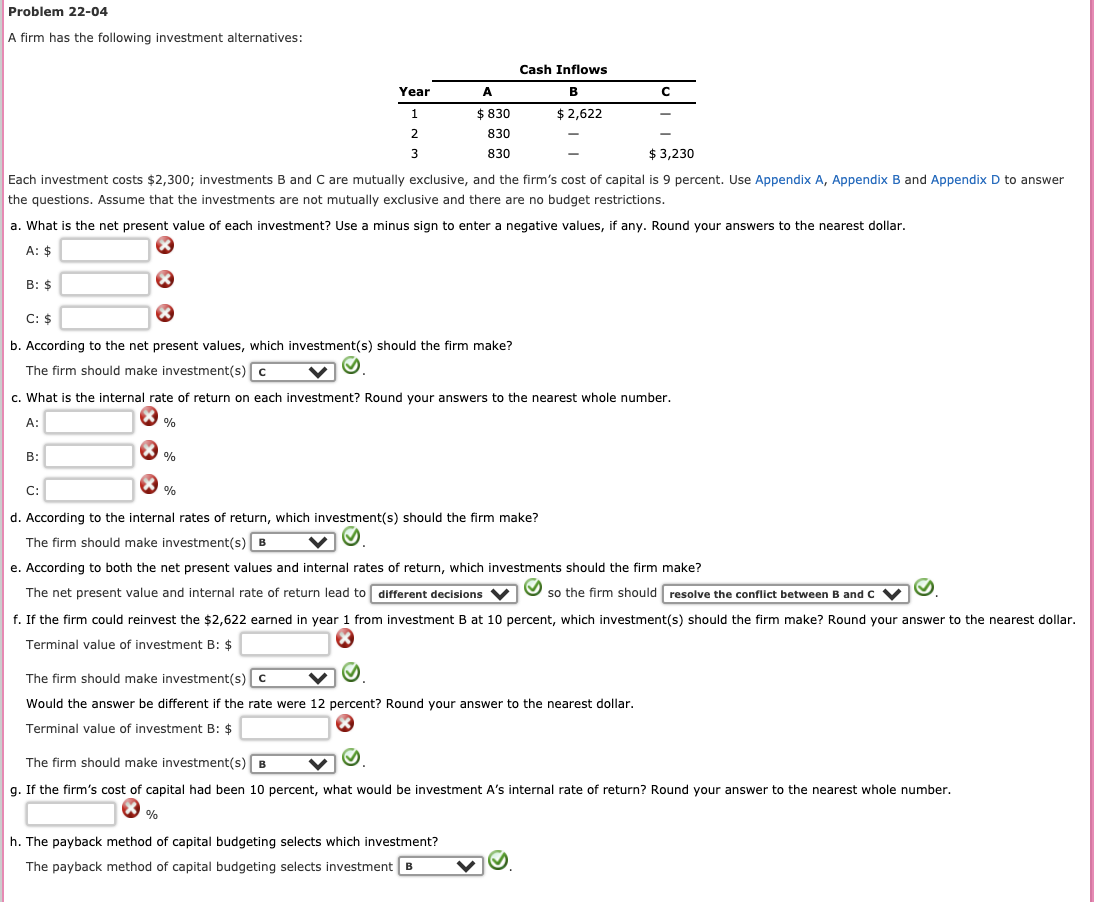

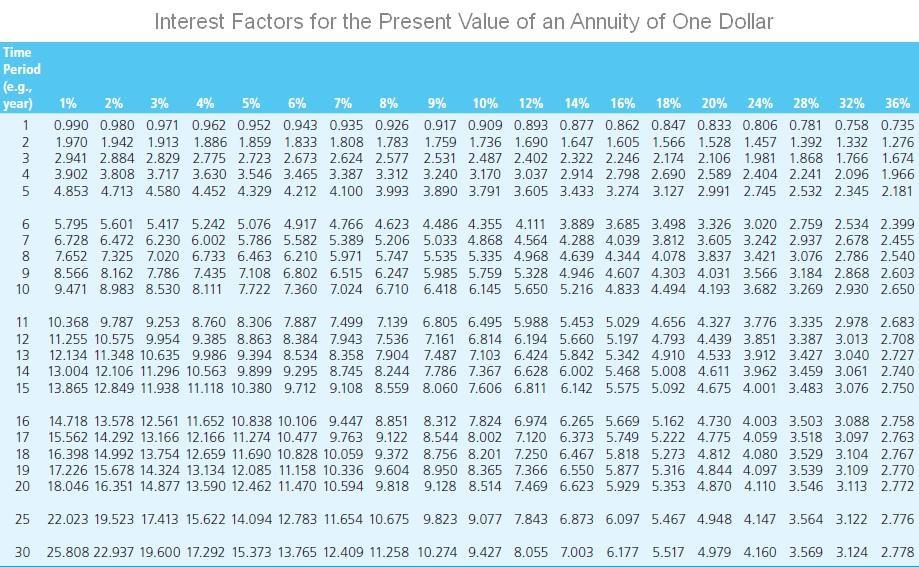

Each investment costs $2,300; investments B and C are mutually exclusive, and the firms cost of capital is 9 percent. Use Appendix A, Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions.

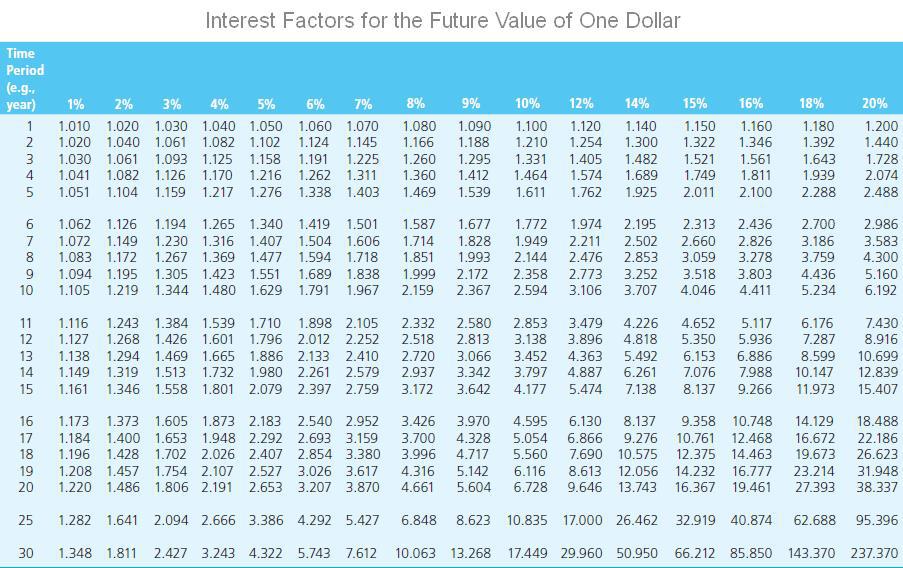

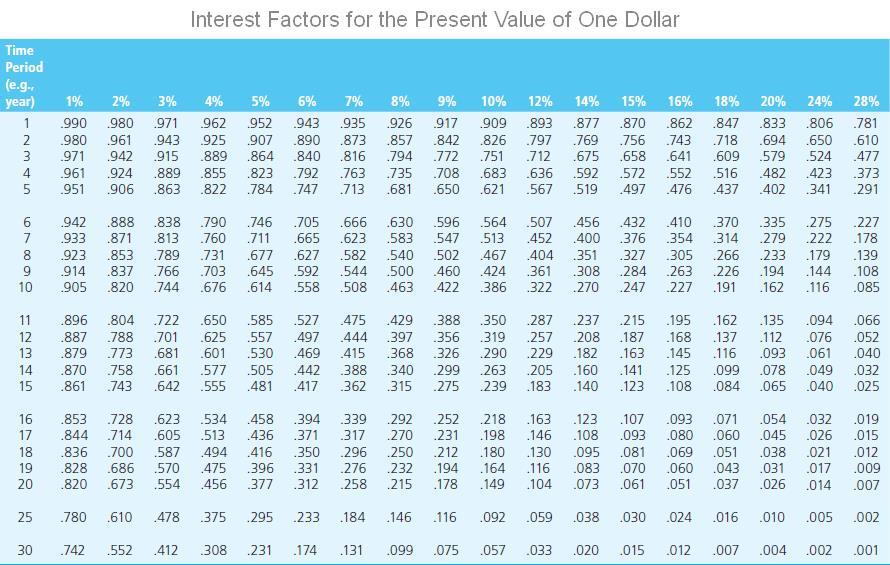

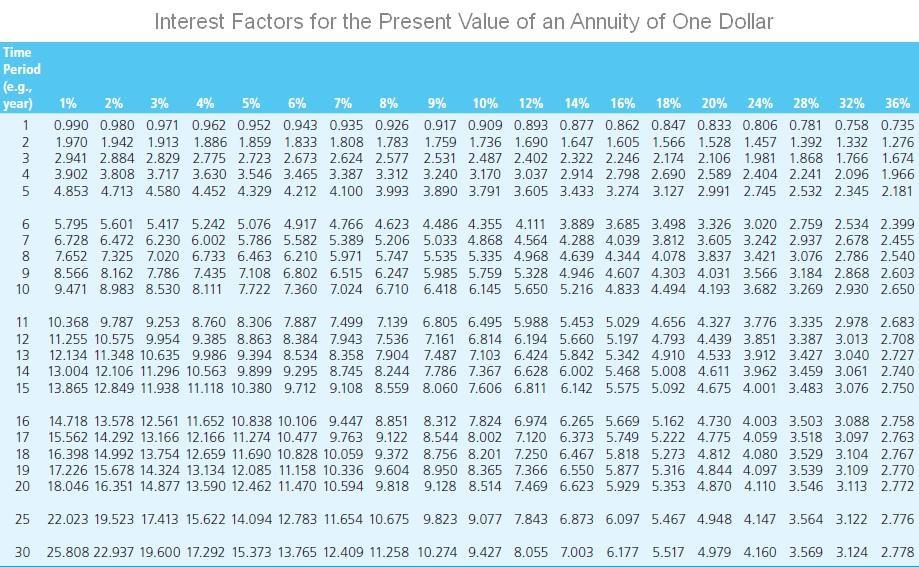

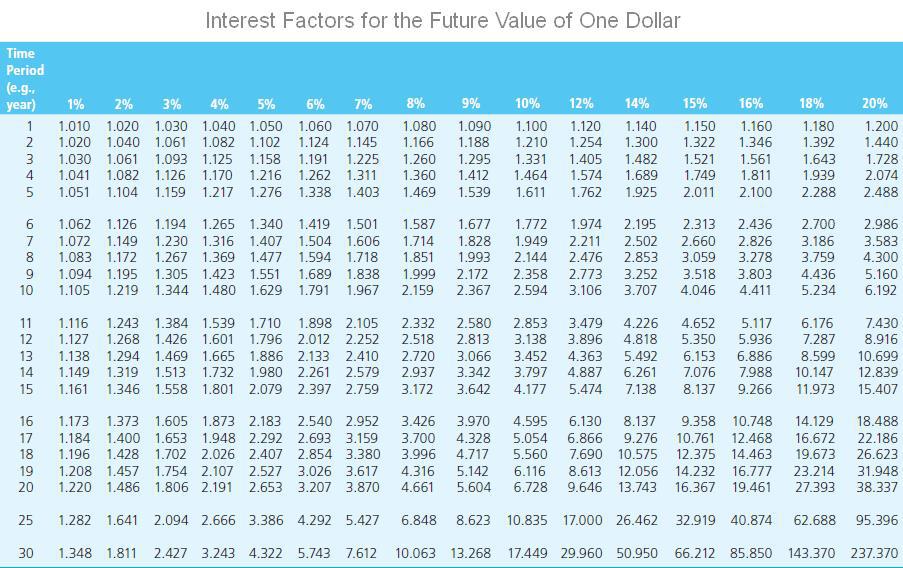

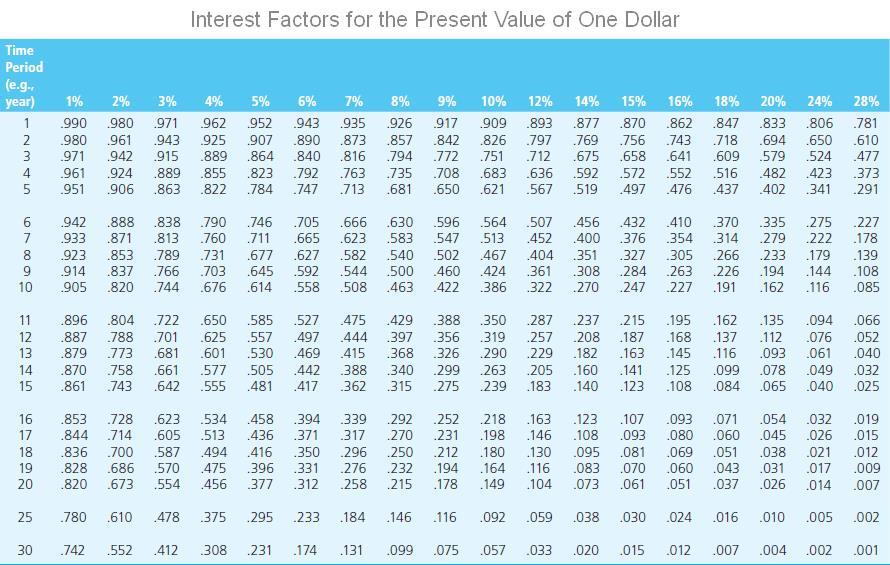

Interest Factors for the Future Value of One Dollar 2% 7% Time Period (e.g.. year) 1 2 3 4 5 1% 3% 4% 5% 6% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.020 1.040 1.061 1.082 1.102 1.124 1.145 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.051 1.104 1.159 1.217 1.276 1.338 1.403 8% 9% 1.080 1.090 1.166 1.188 1.260 1.295 1.360 1.412 1.469 1.539 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.322 1.521 1.749 2.011 16% 1.160 1.346 1.561 1.811 2.100 18% 1.180 1.392 1.643 1.939 2.288 20% 1.200 1.440 1.728 2.074 2.488 6 7 8 9 10 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.105 1.219 1.344 1.480 1.629 1.791 1.967 1.587 1.714 1.851 1.999 2.159 1.677 1.828 1.993 2.172 2.367 1.772 1.949 2.144 2.358 2.594 1.974 2.211 2.476 2.773 3.106 2.195 2.502 2.853 3.252 3.707 2.313 2.436 2.660 2.826 3.059 3.278 3.518 3.803 4.046 4.411 2.700 3.186 3.759 4.436 5.234 2.986 3.583 4.300 5.160 6.192 11 12 13 14 15 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 2.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.797 4.177 3.479 4.226 3.896 4.818 4.363 5.492 4.887 6.261 5.474 7.138 4.652 5.117 5.350 5.936 6.153 6.886 7.076 7.988 8.137 9.266 6.176 7.287 8.599 10.147 11.973 7.430 8.916 10.699 12.839 15.407 16 17 18 19 20 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.996 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4.661 3.970 4.328 4.717 5.142 5.604 4.595 6.130 8.137 9.358 10.748 5.054 6.866 9.276 10.761 12.468 5.560 7.690 10.575 12.375 14.463 6.116 8.613 12.056 14.232 16.777 6.728 9.646 13.743 16.367 19.461 14.129 16.672 19.673 23.214 27.393 18.488 22.186 26.623 31.948 38.337 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 17.000 26.462 32.919 40.874 62.688 95.396 30 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.063 13.268 17.449 29.960 50.950 66.212 85.850 143.370 237.370 Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 1 4% 7% NM 1% .990 980 971 .961 951 2% 3% 5% .980 971 1962 952 1961 943 925 907 1942 .915 .889864 924 889 855 .823 .906 863 822 .784 6% 943 .935 .890 .873 .840.816 .792 .763 .747 .713 8% 1926 .857 .794 .735 .681 9% 917 .842 .772 .708 .650 10% 12% 14% 15% 16% 909.893 .877 870 .862 .826 .797 .769 .756 .743 .751 .712 .675 .658 .641 .683 636 592 .572 .552 .621 567 519 497 476 18% .847 .718 .609 .516 437 20% .833 .694 .579 482 402 24% .806 .650 .524 423 341 28% .781 .610 477 .373 291 4 5 .432 6 7 8 9 10 942 933 923 914 905 .888 838 790 .746 .705.666 630 .871 .813 .760 .711 .665.623 583 .853 .789 .731 677 627 582 .540 .837 .766 .703 645 592 544 .500 .820 .744 676 614 558 508 463 596 -547 -502 460 .422 .564 507 .513 452 467 .404 424 361 .386 .322 456 .410 .370 .335 400 376 .354 314 .279 351 327 305 266 233 .308 .284 .263 226 194 .270 247 .227 191 .162 .275 .222 .179 .144 .116 .227 .178 .139 .108 .085 11 12 13 .896 .887 .879 .870 .861 .804 .788 .773 .758 .743 .722 .701 .681 .661 .642 .650 .625 .601 .577 .555 .585 .557 .530 .505 .481 .527 .497 469 .442 .417 475 .444 415 388 .362 .429 .388 .397 .356 368 326 .340 .299 .315 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 .208 .182 .160 .140 .215 .187 .163 .141 .123 .195 162 .168 .137 .145 .116 .125 .099 .108 .084 .135 .112 .093 .078 .065 .094 .076 .061 .049 .040 .066 .052 .040 .032 .025 16 17 18 19 20 .853 .844 .836 .828 .820 .728 .714 .700 .686 .673 .623 .605 .587 .570 .554 .534 .513 1494 475 456 .458 436 416 .396 377 .394 .371 350 .331 312 339 .317 .296 .276 .258 .292 .270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .163 .146 .130 .116 .104 .123 .107.093 071 .054 .032 .019 .108.093 .080 .060 .045 .026 .015 .095 .081 069 .051 038 021 .012 .083 .070 ,060 .043 031 .017 .009 .073 .061 .051 037 .026 .014 .007 25 .780 .610 478 .375 .295 .233 .184 .146 .116 .092 .059 .038 .030 .024 .016 .010 .005 .002 30 .742 552 412 308 .231 .174 .131 .099 .075 .057 033 .020 .015 .012 .007.004 .002 .001 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g., year) 1 2 3 4 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 2.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.76 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778 Problem 22-04 A firm has the following investment alternatives: Year Cash Inflows B $ 2,622 1 2 3 $ 830 830 830 $3,230 Each investment costs $2,300; investments B and C are mutually exclusive, and the firm's cost of capital is 9 percent. Use Appendix A, Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions. a. What is the net present value of each investment? Use a minus sign to enter a negative values, if any. Round your answers to the nearest dollar. A: $ B: $ C: $ b. According to the net present values, which investment(s) should the firm make? The firm should make investment(s) C c. What is the internal rate of return on each investment? Round your answers to the nearest whole number. A: % B: X % C: % d. According to the internal rates of return, which investment(s) should the firm make? The firm should make investment(s) B e. According to both the net present values and internal rates of return, which investments should the firm make? The net present value and internal rate of return lead to different decisions vso the firm should resolve the conflict between B and c V f. If the firm could reinvest the $2,622 earned in year 1 from investment B at 10 percent, which investment(s) should the firm make? Round your answer to the nearest dollar. Terminal value of investment B: $ The firm should make investment(s) C Would the answer be different the rate were 12 percent? Round your answer to the nearest dollar. Terminal value of investment B: $ The firm should make investment(s) B g. If the firm's cost of capital had been 10 percent, what would be investment A's internal rate of return? Round your answer to the nearest whole number. % h. The payback method of capital budgeting selects which investment? The payback method of capital budgeting selects investment B Interest Factors for the Future Value of One Dollar 2% 7% Time Period (e.g.. year) 1 2 3 4 5 1% 3% 4% 5% 6% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.020 1.040 1.061 1.082 1.102 1.124 1.145 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.051 1.104 1.159 1.217 1.276 1.338 1.403 8% 9% 1.080 1.090 1.166 1.188 1.260 1.295 1.360 1.412 1.469 1.539 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.322 1.521 1.749 2.011 16% 1.160 1.346 1.561 1.811 2.100 18% 1.180 1.392 1.643 1.939 2.288 20% 1.200 1.440 1.728 2.074 2.488 6 7 8 9 10 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.105 1.219 1.344 1.480 1.629 1.791 1.967 1.587 1.714 1.851 1.999 2.159 1.677 1.828 1.993 2.172 2.367 1.772 1.949 2.144 2.358 2.594 1.974 2.211 2.476 2.773 3.106 2.195 2.502 2.853 3.252 3.707 2.313 2.436 2.660 2.826 3.059 3.278 3.518 3.803 4.046 4.411 2.700 3.186 3.759 4.436 5.234 2.986 3.583 4.300 5.160 6.192 11 12 13 14 15 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 2.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.797 4.177 3.479 4.226 3.896 4.818 4.363 5.492 4.887 6.261 5.474 7.138 4.652 5.117 5.350 5.936 6.153 6.886 7.076 7.988 8.137 9.266 6.176 7.287 8.599 10.147 11.973 7.430 8.916 10.699 12.839 15.407 16 17 18 19 20 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.996 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4.661 3.970 4.328 4.717 5.142 5.604 4.595 6.130 8.137 9.358 10.748 5.054 6.866 9.276 10.761 12.468 5.560 7.690 10.575 12.375 14.463 6.116 8.613 12.056 14.232 16.777 6.728 9.646 13.743 16.367 19.461 14.129 16.672 19.673 23.214 27.393 18.488 22.186 26.623 31.948 38.337 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 17.000 26.462 32.919 40.874 62.688 95.396 30 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.063 13.268 17.449 29.960 50.950 66.212 85.850 143.370 237.370 Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 1 4% 7% NM 1% .990 980 971 .961 951 2% 3% 5% .980 971 1962 952 1961 943 925 907 1942 .915 .889864 924 889 855 .823 .906 863 822 .784 6% 943 .935 .890 .873 .840.816 .792 .763 .747 .713 8% 1926 .857 .794 .735 .681 9% 917 .842 .772 .708 .650 10% 12% 14% 15% 16% 909.893 .877 870 .862 .826 .797 .769 .756 .743 .751 .712 .675 .658 .641 .683 636 592 .572 .552 .621 567 519 497 476 18% .847 .718 .609 .516 437 20% .833 .694 .579 482 402 24% .806 .650 .524 423 341 28% .781 .610 477 .373 291 4 5 .432 6 7 8 9 10 942 933 923 914 905 .888 838 790 .746 .705.666 630 .871 .813 .760 .711 .665.623 583 .853 .789 .731 677 627 582 .540 .837 .766 .703 645 592 544 .500 .820 .744 676 614 558 508 463 596 -547 -502 460 .422 .564 507 .513 452 467 .404 424 361 .386 .322 456 .410 .370 .335 400 376 .354 314 .279 351 327 305 266 233 .308 .284 .263 226 194 .270 247 .227 191 .162 .275 .222 .179 .144 .116 .227 .178 .139 .108 .085 11 12 13 .896 .887 .879 .870 .861 .804 .788 .773 .758 .743 .722 .701 .681 .661 .642 .650 .625 .601 .577 .555 .585 .557 .530 .505 .481 .527 .497 469 .442 .417 475 .444 415 388 .362 .429 .388 .397 .356 368 326 .340 .299 .315 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 .208 .182 .160 .140 .215 .187 .163 .141 .123 .195 162 .168 .137 .145 .116 .125 .099 .108 .084 .135 .112 .093 .078 .065 .094 .076 .061 .049 .040 .066 .052 .040 .032 .025 16 17 18 19 20 .853 .844 .836 .828 .820 .728 .714 .700 .686 .673 .623 .605 .587 .570 .554 .534 .513 1494 475 456 .458 436 416 .396 377 .394 .371 350 .331 312 339 .317 .296 .276 .258 .292 .270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .163 .146 .130 .116 .104 .123 .107.093 071 .054 .032 .019 .108.093 .080 .060 .045 .026 .015 .095 .081 069 .051 038 021 .012 .083 .070 ,060 .043 031 .017 .009 .073 .061 .051 037 .026 .014 .007 25 .780 .610 478 .375 .295 .233 .184 .146 .116 .092 .059 .038 .030 .024 .016 .010 .005 .002 30 .742 552 412 308 .231 .174 .131 .099 .075 .057 033 .020 .015 .012 .007.004 .002 .001 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g., year) 1 2 3 4 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 2.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.76 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778 Problem 22-04 A firm has the following investment alternatives: Year Cash Inflows B $ 2,622 1 2 3 $ 830 830 830 $3,230 Each investment costs $2,300; investments B and C are mutually exclusive, and the firm's cost of capital is 9 percent. Use Appendix A, Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions. a. What is the net present value of each investment? Use a minus sign to enter a negative values, if any. Round your answers to the nearest dollar. A: $ B: $ C: $ b. According to the net present values, which investment(s) should the firm make? The firm should make investment(s) C c. What is the internal rate of return on each investment? Round your answers to the nearest whole number. A: % B: X % C: % d. According to the internal rates of return, which investment(s) should the firm make? The firm should make investment(s) B e. According to both the net present values and internal rates of return, which investments should the firm make? The net present value and internal rate of return lead to different decisions vso the firm should resolve the conflict between B and c V f. If the firm could reinvest the $2,622 earned in year 1 from investment B at 10 percent, which investment(s) should the firm make? Round your answer to the nearest dollar. Terminal value of investment B: $ The firm should make investment(s) C Would the answer be different the rate were 12 percent? Round your answer to the nearest dollar. Terminal value of investment B: $ The firm should make investment(s) B g. If the firm's cost of capital had been 10 percent, what would be investment A's internal rate of return? Round your answer to the nearest whole number. % h. The payback method of capital budgeting selects which investment? The payback method of capital budgeting selects investment B

PLEASE HELP ME!!!!!!!

PLEASE HELP ME!!!!!!!