please help me eith this wuestion i really meed help

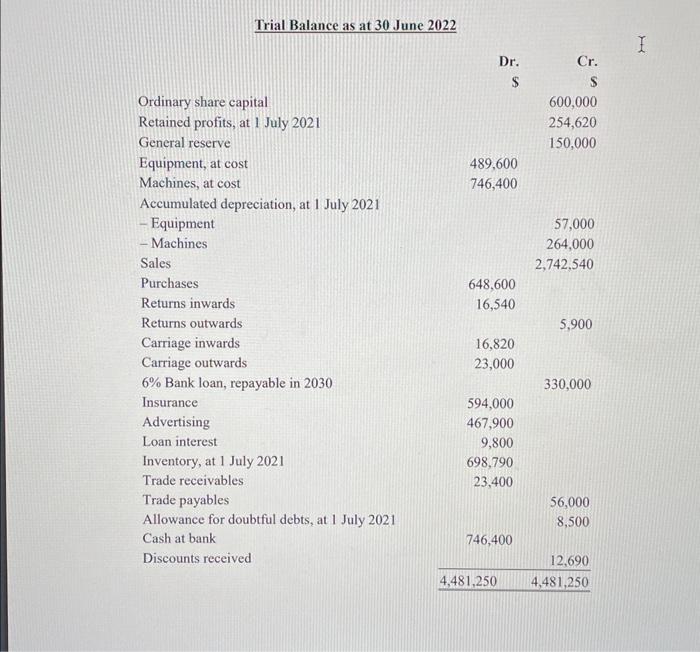

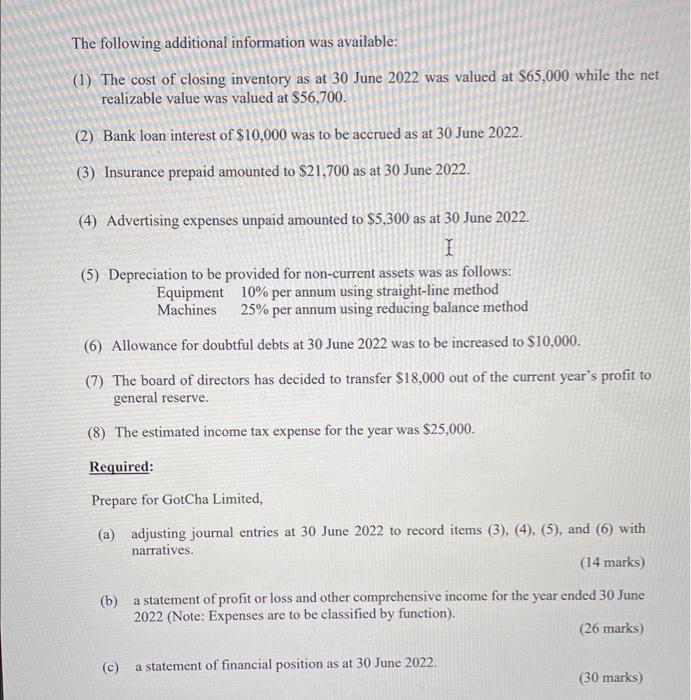

Trial Balance as at 30 June 2022 The following additional information was available: (1) The cost of closing inventory as at 30 June 2022 was valued at $65,000 while the net realizable value was valued at $56,700. (2) Bank loan interest of $10,000 was to be accrued as at 30 June 2022. (3) Insurance prepaid amounted to $21,700 as at 30 June 2022. (4) Advertising expenses unpaid amounted to $5,300 as at 30 June 2022. (5) Depreciation to be provided for non-current assets was as follows: Equipment 10% per annum using straight-line method Machines 25% per annum using reducing balance method (6) Allowance for doubtful debts at 30 June 2022 was to be increased to $10,000. (7) The board of directors has decided to transfer $18,000 out of the current year's profit to general reserve. (8) The estimated income tax expense for the year was $25,000. Required: Prepare for GotCha Limited, (a) adjusting journal entries at 30 June 2022 to record items (3), (4), (5), and (6) with narratives. (14 marks) (b) a statement of profit or loss and other comprehensive income for the year ended 30 June 2022 (Note: Expenses are to be classified by function). (26 marks) (c) a statement of financial position as at 30 June 2022. (30 marks) Trial Balance as at 30 June 2022 The following additional information was available: (1) The cost of closing inventory as at 30 June 2022 was valued at $65,000 while the net realizable value was valued at $56,700. (2) Bank loan interest of $10,000 was to be accrued as at 30 June 2022. (3) Insurance prepaid amounted to $21,700 as at 30 June 2022. (4) Advertising expenses unpaid amounted to $5,300 as at 30 June 2022. (5) Depreciation to be provided for non-current assets was as follows: Equipment 10% per annum using straight-line method Machines 25% per annum using reducing balance method (6) Allowance for doubtful debts at 30 June 2022 was to be increased to $10,000. (7) The board of directors has decided to transfer $18,000 out of the current year's profit to general reserve. (8) The estimated income tax expense for the year was $25,000. Required: Prepare for GotCha Limited, (a) adjusting journal entries at 30 June 2022 to record items (3), (4), (5), and (6) with narratives. (14 marks) (b) a statement of profit or loss and other comprehensive income for the year ended 30 June 2022 (Note: Expenses are to be classified by function). (26 marks) (c) a statement of financial position as at 30 June 2022. (30 marks)