Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME EXPLAIN HOW THIS ANSWER IS GOTTEN. A pension fund wants to enter into a six - month equity swap with a notional

PLEASE HELP ME EXPLAIN HOW THIS ANSWER IS GOTTEN.

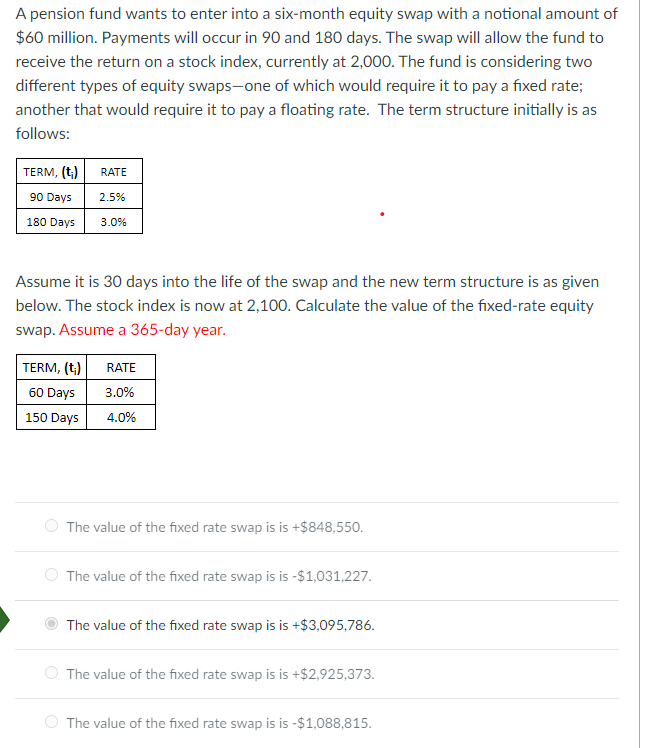

A pension fund wants to enter into a sixmonth equity swap with a notional amount of

$ million. Payments will occur in and days. The swap will allow the fund to

receive the return on a stock index, currently at The fund is considering two

different types of equity swapsone of which would require it to pay a fixed rate;

another that would require it to pay a floating rate. The term structure initially is as

follows:

Assume it is days into the life of the swap and the new term structure is as given

below. The stock index is now at Calculate the value of the fixedrate equity

swap. Assume a day year.

The value of the fixed rate swap is is $

The value of the fixed rate swap is is $

The value of the fixed rate swap is is $

The value of the fixed rate swap is is $

The value of the fixed rate swap is is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started