Answered step by step

Verified Expert Solution

Question

1 Approved Answer

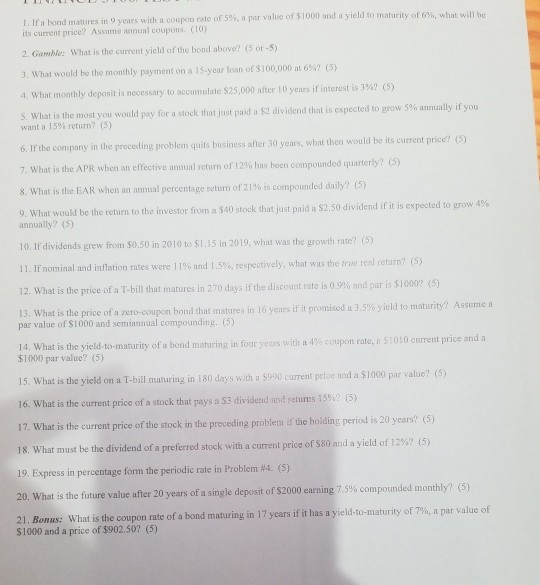

Please help me figure and show formula used reviewing for my test a value of 51000 and n yield to maturity of 6% what will

Please help me figure and show formula used reviewing for my test

a value of 51000 and n yield to maturity of 6% what will be a nd matures in Ovcars with a coupon rate of 5% its current price? Assuno annunt coupons (10) 2. Gamble: What is the current yield of the bond above? (5 or-5) 3. What would be the monthly payment on a 15-year loan of $100,000 n67 (5) (5) 4. What monthly deposit is necessary to accumulate S25,000 after 10 years if interest is 3% $2 dividend that is expected to grow 5% annually if you 5. What is the most you would pay for a stock that just paid Santi 15% returny (5) 6. If the company in the preceding problem quits businessler 30 years, what then would be its current price? (5) 7. What is the APR when an effective annual return of 12% has been compounded quarterly (5) 8. What is the EAR when an annual percentage return of 21% is compounded daily? (5) 9. What would be the return to the investor from a $40 stock that just paid it $2.50 dividend if it is expected to grow 4% annunlly? (5) 10. Il dividends grew from $0.50 in 2010 to $1.15 in 2019, what was the growth rate? (5) 11. If nominal and inflation rates were 11% and 1.5%, respectively, what was the true real returny (5) 12. What is the price of a T-bill that matures in 270 days if the discount rate is 0.9% and gar is $10002 (5) 13. What is the price of a zero-coupon bond that matures in 16 years if it promised a 3.5% yield to maturity? Assume a par value of S1000 and semiannual compounding (5) 14. What is the yield-to-maturity of a bond maturing in four years with a 4% coupon rate, SEDI current price and a $1000 par value? (5) 15. What is the yield on a T-bill maturing in 180 days with $900 current price and a $1000 par value? (5) 16. What is the current price of a stock that pays a S3 dividend and returns 15%? (5) (5) 17. What is the current price of the stock in the preceding problem if the holding period is 20 years 18. What must be the dividend of a preferred stock with a current price of 580 and a yield of 12%? (5) 19. Express in percentage for the periodic rate in Problem #4 (5) 20. What is the future value after 20 years of a single deposit of $2000 earning 7.5% compounded monthly? (5) 21. Bonus: What is the coupon rate of a bond maturing in 17 years if it has a yield-to-maturity of 7%, il par value of $1000 and a price of $902.507Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started