please help me figure out the numeric amounts to debit/credit for #7-14, i attached additional info to help you out. thank you so much in advance!!

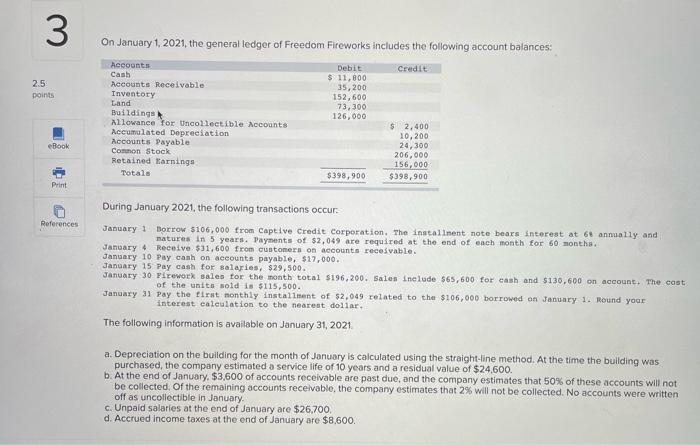

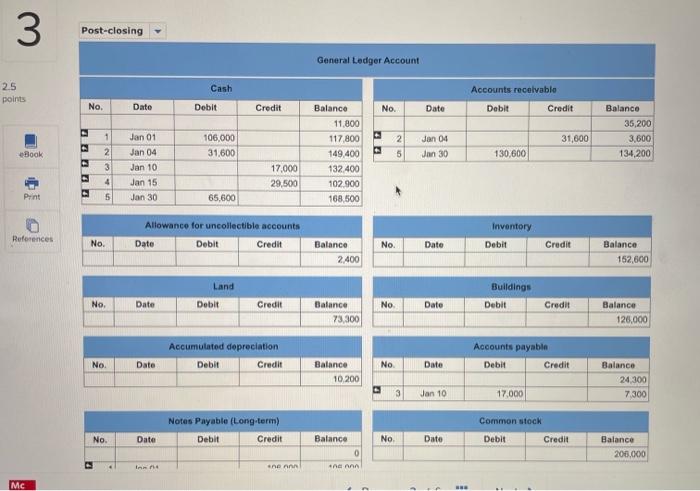

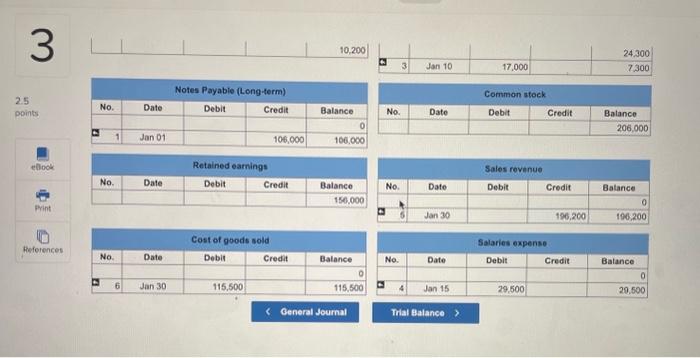

On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: During January 2021, the following transactions occur: January 1 Borrow $106,000 from Captive Credit corporation. The inataliment note bears interest at 68 annually and natures in 5 years. Paynents of $2,049 are required at the end of each nonth for 60 nonths. January 4 Recelve $31,600 from cuntonern on accounts receivable. January 10. Pay canh on aceounts payable, $17,000. January 15 Pay cast for solaries, $29,500. January 30 Firework sales tor the month total $196,200. Salen fnelude $65,600 for cash and 5130,600 on account, The cast January 31 of the units sold is $115,500. January 31 Pay the f1rnt nonthly instal1eent of $2,049 related to then $106,000 borrowed an January 1. Round your interest ealeulation to the nearest dollar. The following information is available on January 31,2021 . a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $24,600. b. At the end of January, $3,600 of accounts receivable are past due, and the company estimates that 50% of these accounts will not be collected, Of the remaining accounts receivable, the company estimates that 2% will not be collected. No accounts were written off as uncollectible in January. c. Unpaid salaries at the end of January are $26,700. d. Accrued income taxes at the end of January are $8,600. General Ledger Account \begin{tabular}{|r|r|r|r|r|} \hline & & & & 24,300 \\ \hline E & 3 & Jan10 & 17,000 & 7,300 \\ \hline \end{tabular} 2.5 points \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{ Retalned eamings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 150.000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{ Cormmon stock } \\ \hline No. & Date & Debit & Credit & Batance \\ \hline & & & & 206,000 \\ \hline \end{tabular} \& General Journal Trlat Balance ? On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: During January 2021, the following transactions occur: January 1 Borrow $106,000 from Captive Credit corporation. The inataliment note bears interest at 68 annually and natures in 5 years. Paynents of $2,049 are required at the end of each nonth for 60 nonths. January 4 Recelve $31,600 from cuntonern on accounts receivable. January 10. Pay canh on aceounts payable, $17,000. January 15 Pay cast for solaries, $29,500. January 30 Firework sales tor the month total $196,200. Salen fnelude $65,600 for cash and 5130,600 on account, The cast January 31 of the units sold is $115,500. January 31 Pay the f1rnt nonthly instal1eent of $2,049 related to then $106,000 borrowed an January 1. Round your interest ealeulation to the nearest dollar. The following information is available on January 31,2021 . a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $24,600. b. At the end of January, $3,600 of accounts receivable are past due, and the company estimates that 50% of these accounts will not be collected, Of the remaining accounts receivable, the company estimates that 2% will not be collected. No accounts were written off as uncollectible in January. c. Unpaid salaries at the end of January are $26,700. d. Accrued income taxes at the end of January are $8,600. General Ledger Account \begin{tabular}{|r|r|r|r|r|} \hline & & & & 24,300 \\ \hline E & 3 & Jan10 & 17,000 & 7,300 \\ \hline \end{tabular} 2.5 points \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{ Retalned eamings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 150.000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{ Cormmon stock } \\ \hline No. & Date & Debit & Credit & Batance \\ \hline & & & & 206,000 \\ \hline \end{tabular} \& General Journal Trlat Balance