Answered step by step

Verified Expert Solution

Question

1 Approved Answer

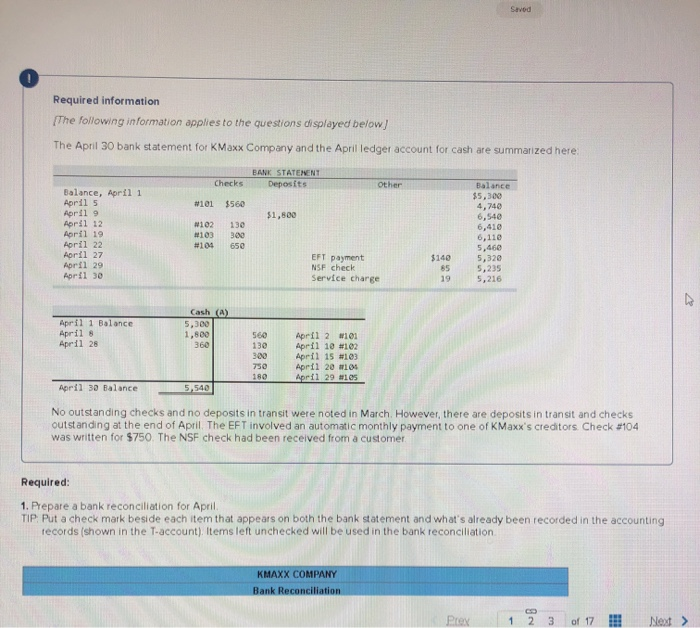

Please help me figure these questions out. Im very stumped Required information {The following information applies to the questions displayed below) The April 30 bank

Please help me figure these questions out. Im very stumped

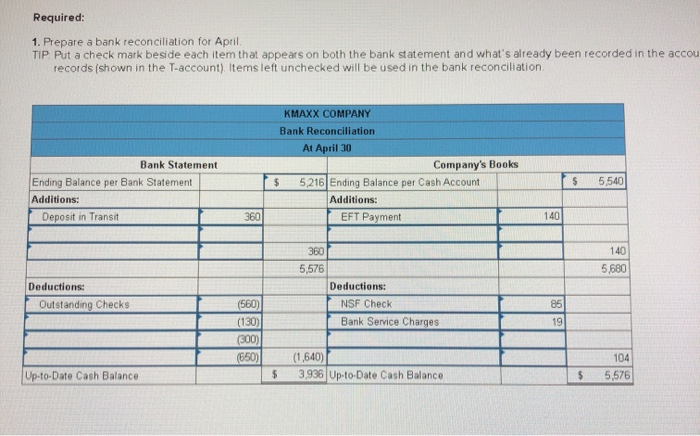

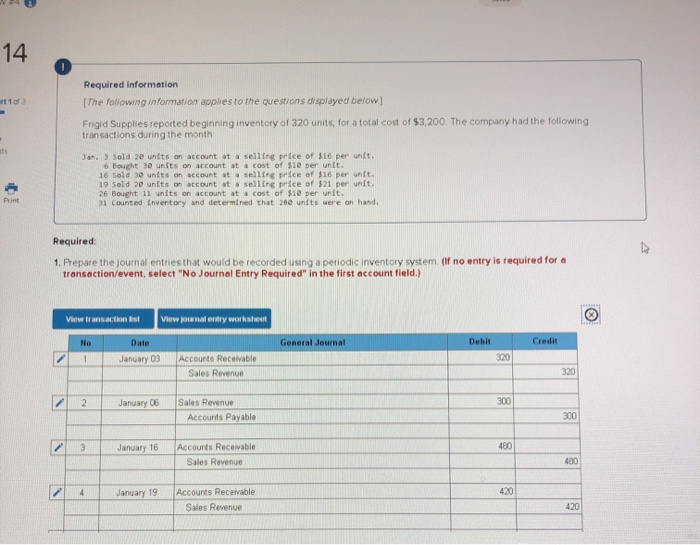

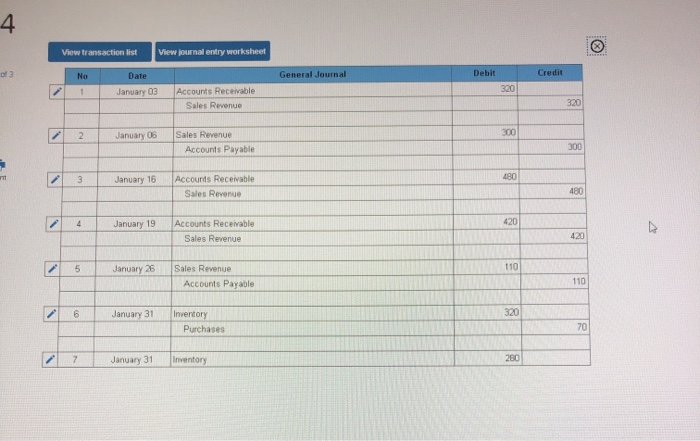

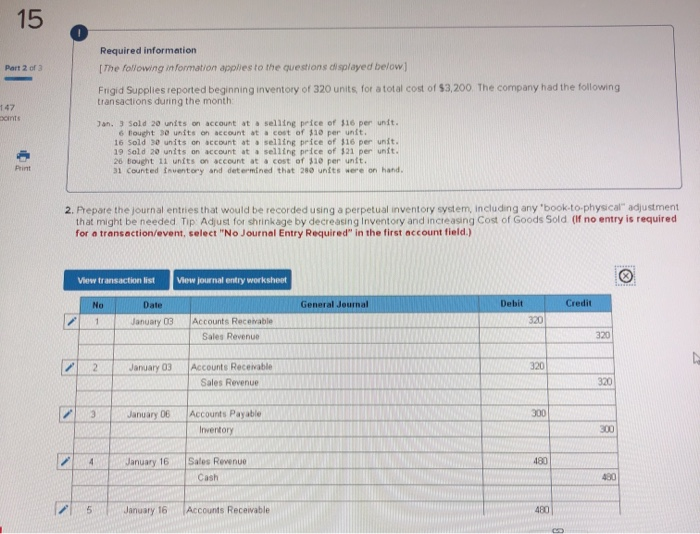

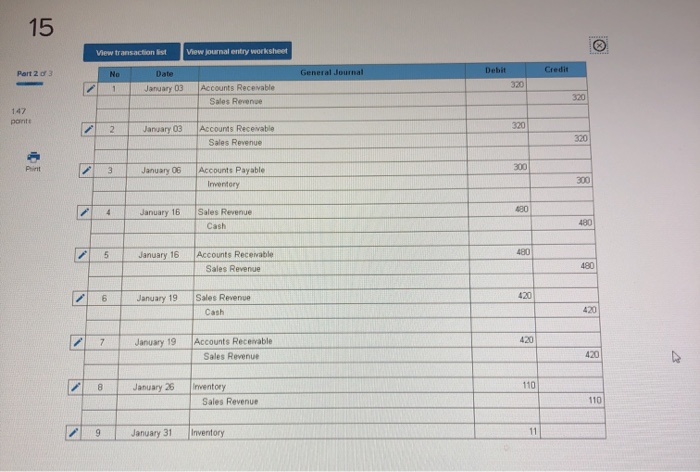

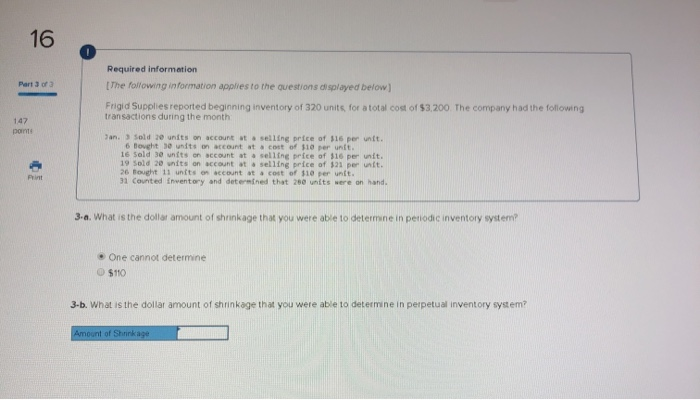

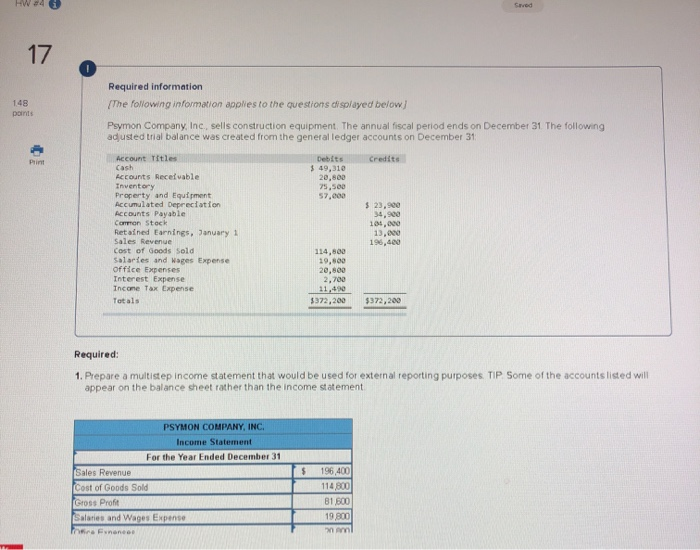

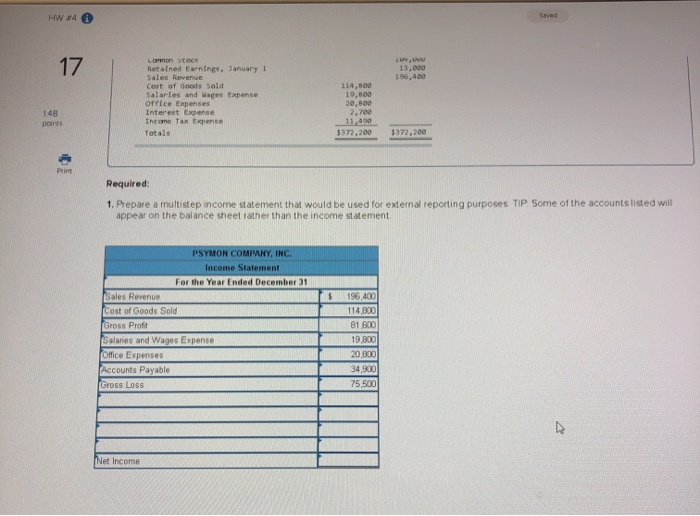

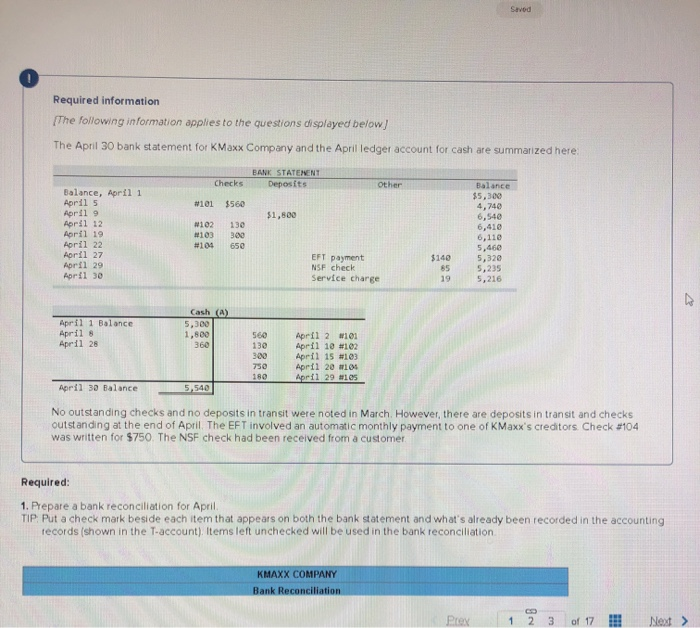

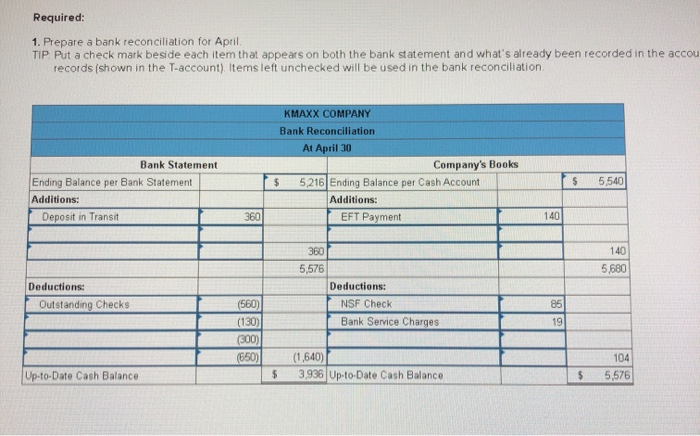

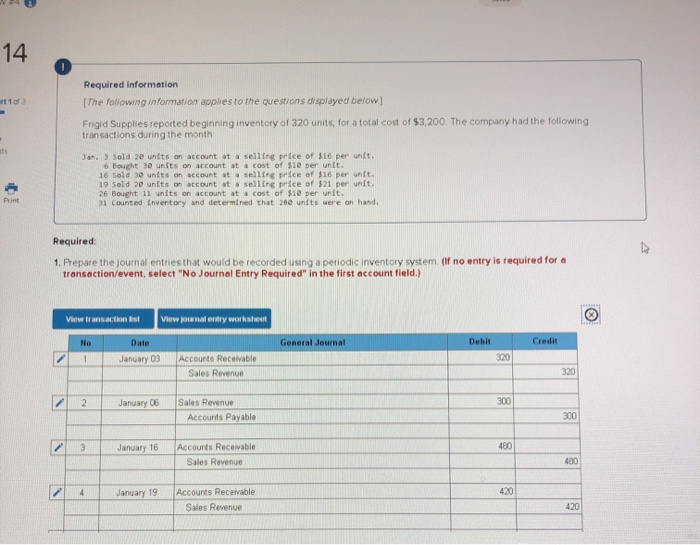

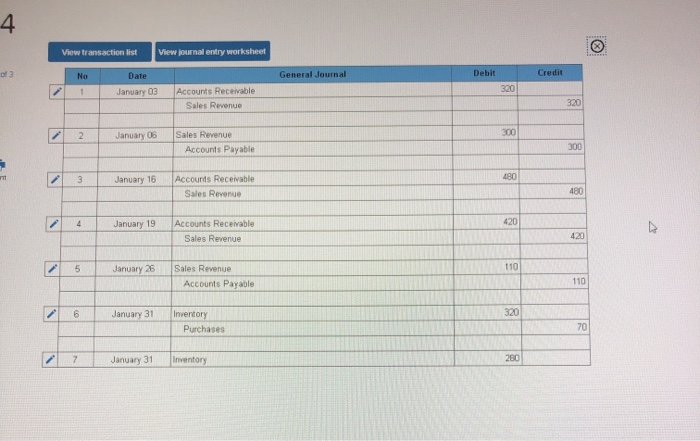

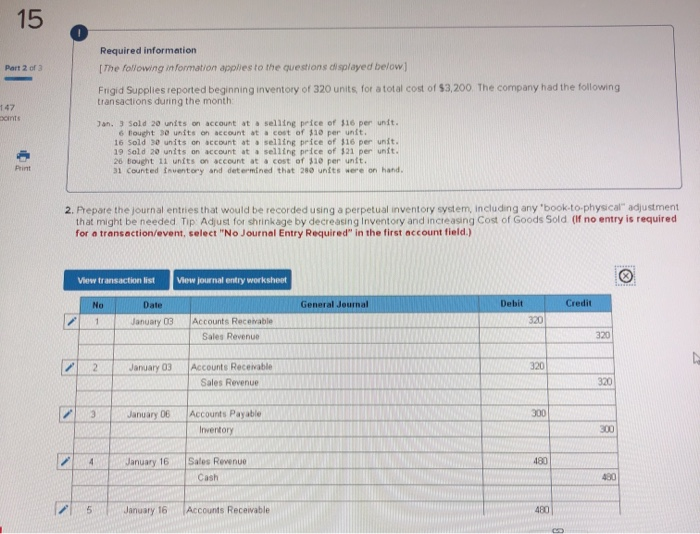

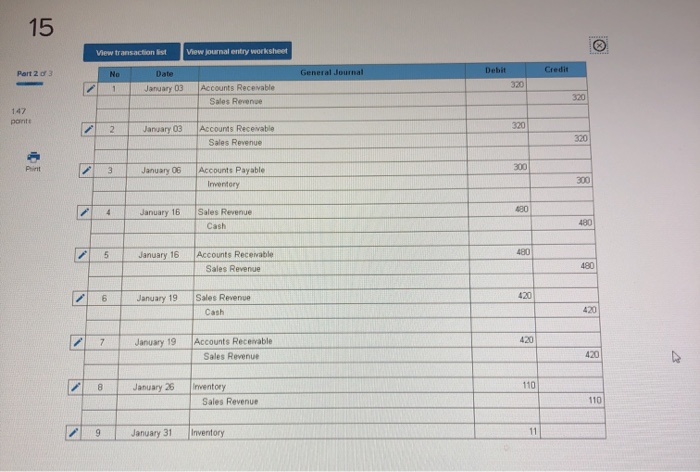

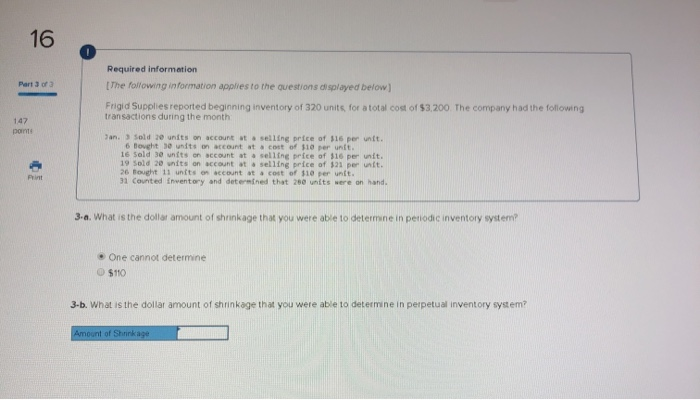

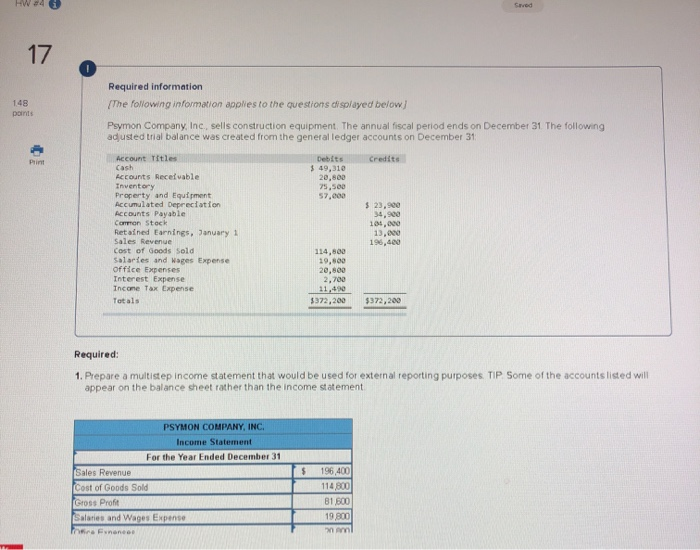

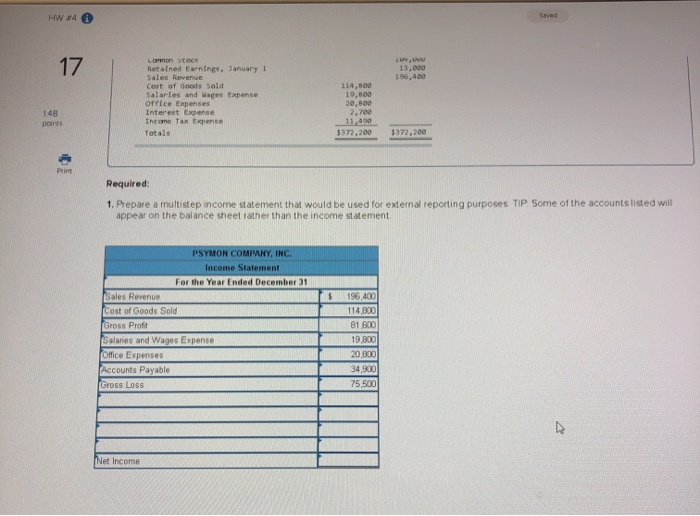

Required information {The following information applies to the questions displayed below) The April 30 bank statement for KMaxx Company and the April ledger account for cash are summarized here: BANK STATEMENT Deposits Checks #101 $560 $1,800 Balance, April 1 April 5 April 9 April 12 April 19 April 22 April 27 April 29 April 30 #102130 #103 300 #104 650 Balance $5.300 4,740 6,540 6,416 6,110 5,460 5,320 5,235 5,216 EFT payment NSF check Service charge (A) April 1 Balance April 8 April 28 Cash 5.300 1.800 560 360 130 300 750 April 2 #101 April 16 #102 April 15 #103 April 2010 April 2010 April 30 Balance 5.540 No outstanding checks and no deposits in transit were noted in March. However, there are deposits in transit and checks outstanding at the end of April. The EFT involved an automatic monthly payment to one of K Maxx's creditors Check #104 was written for $750. The NSF check had been received from a customer Required: 1. Prepare a bank reconciliation for April TIP: Put a check mark beside each item that appears on both the bank statement and what's already been recorded in the accounting records (shown in the T-account). Items left unchecked will be used in the bank reconciliation KMAXX COMPANY Bank Reconciliation Prex 1 2 3 of 17 !! Next > Required: 1. Prepare a bank reconciliation for April TIP Put a check mark beside each item that appears on both the bank statement and what's already been recorded in the accou records (shown in the T-account) Items left unchecked will be used in the bank reconciliation Bank Statement Ending Balance per Bank Statement Additions: KMAXX COMPANY Bank Reconciliation At April 30 Company's Books $ 5,216 Ending Balance per Cash Account Additions: EFT Payment Deposit in Transit 5,576 Deductions: Outstanding Checks Deductions: NSF Check Bank Service Charges (560) (130) (300) (650) (1,640)| 3,936 Up-to-Date Cash Balance Up-to-Date Cash Balance $ 14 Required information The following information applies to the questions displayed below) 103 Frigid Supplies reported beginning inventory of 320 units, for a total cost of $3,200. The company had the following transactions during the month Jan. 3 Sold 20 units on account at a selling price of $16 per unit. 6 Bought 30 units on account at a cost of $10 per unit. 16 Sold 30 units an account ata selle price of $16 per unit. 19 Sold 20 units on account at a selline price of $21 per unit. 26 Bought 11 units on account at a cost of $10 per unit. 31 counted Inventory and determined that 200 units were on hand. Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction est View journal entry worksheet No Date General Journal Debit Credit January 03 Accounts Receivable Sales Revenue January 06 Sales Revenue Accounts Payable January 16 Accounts Receivable Sales Revenue January 19 Accounts Receivable Sales Revenue View transaction list View journal entry worksheet General Journal Debit Credit No 1 Date January 03 Accounts Receivable Sales Revenue 2 2 January 06 Sales Revenue Accounts Payable January 16 Accounts Receivable Sales Revenue 24 January 19 Accounts Receivable Sales Revenue January 26 Sales Revenue Accounts Payable 6 January 31 Inventory Purchases January 31 Inventory Required information The following information applies to the questions displayed below] Frigid Supplies reported beginning inventory of 320 units for a total cost of $3,200 The company had the following transactions during the month 147 ats Jan. Sold 20 units on account at selling price of $16 per unit. 6 Boucht se units on count a cost of $10 per unit. 16 Sold 30 units on account at selling price of $16 per unit. 19 Sold 20 units on count at selling price of 521 per unit. 26 bocht 1 units on account at cost of $10 per unit. 31 counted Inventory and determined that 200 units were on hand. 2. Prepare the journal entries that would be recorded using a perpetual inventory system, including any 'book to physical adjustment that might be needed Tip Adjust for shrinkage by decreasing Inventory and increasing Cost of Goods Sold (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field) View transaction list View journal entry worksheet No Date General Journal Debit Credit January 3 Accounts Receivable Sales Revenue January 03 Accounts Receivable Sales Revenue January 06 Accounts Payable Inventory 74 January 16 Sales Revenue Cash 2 5 January 16 Accounts Receivable View transaction ist View journal entry worksheet General Journal Debit Credit No 1 Date January 03 January 03 Accounts Receivable Swes Revenge January 03 Accounts Receivable Sales Revenue January 06 Accounts Payable Inventory January 16 Sales Revenue Cash 5 January 16 Accounts Receivable Sales Revenue January 19 Sales Revenue 7 January 19 Accounts Receivable Sales Revenue January 26 nentory Sales Revenue January 31 Inventory 16 Required information The following information applies to the questions displayed below) Part of Frigid Supplies reported beginning inventory of 320 units, for a total cost of $3,200 The company had the following transactions during the month 147 pants Jan. Sold units on account at & selling price of $16 per unit. 6 Bovecht 30 units o u t at a cost of $10 per unit. 16 Sold 30 units on account at a selling price of $16 per unit. 19 Sold 20 units on sccount at selling price of 521 per unit. 26 Bought 11 units on account at a cost of $10 per unit. 31 counted Inventory and determined that 250 nits were on hand. 3.a. What is the dollar amount of shrinkage that you were able to determine in periodic inventory system? One cannot determine O $110 3-b. What is the dollar amount of shrinkage that you were able to determine in perpetual inventory system? Amount of Shrinkage W346 17 Required information The following information applies to the questions displayed below) 148 points Psymon Company, Inc., sells construction equipment. The annual fiscal period ends on December 31 The following ad usted trial balance was created from the general ledger accounts on December 31 Account Titles Credits Accounts Receivable Inventory Property and Equipment Accumulated Depreciation Debits $ 49,310 20,800 75,500 57.000 $ 23.990 34.900 105,000 13.000 196,400 Carmen Stock Retained Earnings, January 1 Sales Revenue Cost of Goods Sold Salaries and Wages Expense Office Expenses Interest Expense Incone Tax Expense Totals 114,800 19,800 20,800 2,700 11,490 $372,200 $372,200 Required: 1. Prepare a multistep income statement that would be used for external reporting purposes. TIP Some of the accounts listed will appear on the balance sheet rather than the income statement PSYMON COMPANY, INC. Income Statement For the Year Ended December 31 Sales Revenue Cost of Goods Solde Gross Profit Salaries and Wages Expense 114 90 HW 14 17 13. Lormon stock Retained nines, January 1 Sales Reye cost of boots Sold Salaries and wages Expense Office Expenses Interest Expense Income Tax Expense Totale 19.80 20.00 point 11,490 $372,200 $372.200 Print Required: 1. Prepare a multistep income statement that would be used for external reporting purposes. TIP Some of the accounts listed will appear on the balance sheet rather than the income statement PSYMON COMPANY, INC. Income Statement For the Year Ended December 31 Sales Revenue Cost of Goods Sold Gross Profit Salanes and Wages Expense Office Expenses Accounts Payable Gross Loss 34.900 75,500 Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started