please help me fill in the boxs for part A and help with part B

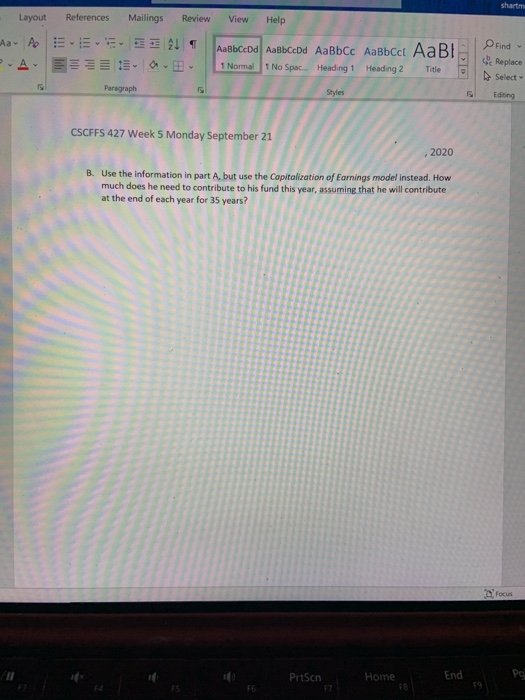

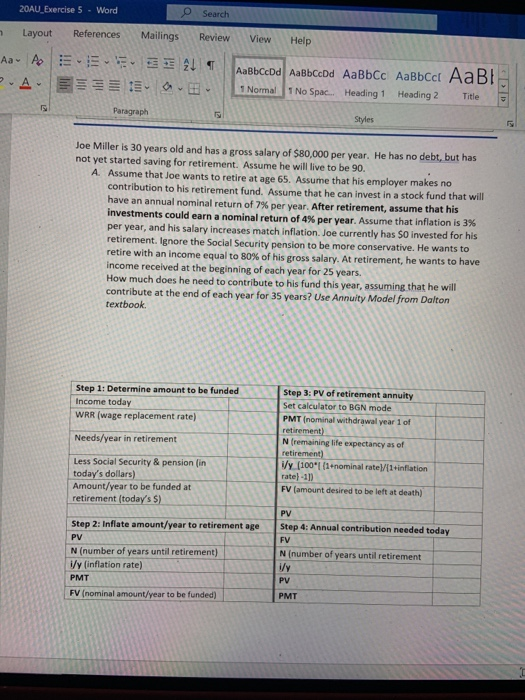

20AU Exercise 5 - Word Search Layout References Mailings Review View Help E- E21 Aa Ao P.A. AaBbccdd AaBbccdd AaBbcc Aabbcct AaB! 1 No Spac. Heading 1 Heading 2 1 Normal Title Paragraph Styles Joe Miller is 30 years old and has a gross salary of $80,000 per year. He has no debt, but has not yet started saving for retirement. Assume he will live to be 90. A Assume that Joe wants to retire at age 65. Assume that his employer makes no contribution to his retirement fund. Assume that he can invest in a stock fund that will have an annual nominal return of 7% per year. After retirement, assume that his investments could earn a nominal return of 4% per year. Assume that inflation is 3% per year, and his salary increases match inflation. Joe currently has 50 invested for his retirement. Ignore the Social Security pension to be more conservative. He wants to retire with an income equal to 80% of his gross salary. At retirement, he wants to have income received at the beginning of each year for 25 years. How much does he need to contribute to his fund this year, assuming that he will contribute at the end of each year for 35 years? Use Annuity Model from Dalton textbook Step 1: Determine amount to be funded Income today WRR (wage replacement rate) Needs/year in retirement Step 3: PV of retirement annuity Set calculator to BGN mode PMT (nominal withdrawal year 1 of retirement) N (remaining life expectancy as of retirement) i/y (100" (1.nominal rate/(1+inflation rate)-11) FV (amount desired to be left at death) Less Social Security & pension in today's dollars) Amount/year to be funded at retirement (today's S) Step 2: Inflate amount/year to retirement age PV N (number of years until retirement) i/y (inflation rate) PMT FV (nominal amount/year to be funded) PV Step 4: Annual contribution needed today FV N (number of years until retirement 1/y PV PMT shart Layout References Mailings Review View Help A APE AaBbccbd AaBbccbd AaBbcc AaBbcct AaB! 1 Normal 1 No Spac. Heading 1 Heading 2 Find Replace Select Title Paragraph Styles Editing CSCFFS 427 Week 5 Monday September 21 2020 B. Use the information in part A, but use the capitalization of Earnings model instead. How much does he need to contribute to his fund this year, assuming that he will contribute at the end of each year for 35 years? PrtScn End Po Home F8 fa F6 20AU Exercise 5 - Word Search Layout References Mailings Review View Help E- E21 Aa Ao P.A. AaBbccdd AaBbccdd AaBbcc Aabbcct AaB! 1 No Spac. Heading 1 Heading 2 1 Normal Title Paragraph Styles Joe Miller is 30 years old and has a gross salary of $80,000 per year. He has no debt, but has not yet started saving for retirement. Assume he will live to be 90. A Assume that Joe wants to retire at age 65. Assume that his employer makes no contribution to his retirement fund. Assume that he can invest in a stock fund that will have an annual nominal return of 7% per year. After retirement, assume that his investments could earn a nominal return of 4% per year. Assume that inflation is 3% per year, and his salary increases match inflation. Joe currently has 50 invested for his retirement. Ignore the Social Security pension to be more conservative. He wants to retire with an income equal to 80% of his gross salary. At retirement, he wants to have income received at the beginning of each year for 25 years. How much does he need to contribute to his fund this year, assuming that he will contribute at the end of each year for 35 years? Use Annuity Model from Dalton textbook Step 1: Determine amount to be funded Income today WRR (wage replacement rate) Needs/year in retirement Step 3: PV of retirement annuity Set calculator to BGN mode PMT (nominal withdrawal year 1 of retirement) N (remaining life expectancy as of retirement) i/y (100" (1.nominal rate/(1+inflation rate)-11) FV (amount desired to be left at death) Less Social Security & pension in today's dollars) Amount/year to be funded at retirement (today's S) Step 2: Inflate amount/year to retirement age PV N (number of years until retirement) i/y (inflation rate) PMT FV (nominal amount/year to be funded) PV Step 4: Annual contribution needed today FV N (number of years until retirement 1/y PV PMT shart Layout References Mailings Review View Help A APE AaBbccbd AaBbccbd AaBbcc AaBbcct AaB! 1 Normal 1 No Spac. Heading 1 Heading 2 Find Replace Select Title Paragraph Styles Editing CSCFFS 427 Week 5 Monday September 21 2020 B. Use the information in part A, but use the capitalization of Earnings model instead. How much does he need to contribute to his fund this year, assuming that he will contribute at the end of each year for 35 years? PrtScn End Po Home F8 fa F6

please help me fill in the boxs for part A and help with part B

please help me fill in the boxs for part A and help with part B