Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me fill out the spreadsheet (part 3 of 3) You are an entrepreneur who has been building your small business for the past

please help me fill out the spreadsheet (part 3 of 3)

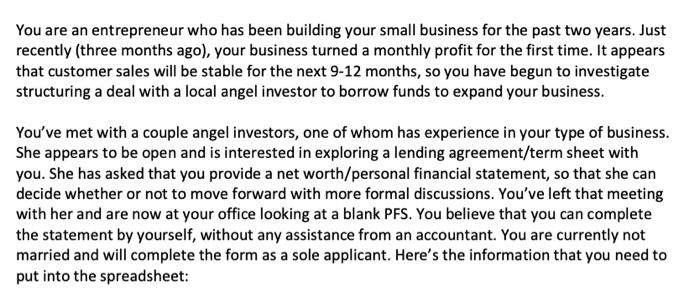

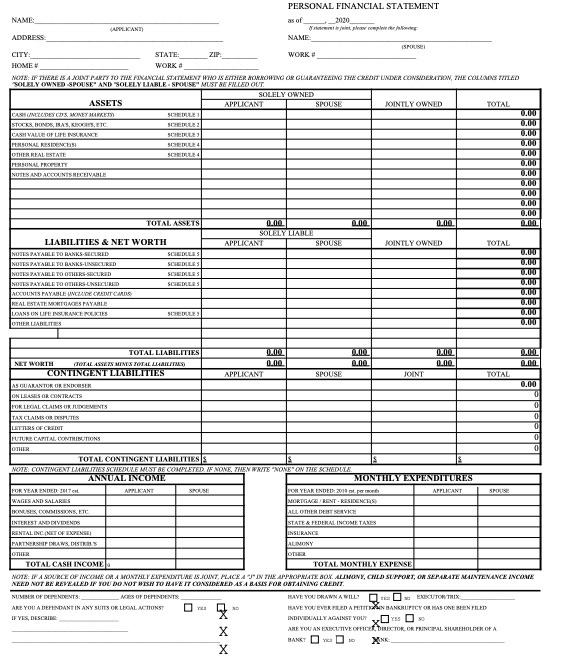

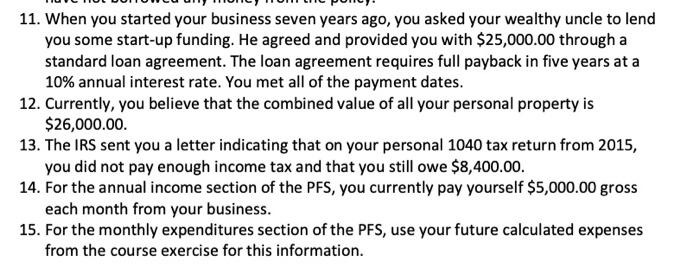

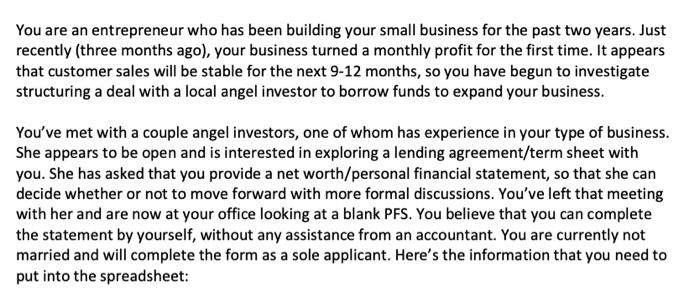

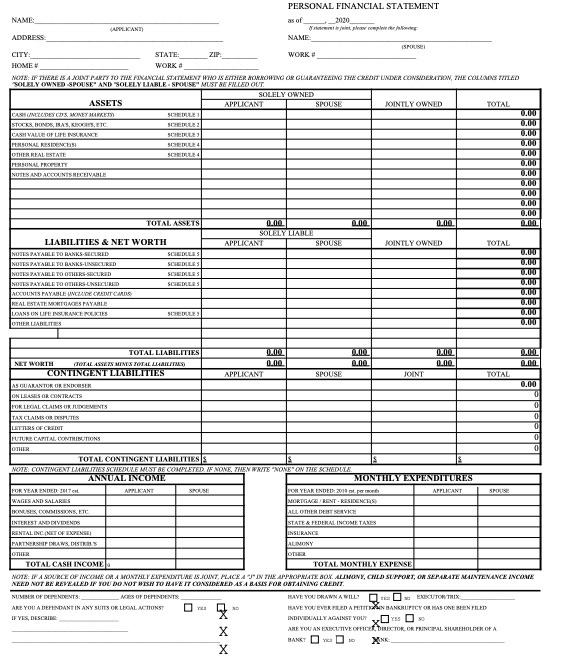

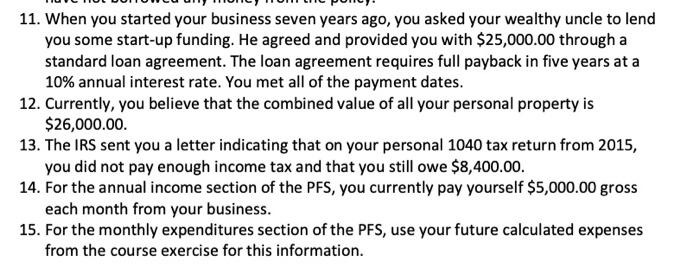

You are an entrepreneur who has been building your small business for the past two years. Just recently (three months ago), your business turned a monthly profit for the first time. It appears that customer sales will be stable for the next 9-12 months, so you have begun to investigate structuring a deal with a local angel investor to borrow funds to expand your business. You've met with a couple angel investors, one of whom has experience in your type of business. She appears to be open and is interested in exploring a lending agreement/term sheet with you. She has asked that you provide a net worth/personal financial statement, so that she can decide whether or not to move forward with more formal discussions. You've left that meeting with her and are now at your office looking at a blank PFS. You believe that you can complete the statement by yourself, without any assistance from an accountant. You are currently not married and will complete the form as a sole applicant. Here's the information that you need to put into the spreadsheet: PERSONAL FINANCIAL STATEMENT NAME: as of 2030 ANKAN the complete ADDRESS NAME SI CITY STATE: ZIP WORK HOME WORK NOTE: IF THERE IS A XUNT PARIT TO THE FINANCIAL STATEMENT WHO IS EMIER MORROWING OR CLARATELING THE CREDIT LINNER CONSIDERATRA, THE COLLANTITLED SOLELY OWNED SPOUSE AND SOLELY LIABLE SPOUSE" MUST BE EN LED OUT SOLELY OWNED ASSETS APPLICANT SPOUSE JOINTLY OWNED TOTAL CASTCOMELCIDES SARINET BANKET SCHEDULE 0.000 STOCKS. BONOS, SAS, KROS, ETC 0.00 CASH VALLE OF LIFE INSURANCE 21 0.00 PERSONAL RESIDENCES 094 0.00 OTHER REAL ESTATE SCHEDULE 0.00 PERSONAL PROPERTY 0.00 NUTES AND ACCOUNTS RECEIVABLE 0.00 0.00 0.00 0.00 0.00 TOTAL ASSETS 0.00 000 200 SOLELY LIABLE LIABILITIES & NET WORTH APPLICANT SPOUSE JOINTLY OWNED TOTAL NOIES PAYABLE TO BANKS SOLID SCHEDULES UUD NUITS PAYABLE TO RANKS LINSURED SCHEDULES UKU XORES PAYABLE TO OTHERS-SUCRID SCHEDULES 0.00 OUES PAYABLE TO OTHERS-UNSECTED SCHEDULE WOO ACCOUNTS PAYABLE CAVI CRTEMOS 00 REAL ESTATE MORTOMES PAYALE 0.00 LOANS UN LIFE INSURANCE LIES SCHELLES 0.00 UTLER LIABILITIES 0.00 OXIDZ 0.00 APPLICANT DIIDI 0.00 OXIDT 0.00 DEL 0.00 TOTAL 0.00 SPOUSE JOINT TOTAL LIABILITIES NET WORTH (TOTAL ASSEN MINYX TOTAL LABILITES) CONTINGENT LIABILITIES ABUARANTUR OR ENDORSER ONLASESOR CONTRACTS POR LEGAL CLAIMSU UVEMENTS TAX CLAIMES OR DISPUTES LETTRS OF CREDIT FUTURE CAPITAL CONTRIBUTIONS OR APPLKANT TOTAL CONTINGENT LIABILITIESIS NOTE. CONTINGENT LIABILITIES SCWEDUWE MUST BE COMPLETED AONE. THEY RITENONE ON THE SCHEDULE ANNUAL INCOME MONTHLY EXPENDITURES FOR YEAR ENDED IT. SEN POH YEAR ENDED: 2011 APPLICANT SP WAGES AND SALARIES NORTONGERENT-KESIDENCES EXISNESTE ALL OTHER DET ER INTEREST AND VIDEOS STATE & FEDERAL INCOME TAXES RENTAL INCINET OF EXPENSE INSURANCE PARTNERSHIFRAWS, DISTRS ALIONY OTHER OTH TOTAL CASH INCOME TOTAL MONTHLY EXPENSE NCHE IN A SERCE OF INCHE ORA MONTALIERTEMINTIREASCUNT, PLACE IN THE APPROPRIATY BOX LIMUNY, CHLD SUPPORT, ON SEPARATE MAINTENANCE INCONE ALED NOT BE REVEALED IF YOU DO NOT WISH TO HAVE IT CONSIDERED AS A BASES FOR ONTAINING CREINT NUMBER OF DENTENTS NES OF DEFINDENTS HAVE YOU DRAWNA WILL OUTON TRIX ARE YOU A DEFINDANTIN ANY SUITS OR LEGAL ACTIONS IRAVE YOU EVER PLEDAIN BANCORUPTCY OR MASONE BEEN FILED IF YES, DESCAR INDIVIDUALLY AGAINST YOUT YES X ARE YOU AN EXCUTIVE DIRECTOR OR PRINCIPAL SHAREHOLDER OF A MANET X X 11. When you started your business seven years ago, you asked your wealthy uncle to lend you some start-up funding. He agreed and provided you with $25,000.00 through a standard loan agreement. The loan agreement requires full payback in five years at a 10% annual interest rate. You met all of the payment dates. 12. Currently, you believe that the combined value of all your personal property is $26,000.00 13. The IRS sent you a letter indicating that on your personal 1040 tax return from 2015, you did not pay enough income tax and that you still owe $8,400.00. 14. For the annual income section of the PFS, you currently pay yourself $5,000.00 gross each month from your business. 15. For the monthly expenditures section of the PFS, use your future calculated expenses from the course exercise for this information. You are an entrepreneur who has been building your small business for the past two years. Just recently (three months ago), your business turned a monthly profit for the first time. It appears that customer sales will be stable for the next 9-12 months, so you have begun to investigate structuring a deal with a local angel investor to borrow funds to expand your business. You've met with a couple angel investors, one of whom has experience in your type of business. She appears to be open and is interested in exploring a lending agreement/term sheet with you. She has asked that you provide a net worth/personal financial statement, so that she can decide whether or not to move forward with more formal discussions. You've left that meeting with her and are now at your office looking at a blank PFS. You believe that you can complete the statement by yourself, without any assistance from an accountant. You are currently not married and will complete the form as a sole applicant. Here's the information that you need to put into the spreadsheet: PERSONAL FINANCIAL STATEMENT NAME: as of 2030 ANKAN the complete ADDRESS NAME SI CITY STATE: ZIP WORK HOME WORK NOTE: IF THERE IS A XUNT PARIT TO THE FINANCIAL STATEMENT WHO IS EMIER MORROWING OR CLARATELING THE CREDIT LINNER CONSIDERATRA, THE COLLANTITLED SOLELY OWNED SPOUSE AND SOLELY LIABLE SPOUSE" MUST BE EN LED OUT SOLELY OWNED ASSETS APPLICANT SPOUSE JOINTLY OWNED TOTAL CASTCOMELCIDES SARINET BANKET SCHEDULE 0.000 STOCKS. BONOS, SAS, KROS, ETC 0.00 CASH VALLE OF LIFE INSURANCE 21 0.00 PERSONAL RESIDENCES 094 0.00 OTHER REAL ESTATE SCHEDULE 0.00 PERSONAL PROPERTY 0.00 NUTES AND ACCOUNTS RECEIVABLE 0.00 0.00 0.00 0.00 0.00 TOTAL ASSETS 0.00 000 200 SOLELY LIABLE LIABILITIES & NET WORTH APPLICANT SPOUSE JOINTLY OWNED TOTAL NOIES PAYABLE TO BANKS SOLID SCHEDULES UUD NUITS PAYABLE TO RANKS LINSURED SCHEDULES UKU XORES PAYABLE TO OTHERS-SUCRID SCHEDULES 0.00 OUES PAYABLE TO OTHERS-UNSECTED SCHEDULE WOO ACCOUNTS PAYABLE CAVI CRTEMOS 00 REAL ESTATE MORTOMES PAYALE 0.00 LOANS UN LIFE INSURANCE LIES SCHELLES 0.00 UTLER LIABILITIES 0.00 OXIDZ 0.00 APPLICANT DIIDI 0.00 OXIDT 0.00 DEL 0.00 TOTAL 0.00 SPOUSE JOINT TOTAL LIABILITIES NET WORTH (TOTAL ASSEN MINYX TOTAL LABILITES) CONTINGENT LIABILITIES ABUARANTUR OR ENDORSER ONLASESOR CONTRACTS POR LEGAL CLAIMSU UVEMENTS TAX CLAIMES OR DISPUTES LETTRS OF CREDIT FUTURE CAPITAL CONTRIBUTIONS OR APPLKANT TOTAL CONTINGENT LIABILITIESIS NOTE. CONTINGENT LIABILITIES SCWEDUWE MUST BE COMPLETED AONE. THEY RITENONE ON THE SCHEDULE ANNUAL INCOME MONTHLY EXPENDITURES FOR YEAR ENDED IT. SEN POH YEAR ENDED: 2011 APPLICANT SP WAGES AND SALARIES NORTONGERENT-KESIDENCES EXISNESTE ALL OTHER DET ER INTEREST AND VIDEOS STATE & FEDERAL INCOME TAXES RENTAL INCINET OF EXPENSE INSURANCE PARTNERSHIFRAWS, DISTRS ALIONY OTHER OTH TOTAL CASH INCOME TOTAL MONTHLY EXPENSE NCHE IN A SERCE OF INCHE ORA MONTALIERTEMINTIREASCUNT, PLACE IN THE APPROPRIATY BOX LIMUNY, CHLD SUPPORT, ON SEPARATE MAINTENANCE INCONE ALED NOT BE REVEALED IF YOU DO NOT WISH TO HAVE IT CONSIDERED AS A BASES FOR ONTAINING CREINT NUMBER OF DENTENTS NES OF DEFINDENTS HAVE YOU DRAWNA WILL OUTON TRIX ARE YOU A DEFINDANTIN ANY SUITS OR LEGAL ACTIONS IRAVE YOU EVER PLEDAIN BANCORUPTCY OR MASONE BEEN FILED IF YES, DESCAR INDIVIDUALLY AGAINST YOUT YES X ARE YOU AN EXCUTIVE DIRECTOR OR PRINCIPAL SHAREHOLDER OF A MANET X X 11. When you started your business seven years ago, you asked your wealthy uncle to lend you some start-up funding. He agreed and provided you with $25,000.00 through a standard loan agreement. The loan agreement requires full payback in five years at a 10% annual interest rate. You met all of the payment dates. 12. Currently, you believe that the combined value of all your personal property is $26,000.00 13. The IRS sent you a letter indicating that on your personal 1040 tax return from 2015, you did not pay enough income tax and that you still owe $8,400.00. 14. For the annual income section of the PFS, you currently pay yourself $5,000.00 gross each month from your business. 15. For the monthly expenditures section of the PFS, use your future calculated expenses from the course exercise for this information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started