Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me for this question. Handwritting. show all neccesary working such as notes to ppe. working additional information no 1- no 8. Thank you

please help me for this question. Handwritting. show all neccesary working such as notes to ppe. working additional information no 1- no 8. Thank you

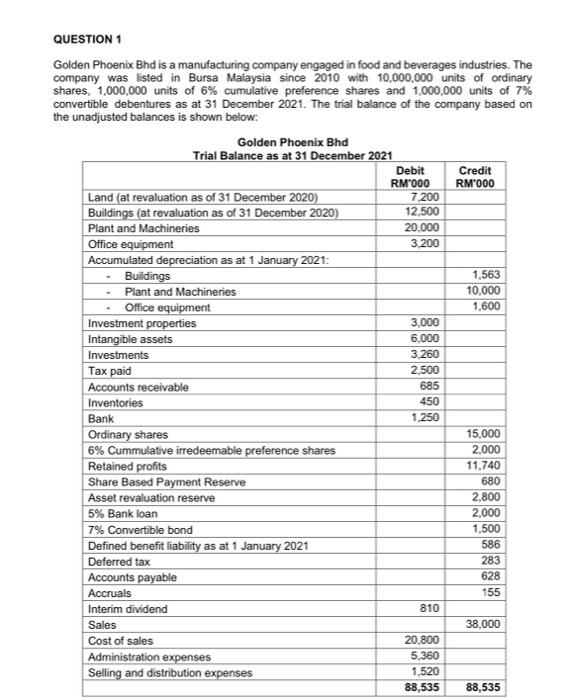

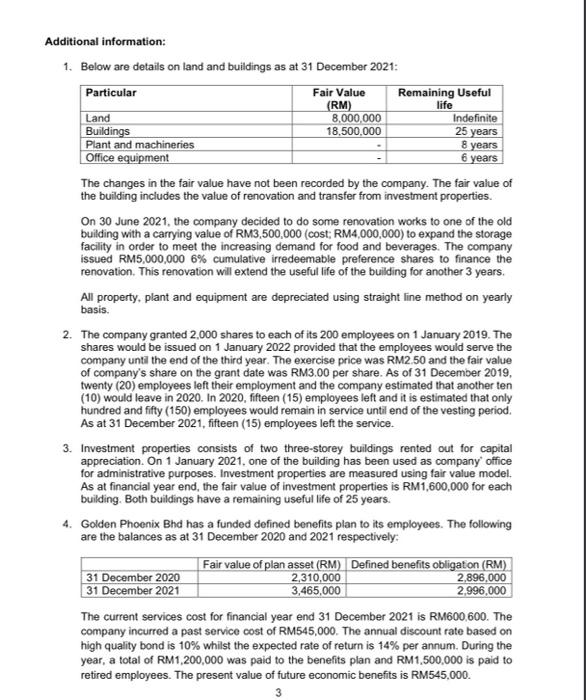

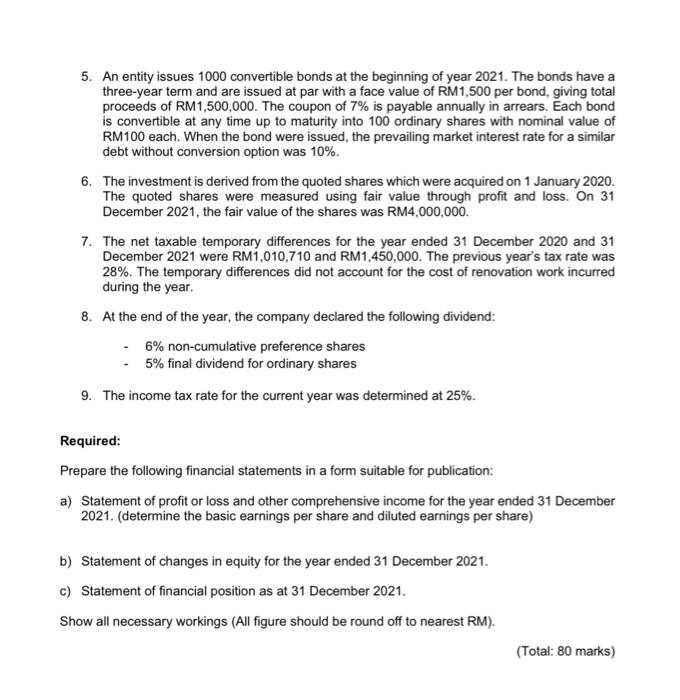

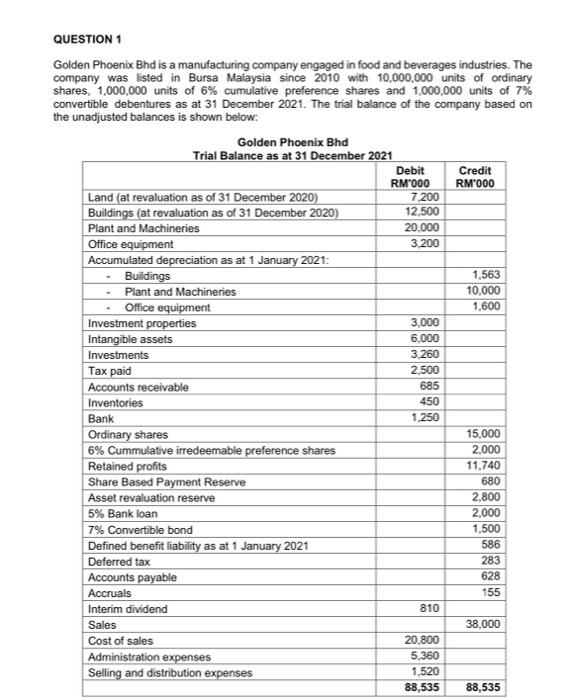

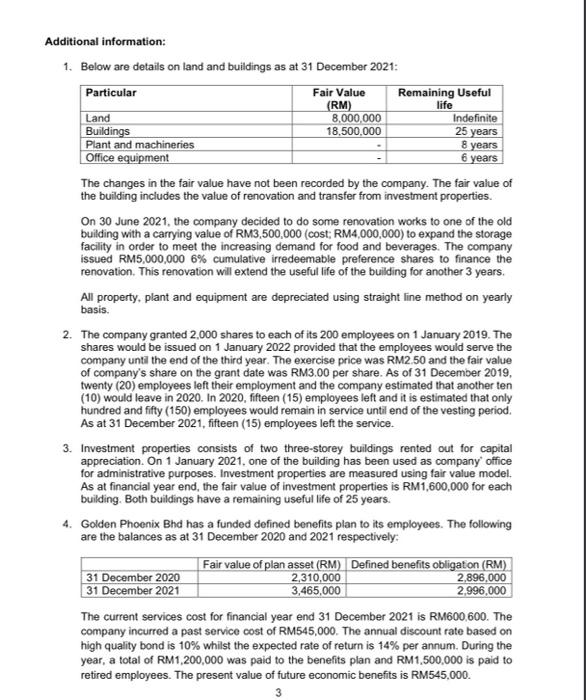

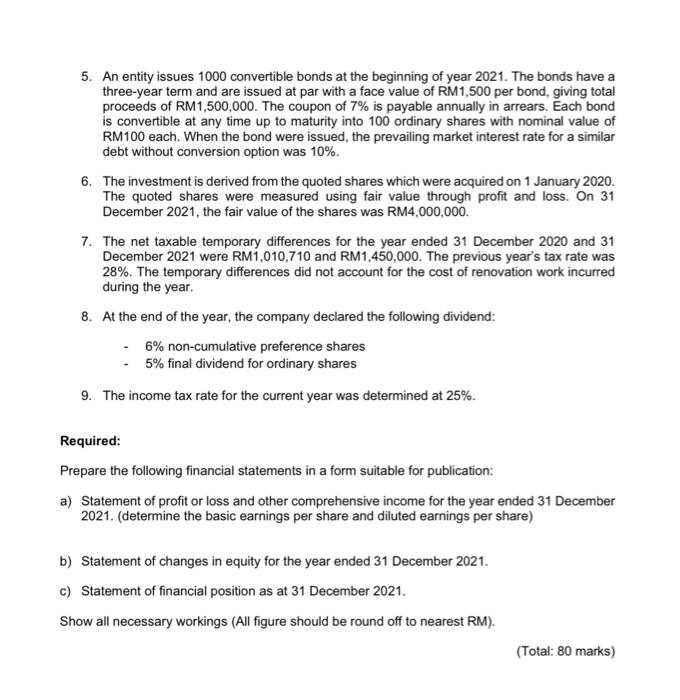

QUESTION 1 Golden Phoenix Bhd is a manufacturing company engaged in food and beverages industries. The company was listed in Bursa Malaysia since 2010 with 10,000,000 units of ordinary shares, 1,000,000 units of 6% cumulative preference shares and 1,000,000 units of 7% convertible debentures as at 31 December 2021. The trial balance of the company based on the unadjusted balances is shown below: Additional information: 1. Below are details on land and buildings as at 31 December 2021: The changes in the fair value have not been recorded by the company. The fair value of the building includes the value of renovation and transfer from investment properties. On 30 June 2021, the company decided to do some renovation works to one of the old building with a carrying value of RM3,500,000 (cost; RM4,000,000) to expand the storage facility in order to meet the increasing demand for food and beverages. The company issued RM5,000,000 6% cumulative irredeemable preference shares to finance the renovation. This renovation will extend the useful life of the building for another 3 years. All property, plant and equipment are depreciated using straight line method on yearly basis. 2. The company granted 2,000 shares to each of its 200 employees on 1 January 2019. The shares would be issued on 1 January 2022 provided that the employees would serve the company until the end of the third year. The exercise price was RM2.50 and the fair value of company's share on the grant date was RM3.00 per share. As of 31 December 2019 , twenty (20) employees left their employment and the company estimated that another ten (10) would leave in 2020. In 2020, fifteen (15) employees left and it is estimated that only hundred and fifty (150) employees would remain in service until end of the vesting period. As at 31 December 2021, fifteen (15) employees left the service. 3. Investment properties consists of two three-storey buildings rented out for capital appreciation. On 1 January 2021, one of the building has been used as company' office for administrative purposes. Investment properties are measured using fair value model. As at financial year end, the fair value of investment properties is RM1,600,000 for each building. Both buildings have a remaining useful life of 25 years. 4. Golden Phoenix Bhd has a funded defined benefits plan to its employees. The following are the balances as at 31 December 2020 and 2021 respectively: The current services cost for financial year end 31 December 2021 is RM600.600. The company incurred a past service cost of RM545,000. The annual discount rate based on high quality bond is 10% whilst the expected rate of return is 14% per annum. During the year, a total of RM1,200,000 was paid to the benefits plan and RM1,500,000 is paid to retired employees. The present value of future economic benefits is RM545,000. 5. An entity issues 1000 convertible bonds at the beginning of year 2021. The bonds have a three-year term and are issued at par with a face value of RM1,500 per bond, giving total proceeds of RM1,500,000. The coupon of 7% is payable annually in arrears. Each bond is convertible at any time up to maturity into 100 ordinary shares with nominal value of RM100 each. When the bond were issued, the prevailing market interest rate for a similar debt without conversion option was 10%. 6. The investment is derived from the quoted shares which were acquired on 1 January 2020. The quoted shares were measured using fair value through profit and loss. On 31 December 2021, the fair value of the shares was RM4,000,000. 7. The net taxable temporary differences for the year ended 31 December 2020 and 31 December 2021 were RM1,010,710 and RM1,450,000. The previous year's tax rate was 28%. The temporary differences did not account for the cost of renovation work incurred during the year. 8. At the end of the year, the company declared the following dividend: - 6% non-cumulative preference shares - 5% final dividend for ordinary shares 9. The income tax rate for the current year was determined at 25%. Required: Prepare the following financial statements in a form suitable for publication: a) Statement of profit or loss and other comprehensive income for the year ended 31 December 2021. (determine the basic earnings per share and diluted earnings per share) b) Statement of changes in equity for the year ended 31 December 2021. c) Statement of financial position as at 31 December 2021. Show all necessary workings (All figure should be round off to nearest RM). (Total: 80 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started