Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me giving the ans quickly You and your spouse are in good health and have reasonably secure careers. You make about $74,000 annually

please help me giving the ans quickly

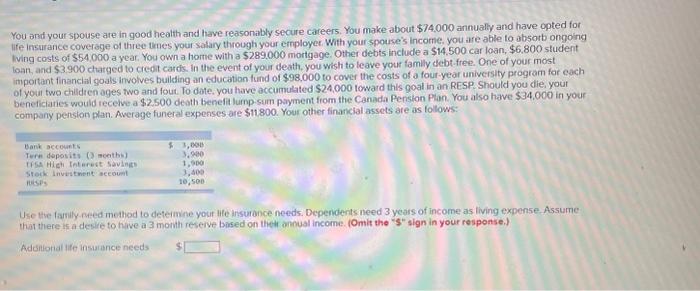

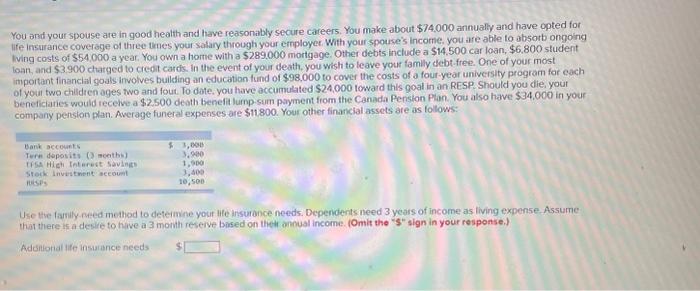

You and your spouse are in good health and have reasonably secure careers. You make about $74,000 annually and have opted for iffe insurance coverage of three thes your salary through your employer. With your spouse's income, you are able to absorb ongoing iving costs of $54,000 a year. You own a home with a $289.000 mortgage. Other debts include a $14,500 car loan, $6.800 student loan, and $3900 charged to credit cards. In the event of your death, you wish to leave your family debt free. One of your most important financial goals involves building an education fund of $98,000 to cover the costs of a four-year university program for each of your two childien ages two and fout. To dote, you have accumulated \$24,000 toward this goal in an RESP. Should you die, your beneficiaries would recelve a $2,500 death benefit lump-sum payment from the Canada Pension Plan. You also have $34,000 in your company pension plan. Awerage funeral expenses are $11800. Your other financial assets are as follows: Use the farnily-peed method to determine your life insurance needs. Dependents need 3 years of income as living expense Assume that there if a desire to have a 3 month reserve based on thet onoual income. (Omit the "s" sign in your response.) Additonal ife insurance needs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started