Answered step by step

Verified Expert Solution

Question

1 Approved Answer

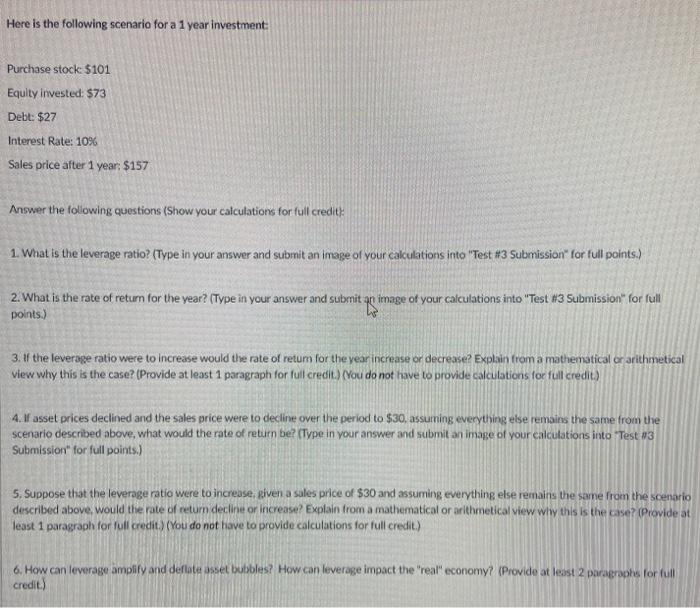

Please help me Here is the following scenario for a 1 year investment: Purchase stock 5101 Equity invested: 573 Debt: $27 Interest Rate: 10% Sales

Please help me

Here is the following scenario for a 1 year investment: Purchase stock 5101 Equity invested: 573 Debt: $27 Interest Rate: 10% Sales price after 1 year: $157 Answer the following questions (Show your calculations for full credit 1. What is the leverage ratio? (Type in your answer and submit an image of your calculations into "Test #3 Submission for full points) 2. What is the rate of return for the year? (Type in your answer and submit an image of your calculations into "Test #3 Submission for full points) 3. If the leverage ratio were to increase would the rate of retum for the year increase or decrease? Explain from a mathematical er arithmetical view why this is the case? (Provide at least 1 paragraph for full credit) (You do not have to provide calculations for full credit) 4. If asset prices declined and the sales price were to decline over the period to $30, assuming everything else remains the same from the scenario described above, what would the rate of return be? (Type in your answer and submit an image of your calculations into Test 93 Submission for full points.) 5. Suppose that the leverage ratio were to increase, given a sales price of $30 and assuming everything else remains the same from the scenario described above, would the rate of return decline or increase? Explain from a mathematical or arithmetical view wiw this is the case? (Provide at least 1 paragraph for full credit) (You do not have to provide calculations for full credit) 6. How can leverage amplify and deflate asset bubbles? How can leverage impact the "real" economy? (Provide at least 2 paragraphs for full credit) Here is the following scenario for a 1 year investment: Purchase stock 5101 Equity invested: 573 Debt: $27 Interest Rate: 10% Sales price after 1 year: $157 Answer the following questions (Show your calculations for full credit 1. What is the leverage ratio? (Type in your answer and submit an image of your calculations into "Test #3 Submission for full points) 2. What is the rate of return for the year? (Type in your answer and submit an image of your calculations into "Test #3 Submission for full points) 3. If the leverage ratio were to increase would the rate of retum for the year increase or decrease? Explain from a mathematical er arithmetical view why this is the case? (Provide at least 1 paragraph for full credit) (You do not have to provide calculations for full credit) 4. If asset prices declined and the sales price were to decline over the period to $30, assuming everything else remains the same from the scenario described above, what would the rate of return be? (Type in your answer and submit an image of your calculations into Test 93 Submission for full points.) 5. Suppose that the leverage ratio were to increase, given a sales price of $30 and assuming everything else remains the same from the scenario described above, would the rate of return decline or increase? Explain from a mathematical or arithmetical view wiw this is the case? (Provide at least 1 paragraph for full credit) (You do not have to provide calculations for full credit) 6. How can leverage amplify and deflate asset bubbles? How can leverage impact the "real" economy? (Provide at least 2 paragraphs for full credit)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started